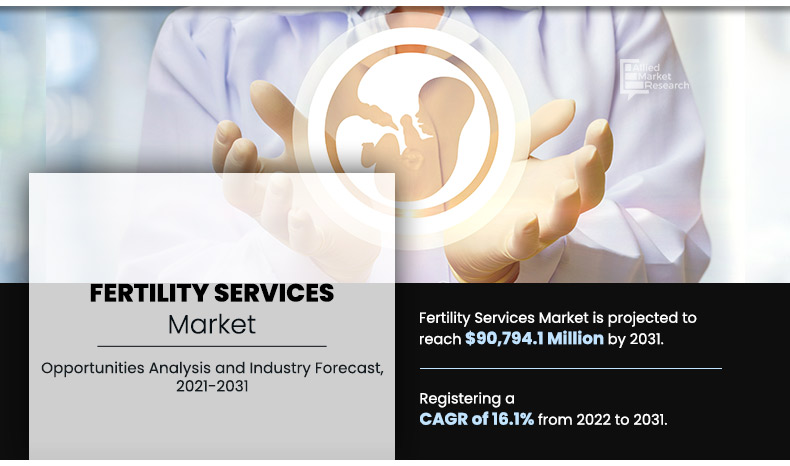

Fertility Services Market Statistics, 2031

The global fertility services market size was valued at $21,138.2 Million in 2021, and is projected to reach $90,794.1 Million by 2031, registering a CAGR of 16.1% from 2021 to 2031. A disorder of the male or female reproductive system known as infertility is characterized by the inability to conceive after 12 months or more of frequent, unprotected sexual activity. Typically, problems with semen ejection, a lack of sperm or low sperm counts, or unusual sperm shape (morphology) and motility are the causes of infertility in men. Numerous illnesses that affect the ovaries, uterus, fallopian tubes, and endocrine system, among other organs, can cause infertility in women.

Different technique alternatives are available as part of fertility services to treat infertility. There are three primary types of treatments for infertility which includes prescription drugs, surgeries, and services for assisted conception. In-vitro fertilization (IVF) without ICSI, surrogacy, intrauterine insemination (IUI), and other methods are included in assisted conception services.

“The fertility services market was slightly negative during the lockdown period owing to a decrease in demand of fertility services. Decrease in the number of consultations for infertility cases, and sharp cut in income during COVID-19 is anticipated to hamper the market growth”

Historical Overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The fertility services market grew at a CAGR of around 16.1% during 2021-2031. Most of the growth during this period was derived from North America owing to the rise in the number of key players who manufacture fertility services products, rising disposable incomes, as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global fertility services market is majorly driven by increase in prevalence of infertility in male and female population and rise in the infertility disorder rate. Moreover, the growth in number of product launches and approvals for fertility services products and technological advancement in fertility services are expected to fuel the market growth. In addition, rise in adoption of in vitro fertilization (IVF) with intracytoplasmic sperm injection (ICSI) technology due to high success rate in treating infertility and rise in adoption of fertility services by the population drives the growth of the market during the forecast period.

Globally, the tendency toward postponed pregnancy has risen gradually. The eggs that the reproductive system produces in older women (those over 40) are not ready to be fertilized by male spermatozoa. The risk of genetic diseases in the egg may occur as a result. The generation of good eggs decreases in older people. Usually, older women produce few eggs of inferior quality. The egg may be at risk of genetic abnormalities because of these reasons. In 2020, the Centers for Disease Control and Prevention (CDC) reported decrease in the pregnancy rate among women aged 35 to 39, which is helping the market for fertility treatments grow.

Numerous elements in either the male or female reproductive systems can lead to infertility. It is sometimes impossible to pinpoint the root causes of infertility. Infertility in females may result from tubal abnormalities, such as obstructed fallopian tubes, which are in turn brought on by untreated sexually transmitted diseases (STIs) or aftereffects of botched abortion, postpartum sepsis, or abdominal/pelvic surgery. Additionally, uterine conditions that may be inflammatory (such as endometriosis), congenital (like a septate uterus), or benign (like fibroids) as well as ovarian conditions such as polycystic ovarian syndrome and other follicular disorders may be to blame for infertility in the female population. For instance, according to Cureus Journal, published in August 2022, the global prevalence of PCOS (polycystic ovarian syndrome) is estimated to be between 4% and 20% in female population.

According to the World Health Organization (WHO) estimation revealed over 116 million women (3.4%) are affected by PCOS worldwide. In addition, according to the Lancet Article, in 2020, it was reported that, estimated number of women suffering from PCOS is 24 million in China. Thus, this factor can drive the demand for fertility services for females who are suffering from polycystic ovarian syndrome which, in turn, is anticipated to drive the growth of the fertility services market.

On the other hand, lack of awareness among the population of low socioeconomic status regarding availability of fertility services is anticipated to hinder the growth of fertility treatment market. Moreover, lack of awareness regarding male infertility and fertility services are attributed to have negative effects on the growth of the fertility services market. Excessive cost of fertility services such as in vitro fertilization (IVF), surrogacy, artificial insemination, and others are expected to have negative impact on the growth of the fertility services market. Factors such as excessive cost of in vitro fertilization (IVF), surrogacy, cost of ultrasound scans & tests, cost of donor eggs, cost of embryos freezing, uniqueness of medical and fertility condition, and cost of intracytoplasmic sperm injection (ICSI) treatment are anticipated to restrain the market growth.

COVID-19 Impact on Fertility Services Market

The COVID-19 outbreak is expected to negatively impact the global fertility services market's growth. Most of the fertility services such as in vitro fertilization (IVF), surrogacy, artificial insemination, and others were postponed or rescheduled due to conversion of surgical centers and diagnostic centers into COVID hospitals. Moreover, during this COVID-19 era, infertility services have been hampered. The onset of this deadly pandemic has led to postponing and rescheduling of infertility services worldwide. For instance, according to the Journal of Obstetrics and Gynecology Canada (JOGC), the COVID-19 pandemic resulted in decreased annual volumes of medically assisted reproductive procedures at a university-affiliated fertility practice in southwestern Ontario. Moreover, according to Reproductive Biomedicine & Society Online Article, on 1 April 2020, all European countries reported partial or complete cessation of ART (Assisted Reproductive Technology) treatment, and fertility clinics remained closed for an average of 7 weeks.

In addition, according to Human Fertilization & Embryology Authority, it was reported that, in April 2020 fertility treatments were suspended across the UK, along with other elective medical treatments, due to the impact of COVID-19 on the National Health Service (NHS).

Global Fertility Services Market Segmental Overview

The global fertility services market is classified into procedure, service, end user, and region. By procedure, the market is divided into IVF with ICSI, IUI, IVF without ICSI, surrogacy, and others. As per service, it is categorized into fresh non-donor, frozen non-donor, egg & embryo banking, fresh donor, and frozen donor. According to end user, the market is segmented into fertility clinics, hospitals, surgical centers, and clinical research institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Procedure

Based on procedure, the market is classified into IVF with ICSI, IUI, IVF without ICSI, surrogacy, and others. The IVF with ICSI segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to increase in number of product launches for IVF with ICSI technology, high success rate, and rise in adoption of IVF with ICSI by professionals who treat infertility diseases.

By Procedure

IVF with ICSI segment held a dominant position in 2021 and would continue to maintain the lead over the forecast period.

By Service

As per services, it is classified into fresh non-donor, frozen non-donor, egg & embryo banking, fresh donor, and frozen donor. The fresh non-donor segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in the prevalence of infertility, increasing prevalence of infertility among male population due to unhealthy lifestyle, and technological advancement in the development of different fertility services.

By Services

The egg & embryo banking segment is expected to witness the fastest market growth.

By End User

According to end user, the market is classified into fertility clinics, hospitals, surgical centers, and clinical research institutes. The fertility clinics segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in number of professionals who can treat infertility, increase in number of licensed fertility clinics, and rising disposable income among developing countries such as India, China, and others.

By End User

Fertility Clinics was holding a dominant position in 2021 and would continue to maintain the lead over the analysis period.

By Region

The fertility services market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America fertility treatment market is expected to grow during the forecast period owing to a rise in the prevalence of infertility and a rise in the number of product launches and product approvals for fertility services products. In addition, increase in adoption of key strategies such as collaboration, acquisition, agreement, business expansion, and partnership by market players who manufacture fertility services products are anticipated to boost the growth of the IVF services market. For instance, in February 2021, Cooper Surgical, a leader in women’s healthcare solutions, announced a multi-year strategic collaboration, commencing with Virtus Health, a leading global assisted reproductive services provider, to drive innovation, digitalization, and advancement in fertility treatment.

By Region

North America was holding a dominant position in 2021 and would continue to maintain the lead over the analysis period.

Moreover, increase in adoption of unhealthy lifestyle by male and female population, such as consumption of alcohol, smoking, and lack of physical activity is anticipated to drive the prevalence of infertility. Therefore, this factor is attributed to boosting the growth of the fertility services market in North America. In addition, technological advancement in the healthcare sector and high presence of market players who manufacture fertility services products are anticipated to fuel the market growth during forecast period.

Fertility services market in Asia-Pacific is expected to grow during the forecast period owing to increase in adoption of key strategies such as collaboration, acquisition, agreement, business expansion, and partnership by market players who manufacture fertility services products. For instance, in May 2021, Virtus Health, a global leader in Assisted Reproductive Services (ARS) announced a strategic collaboration with Drop Bio, an Australian biotechnology and digital health company focused on chronic inflammation, to drive further advancements to delivering precision fertility.

Technological advancement for the development of different fertility services by market players are anticipated to drive the growth of the market. Rise in number of product launches and product approvals for high technology fertility services are anticipated to boost the growth of the market. For instance, in January 2019, City Fertility, announced the launch of women’s egg freezing services-Chill in Australia. This Chill service preserves women fertility and egg quality through freezing eggs.

Competition Analysis

Competitive analysis and profiles of the major players in the fertility services market include Apollo Hospitals Enterprise Ltd., Care Fertility Group Ltd., Carolinas Fertility Institute, City Fertility, Fertility Associates Limited, Genea Limited, Medicover Group, Monash IVF Group Limited, Progyny Inc., and Virtus Health. There are some important players in the market such as City Fertility and Virtus Health who have adopted product launch, product expansion, and acquisition as key developmental strategies to improve the product portfolio of the fertility services market.

Some examples of product launches in the market

In January 2019, City Fertility, announced the launch of women’s egg freezing services-Chill in Australia. This Chill service preserves women fertility and egg quality through freezing eggs.

Collaboration in the market

In May 2021, Virtus Health, a global leader in Assisted Reproductive Services (ARS) announced a strategic collaboration with Drop Bio, an Australian biotechnology and digital health company focused on chronic inflammation, to drive further advancements to delivering precision fertility.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the fertility services market and the current trends & future estimations to elucidate imminent investment pockets.

- It presents a quantitative analysis of the market from 2022 to 2031 to enable stakeholders to capitalize on the prevailing market opportunities.

- Extensive analysis of the market based on procedures and services assists to understand the trends in the industry.

- Key players and their strategies are thoroughly analyzed to understand the competitive outlook of the fertility services market.

Fertility Services Market Report Highlights

| Aspects | Details |

| By Procedure |

|

| By Service |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

Services related to fertility are ones that are offered to help in infertility treatment. These services use methods such in vitro fertilization (IVF), artificial insemination, surrogacy, and others to aid couples, single mothers, and members of the lesbian, gay, bisexual, and transgender (LGBT) community who are having trouble getting pregnant. People of childbearing age can both experience infertility. Fertility services market is expected to grow during the forecast period owing to rise in the prevalence of infertility, increase in the number of PCOS cases, and technological advancement for development of different fertility services.

Rise in adoption of key strategies such as collaboration, acquisition, agreement, and partnership by key players of fertility services fuels the growth of the market. For instance, in November 2020, Genea Biomedx (a subsidiary of Genea Limited) and Hamilton Thorne partnered to grow Genea Biomedx operations. Under the terms of the collaboration agreement, Hamilton Thorne will exclusively commercialize and market Genea Biomedx’s flagship fertility technologies and products in the United States and Canada. Moreover, in July 2019, Fertility Solutions, a privately owned and operated assisted reproductive service (ARS) clinic was acquired by Monash IVF Group. This acquisition was for creating a more balanced business portfolio across Australia.

In addition, rise in the number of product approvals for innovative technologies fuels the market growth. For instance, in June 2019, City Fertility launched women’s egg freezing service called Chill in Australia. This Chill service preserves women fertility and egg quality through freezing eggs.

The total market value of fertility services market is $21,138.2 million in 2021 .

The forecast period in the report is from 2021 to 2032

The market value of fertility services market in 2022 was $23,720.2 million

The base year for the report is 2021.

Yes, fertility services companies are profiled in the report

The top companies that hold the market share in fertility services market are Apollo Hospitals Enterprise Ltd., Care Fertility Group Ltd., Carolinas Fertility Institute, City Fertility, Fertility Associates Limited, Genea Limited, Medicover Group, Monash IVF Group Limited, Progyny Inc., and Virtus Health.

The key trends in the fertility services market are increase in prevalence of infertility in female population, increase in prevalence of infertility in male population, and delayed pregnancies in woman.

Loading Table Of Content...