Ferulic Acid Market Research, 2035

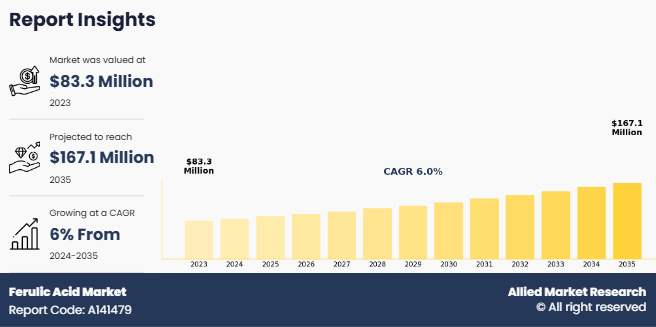

The global ferulic acid market was valued at $83.3 million in 2023, and is projected to reach $167.1 million by 2035, growing at a CAGR of 6% from 2024 to 2035. Ferulic acid is a plant-based antioxidant widely found in seeds, grains, fruits, and vegetables. It is known for its anti-inflammatory, anti-aging, and UV-protective properties, making it an essential ingredient across various industries, including food and beverages, pharmaceuticals, and cosmetics. The market for ferulic acid is growing due to increasing consumer demand for natural antioxidants, rising awareness of skincare benefits, and its expanding applications in functional foods and dietary supplements.

The global ferulic acid industry is experiencing steady growth, driven by its expanding applications across multiple sectors. The increasing demand for natural antioxidants in cosmetics and food preservation is one of the key growth drivers. Ferulic acid is widely used in anti-aging skincare products as it neutralizes free radicals and enhances the stability of other antioxidants like vitamins C and E. In the food and beverage sector, ferulic acid is used as a preservative and functional ingredient due to its antimicrobial and antioxidant properties. Moreover, the pharmaceutical industry is leveraging the anti-inflammatory and cardiovascular benefits of ferulic acid to develop new therapeutic solutions. The rising preference for plant-derived bioactive compounds in healthcare and nutraceuticals is fueling market expansion. With growing R&D investments and technological advancements in extraction methods, synthetic production is also gaining traction to meet the rising demand for high-purity ferulic acid.

However, challenges such as high extraction costs from natural sources and regulatory constraints regarding synthetic variants may hinder market growth. Despite this, increasing awareness of clean-label ingredients and advancements in fermentation-based production methods offer promising growth opportunities.

Key Takeaways

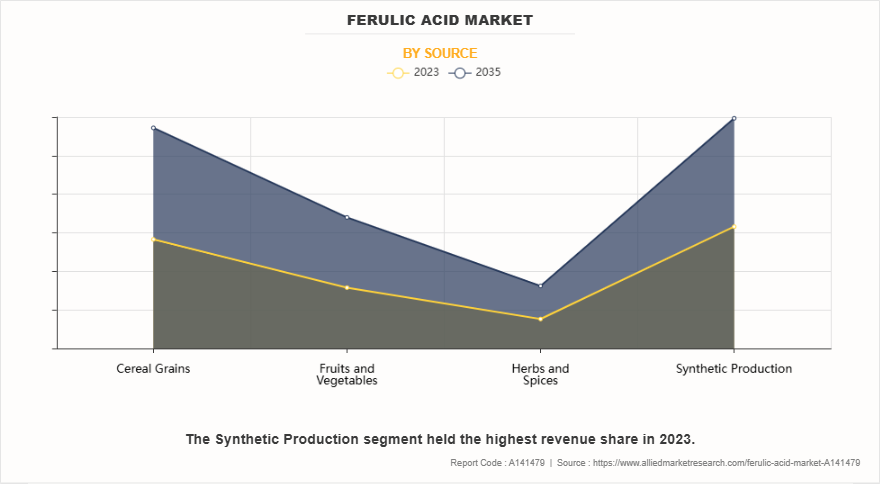

- Based on source, the synthetic production segment dominated the ferulic acid industry in 2023 and is expected to retain its dominance throughout the ferulic acid market forecast period.

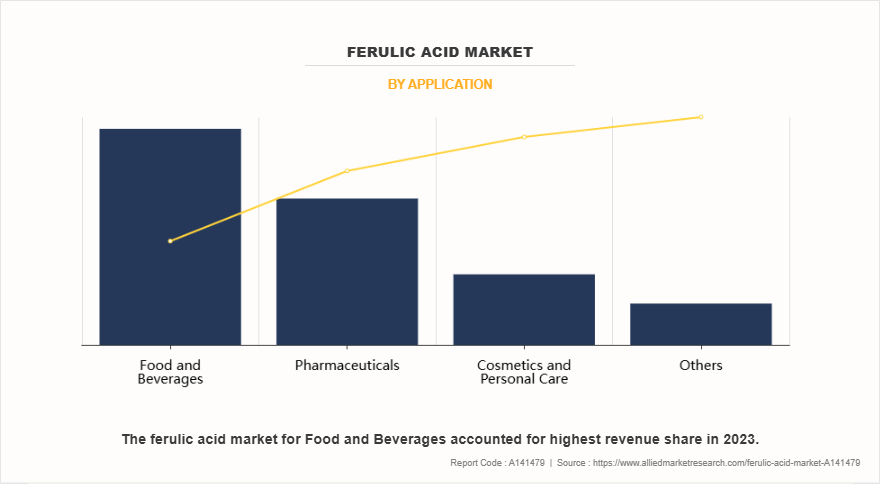

- By application, the food and beverages segment was the major holder of ferulic acid market share in 2023.

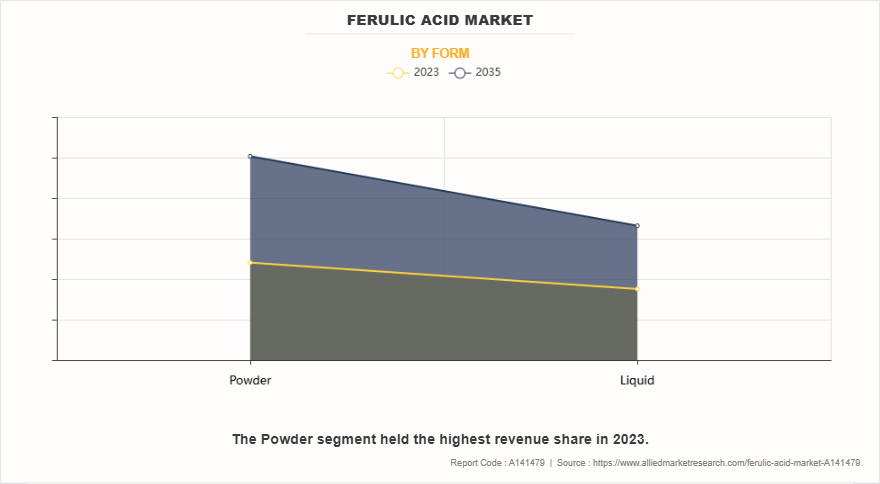

- By form, powder segment was dominant in 2023.

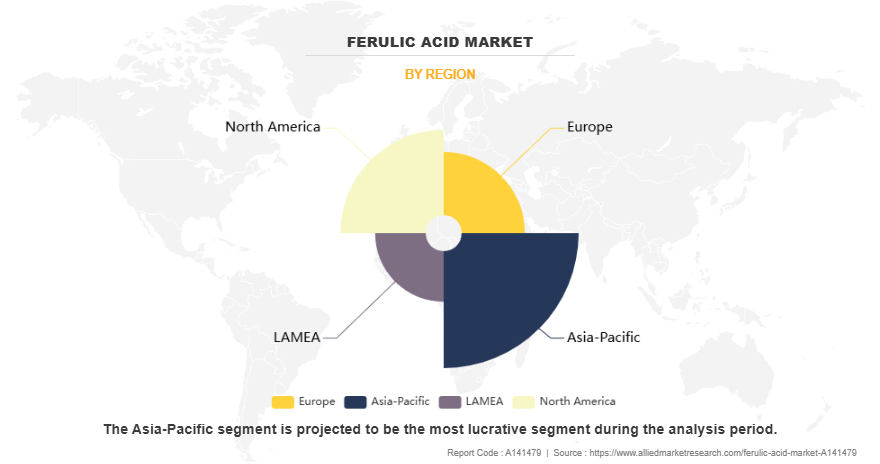

- Region wise, Asia-Pacific dominated the ferulic acid market share in 2023.

Market Dynamics

In the food and beverage sector, ferulic acid plays a crucial role as a natural preservative, antioxidant, and functional ingredient. It is widely incorporated into bakery products, dairy, beverages, and nutraceuticals to extend shelf life and improve nutritional value. The growing demand for fortified and functional foods, along with increasing consumer awareness of health and wellness, is propelling the adoption of ferulic acid in food formulations. The clean-label movement is also encouraging food manufacturers to replace synthetic antioxidants with plant-derived alternatives, further accelerating market growth.

The availability of functional and processed food products such as jam, meat, bakery & confectionery, dairy products, and others in the market has attracted consumers for a few years. The consumers look for multifunctional food that will fulfill their nutritional requirements through food in their daily diet. Rise in health awareness among the consumers plays a major role in their food choices that presents manufacturers with a huge opportunity to offer healthy products in innovative ways. According to the report by the Kerry Group 2020, the global functional food market was valued at ~$230 billion that was expected to reach ~$270 billion by the end of the year 2025.

Functional food products are developing according to the ferulic acid market demand and consumer necessities with time. The manufacturers are utilizing several nutrients such as protein, vitamins, fat, and others to develop novel products that are demanded in the market. Ferulic acid is one of the most important nutrients that fulfill the requirements of functional food by offering several benefits such as antioxidants, energy production, and others. Functional food manufacturing companies are trying different combinations of ferulic acids in their food that would help increase the overall production. Rise in sales of functional food thus boosts the ferulic acid market growth.

The global cosmetics business is rapidly expanding, owing to increase in consciousness about appearance among people and rise in desire for different cosmetic goods, skincare products, beauty care products, and personal care products. The expansion of well-known cosmetic companies in western nations, availability of new cosmetic items, and improved product quality have all contributed to increased market demand and sales. Ferulic acid is the most popular type of ferulic acid that is utilized by the cosmetics manufacturers in a significant quantity. Ferulic acid plays a major role in the offerings of anti-aging treatments, skin firmness and brightness, and serves to rejuvenate the skin of the consumers. The expanding cosmetics and personal care products are expected to demand more ingredients such as ferulic acid which is anticipated to subsequently boost the ferulic acid market size during the forecast period.

However, The expansion of the ferulic acid market size is hampered by the rise in the prices of raw materials used in its manufacturing. The primary raw materials utilized in ferulic acid production are fruits, grains, vegetables, and others. The raw material prices are volatile and can be influenced by a series of factors, including extreme weather, political instability, and pests & disease. In addition, the increase in the supply-demand gap in the fruit industry has accelerated the prices of citrus and other fruits. The ongoing inconsistency of the production of ferulic acid from natural sources has affected the price, as the price increased due to less production and more demand. Increased price and a lack of raw materials for processing ferulic acid restrains the growth and development of market.

The production of ferulic acid is a complex procedure that must adhere to the several requirements imposed by the governments of different nations in the world. National and international scientific bodies and laboratories rigorously examine ferulic acid as a food additive. The worldwide Joint FAO/WHO Expert Committee on Food Additives (JECFA), the European Food Safety Authority (EFSA), and state agencies are among the independent bodies. In Europe, the European Food Safety Authority (EFSA) is in charge of checking such substances at each stage of manufacturing and has published rules on how much quantity can be used in food & beverages. In addition, the Food and Drug Administration has recommended a list of ferulic acids that are acceptable for use within its respective constraints. Stringent government regulations on the production of ferulic acid interrupts marketing activities and results in a procedural delay to reach the market that is impacting demand-supply gap of the market negatively.

Segmental Overview

The market is segmented into source, application, form, and region. On the basis of source, the market is divided into cereal grains, fruits and vegetables, herbs and spices, and synthetic production. As per application, it is divided into food and beverages, pharmaceuticals, cosmetics & personal care, and others. On the basis of form, the market is bifurcated into powder and liquid. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, and the Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Source

By source, the market is categorized into cereal grains, fruits and vegetables, herbs and spices and synthetic production. The synthetic production segment dominated the market in 2023. The synthetic ferulic acid market is growing due to advancements in biotechnological fermentation and chemical synthesis techniques, ensuring high purity and cost efficiency. Increasing demand for consistent-quality antioxidants in cosmetics, pharmaceuticals, and food preservation is driving adoption.

By Application

By application, the market is categorized into food and beverages, pharmaceuticals, cosmetics and personal care and others. The food and beverages segment dominated the ferulic acid market in 2023. Food items such as sauces & jams, meat products, dairy products, confectionery, bakery, and others are prepared and processed by adding ferulic acid. Ferulic acid plays a major role in the food and beverages industry; it has various uses and helps to preserve food products for an extended period offering various nutritional benefits. Soft drinks, energy drinks, and juices are few of the major categories in the beverage industry which uses ferulic acid in huge quantity.

By Form

By form, the ferulic acid market is categorized into powder and liquid. The powder segment dominated the ferulic acid market in 2023. Powder form of ferulic acid is used for manufacturing several food products, including bakery goods, candies, and chewing gums that offer the benefits of ferulic acid to the consumers. In the form of powder, the product is widely used as a drug component in the pharmaceutical industry. They provide a longer shelf life and are easier to handle and transport.

By Region

The ferulic acid market is analyzed across four following key regions North America: U.S., Canada, Mexico Europe: France, Germany, Italy, Spain, UK, Rest of Europe Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia-Pacific LAMEA: Latin America, Middle East, Africa The Asia-Pacific region dominated the ferulic acid market in 2023. The Europe region held the fastest CAGR during the forecast period.

Competition Analysis

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have also been focusing on strengthening their market reach to maintain their reputation in the ever-competitive market. Key players profiled in this report include Tokyo Chemical Industry Co., Ltd., Aktin Chemicals Inc., Pfaltz and Bauer, Inc., Spectrum Chemical Manufacturing Corp., Tianjin NWC Biotechnology Co., Ltd., Chemfaces, Sigma-Aldrich Corporation, Nomura Chemical Co., Ltd., and Merck KGaA.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ferulic acid market analysis from 2023 to 2035 to identify the prevailing ferulic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ferulic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ferulic acid market trends, key players, market segments, application areas, and market growth strategies.

Ferulic Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 167.1 million |

| Growth Rate | CAGR of 6% |

| Forecast period | 2023 - 2035 |

| Report Pages | 351 |

| By Source |

|

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | Pfaltz and Bauer, Inc., Merck KGaA, Tianjin NWC Biotechnology Co., Ltd., Tokyo Chemical Industry Co., Ltd., Chemfaces, Sigma-Aldrich Corporation, Spectrum Chemical Manufacturing Corp., Aktin Chemicals Inc., Nomura Chemical Co., Ltd. |

Analyst Review

According to CXOs, the introduction of a new production process for ferulic acid is expected to close down the demand and supply gap, as every year the demand for food-grade ferulic acid rises by ~5%. The fermentation industry contributes to ferulic acid production, posing enormous challenges for conventional industrial recovery methods and processes. There are several recovery technologies available for this acid, such as precipitation, extraction, adsorption, and membrane. Introduction of new technologies in the conventional production process may offer a new perspective without the use of any living organism.

The ferulic acid market was valued at $83.3 million in 2023 and is estimated to reach $167.1 million by 2035, exhibiting a CAGR of 6.0% from 2024 to 2035. ?

The Ferulic acid market registered a CAGR of 6.0% from 2024 to 2035.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.??

The forecast period in the Ferulic acid market report is from 2024 to 2035.??

The ferulic acid market is segmented into source, application, form, and region. On the basis of source, the market is divided into cereal grains, fruits and vegetables, herbs and spices, and synthetic production. As per application, it is classified into food and beverages, pharmaceuticals, cosmetics & personal care, and others. On the basis of form, the market is bifurcated into powder and liquid. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By form, the powder segment dominated the global ferulic acid market in 2023.

Key players profiled in this report include Tokyo Chemical Industry Co., Ltd., Aktin Chemicals Inc., Pfaltz and Bauer, Inc., Spectrum Chemical Manufacturing Corp., Tianjin NWC Biotechnology Co., Ltd., Chemfaces, Sigma-Aldrich Corporation, Nomura Chemical Co., Ltd., and Merck KGaA.

Loading Table Of Content...

Loading Research Methodology...