Fiber Optic Preform Market Research, 2032

The Global Fiber Optic Preform Market was valued at $5.1 billion in 2022, and is projected to reach $12.4 billion by 2032, growing at a CAGR of 9.4% from 2023 to 2032.

The fiber optic preform is a cylindrical optical glass that aids in the production of fiber optics in the fiber drawing tower. During the drawing process, the optic fibers are drawn via preforms with the usage of the water slurry framework, coordinated fiber process, and coating materials such as silicone, polyamide, and acrylate.

Segment Overview

The fiber optic preform market is segmented into Process, Product Type and End Use.

There are various advantages to having fiber optics. For instance, it provides faster speed with less attenuation, less impervious to electromagnetic interference (EMI), smaller size and greater information carrying capacity. The unceasing bandwidth needs, on the other hand, are also yielding significant growth in fiber optic preform market demand. They also exhibit lower vulnerability to electromagnetic interference in contrast to conventional electronic devices. Moreover, electro-optics facilitates non-intrusive sensing capabilities, as evidenced in applications such as medical imaging and remote sensing.

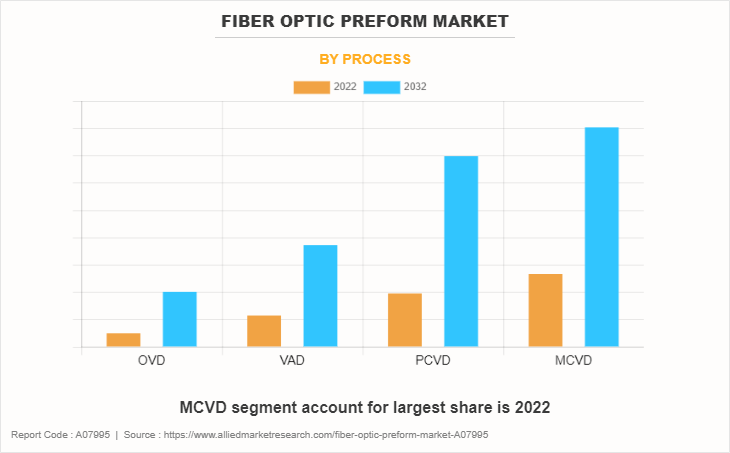

By process, the market is divided into OVD, VAD, PCVD, and MCVD. In 2022, MCVD segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period and is expected to emerge as the fastest growing segment of the market during the forecast period 2023-2032.

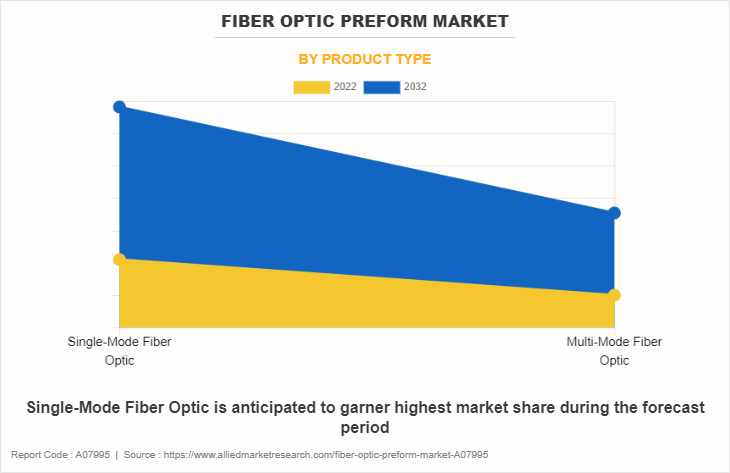

By product type, the market is bifurcated into Single-Mode Fiber Optic and Multi-Mode Fiber Optic. In 2022, Single-Mode Fiber Optic segment dominates the market in terms of revenue and is anticipated to follow same trend during the forecast period.

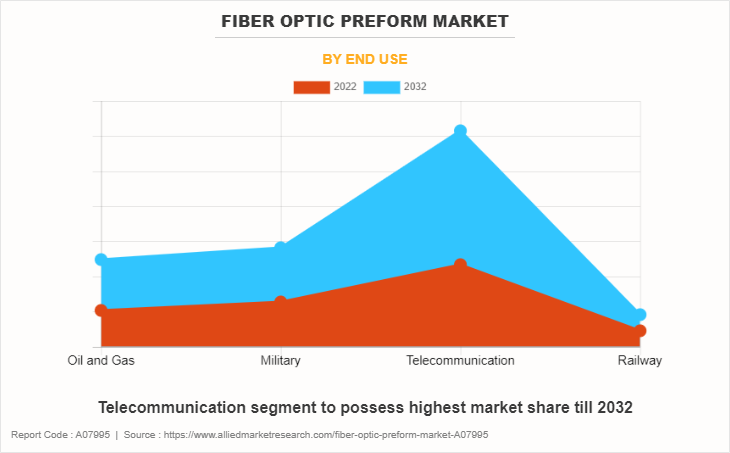

By end user, the market is classified into oil & gas, military, telecommunication, and railway. In 2022, the telecommunication segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the telecommunication segment is expected to grow at a high CAGR during the period of 2023-2032.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, Specifically China, remains a significant participant in the fiber optics preform market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced fiber optics preform which is driving the growth of the fiber optics preform industry in Asia-Pacific.

The growing demand for high bandwidth communication is one of the prominent drivers for optical fibers and hence the preform market. The innovations in the telecommunication industry have paved the way for bandwidth-intensive communication based on fiber optic network, optical fibers are also finding applications in other industries, including oil and gas, aerospace, defense, railway, and healthcare, among others.

Furthermore, the preforms also aid in enhancing the performance of optical fibers that are specially integrated to establish vehicle safety in automobiles. The surge in interconnectivity among end-user industries such as IT & telecommunications, retail, and business enterprises boosts the market growth in terms of rise in digital infrastructure.

The high cost of fiber cable installation in comparison to copper wires is anticipated to impede the growth of the fiber optic perform market during the forecast period. In addition, the need for research and development investments to stay at the forefront of technological advancements in fiber-optics strain budgets. This financial barrier may limit the number of players in the market and slow down innovation, making it challenging for some potential users to adopt fiber-optical solutions, despite their numerous advantages, until economies of scale and competition drive costs down over time.

In addition, the rise in data traffic in line with the continued proliferation of tablets, smart devices, laptops, and other portable devices is anticipated to further trigger the demand for optical fiber. The fiber optic preform market is evolving continuously, as it happens to be a vital element of the supply chain associated with the broader optical fiber industry.

The fiber optics preform market is segmented into process, product type, end user, and region. By process, the market is divided into OVD, VAD, PCVD, and MCVD. In 2022, MCVD segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period and is expected to emerge as the fastest growing segment of the market during the forecast period 2023-2032. By product type the market is bifurcated into Single-Mode Fiber Optic and Multi-Mode Fiber Optic. In 2022, Single-Mode Fiber Optic segment dominates the market in terms of revenue and is anticipated to follow same trend during the forecast period. By end user, the market is classified into oil & gas, military, telecommunication, and railway. In 2022, the telecommunication segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the telecommunication segment is expected to grow at a high CAGR during the period of 2023-2032.

Competition Analysis

Competitive analysis and profiles of the major fiber optics preform market players, such as Fujikura Ltd, Furukawa Electric Co., Ltd., Hengtong Group Co., Ltd, Heraeus Holding, Fiberhome, Prysmian Group, sterlite technologies limited, Sumitomo Electric Industries Ltd., Yangtze Optical Fiber and Cable Joint Stock Limited Company, and Corning Incorporated is provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

North America-wise, the U.S. acquired a prime share in the Fiber optics preform market in the North American region and is expected to grow at a CAGR of 7.57% during the forecast period of 2023-2032. The U.S. holds a dominant position in the fiber optics preform market, owing to an increase in investing in smart city initiatives to enhance urban living and sustainability.

In Europe, the France dominated the Europe fiber optic preform market size in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, the UK is expected to emerge as one of the fastest growing country in Europe's fiber optics preform industry with a CAGR of 11.01%, owing to the rise in the demand of telecommunication and high-speed data transmission networks across the region.

In Asia-Pacific, China holds a dominated fiber optic preform market share in Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to adoption of advanced technologies, such as wavelength division multiplexing (WDM) and dense wavelength division multiplexing (DWDM). However, South Korea is expected to emerge as a highest CAGR in fiber Optic preform industry Asia-Pacific region.

In LAMEA, Latin America is growing the fastest in the fiber optic preform industry because of its growing economy, increasing disposable income, and ongoing expansion of telecommunications infrastructure throughout the area. Moreover, the Middle East region is expected to grow at a high CAGR of 10.34% from 2023 to 2032, owing to its economic growth and infrastructure investment.

Top Impacting Factors

The optical fiber preform market is anticipated to expand significantly during the forecast period owing to the rise in demand for high bandwidth communications. In addition, the increase in the use of internet services and the demand for high-speed data fuel fiber optic preform market growth. Moreover, the optical fiber preform market is anticipated to benefit owing to the expansion of the data center industry, and the surge in the reach of communication networks is expected to present enormous opportunities for the market over the forecast period. On the other hand, high fiber cable installation costs are anticipated to restrain optical fiber preform market growth during the forecast period.

Historical Data & Information

The optical fiber preform market is highly competitive, owing to the strong presence of existing vendors. Vendors of fiber optics preform with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to fiber optic preform market demand. The competitive environment in this fiber optic Preform market forecast is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent investment in fiber optics preform market

In October 2023, Yangtze Optical Fiber and Cable invested for communication optical cable production base in Minas Gerais, Brazil. The move is expected to benefit local people by enabling access to more reliable and stable communication experience with its superior products solutions, and more significantly, inject impetus into Brazil's technology development and foster technological cooperation for the two countries.

- In May 2022, Prysmian Group, announced investment of a $30 million to the $85 million to increase optical fiber cable capacity and capability in plants in North America. With these investments, Prysmian further expands its North American optical cable production footprint of its telecom US sites.

Recent expansion in fiber optics preform market

In September 2023, Corning Incorporated opened an optical fiber manufacturing facility in Mszczonow, Poland, to meet growing demand for high-speed connectivity in the European Union and surrounding regions.

Recent Product Development in fiber optics preform market

On January 2023, Prysmian Group,upgraded Sirocco HD range of microduct cables to include an 864f cable. Its cables provide world record diameters and fibre densities for blown microduct cables. The cable boasts 864 fibres in a diameter of 11.0mm, providing a fibre density of 9.1 fibres per mm2, and is installable into a 13mm duct.

Recent Product launch in fiber optics preform market

On May 2023, Prysmian Group, launched its sustainable telecommunication system Ecoslim, using Sirocco HD and Sirocco Extreme (XT) optical cables which are available with up to 864 optical fibers. Sirocco HD cables are made with 50% less plastics and up to 25% smaller in diameter, in line with the Group’s commitment to increase the amount of recycled material in their products.

- In October 2022, STL launched India’s first Multicore fiber and cable. This breakthrough innovation changes the optical connectivity landscape of India. STL’s Multiverse leverages Space Division Multiplexing to gain 4X transmission capacity per fiber, within the same diameter.

Recent partnership in fiber optics preform market

In June 2023, STL partnered with TruVista, a provider of broadband services and applications, to drive the growth and enhancement of South Carolina’s rural connectivity infrastructure. STL and TruVista invested heavily in manufacturing and building fiber networks. It invested significantly in a state-of-the-art fiber optic technology manufacturing facility in Lugoff, South Carolina, with end-to-end advanced automation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fiber optic preform market analysis from 2022 to 2032 to identify the prevailing fiber optic preform market demand, opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fiber optic preform market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fiber optic preform market trends, key players, market segments, application areas, and market growth strategies.

Fiber Optic Preform Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.4 billion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Process |

|

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | FiberHome, Yangtze Optical Fibre and Cable Joint Stock Limited Company, Heraeus Holding, Hengtong Group Co., Ltd, Corning Incorporated, Prysmian Group, Sumitomo Electric Industries, Ltd., Fujikura Ltd., STL Tech, FURUKAWA ELECTRIC CO., LTD. |

Analyst Review

The global fiber optics preform market forecast holds high potential for the semiconductor industry. The business scenario has witnessed an increase in the demand for electro optics devices, particularly in developing regions, such as China, India, Japan, the U.S., the UK, South Korea, and France. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

Rise in demand for high bandwidth communications, increase in use of internet services, and demand for high-speed data drive the market growth. However, high fiber cable installation costs impede the growth of the market. The data center industry is expected to create lucrative opportunities for the key players operating in this market during the forecast period.?

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players.

Increase in demand for high-bandwidth applications and Growing data center construction are the upcoming trends of fiber optic preform market in the world.

Telecommunication is the leading application of fiber optic preform market.

Asia-Pacific is the largest regional market for fiber optic preform.

$12.36 billion is the estimated size for fiber optic preform market.

Fujikura Ltd, Furukawa Electric Co., Ltd., Hengtong Group Co., Ltd, Heraeus Holding, Fiberhome, Prysmian Group, sterlite technologies limited, Sumitomo Electric Industries Ltd., Yangtze Optical Fiber and Cable Joint Stock Limited Company, and Corning Incorporated are the top companies to hold the market share in fiber optics preform market.

Loading Table Of Content...

Loading Research Methodology...