Fixed-Wing VTOL UAV Market Research, 2033

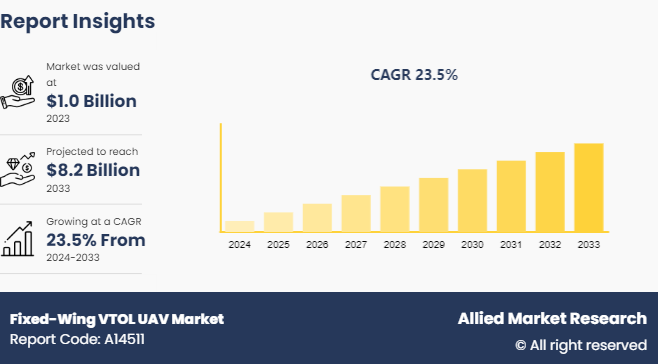

The global fixed-wing VTOL UAV market size was valued at $1.0 billion in 2023, and is projected to reach $8.2 billion by 2033, growing at a CAGR of 23.5% from 2024 to 2033.

Market Introduction and Definition

The Fixed-Wing Vertical Takeoff and Landing (VTOL) Unmanned Aerial Vehicle (UAV) market represents a rapidly growing segment within the broader drone industry. These hybrid drones combine long-endurance and high-speed capabilities of fixed-wing aircraft with the vertical takeoff and landing flexibility of rotary-wing systems. This unique combination allows for a wide range of applications including military reconnaissance, disaster response, agricultural monitoring, and infrastructure inspection. The market is driven by advancements in UAV technology, increasing demand for efficient and versatile aerial solutions, and the rising use of drones in commercial sectors. Key players in the market are continuously innovating to enhance payload capacity, flight range, and operational efficiency.

In addition, regulatory developments and the integration of AI and ML for autonomous operations are further propelling the market growth. Despite challenges such as high development costs and regulatory hurdles, the fixed-wing VTOL UAV industry is expected to expand significantly, supported by investments in R&D and the surge in adoption across various industries seeking cost-effective and agile aerial solutions.

Key Takeaways

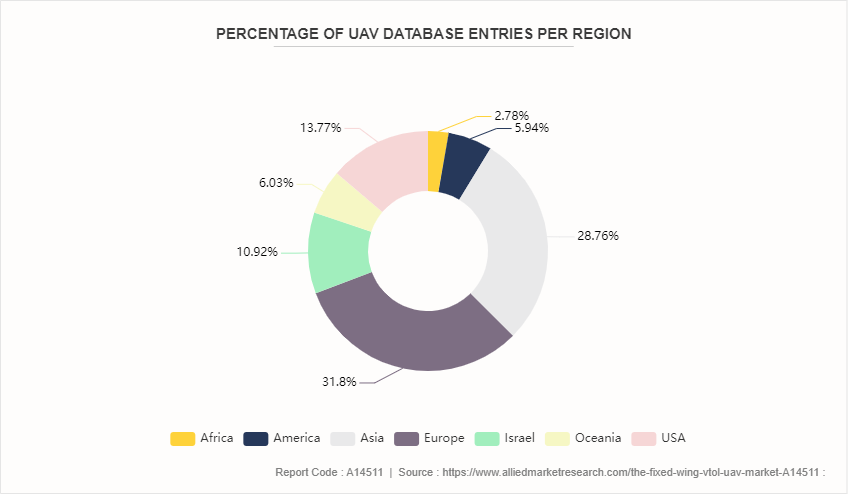

The fixed-wing VTOL UAV market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major the fixed-wing VTOL UAV industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In May 2023, AeroVironment, Inc. launched the Puma™ VTOL kit, a plug-and-play upgrade for Puma 2 AE and Puma 3 AE SUAS, enhancing their operational capabilities by enabling vertical take-off and landing in complex terrains without the need for a runway or large open space.

In May 2023, AeroVironment has been chosen by the Defense Advanced Research Projects Agency (DARPA) to provide a vertical take-off uncrewed aerial system with six designs. The ANCILLARY program aims to develop a lightweight, high-payload, long-endurance VTOL UAS. Wildcat is designed to meet these requirements, offering a mission radius of more than 500 miles and over 12 hours of operational endurance with a 60-pound payload.

Key Market Dynamics

The rise in use of drones in military, commercial, and industrial application is significantly driving the growth of the fixed-wing VTOL UAV market share. In the military sector, these UAVs are increasingly utilized for reconnaissance, surveillance, and targeted missions due to their ability to cover long distances and operate in challenging environments. In commercial applications, industries such as logistics, agriculture, and infrastructure are adopting these drones for tasks like aerial mapping, delivery services, and crop monitoring, leveraging their efficiency and versatility. In the industrial sector, Fixed-Wing VTOL UAVs are used for inspecting large-scale infrastructure, monitoring construction sites, and ensuring safety compliance, reducing operational costs and improving accuracy. The expanding adoption across these diverse fields underscores the growing reliance on advanced UAV technology, propelling the market growth. Furthermore, reduction in operation costs compared to traditional manned aircraft have driven the growth of the fixed-wing VTOL UAV market share.

However, limitation of existing battery technology significantly hampers the growth of the fixed-wing VTOL UAV market growth. The energy density of current batteries is often insufficient to support long missions, limiting the operational time and distance that these drones can cover. This constraint affects their effectiveness in applications requiring prolonged or extensive coverage, such as large-scale agricultural monitoring, long-distance delivery services, and wide-area surveillance. As a result, the market growth is stifled by the need for more advanced battery solutions that can enhance endurance and expand the potential use cases for Fixed-Wing VTOL UAVs. Moreover, intense competition from other UAV types and traditional aircraft, and concerns over privacy and safety issues among the public. are major factors that hamper the growth of the fixed-wing VTOL UAV market size.

On the contrary, expanding use in delivery services, agriculture, and infrastructure inspection presents lucrative opportunities for the fixed-wing VTOL UAV market. UAVs offer faster and more flexible delivery options, particularly in remote or challenging terrain where traditional methods may be impractical. Fixed-Wing VTOL UAVs can carry larger payloads over longer distances, making them suitable for delivery of medical supplies, parcels, and other goods.

Aftermarket and Replacement Parts Demand for the Fixed-Wing VTOL UAV Market

As the number of deployed UAVs increases, there is a corresponding need for maintenance and repair services. Replacement parts such as propellers, motors, batteries, and avionics components are essential for keeping UAVs operational and ensuring minimal downtime. Operators often seek to upgrade their UAVs with newer technologies or enhanced capabilities. This drives demand for aftermarket parts that can improve performance, extend range, or enhance payload capacity. UAVs have a finite operational lifecycle, after which certain components may need to be replaced due to wear and tear. This lifecycle management necessitates a steady supply of replacement parts to sustain fleet operations over time. Changes in regulatory requirements may prompt operators to retrofit existing UAVs with updated components to remain compliant. This can lead to increased demand for specific aftermarket parts that meet new standards or regulations.

Market Segmentation

The fixed-wing VTOL UAV market is segmented into propulsion type, mode of operation, range, application and region. On the basis of propulsion type, the market is divided into electric, gasoline, and hybrid. On the basis of operation, the market is segregated into remotely piloted, optionally piloted, and fully autonomous. On the basis of range, the market is classified into beyond line of sight, extended visual line of sight, and visual line of sight. On the basis of application, the market is categorized into military, government & law enforcement, commercial, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

North America, particularly the U.S., is home to leading technology companies and research institutions that drive innovation in UAV technology. This includes advancements in AI, sensors, and battery technologies that enhance the capabilities of fixed-wing VTOL UAV market analysis. The substantial investment by the U.S. Department of Defense in UAVs for reconnaissance, surveillance, and other military applications significantly boosts the market. The defense sector's focus on advanced UAV technology for various missions supports the market growth. North America has a more favorable regulatory framework for UAV operations compared to many other regions. Regulatory bodies like the FAA in the U.S. are actively working to integrate UAVs into national airspace, fostering the industry growth.

Rapid economic growth and industrialization in countries such as China, India, and Southeast Asian nations have driven increased investment in advanced technologies, including UAVs. These countries are investing heavily in infrastructure, agriculture, and defense, all of which benefit from UAV technology. Increasing defense budgets in countries like China, India, and Japan are fueling demand for advanced UAVs for surveillance, reconnaissance, and combat operations. These nations are prioritizing the modernization of their defense capabilities, including the integration of UAV technology. The region is home to a growing number of UAV manufacturers and technology firms that are driving innovation and producing cost-effective UAV solutions. Countries like China have become global leaders in UAV manufacturing, contributing to the rapid market growth.

In July 2022, Textron Aviation launched Maritime Patrol Aircraft variant of its Cessna Citation Longitude Aircraft. The Cessna Citation Longitude is designed and manufactured by Textron Aviation Inc., a Textron Inc. company.

In January 2021, the Indian signed a contract with ideaForge to procure an undisclosed number of a high-altitude variant of SWITCH1.0 unmanned aerial vehicles (UAVs) to strengthen its surveillance along the Line of Actual Control (LAC) , military officials said.

Competitive Landscape

The report analyzes the profiles of key players operating in the fixed-wing VTOL UAV market such as AeroVironment Inc, Carbonix, DJI Innovations, Lockheed Martin Corporation, Northrop Grumman Corporation, Parrot SA, Quantum Systems GmbH, Teledyne FLIR LLC, Textron Inc., and Wingtra. These players have adopted various strategies to increase their market penetration and strengthen their position in the fixed-wing VTOL UAV market.

Industry Trends

In March 2024, Carbonix, RIEGL, and Phase One have successfully integrated the RIEGL VUX-120 LiDAR and Phase One iXM 100 medium format camera into Carbonix’s fixed-wing VTOL platform. This advanced system, used for remote sensing and geospatial data collection, has been effectively deployed in Australia and the U.S., covering over 12, 000 hectares in a single mission. This technology creates detailed, colorized 3D models of infrastructure and terrain, demonstrating its transformative impact on commercial operations in the linear infrastructure and mining sectors.

In January 2024, T-DRONES launched its new VTOL fixed-wing UAV, the VA23, which boasts impressive specifications tailored for various demanding applications. The VA23 features a maximum range of 240 kilometers, allowing it to cover extensive areas without needing frequent recharges or landings. Its level 5 wind resistance ensures reliable performance in adverse weather conditions, making it suitable for use in diverse environments. With a payload capacity of 2.5 kilograms, the VA23 can carry various sensors, cameras, or other equipment necessary for specialized missions.

In October 2023, Atva, a versatile and compact hybrid VTOL drone, is set to revolutionize aerial cargo transport, mapping, and surveillance with its innovative electric Vertical Takeoff and Landing (eVTOL) technology. This cutting-edge drone combines the efficiency and speed of fixed-wing flight with the maneuverability of rotary-wing systems, enabling it to perform a wide range of tasks with enhanced precision and flexibility.

In October 2022, Textron Aviation announced during the National Business Aviation Association’s Business Aviation Convention & Exhibition (NBAA-BACE) that it has entered into a purchase agreement with Fly Alliance for up to 20 Cessna Citation business jets, four firm with options for 16 additional aircraft. Fly Alliance will use the aircraft for its luxury private jet charter operations and expects to take delivery of the first aircraft, an XLS Gen2, in 2023.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of the fixed-wing VTOL UAV market segments, current trends, estimations, and dynamics of the market analysis to identify the prevailing fixed-wing VTOL UAV market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the fixed-wing VTOL UAV market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global fixed-wing VTOL UAV market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global fixed-wing VTOL UAV market trends, key players, market segments, application areas, and market growth strategies.

Fixed-Wing VTOL UAV Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 8.2 Billion |

| Growth Rate | CAGR of 23.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 534 |

| By Propulsion Type |

|

| By Mode Of Operation |

|

| By Range |

|

| By Application |

|

| By Region |

|

| Key Market Players | Quantum Systems GmbH, Aerovironment Inc., Northrop Grumman Corporation, carbonix, Textron Inc., Teledyne FLIR LLC, Lockheed Martin Corporation, DJI Innovations, Parrot SA, wingtra |

Upcoming trends in the Fixed-Wing VTOL UAV market include advancements in hybrid propulsion systems for longer flight times, increased use in logistics and delivery services, and improvements in autonomous flight capabilities. There's also a focus on enhancing payload capacities and integrating advanced navigation systems for better operational efficiency.

Military is the leading application of The Fixed-Wing VTOL UAV Market

North America is the largest regional market for The Fixed-Wing VTOL UAV

$8.2 billion is the estimated industry size of The Fixed-Wing VTOL UAV

AeroVironment Inc, Carbonix, DJI Innovations, Lockheed Martin Corporation, Northrop Grumman Corporation, Parrot SA, Quantum Systems GmbH, Teledyne FLIR LLC, Textron Inc., and Wingtra.

Loading Table Of Content...