Flashing Tape Market Research, 2033

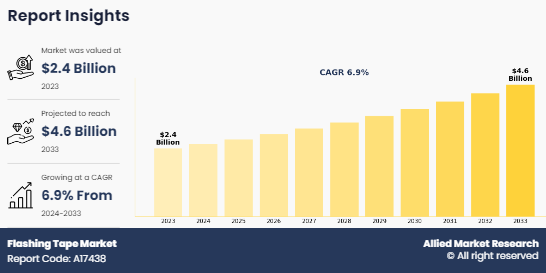

The global flashing tape market was valued at $2.4 billion in 2023, and is projected to reach $4.6 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Introduction

Flashing tapes are uniform impervious thin materials that help prevent water and air infiltration. In addition, these are used in door and window installations and offer an added layer of protection in rough openings. Different type of flashing tapes such as butyl rubber flashing tapes, aluminum flashing tapes, bitumen tape, and others are available in the market.

Key Takeaways

- The global flashing tape market is highly fragmented, with several players including 3M, Bostik, DuPont, H.B. Fuller, Henkel AG & Co., Isoltema Group, Jining Xunda Pipe Coating Materials Co. Ltd., Nitto Denko Corporation, Omega Rubber Industries, and Saint-Gobain.

- More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and flashing tape market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Flashing tape market news and key industry trends are also included in the report.

Market Dynamics

Increase in investments in building infrastructure in countries such as the U.S., China, Japan, Mexico, and India, have led the building and construction sector to witness significant growth where flashing tape is used for flooring, mounting wall, and roofing applications. In addition, sustainable economic growth coupled with an increase in demand for consumer goods has led the automotive & transportation sector to witness a significant increase in demand where flashing tape is widely used for UV and moisture protection applications in under hood parts, engine components, interior of containers, and storage vessels. These factors are predicted to contribute toward the global market growth.

However, lack of awareness among people regarding the benefits and usage of flashing tape is expected to hamper the market growth. Also, strict government norms and regulations on the plastic-based flashing tape products are projected to hamper the market growth. In addition, fluctuation in the prices of flashing tape is anticipated to affect the growth of the market. These factors are likely to hamper the flashing tape market growth during the forecast period.

Nevertheless, increase in awareness for eco-friendly products has surged the popularity of high-sold flashing tape owing to its minimal or no volatile organic compound (VOCs) levels. Furthermore, high solid flashing tape requires less drying, has good adhesion, and is easy to apply. These factors make flashing tapes a highly preferred option for coating applications in various end-use sectors, thereby creating lucrative opportunities for the market.

Segments Overview

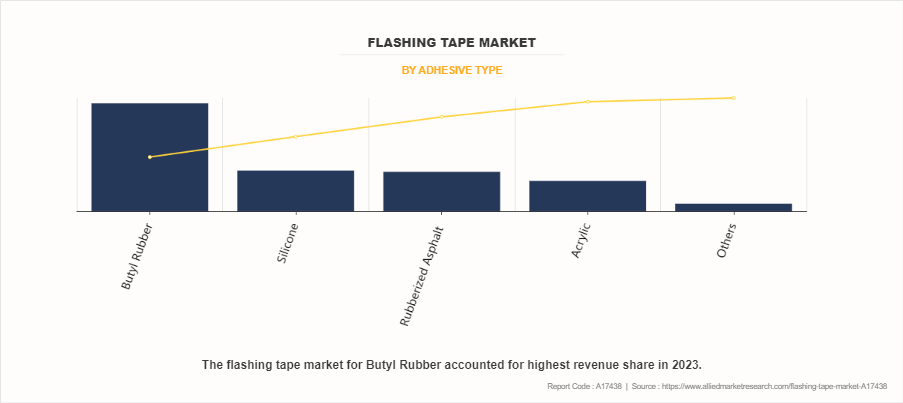

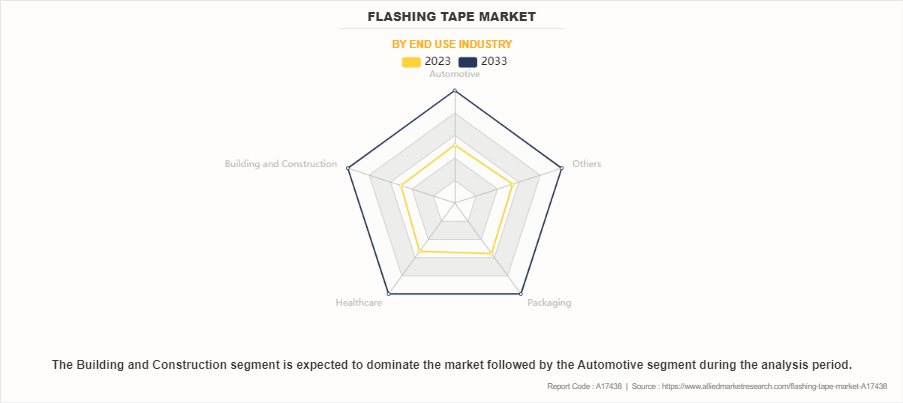

The flashing tape market is segmented on the basis of adhesive type, substrate type, end-use industry, and region. On the basis of adhesive type, the market is categorized into silicone, acrylic, butyl rubber, rubberized asphalt, and others. On the basis of substrate type, the market is classified into plastic, metals, rubber, and others. On the basis of end-use industry, it is divided into automotive, building and construction, healthcare, packaging, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Flashing Tape Market, By Region

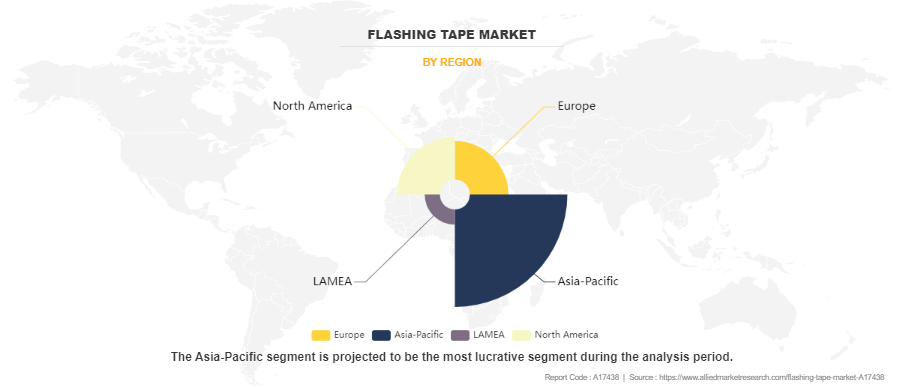

Asia-Pacific was the highest revenue contributor, growing with a CAGR of 7.2%. The rapid development of industrial sector in countries such as China, India, Indonesia, Malaysia, and others, is expected to boost the growth of the flashing tape market in the Asia-Pacific region. In addition, there is expected to be rise in residential and commercial building & infrastructure projects in countries such as India, Thailand and Japan, where flashing tape are widely used for sealing and concrete flooring applications. For instance, according to a report published by the National Investment Promotion and Facilitation Agency of India, the construction output in India is expected to grow on an average of 7.1% each year and may emerge as the third-largest industry by 2025. This is anticipated to enhance the sales of flashing tape in the building and construction sector; thus, creating remunerative opportunities for the market.

Flashing Tape Market, By Type

The butyl rubber segment is expected to grow faster throughout the forecast period. Rubber-based flashing tapes include butyl rubber. Butyl rubber is a copolymer of isobutylene with isoprene; it is also called synthetic rubber, or elastomer. It is impermeable to air due to which it is mainly used in airtight applications. These synthetic rubbers do not have solvents or VOCs, and they are most effective at 30-200ËšF (-1-93ËšC). Rise in consumer goods has surged the establishment of chemical industries in both developed and developing economies where rubber-based flashing tape is widely used for high and cold temperature applications in various industrial equipment. This may act as one of the key drivers for the growth of the flashing tape market. Furthermore, growth in the real estate industry and growth in consumer demand for energy efficient homes, leads to increase in construction of residential and commercial institutes such as hotels, hospitals, homes, flats, and offices, where butyl rubber-based flashing tape is widely used in door frames, flash straight window frames, and other construction seams.

In addition, rubber-based flashing tape is widely used across the globe as it has simple application process, it self-seals, has high adhesion property in both cold and hot temperature range, and is waterproof. In addition, there is a growing preference for premium-quality and luxury furniture products among consumers. In this context, rubber-based flashing tape is widely preferred for its ability to make metal surfaces resistant to impact, abrasion, and water. This type of tape provides durability and protection, ensuring that furniture made with metal components maintains its quality and appearance over time. The use of rubber-based flashing tape in furniture manufacturing enhances the longevity and performance of these high-end products, meeting the demands of consumers who prioritize both aesthetics and functionality.

Flashing Tape Market, By Segment

The others segment was the highest revenue contributor to the market growing with a CAGR of 6.5%. Other adhesive types of flashing tapes include hybrid adhesives. Hybrid adhesives in flashing tape are engineered by blending different adhesive technologies to leverage the unique benefits of each component. This combination results in adhesives that exhibit superior performance characteristics, making them suitable for demanding construction applications. Hybrid adhesives are formulated to provide powerful bonding capabilities to a variety of substrates, including metal, wood, glass, and plastics. This versatility ensures a secure and durable seal across different materials, which is crucial in construction projects involving multiple surfaces.

Flashing Tape Market, By End-Useindustry

The building and construction segment was the highest revenue contributor to the market growing with a CAGR of 7.2%. Flashing tapes are used over concrete floors in various residential and commercial building and construction sites such as hotels, hospitals, homes, flats, warehouses, hospitals, showrooms, garages, and offices, for protecting pipelines and sealing warehouse floors. In addition, it protects concrete surfaces, strengthens materials, and protects metal infrastructures from UV, moisture, air, and decay.

Growing population has led the building and construction sector to witness significant growth where flashing tape is widely used for protective coating and sealing applications. In addition, governments of developing economies such as China, India, and others, have increased spending on the development of townships, housing, built-up infrastructure and construction development projects where flashing tape are widely used for concrete coating applications.

As per The International Trade Administration, China, the world’s largest construction market, has been significantly influenced by shifts in government regulations and policies. Under China’s 14th Five-Year Plan, there is a strong focus on new infrastructure projects across transportation, energy, water systems, and urbanization. It is estimated that total investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will amount to approximately 27 trillion yuan (about $4.2 trillion). The plan highlights nine key areas for energy efficiency and green building development, including the retrofitting of over 350 million square meters of existing buildings and the construction of more than 50 million square meters of buildings with net-zero energy consumption. This may propel the demand for flashing tape in the growing construction sector during the forecast period.

Competitive Analysis

The major companies profiled in this report include 3M, Bostik, DuPont, H.B. Fuller, Henkel AG & Co., Isoltema Group, Jining Xunda Pipe Coating Materials Co. Ltd., Nitto Denko Corporation, Omega Rubber Industries, and Saint-Gobain. Nowadays, the key manufacturers operating in the flashing tape market have adopted strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration to increase their market share.For example, in January 2023, H.B. Fuller Company launched Swift melt 1515-I, its first bio-compatible adhesive product, specifically developed to meet the regulatory requirements of the IMEA region (India, Middle East, and Africa). This innovative adhesive is designed for use in medical tape applications, providing secure and reliable adhesion to the skin. It is particularly suited to the challenging climatic conditions of the Indian subcontinent, where high temperatures and humidity can affect the performance of adhesives. The introduction of Swift melt 1515-I reflects H.B. Fuller's commitment to delivering high-quality, safe, and effective solutions for the healthcare industry in diverse environments.

Key Regulations

Key regulations for flashing tape are primarily focused on ensuring its effectiveness in maintaining building integrity and enhancing energy efficiency. Building codes and standards often mandate the use of flashing tape for specific applications to prevent water infiltration and air leaks, which are crucial for a building's durability and performance. For example, in many regions, building codes require flashing tape to be used around windows, doors, and roof penetrations to create a continuous seal that protects against moisture intrusion and drafts. In addition to these general requirements, flashing tape must comply with specific performance standards related to its adhesive properties, durability, and resistance to environmental factors such as UV radiation and temperature extremes. Standards such as American Society for Testing and Materials (ASTM) and International Organization for Standardization (ISO) provide guidelines for these properties, ensuring that flashing tapes meet industry expectations for quality and effectiveness. Moreover, regulations often address the environmental impact of construction materials, including flashing tape. There is a growing focus on sustainability, which drives the development and adoption of eco-friendly flashing tape options. This includes reducing the use of harmful chemicals and ensuring that the materials used in flashing tape are recyclable or have a minimal environmental footprint.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flashing tape market analysis from 2023 to 2033 to identify the prevailing flashing tape market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flashing tape market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flashing tape market trends, key players, market segments, application areas, and market growth strategies.

Flashing Tape Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.6 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 386 |

| By Adhesive Type |

|

| By Substrate Type |

|

| By End use Industry |

|

| By Region |

|

| Key Market Players | Omega Rubber Industries, Isoltema Group S.p.A., Henkel AG & Co. KGaA, Jining Xunda Pipe Coating Materials Co. Ltd., H.B. Fuller Company, DuPont, Bostik SA, Nitto Denko Corporation, Saint-Gobain, 3M |

Analyst Review

According to the opinions of various CXOs of leading companies, the flashing tape market is expected to witness increased demand during the forecast period owing to growth of the building and construction sector. The growing population has led the building and construction sector to witness significant growth where flashing tape is widely used for protective coating and sealing applications. For instance, according to a report published by the International Trade Administration, China’s construction industry is projected to grow at an annual average rate of 8.6% from 2022 to 2030. This is expected to propel the demand for flashing tape in the growing construction sector during the forecast period. In addition, governments of developing economies such as China, India, and others, have increased spending on the development of townships, housing, built-up infrastructure, and construction development projects where flashing tape are widely used for concrete coating applications.

Further, the emergence of flashing tape in the medical sector has enhanced the performance of flashing tape during the forecast period. Flashing tapes are less allergic due to which these are majorly preferred sealing material in wound dressing. This is anticipated to increase the sales of flashing tape in the medical sector; thus, creating lucrative opportunities for the market.

Flashing tape is increasingly in demand due to rise in focus on sustainable building practices and energy efficiency. As construction standards evolve, there is a growing need for materials that can prevent water infiltration and air leaks, thus improving the longevity and energy performance of buildings.

Building and Construction is the leading application of Flashing Tape Market.

Asia-Pacific is the largest regional market for Flashing Tape.

The flashing tape market was valued at $2.4 billion in 2023, and is estimated to reach $4.6 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

The major companies profiled in this report include 3M, Bostik, DuPont, H.B. Fuller, Henkel AG & Co., Isoltema Group, Jining Xunda Pipe Coating Materials Co. Ltd., Nitto Denko Corporation, Omega Rubber Industries, and Saint-Gobain.

Loading Table Of Content...

Loading Research Methodology...