Fintech As A Service Market Research, 2032

The global fintech as a service market was valued at $268.4 billion in 2022, and is projected to reach $1.4 trillion by 2032, growing at a CAGR of 18.5% from 2023 to 2032.

The term “fintech” refers to financial technology. It is a software application designed to automate and enhance the experience of customers accessing financial services, as well as simplify the administration of financial operations for business owners. Fintech as a service technology provider is solely accountable for the platform’s development, maintenance, updates, compliance with security requirements, and others.

The growing digitalization in BFSI sector is a major factor driving the fintech as a service market growth. In addition, digital platforms offer the ability to connect to financial and other service providers through an online or mobile channel as an integrated part of their day-to-day activities. Furthermore, the emergence of cloud computing technologies has transformed fintech as a service market by offering enhanced operational flexibility and scalability. Fintech organizations use cloud computing to leverage virtualized resources and services delivered over the internet, removing the requirement for on-premises infrastructure. Thus, this factor propels the growth of fintech as a service market.

The adoption of Fintech as a Service (FaaS) was also driven by the growth of the API economy and the introduction of open banking rules in various nations. However, as financial services become more digitalized, consumers' concerns about their privacy and security are limiting market expansion. On the contrary, rising acceptance of FinTech solutions and platforms is anticipated to fuel market expansion. Moreover, the development of AI, cloud-based software, and big data connected to financial services will hasten the growth of FaaS. The market for fintech as a service is anticipated to receive a considerable boost from the growing use of mobile devices for online shopping.

The report focuses on growth prospects, restraints, and trends of fintech as a service market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the Fintech as a service market outlook.

Segment Review

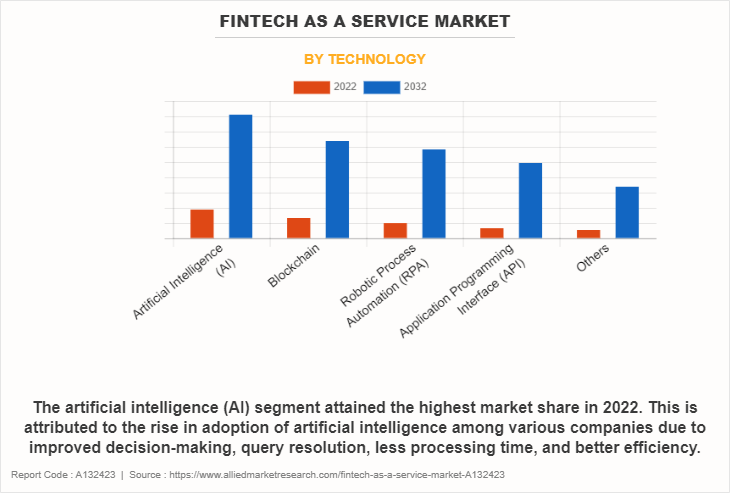

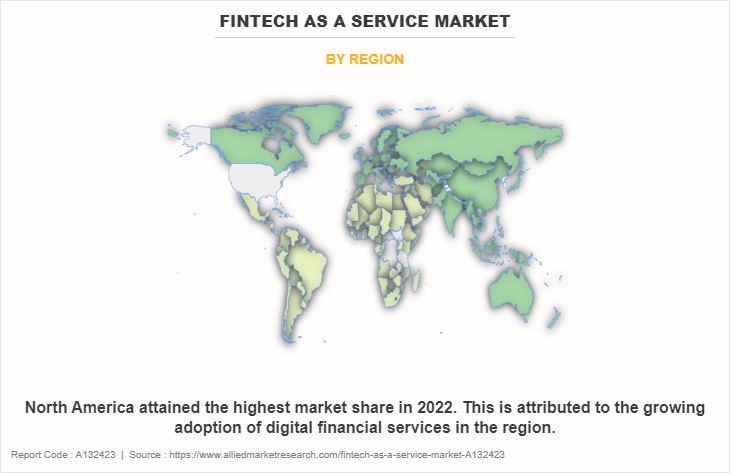

The fintech as a service market is segmented into type, technology, application, end user, and region. By type, the market is differentiated into banking, payment, lending, and others. Depending on technology, it is fragmented into artificial intelligence (AI), blockchain, robotic process automation (RPA), application programming interface (API), and others. By application, the market is differentiated into fraud monitoring, KYC verification, compliance & regulatory support, and others. The end user segment is divided into banks, financial institutions, insurance companies, and others. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By technology, the artificial intelligence segment acquired a major share in 2022. This is owing to the increasing acceptance of AI among businesses due to its improved decision-making, query-solving, reduced downtime, and increased efficiencies. Furthermore, AI-powered fintech solutions allow for the automation of many procedures, resulting in better operational efficiency and fewer manual errors. However, the application programming interface (API) segment is attributed to be the fastest-growing segment during the forecast period. This is attributed to the fact that API enables automatic data exchange and transaction processing, lowering the need for human intervention and streamlining operations.

Region-wise, North America dominated the fintech as a service market share in 2022. This is attributed to the rise in technological advancement in the financial sector, increasing investments in fintech innovations across North America. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the rising awareness about the benefits of FaaS platforms in countries such as China, India, and Japan. Furthermore, rise in digital payment platforms contribute to the growth of fintech as a service market in the region.

The key players operating in the fintech as a service market include Adyen, Finastra, FIS, Fiserv, Inc., Mastercard, OpenPayd, PayPal, Inc., Rapyd Financial Network Ltd., Revolut Ltd, and Stripe, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the fintech as a service industry.

Market Landscape and Trends

Open banking rules have been adopted by several nations, mandating financial institutions to securely exchange consumer data with approved third-party providers. This encourages cooperation between established financial institutions and fintech companies, expanding the range of services available to customers. For instance, the UK's Open Banking Standard requires banks to securely share consumer data, encouraging the creation of cutting-edge fintech products. Furthermore, fintech as a service provider offers white-label solutions, enabling other businesses to rebrand and customize these services as their own. This approach saves time and resources for businesses looking to incorporate fintech features without building them from scratch. For instance, companies such as Mambu and Symphony provide white-label banking and messaging solutions, respectively.

In addition, fintech as a service providers are integrating artificial intelligence (AI) and automation technologies into their offerings. These technologies enhance risk assessment, fraud detection, customer support, and personalized financial recommendations. For instance, Kasisto's conversational AI platform powers virtual assistants for banking, enabling personalized customer interactions. Thus, these factors played a significant role in driving the growth of fintech market.

The COVID-19 pandemic acted as a catalyst for the growth of fintech as a service market size. With lockdowns and restrictions in place, people relied more on digital financial services, leading to increased demand for fintech solutions. The pandemic accelerated the adoption of online payment platforms, digital wallets, and contactless payment methods. In addition, financial institutions turned to fintech services to streamline their operations and provide remote services. As a result, the fintech as a service market experienced rapid growth and innovation, with new players entering the industry to meet the rising demand for digital financial solutions and services.

Top Impacting Factors

Increase in Demand for Digital Financial Services

The ongoing digitization of financial services, as well as the rise of online and mobile banking, has resulted in an increase in demand for innovative and flexible financial solutions. Fintech as a service provider meets this demand by providing white-label APIs and platforms that allow traditional financial institutions, retailers, and other enterprises to provide digital financial services to their clients. This enables them to launch new financial goods and services rapidly and cost-effectively without having to create everything from the start.

For instance, in February 2023, European fintech, Citizen, announced that it has chosen embedded finance infrastructure provider, OpenPayd, as its real-time payments provider. The partnership gives the end-users of Citizen’s clients a simplified payments experience via OpenPayd’s BaaS platform, which offers plug-and-play banking and payments infrastructure through a single API. Thus, this factor propels the growth of fintech as a service market.

API Economy and Open Banking Initiatives

The rise of the API economy and the implementation of open banking regulations in many countries have accelerated the adoption of Fintech as a Service (FaaS). Open banking allows financial institutions to securely exchange client data with third-party suppliers which boosts the integration between banks and fintech companies. FaaS providers leverage this by offering APIs that enable secure access to financial data and functionalities, further driving innovation and competition in the financial services sector.

For instance, in July 2023, Finastra, a global fintech company, launched FedNow connectivity through its cloud-based payments hub, called Payments to Go. FedNow presents both technical and operational challenges for banks.

Digital Transformation in Financial Services

The financial services industry has undergone a significant digital transformation. To speed up their digitalization efforts, traditional financial institutions are increasingly collaborating with FaaS companies. FaaS platforms enable these businesses to provide cutting-edge, user-friendly, and innovative financial goods and services, improving their accessibility to tech-savvy customers. This trend is probably to continue as more financial services industry participants recognize the importance of utilizing fintech solutions. Continuous advancements in technology such as artificial intelligence (AI), machine learning (ML), blockchain, and data analytics have a major effect on fintech solutions. FaaS companies use these technologies to offer cutting-edge services such as customized advisory services on finances, fraud detection, and risk assessment. As a result, customers have better overall experience and better financial results. Consequently, it is anticipated that these variables would create profitable growth possibilities for the fintech as a service market.

Shift Towards Open Banking

Open banking initiatives, where banks open up their data and functionalities to third-party providers, have gained traction globally. FaaS providers integrate with these banks through APIs, offering enhanced services such as account aggregation, financial planning, and easy fund transfers. Customers gain from open banking, which also fosters a massive ecosystem of cooperation and innovation among financial institutions and fintech companies.

Furthermore, there is an increase in demand for safe and effective payment solutions due to the growth of e-commerce, digital payments, and mobile banking. FaaS vendors provide APIs and platforms that enable frictionless payment processing, lowering costs and enhancing customer satisfaction. FaaS solutions are anticipated to be essential in satisfying these needs as demand for digital payments increases. Therefore, these reasons provide fintech as a service sector significant growth prospects.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fintech as a service market analysis from 2022 to 2032 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fintech as a service market segmentation assists to determine the prevailing fintech as a service market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as fintech as a service market trends, key players, market segments, application areas, and market growth strategies.

Fintech as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.4 trillion |

| Growth Rate | CAGR of 18.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 257 |

| By Type |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Mastercard Incorporated., Stripe, Inc., FIS, OpenPayd, Adyen N.V., Rapyd Financial Network Ltd., Revolut Ltd, Finastra, Fiserv, Inc., PayPal, Inc. |

Analyst Review

Fintech companies have transformed the finance industry due to their cutting-edge technology capabilities. Fintech innovation has eliminated the limits that have long restricted the old financial and banking sector. They have brought a radical shift in the financial ecosystem by challenging existing value chains, business models, and market positioning. Fintech innovation has strengthened customer experiences and expectations by encouraging a more client-centric and interactive approach to financial and banking services.

In addition, FaaS enables businesses to effortlessly leverage fintech solutions to optimize their end-to-end processes, deliver the best client experiences, and provide commercial services at significantly better standards. For instance, in February 2021, to drive digital payments acceptance by small businesses and startups in India, Mastercard and Razorpay launched a strategic partnership that combines Razorpay’s payment processing capabilities with Mastercard’s trusted and secure digital banking solutions and card services. The partnership enables Indian micro, small, and medium-sized companies (MSMEs) to digitize their operations while maintaining business continuity.

The COVID-19 outbreak had a positive impact on the fintech as a service market. The adoption of contactless payment methods and digitized financial services increased as people were confined to their homes. Consumers across the globe adopted contactless payment methods as a safe mode of transaction. At the same time, several retail stores adopted contactless payments as part of their efforts to ensure a safe and secure way of payment for customers. The increased adoption of digital fintech services such as digital wallets during the pandemic indicated the acceleration of fintech platform as a service.

The key players in the fintech as a service market are Adyen, Finastra, FIS, Fiserv, Inc., Mastercard, OpenPayd, PayPal, Inc., Rapyd Financial Network Ltd., Revolut Ltd, and Stripe, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With the increase in awareness & demand for Fintech as a service across the globe, major players collaborated to enhance their product portfolio to provide differentiated and innovative products.

At a CAGR of 18.5%, the Fintech as a Service Market will expand from 2023 - 2032.

By the end of 2032, the market value of Fintech as a Service Market will be $1,431.98 billion.

Increase in demand for digital financial services, API economy and open banking initiatives, financial inclusion efforts and regulatory compliance & security drive the market growth.

The fintech as a service market is segmented into type, technology, application, end user, and region. By type, the market is differentiated into banking, payment, lending, and others. Depending on technology, it is fragmented into artificial intelligence (AI), blockchain, robotic process automation (RPA), application programming interface (API), and others. By application, the market is differentiated into fraud monitoring, KYC verification, compliance & regulatory support, and others. The end user segment is divided into banks, financial institutions, insurance companies, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the study are Adyen, Finastra, FIS, Fiserv, Inc., Mastercard, OpenPayd, PayPal, Inc., Rapyd Financial Network Ltd., Revolut Ltd, and Stripe, Inc.

Loading Table Of Content...

Loading Research Methodology...