Filter Bags Market Research, 2033

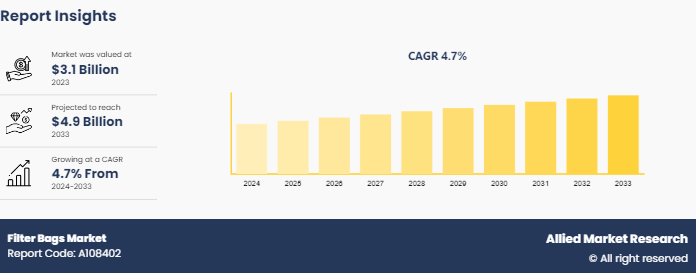

The global filter bags market size was valued at $3.1 billion in 2023, and is projected to reach $4.9 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Market Introduction and Overview

A filter bag is a dust removal bag that uses fabric filter elements to capture solid particles from a dust-laden gas. With a history spanning over a century, modern advancements have refined its design, incorporating new materials and automatic cleaning technologies. Filter bags are categorized primarily by their ash removal methods, which include mechanical vibration, room reverse blowing, nozzle backflush, vibration combined with backflushing, and pulse jetting. Structurally, filter bags also known as bag filters can be classified into upper or lower intake types, round or flat filters, and suction or press-in types. In addition, filters can be designed for either inner or outer filtration, depending on whether the dust-laden air flows inside-out or outside-in. This variety allows filter bags to be tailored to diverse industrial applications, enhancing their effectiveness and efficiency in managing airborne dust and particulates.

Key Takeaways

- The filter bags market share analysis covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major filter bags participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The filter bags market growth is driven by their critical role across various industries, including water treatment, industrial dust collection, and pharmaceuticals. Their effectiveness in removing impurities, maintaining product quality, and ensuring safety standards makes them indispensable. Innovations in materials and design also contribute to their rising use, as industries seek more efficient and durable filtration solutions to meet regulatory and operational requirements. These factors are anticipated to boost the filter bags market demand in the upcoming years.

The filter bags market faces several restraints related to dust characteristics. High moisture content in dust, common in industries like chemicals, pharmaceuticals, and cement, can cause dust to become sticky or heavy, leading to premature filter bag failure and excessive build-up in system components. Abrasive dust presents another challenge, as it wears down filter media more quickly, necessitating the use of more durable materials such as aramid, PTFE (Polytetrafluoroethylene) , or Ryton.

The filter bag industry presents opportunities for growth through advancements in material technology and customization. Increasing environmental regulations and a focus on sustainability are driving the need for more efficient filtration solutions. For instance, the use of high-performance fabrics such as advanced polymer blends and nanofibers offer improved filtration efficiency, higher temperature resistance, and better chemical compatibility. Emerging sectors like renewable energy and advanced manufacturing offer new applications for filter bags. These factors are anticipated to have a positive impact on filter bags market forecast opportunities.

Analysis of the Filter Bags Market

Filter bags are crucial components in industrial filtration systems, designed to capture particulate matter from gases or liquids to ensure process efficiency and environmental compliance. They come in a variety of materials and configurations to meet specific operational needs, from handling extreme temperatures to dealing with corrosive substances. Key types include polyester, PTFE, and fiberglass, each offering unique properties like chemical resistance or high filtration efficiency. With customizable sizes and finishes, filter bags are tailored to fit diverse applications across industries such as manufacturing, power generation, and food processing.

In the following table, key specifications and characteristics of filter bags are provided:

Filter Bag Type | Key Features |

Filter Shaker Bags | Designed for mechanical shaking to dislodge dust. |

Reverse Air Filter Bags | Use reverse air to clean dust off the bags. |

Pulse Jet Filter Bags | Cleaned with high-pressure air bursts for efficiency. |

Envelope Filter Bags | Provide larger surface area for filtration. |

Filter Bags for Special Conditions | Custom-designed for unique operational environments. |

Bag Sizes (Diameter)

Size | Available Diameters |

Standard | 100 mm, 125 mm, 130 mm, 150 mm, 180 mm, and 250 mm. |

Custom | Any length and diameter available |

Material Specifications

Material | Operation Temperature | Max Surge | Key Properties | Finishes |

Polyester | 302°F | 150°C | Anti-acid, anti-alkali, good stability | Singed, calendared, PTFE membrane |

Polyester with PTFE | 302°F | 150°C | Excellent dust cake release, long life | PTFE membrane |

Nomex (Aramid) | 399°F | 464°F | Fire resistant, high temperature resistant | Good chemical resistance |

PPS | 374°F | 446°F | High temperature resistant, no melting point | Large filtration area |

Acrylic | 464°F | 500°F | High temperature resistance, large filtration area | Excellent filtration performance |

P84 | 464°F | 500°F | Fire resistant, high temperature resistant | Cross-sectional leaf shape |

PTFE | 750 gsm (Grams per Square Meter) | High temp. | Excellent chemical resistance, high efficiency | High filtration efficiency |

Fiberglass | Various thicknesses | 120 mm – 300 mm | High strength, good filtration efficiency | Heat treated, silicone oil, graphite |

Market Segmentation

The filter bags market is segmented into product type, media, material, application, and region. On the basis of product type, the market is divided into pulse jet, reverse air, shaker, and cartridge bag filters. On the basis of media, the market is classified into woven and non-woven. On the basis of material, the market is divided into polyester, polypropylene, nomex, acrylic fibers, teflon, fiberglass, polyimide/P84, and others. On the basis of application, the market is classified into cement, pharmaceuticals, power generation, materials & chemicals, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The materials and chemicals industry in Asia-Pacific is poised to significantly drive the demand for filter bags due to its expansive and diverse industrial activities. As the region represents over 45% of global chemical manufacturing and a substantial share of global jobs in the sector, the need for effective filtration solutions becomes critical.

With major players like Formosa Plastics, LG Chem, Mitsubishi Chemical Holdings, and Sinopec leading the way, the region's vast production capabilities and focus on innovation necessitate advanced filtration systems to handle various chemicals and ensure product purity. In addition, the rapid growth of sectors like petrochemicals, pharmaceuticals, and electronics amplifies the need for specialized filter bags that can manage high solid loads, withstand extreme temperatures, and handle aggressive chemicals. As companies expand their operations and invest in new technologies, the demand for robust, high-performance filter bags is expected to continue to increase, driving advancements in filtration technology across Asia-Pacific.

Competitive Landscape

The key players operating in the filter bags market are Albarrie Canada Limited, American Air Filter Company, Inc., Kayser Filtertech, Lydall, Inc., BWF Offermann, Waldenfels & Co. KG, TTL France, Micronics Engineered Filtration Group, Inc., Testori Spa, Yanpai Filtration Technology Co., Ltd., U.S. Air Filtration, Inc., and others.

Recent Key Strategies and Developments

In April 2024, Eaton launched its latest SENTINEL MAXPO and DURAGAF MAXPOXL filter bag ranges, featuring an internal pre-filter for enhanced particle and oil separation. These polypropylene filter bags combine effective particle removal with powerful oil absorption, eliminating the need for an additional process step. The new filter bags, designed for applications across industries including water treatment and chemicals, offer improved lifespan and ease of use, optimizing filtration performance.

In September 2021, Donaldson Torit, the leading manufacturer of dust collectors, introduced UWSB (Ultra-Web Spunbond) pleated filter bags featuring Ultra-Web technology, designed to outperform traditional polyester bags. These pleated filters offer lower pressure drops, leading to energy and labor savings. With superior dust capture and longer filter life, the UWSB pleated bags require fewer changeouts, reducing maintenance costs and downtime. Ideal for baghouse dust collectors, these filters promise efficiency and durability in industrial applications.

Filter Bags Industry Trends

In March 2024, in Sweden, ACG Kinna Automatic and ACG Nyström, with JUKI Central Europe, unveiled a groundbreaking microfactory for filter bag production. This fully automated system revolutionizes the process by eliminating labor-intensive manual assembly. The microfactory, featuring the Smart Filter Line and Filtermaster 2.0, can produce 120 finished filter bags per hour with high precision and quality control. This innovation aims to enhance efficiency and sustainability in the filtration industry.

In December 2022, Filcon Filters launched the Jumbo Titan Filter bag, designed to tackle industrial challenges with its enhanced surface area and durability. The new filter bag boasts improved flow rates, higher maximum pressure drops, and patented double seal rings to prevent particulate bypass. Suitable for diverse applications including water treatment, pharmaceuticals, and food processing, it ensures fewer change-outs and extended service life. Filcon Filters aims to export this innovative product to various African markets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the filter bags market analysis from 2023 to 2033 to identify the prevailing filter bags market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the filter bags market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global filter bags market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Camfil

- European Filter Manufacturers Association (EFMA)

- Filter Manufacturers Council (FMC)

- Donaldson Torit

- American Filtration and Separations Society (AFS)

Filter Bags Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.9 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 305 |

| By Product Type |

|

| By Media |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Yanpai Filtration Technology Co., Ltd., American Air Filter Company, Inc., Testori Spa, Kayser Filtertech, BWF Offermann, TTL France, Micronics Engineered Filtration Group, Inc., Waldenfels & Co. KG, Albarrie Canada Limited, U.S. Air Filtration, Inc., Lydall, Inc. |

The filter bags market size is estimated to reach $4.9 billion by 2033.

The upcoming trends in the filter bags market include the use of eco-friendly materials, an increase in the demand for high-efficiency particulate air (HEPA) filters, and advanced filtration technologies.

Asia-Pacific is the largest regional market for filter bags.

The metals & chemicals segment is anticipated to show the fastest growth during the forecast period.

The top companies to hold high market share in the filter bags market are Albarrie Canada Limited, American Air Filter Company, Inc., Kayser Filtertech, Lydall, Inc., BWF Offermann, Waldenfels & Co. KG, TTL France, Micronics Engineered Filtration Group, Inc., Testori Spa, Yanpai Filtration Technology Co., Ltd., and U.S. Air Filtration, Inc.

Loading Table Of Content...