Ferrotitanium Market Research, 2033

The global ferrotitanium market was valued at $231.4 million in 2023, and is projected to reach $367.1 million by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Ferrotitanium is an alloy composed primarily of iron and titanium, typically containing between 20% and 70% titanium. The manufacturing process of ferrotitanium involves melting titanium scrap, iron, and sometimes additional elements in electric arc furnaces. The resulting ferrotitanium is then cast into various forms such as lumps, granules, or powder, depending on the intended application. Known for its high strength, low density, and excellent corrosion resistance, ferrotitanium is widely used in steelmaking to enhance mechanical properties and reduce grain size in steel products. Its applications extend to foundries, aerospace, automotive, and power industries, where it improves the quality and performance of components exposed to high stress and corrosive environments. In addition, ferrotitanium is utilized in producing specialty steels, casting alloys, and as a deoxidizing agent in metal production processes.

Key Takeaways

- The ferrotitanium market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major ferrotitanium industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The ferrotitanium market is experiencing notable growth, driven by its increased use in the aerospace and automotive sectors. In aerospace, there is a growing demand for materials that offer superior strength, endurance, and corrosion resistance. Ferrotitanium meets the aerospace industry's requirements for materials with superior strength, endurance, and corrosion resistance, making it a preferred choice for manufacturing high-performance components. Similarly, in the automotive industry, the shift towards lightweight and durable materials for improved fuel efficiency and vehicle performance is boosting ferrotitanium's popularity. Its ability to enhance the properties of steel and other alloys makes it essential in these advanced manufacturing processes.

Rise in applications of ferrotitanium in the steelmaking industry drives the market growth. As steel remains a cornerstone material in construction, automotive, and infrastructure sectors, the demand for enhanced steel properties is paramount. Ferrotitanium's ability to refine grain size, improve strength, and impart resistance to corrosion and fatigue aligns perfectly with these requirements. This alloy acts as a vital additive in steel production, enabling manufacturers to achieve higher quality and performance standards in their end products. Thus, rise in adoption of ferrotitanium in steelmaking processes is a key driver fueling the expansion of the market.

The ferrotitanium market faces significant challenges due to its costly manufacturing processes. These intricate procedures and specialized equipment inflate production expenses substantially. Moreover, the high energy requirements, complex alloying techniques, and stringent quality control measures further contribute to high costs. These factors render ferrotitanium a costly material to produce, restraining the market growth, especially in price-sensitive industries or regions where competitive pricing is crucial.

The growing need of sustainable alloys presents a promising avenue in the ferrotitanium market. With industries prioritizing environmental sustainability and seeking eco-friendly alternatives, demand for environmentally conscious materials is escalating. This focus has spurred attention on developing sustainable ferrotitanium alloys, aimed at reducing environmental impact across their lifecycle. These alloys offer properties akin to traditional ferrotitanium while adhering to stringent environmental regulations. Industries striving for sustainability and compliance with eco-friendly directives are increasingly embracing these environmentally conscious materials.

Market Segmentation

The ferrotitanium market is segmented into grade, form, application, end-use industry, and region. By grade, the market is divided into 20-25%, 25-35%, 35-45%, 45-55%, and 65-75%. By form, the market is segregated into powder, granules, and lumps. By application, the market is categorized into steel making, foundries, and others. By end-use industry, the market is divided into automotive, aerospace, marine, construction, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The key market players operating in the ferrotitanium market include Minex, M/s Bansal Brothers, Heneken s.r.o., OSAKA Titanium Technologies Co., Ltd., VSMPO-AVISMA, G K Min Met Alloys Co, Mottram, Cronimet, Shree Bajrang Sales Pvt Ltd., and MMTA. Other players in ferrotitanium market include Advanced Refractory Metals, Chengdu Huarui Industrial Co., Ltd., Kamman Group, Sarthak Metals Marketing Private Limited, and others. The key players have adopted development strategies for instance, In October 2023, Ukrainian-owned company, MPS Technology, launched a new ferro-titanium production in Poland. The plant is expected to produce all grades of ferro-titanium and have the capacity to produce between 200 and 600 tonnes per month (tpm) of the ferro-alloy, depending on the number of shifts.

Regional Market Outlook

In Asia-Pacific and North America regions, countries such as India, China, and the U.S. are propelling the growth of the ferrotitanium market. This surge is fueled by the increasing applications of ferrotitanium across industries such as steelmaking, construction, automotive, and aerospace. As these sectors expand, the demand for high-performance materials like ferrotitanium rises, thus driving the market growth. The pivotal role of ferrotitanium to enhance the properties of steel and other alloys makes it indispensable in meeting the evolving needs of these dynamic industries.

- According to the Aerospace Industries Association (AIA) , the Aerospace and defense industry’s workforce generated $952 billion in combined sales in 2022, a 6.7% increase from the prior year. In addition, the A&D industry generated $418 billion in economic value in 2022, which represented 1.65% of total nominal GDP in the U.S.

- As per the Invest India, India's automotive industry is worth around $222 billion, while the EV market in India is estimated to be valued at $2 billion by 2023 and $7.09 billion by 2025. Further, the automotive industry accounts for 8% of all national exports. This sector accounts for 40% of the total $31 billion of global research and development spending.

- According to the Bureau of Economic Analysis, the total value generated by the construction industry in the first three quarters of 2022 in the U.S. was around $2, 980 billion, or roughly 5% more than the previous year for the same time. Thus, the expanding landscape of construction and infrastructure projects globally drives the growth of ferrotitanium market.

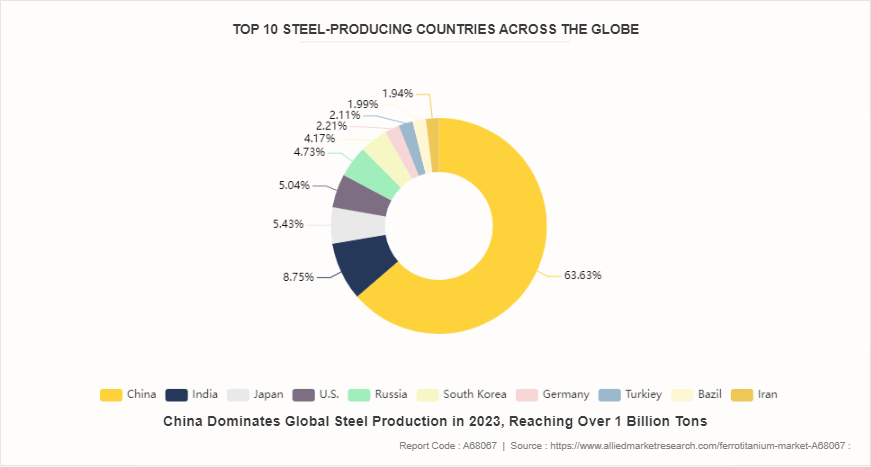

The steel production data for 2023 underscores China's dominant position with over 1, 019 million tons, significantly driving the global ferrotitanium market. As a crucial alloying agent, ferrotitanium enhances the strength and corrosion resistance of steel. China's vast steel output, along with substantial production in India, Japan, and the United States, propels the demand for ferrotitanium. This high demand supports its market growth and encourages increased production and innovation within the ferrotitanium sector. The substantial steel outputs from these leading countries highlight a robust and growing need for ferrotitanium, pivotal in advanced steelmaking processes worldwide.

Industry Trends

- According to the Invest India, in 2023 the steel sector has witnessed tremendous growth and India has emerged as a global force in steel production and the 2nd largest producer of steel in the world. From April to October 2023-24, India produced 81.75 million tonnes (MT) of crude steel, 77.30 MT of finished steel, and consumed 75.66 MT of finished steel.

- According to the World Steel Association, the global steel industry continues to grow, with an estimated 1.9 billion metric tons of crude steel produced in 2023. Ferrotitanium is crucial in improving steel properties, leading to increased demand. World crude steel production for the 71 countries reporting to the World Steel Association was 135.7 million tonnes (Mt) in December 2023.

Key Sources Referred

- Invest India

- India Brand Equity Foundation

- World Steel Association

- American Iron and Steel Institute

- Indian Steel Association

- Association for Iron & Steel Technology

- Steel Manufacturers Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ferrotitanium market analysis from 2024 to 2033 to identify the prevailing ferrotitanium market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ferrotitanium market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ferrotitanium market trends, key players, market segments, application areas, and market growth strategies.

Ferrotitanium Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 367.1 Million |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Grade |

|

| By Form |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Mottram, OSAKA Titanium Technologies Co., Ltd., Heneken s.r.o., MMTA, G K Min Met Alloys Co, M/s Bansal Brothers, VSMPO-AVISMA, Shree Bajrang Sales Pvt Ltd., Minex, Cronimet |

The ferrotitanium market was valued at $231.4 million in 2023 and is estimated to reach $367.1 million by 2033, exhibiting a CAGR of 4.8% from 2024 to 2033.

Asia-Pacific is the largest regional market for ferrotitanium

Steel making is the leading application of ferrotitanium market

Rise in emphasis on sustainable alloys is the upcoming trends of ferrotitanium market in the globe

The key market players operating in the ferrotitanium market include Minex, M/s Bansal Brothers, Heneken s.r.o., OSAKA Titanium Technologies Co., Ltd., VSMPO-AVISMA, G K Min Met Alloys Co, Mottram, Cronimet, Shree Bajrang Sales Pvt Ltd., and MMTA.

Loading Table Of Content...