Global Fiber Management Systems Market Outlook - 2031

The Global Fiber Management Systems Market was valued at $3.4 billion in 2021 and is projected to reach $9.3 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031

The global fiber management system market is expected to showcase remarkable growth during the forecast period of 2022-2031. The report contains a thorough examination of the fiber management systems market size, fiber management systems market trends, key market players, sales analysis, major driving factors, and key investment pockets. The report on the global fiber management system market provides an overview of the market as well as market definition and scope.

The ongoing technological advancements and surge in demand have an impact on market growth. Furthermore, the report provides a quantitative and qualitative analysis of the fiber management system market, as well as a breakdown of the pain points, value chain analysis, and key regulations.

A fiber management system (FMS) is a system that manages optical fiber connections from the outside of the fiber rack to the fiber routers. A fiber network is managed using the FMS method. It logs system operations and features like schematic design, asset physical locations, mechanical/fusion splice points, and more. Among its applications are the creation and distribution of cable capacity reports, the calculation of total cable lengths, the recording of fiber cable locations, splicing records, the verification of the presence of dark fiber cables, and the troubleshooting of fiber breakage.

To execute these tasks, most organizations rely on software-based platforms, databases, and spreadsheets. Managers and installers can utilize these technologies to save data on network components, connections, and testing, which can be useful for future upgrades or diagnosing problems if they arise. Reports from fiber optic management systems can reveal network statistics such as cable section lengths, loss budgets, network capacity, optical loss, and splice and termination sites. All of these factors contribute to the global expansion of fiber management solutions.

Fiber management solutions are most typically used in fiber optic communication networks. Cellular wireless technology has always relied on fiber networks and will continue to do so in the future. The use of the 5G network, the fifth generation of mobile network technology that promises faster speeds, cleaner connections, and higher capacity for individual devices, is widely expected to grow during the forecast period. As a result, in order to handle 5G cell installations, fiber management solutions will need to be significantly denser. The high manufacturing costs connected with the development of this technology, as well as its fragility and installation challenges, may hinder the market growth of fiber management systems.

The largest end-use industry for fiber optics is telecommunication, and the optical fiber is the primary medium for data transport from one location to another. The sector is quickly expanding as a result of the rising use of mobile devices and the associated bandwidth connectivity. Positive market developments in broadband services and big data management, such as 5G networks, AI implementation, and the Internet of Things, are propelling the telecommunications business. The number of connected devices continues to grow, and the use of fiber management solutions will follow the pace as device usage and connectivity grow.

The global fiber management systems market size is expected to witness notable growth during the forecast period, owing to a surge in demand for Internet of Things (IoT) devices. Moreover, the rise in the deployment of data centers and the rise in demand for higher bandwidth are expected to boost the fiber management systems market growth during the forecast period. However, the lack of professionals to operate and install fiber optic cassette solutions is one of the prime factors that restrain the global fiber management systems market growth. On the contrary, the expansion of telecom infrastructure in developing economies is expected to provide lucrative opportunities for the growth of the fiber management systems market during the forecast period.

Segment Overview

The fiber management systems market share is segmented into Type and Application.

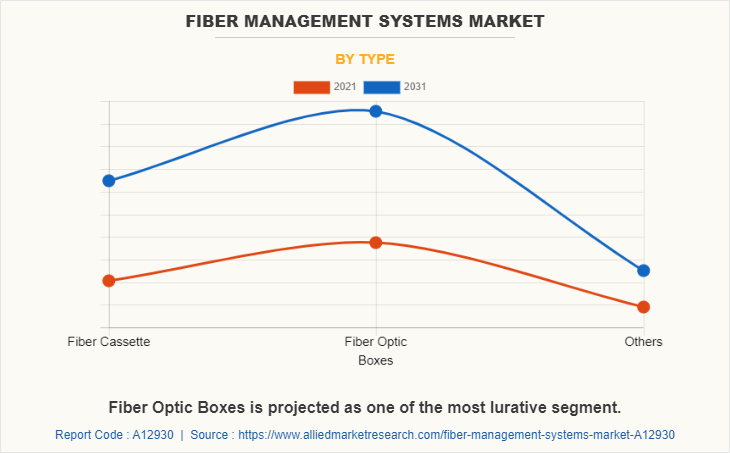

On the basis of type, the fiber management systems market outlook is divided into fiber cassettes, fiber optic boxes, and others. In 2021, the fiber optic box segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

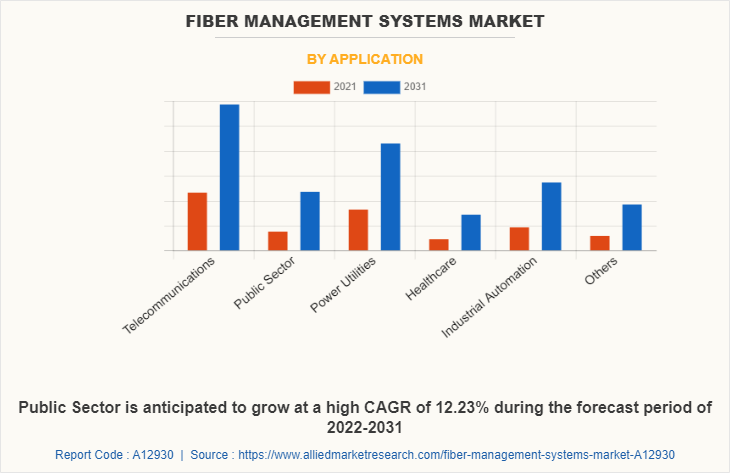

On the basis of application, the fiber management systems market opportunity is segregated into telecommunications, the public sector, power utilities, healthcare, industrial automation, and others. Thetelecommunicationssegment acquired the largest share in 2021 and is expected to grow at a significant CAGR from 2022 to 2031.

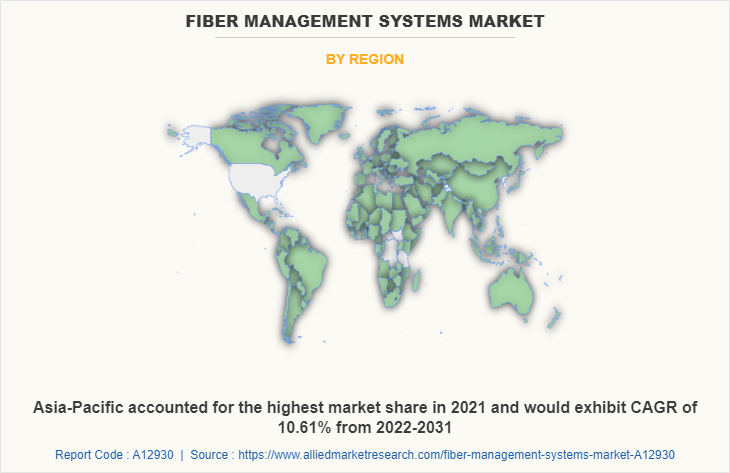

On the basis of region, the fiber management systems market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific remains a significant participant in the fiber management system market. Major organizations and government institutions in the region are putting resources into technology.

Competitive Analysis

The major global fiber management systems market players that have been provided in the report include 3M, Belden Inc., BUD Industries, Eaton Corporation Plc (Tripp Lite), HUBER+SUHNER, Molex, Panduit, Phoenix Contact, RockOm, Santron, and TE Connectivity Ltd.

Country Analysis

Country-wise, the U.S. acquired a prime share in the fiber management systems market forecast in the North American region and is expected to register a high CAGR of 10.87% during the forecast period of 2022-2031. The U.S. holds a dominant position in the fiber management system market, owing to a rise in investment by prime vendors to boost smart infrastructure solutions.

In Europe, Germany dominated the fiber management systems market in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. However, the UK is expected to emerge as the fastest-growing country in Europe's fiber management system market with a CAGR of 12.33%, owing to significant developments in the Internet of Things devices in telecommunication, automotive, and other sectors in the country.

In Asia-Pacific, China is expected to emerge as a significant market for the fiber management system industry, owing to a significant rise in investment by prime players and government institutions to boost telecommunication sectors.

In the LAMEA region, Latin America garnered a significant fiber management systems industry share in 2021. The LAMEA fiber management system market has been witnessing improvement, owing to the growing inclination of companies towards research and development for enhanced connectivity for consumer electronics and smart factories across this region. The region has the potential for increased FTTH (fiber to the home) deployment. This is primarily due to new strategies being developed by the government and service providers to aid in the expansion of the FTTH network. Initially, only the healthcare industry and a few other businesses used fiber optic networks. Furthermore, as internet penetration has increased, so has the number of fiber optic rollouts. As a result of the transformation that many businesses are bringing about in the optical communication & network equipment industry, the market for fiber management systems is anticipated to expand rapidly during the forecast period.

Moreover, the Latin America region is expected to expand at a high CAGR of 12.82% from 2022 to 2031, owing to new developments and investments in fiber and an increase in the deployment of high-speed networks in the region. This is expected to reshape the growth of the fiber management system market in Latin America.

Top Impacting Factors

Significant factors that impact the growth of the global fiber management system industry include the high demand for Internet of Things devices. Moreover, increased deployment of data centers around enterprises and government centers, rising demand for bandwidth for faster connectivity, and expansion of telecom infrastructure in developing economies are expected to drive market growth during the forecast period. However, the lack of professionals to operate and install fiber optic cassette solutions may hamper the growth of the market.

Historical Data & Information

The global fiber management system market is highly competitive, owing to the strong presence of existing vendors. Vendors of fiber management systems with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Santron, Panduit, HUBER+SUHNER, Eaton Corporation Plc (Tripp Lite), and Phoenix Contact are the top 5 companies that hold a prime share in the fiber management system market. Top market players have adopted various strategies, such as product launch, branding, innovation, and acquisition to expand their foothold in the fiber management system market.

- For instance, in January 2020, JO Software Engineering GmbH, a modern software company with over 30 years of experience in network technology and engineering, announced the launch of cables cut, which enables companies to comprehensively manage in one system all types and topologies of fiber optic and copper networks together with the transmission and connection technologies installed such as xWDM, xPON, xDSL and FTTx from one national location through the other location’s signal level.

- In May 2021, HUBER+SUHNER, a company that offers a range of high-performance, innovative fiber management solutions that thrive in different environments, announced the launch of SYLFA HD, a fiber management system for customers who require a space-saving, structured cabling solution. With decades of expertise, it understands that time, accessibility, and protection are key elements for customers and should not be compromised, regardless of the environment’s size.

In March 2022, Panduit announced the launch of its new FlexCoreoptical distribution frame [ODF], a versatile front-access cabling system that provides the necessary protection for critical connections. Utilizing innovative cable management and simple, intuitive cable routing, the FlexCore ODF simplifies and reduces the time for moves, adds, and changes. Through standard doors with locks and optional locks for each enclosure, the FlexCore ODF solution enables multi-tiered security that is important for multiple client access.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fiber management systems market analysis from 2021 to 2031 to identify the prevailing fiber management systems market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights buyers' and suppliers' potency to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fiber management systems market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of regional and global fiber management systems market trends, key players, market segments, application areas, and market growth strategies.

Fiber Management Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 9.3 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 195 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Corning Inc, HUBER SUHNER, 3M Company, Eaton Corporation Plc (Tripp Lite), RackOm System, panduit, Molex, TE Connectivity Ltd., Belden Inc., Santron Electronics, bud industries, inc., phoenix contact |

Analyst Review

The fiber management system market is anticipated to depict prominent growth during the forecast period, owing to an increase in demand for IoT devices for various applications such as digital signage, data centers, smart infrastructure, and others. In addition, the need for fiber management systems for interactive kiosks, and networking solutions such as cloud computing, automated inspection, and others are increasing rapidly.

Demand for fiber management systems among manufacturing businesses has surged as IoT, big data, and machine learning have advanced globally. The value of data has changed significantly through IT efficiencies. In this period of industry transformation and growth, more and more devices are being connected using fiber optic boxes. The demand for higher bandwidths and high-switching servers that can handle a variety of workloads and specific functions is skyrocketing as a result of the rise in the deployment of fiber optic technology globally. Fiber management systems are currently used as platforms for local or edge-level workload convergence and customized workload consolidation due to their effective performance and low power consumption.

For instance, in March 2022, R&M, a globally active developer and supplier of cabling systems for high-quality network infrastructures announced the launch of fiber-to-the-home (FTTH) products and services in the U.S. in order to provide end-to-end connectivity. According to Paulo Campos, Executive VP, of Americas, and president of R&M USA Inc., R&M will offer its high-end fiber optic portfolio and international expertise in FTTH projects to the U.S. to help telecommunications customers meet the demand for virtually unlimited bandwidth in the digital era.

Asia-Pacific is the largest regional market for Fiber Management Systems.

Thetelecommunicationssegment acquired the largest share in 2021 and is expected to grow at a significant CAGR from 2022 to 2031.

The global fiber management system market was valued at $3,357.8 million in 2021 and is projected to reach $9,264.8 million by 2031, registering a CAGR of 10.84% from 2022 to 2031.

high demand for Internet of Things devices. Moreover, increased deployment of data centers around enterprises and government centers, rising demand for bandwidth for faster connectivity, and expansion of telecom infrastructure in developing economies are expected to drive market growth during the forecast period.

Santron, Panduit, HUBER+SUHNER, Eaton Corporation Plc (Tripp Lite), and Phoenix Contact are the top 5 companies that hold a prime share in the fiber management system market.

Loading Table Of Content...