Fiberglass Doors Market Research, 2032

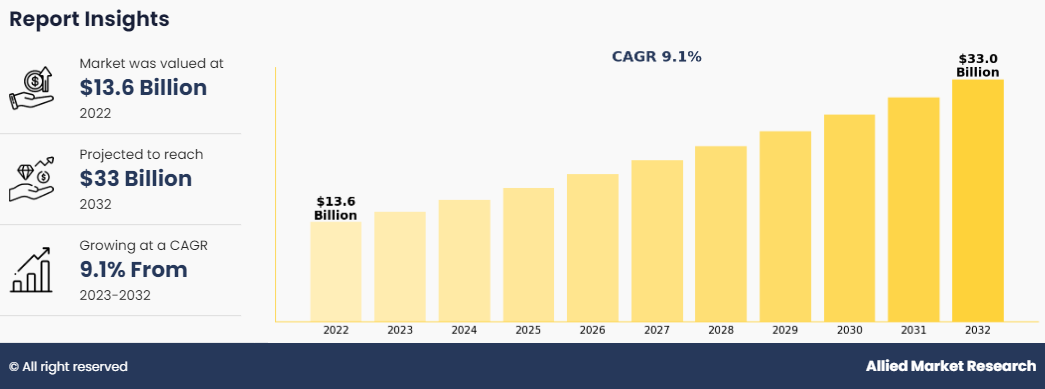

The global fiberglass doors market size was valued at $13.6 billion in 2022, and is projected to reach $33.0 billion by 2032, growing at a CAGR of 9.1% from 2023 to 2032. A fiberglass door is made of compression molded fiberglass. The high density of this strong material gives the door its long durability without losing the required flexibility and appearance. fiberglass doors are a strong alternative to wooden doors. It has three major components, such as the frame, core, and skin. The frame is usually made of wood or a high-strength composite material. The core is filled with a polyurethane insulating foam for both, insulation and soundproofing.

Market Dynamics

According to the United Nations statistics, in 2022, nearly 56% of the global population resided in urban regions and if the same trend continues by 2050, 68% population is expected to reside in urban areas. Further, as per the fiberglass doors market analysis, about 80% of urban growth is expected to take place in emerging economies, such as Asia Pacific and Africa, in the next 20 years. According to the World Economic Forum, in 1950, less than 20% of Africans and Asians lived in cities, but as of 2020, that number has increased to 43% and 51%, respectively. In addition, in 2020, South America also saw a similar trend, and as of 2020 urban population totaled to more than 80%, which is higher than that of Europe. Such trends of urbanization boost the demand for residential as well as non-residential construction. Thus, driving the fiberglass doors market growth.

Furthermore, the real estate industry has witnessed rapid growth over the last few decades and is expected to exhibit moderate growth in future. In addition, rise in residential and commercial places, is expected to drive the growth of the fiberglass doors market. For instance, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, in February 2021, 1,769,000 housing units went under construction, which is a 6.8% increase from the revised January estimate of 1,657,000 housing units. In addition, the real estate sector in India saw a huge rise, despite the impact of COVID-19. As the studies showed, home sales rose 71% year-on-year, with 237,000 units sold in 2021, which is 90% as compared to pre-COVID 2019 levels. Mumbai Metropolitan Region sold 76,400 units, followed by the National Capital Region (NCR), which sold 40,050 units. Thus, a sharp rise in the building construction sector be seen globally. For example, in October 2021, the Dubai and Indian governments agreed to develop infrastructures such as industrial parks, multipurpose towers, logistics centers, a medical college, and a specialized hospital in the state of Jammu & Kashmir, India. Moreover, the government of Indonesia has planned to shift its capital from Jakarta to Nusantra, where a number of new buildings will be constructed. Moreover, according to Stastista, the size of the construction market amounted to $6.4 trillion in 2020, and it is expected to reach $14.4 trillion in 2030. Such factors indicate an increasing number of buildings are propelling the demand for fiberglass door. As per the industry sources, global expenditure in the construction sector increased by 1.5% in 2022;

However, Asia-Pacific is expected to witness higher growth rate, owing to rise in expenditure in China’s and India’s housing market, thus supplementing the market growth. Thus, surge in construction projects across different regions is projected to drive the market growth.

Moreover, the evolution of trends related to building decor plays an important role in rise in spending on building renovation and improvement activities. For instance, according to the data from the U.S. Census Bureau, around 59% of all houses in the U.S. were renovated between 2019 and 2021, and the total average spending on door and window renovation during this period by a U.S. citizen was $1,900, which is a significant rise from $1,500 spent during 2017 and 2019. Such factors drive a major demand for fiberglass door, especially the ones made with insulated foam core, and a thick polyurethane frame. Fiberglass door is vastly preferred over aluminum and wood, owing to their high performance, lightweight, and enhanced security. Thus, increase in building renovation and improvement activities is driving the growth of the fiberglass doors market.

Fiberglass door save energy and provide superior insulation than wooden or steel doors. The exceptional insulating capabilities assist to manage indoor temperatures, decreasing the need for excessive heating and cooling. Thus, homeowners can save money on their energy bills. In the recent years, demand for energy efficient construction products including doors has increased. This is primarily due to various targets established by many countries to make their building sector more energy friendly. For example, the U.S., and countries in Europe have established targets to make their building sectors carbonneutral by 2030. fiberglass door is renowned for their exceptional insulation properties. The material's low thermal conductivity helps create a barrier that minimizes heat transfer between the interior and exterior spaces. This insulation effectiveness contributes to maintaining a consistent and comfortable indoor temperature throughout the seasons, reducing the reliance on heating or cooling systems. This is a major fiberglass doors market opportunity, that is expected to have a greater positive impact on the market growth.

The fiberglass doors market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for fiberglass door from the building construction and industrial sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 have been performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for construction which is a major end-user sector of leaders and other such as construction equipment. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, a peace agreement between Ukraine and Russia can be devised, with the continued talks between different countries, which is expected to end the war between them and reduce global inflation.

Segmental Overview

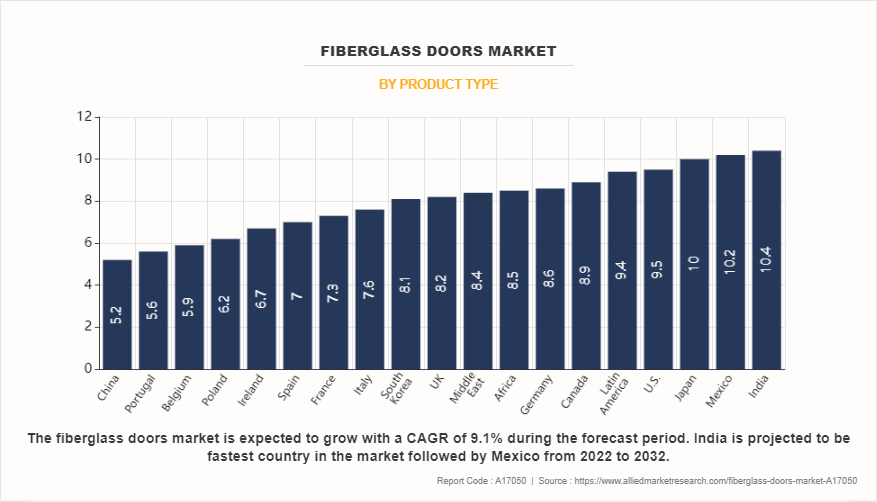

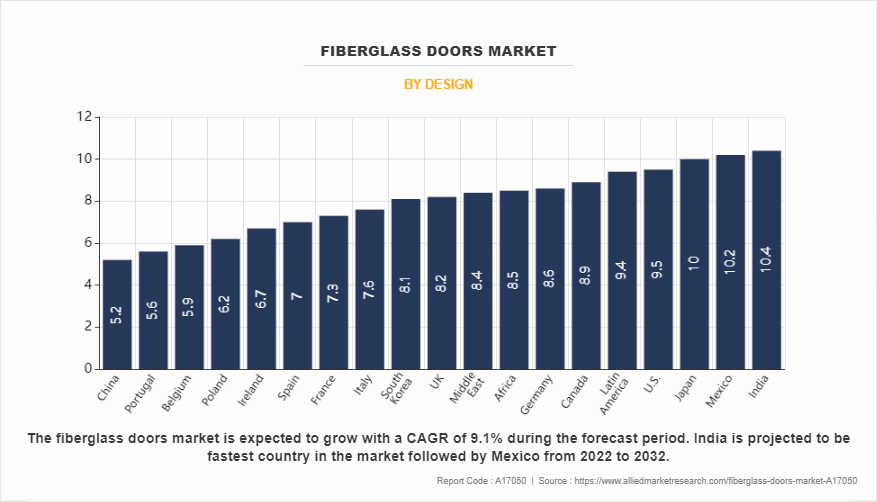

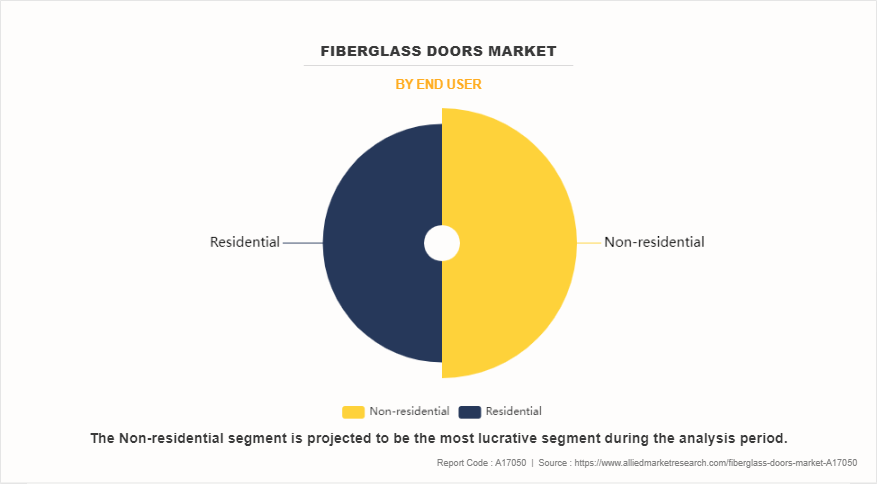

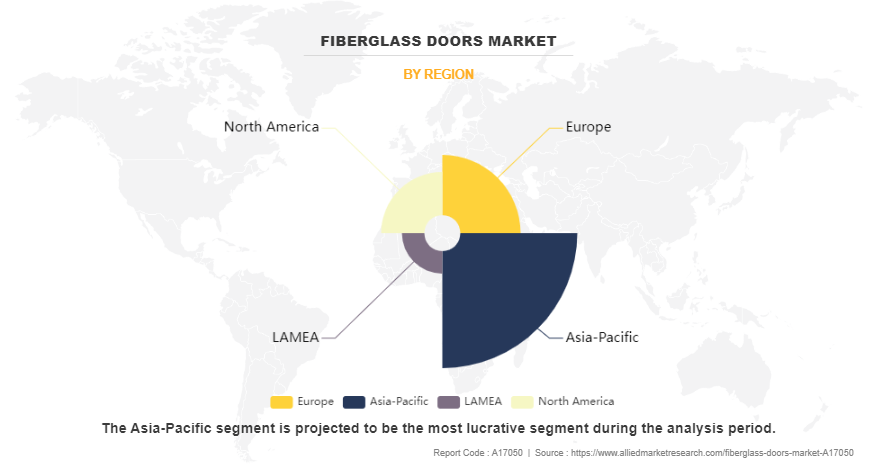

The fiberglass doors market is segmented on the basis of product type, design, end user, and region. On the basis of product type, the market is divided into interior and exterior. On the basis of design, the market is divided into solid doors and doors with glass. On the basis of end user, the market is divided into residential and non-residential. Region-wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, Spain, Ireland, Poland, Belgium, Portugal and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By product type, the fiberglass doors market is categorized into interior and exterior. The exterior segment accounted for the highest fiberglass doors market share in 2022, and the interior segment is projected to grow with the highest CAGR during the forecast period. Exterior doors serve as an ideal solution for convenience and energy efficiency and augment the visual appeal of a building. The constant demographic movement, together with the increasing rate of urbanization, is expected to drive the growth of exterior doors globally. In addition, exterior doors are produced with additional durability as compared to interior doors to be proficient to bear climate changes and different levels of misuse. As a result, residential constructions are developing to satisfy rising consumer demand, promoting the market growth.

By design, the fiberglass doors market is categorized into solid doors and doors with glass. The doors with glass segment accounted for the highest market share in 2022, and the solid door segment is projected to grow with the highest CAGR during the forecast period. In fiberglass door market, companies are regularly coming up with advanced product types to keep pace with the rapid technological advancements. For example, in March 2021, JELD-WEN launched the pro core doors product line, which includes solid-core doors that reduce noise by up to 50%. In addition, JELD-WEN offers an extensive range of interior and exterior doors for use in new construction and repair and remodeling of residential homes and non-residential buildings. In addition, rapid industrialization and urbanization are important drivers of market expansion. As a result, such new releases give customers with more options, hence propelling the fiberglass doors industry.

By end user, the fiberglass doors market is categorized into residential and non-residential. The non-residential segment accounted for the highest market share in 2022, and the same segment is projected to grow with the highest CAGR during the forecast period. Installation of fiberglass doors during construction of buildings has helped builders to enhance the overall appearance of the building, driving the market growth due to rise in demand for solid door and glass door from Asia-Pacific countries. Moreover, Asia-Pacific is estimated to exhibit the highest growth owing to increase in use of solid doors and glass doors in infrastructure projects and housing & commercial buildings, especially in China and India. The China government has shifted to a growth support policy that emphasizes investment housing market in the region. Latin America is among the fastest growing construction spending markets after AsiaPacific, hence, increase in investments in the residential and non-residential construction projects are expected to drive the demand for fiberglass doors.

By region: Asia-Pacific accounted for the highest market share in 2022 and the same region is expected to grow with the highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest-growing population. Asia-Pacific is one of the fastest growing regions in the world attributed to its large population and their growing disposable income. China and India are leading in construction of affordable housing. Furthermore, the construction and tourism sector in countries, such as India, Indonesia, Singapore, and Malaysia is experiencing significant growth. These factors boost the demand for fiberglass doors, as they are extensively used in construction of residential and non-residential buildings.

Competition Analysis

Competitive analysis and profiles of the major players in the fiberglass door market are provided in the report. Major companies in the report include Assa Abloy AB, Bayer Built Inc., ETO DOORS, Fibertec, GlassCraft, JELD-WEN, Kohltech, Masonite, Master Grain, Milgard Manufacturing, LLC, Pella, PLASTPRO, Stanley Black & Decker, Inc., Steves & Sons, Taylor Entrance Systems, Therma-Tru Doors, and Trinity Glass International, Inc.

Major players to remain competitive adopt development strategies such as product launches, business expansion, acquisitions, expansion, partnerships, and mergers. For example, in January 2022, ThermaTru introduced new product designs, which include classic craft mahogany-grained 3/4-lite doors with flush-glazed zaha glass, classic craft walnut-grained flush doors, direct set sidelites, full-lite reeded glass in classic craft, fiber-classic, smooth-star, and pulse doors, the impressions integrated storm and entry door system, and retractable screen doors. Similarly, for example, in March 2021, JELD-WEN launched the pro core doors product line, which include solid-core doors that reduce noise by up to 50%. In addition, JELD-WEN offers an extensive range of interior and exterior doors for use in new construction and repair and remodeling of residential homes and non-residential buildings.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging fiberglass doors market trends.

- In-depth fiberglass doors market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the fiberglass doors market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The fiberglass doors market forecast analysis from 2023 to 2032 are included in the report.

- The key players within the fiberglass doors market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the fiberglass doors industry.

Fiberglass Doors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 33 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By End user |

|

| By Product type |

|

| By Design |

|

| By Region |

|

| Key Market Players | Jeld-Wen Holding Inc., PlastPro Inc., Steves & Sons, Inc., Therma-Tru Doors, Trinity Glass International, Inc., ETO Doors, LLC, Stanley Black & Decker, Inc., Fibertec Windows & Doors Mfg., Kohltech Windows & Entrance Systems, Pella Corporation, Bayer Built Inc., Milgard Manufacturing, LLC, Taylor Entrance Systems, ASSA ABLOY Group, MasterGrain, Masonite International Corporation, GlassCraft Door Company |

Analyst Review

The fiberglass door market has witnessed significant growth in the past few years, owing to increase in construction activities, rise in industrialization, and upsurge in investments in home & building improvements. The fiberglass door market has seen tremendous growth in North America, Asia-Pacific, and Europe. Asia-Pacific is expected to have rapid growth in the near future as a result of increased urbanization and government investment in infrastructure. Furthermore, improvements by industry players, rise in residential and commercial building activities, and increase in house renovation and remodeling drive the fiberglass door market growth. Several competitors have used methods such as product launches, company growth, acquisitions, and partnerships to grow their companies and increase their market position. For example, in January 2022, ThermaTru introduced new product designs, which include classic craft mahogany-grained 3/4-lite doors with flush-glazed zaha glass, classic craft walnut-grained flush doors, direct set sidelites, full-lite reeded glass in classic craft, fiber-classic, smooth-star, and pulse doors, the impressions integrated storm and entry door system, and retractable screen doors. The launch is expected to broaden its product portfolio. As a result, such strategic efforts are likely to generate significant growth in the fiberglass door market.

Key factors driving the growth of the fiberglass door market include the rise in construction and infrastructure industry, growth in residential, and non-residential remodeling industry, and increase in focus on public-private partnerships (PPP).

The latest version of the global fiberglass door market report can be obtained on demand from the website.

The global fiberglass door market size was valued at $13,571.6 billion in 2022.

The global fiberglass door market size is estimated to reach $33,033.1 billion by 2032, exhibiting a CAGR of 9.1% from 2023 to 2032.

The forecast period considered for the global fiberglass door market is 2023 to 2032, wherein, 2022 is the base year, 2023 to 2032 is the forecast duration.

Asia-Pacific is the largest regional market for fiberglass door market.

Key companies profiled in the fiberglass door market report include e Assa Abloy AB, Bayer Built Inc., ETO DOORS, Fibertec, GlassCraft, JELD-WEN, Kohltech, Masonite, Master Grain, Milgard Manufacturing, LLC, Pella, PLASTPRO, Stanley Black & Decker, Inc.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...