Flexible OLED Market Summary, 2031

The global flexible OLED market was valued at $4.1 billion in 2021, and is projected to reach $117.7 billion by 2031, growing at a CAGR of 40.4% from 2022 to 2031. A light-emitting diode (LED) with an organic compound film as the emissive electroluminescent layer generates light in response to an electric current is referred to as an organic light-emitting diode (OLED or organic LED) or an organic electroluminescent (organic EL) diode. This organic layer is sandwiched between two electrodes, usually with at least one transparent electrode. OLEDs are utilized to make digital displays in gadgets like televisions, computer monitors, and portable gaming systems like smartphones.

Flexible OLEDs allow the device to rotate or flex during operation. OLEDs emit light due to the presence of thin films of organic semiconductors about 100 tors about 100 nanometres thick. While regular OLEDs are made on glass substrates, flexible OLED screen use flexible plastics such as polyethylene terephthalate (PET).

Flexible OLEDs allow the device to rotate or flex during operation. OLEDs emit light due to the presence of thin films of organic semiconductors about 100 tors about 100 nanometres thick. While regular OLEDs are made on glass substrates, flexible OLED screen use flexible plastics such as polyethylene terephthalate (PET).

The global market is anticipated to expand during the forecast period as a result of a few key factors, including the rising demand for low-energy consumer electronics and rapid technological advancements in electronic devices.

In addition, a rise in the use of flexible OLED screen in a variety of consumer electronics, including television displays, smartphones, smart watches, tablets, and others, is contributing to the expansion of the market due to the flexible design and color, superior durability, thin display, and brighter displays compared to LCD displays.

According to the OLED Association, OLED panel shipments are expected to reach 1.07 billion units, accounting for 84% of smartphones by 2023. This is expected to create growth opportunities for the flexible OLED display market during the forecast period.

However, the high cost of manufacturing, lower performance, and low temperature tolerance of flexible OLED panels are some of the major factors expected to hinder the market growth. In addition, the outbreak of the COVID-19 pandemic has damaged the consumer electronics industry due to supply chain and manufacturing process disruptions.

All these factors are restraining the growth of the flexible OLED market. OLED displays are expected to be widely used in developed countries in the near future due to their biodegradability. OLED displays are also expected to minimize power consumption as the international power demand and supply imbalance grow. This makes opportunity for OLED market in the near future.

Segment Overview

The market is segmented into Type and Application.

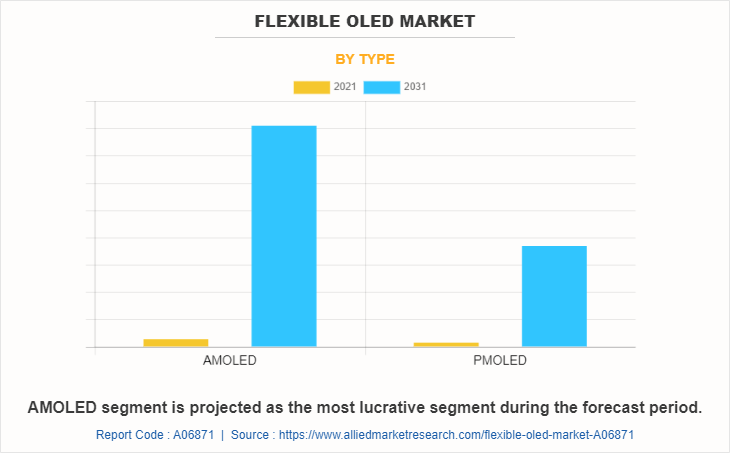

Based on type, the flexible OLED market is bifurcated into AMOLED and PMOLED.The AMOLED segment was the highest revenue contributor to the market.

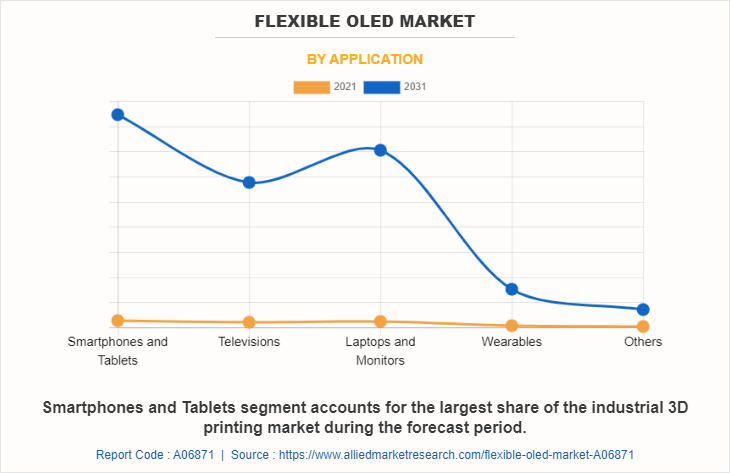

Based on application, the market is categorized into smartphones & tablets, televisions, laptops & monitors, wearables, and others. The smartphones & tablets segment was the highest revenue contributor to the market.

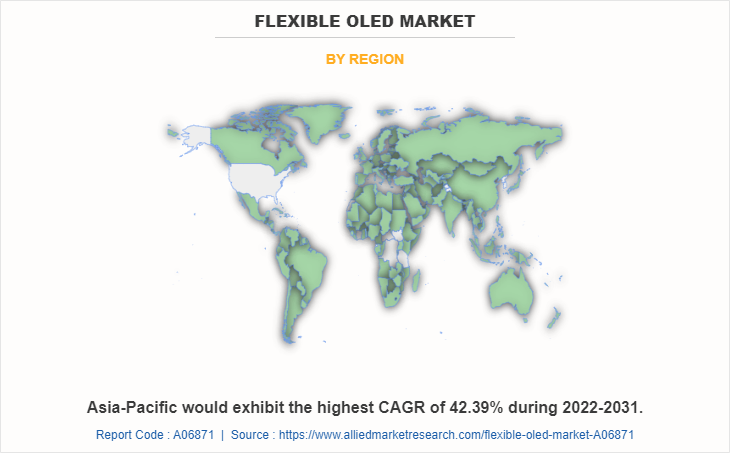

Region-wise, the flexible OLED market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically the China region, remains a significant participant in the global flexible OLED industry. Major organizations and government institutions in the country are intensely putting resources into this industry.

Country-wise, the U.S. acquired a prime share in the flexible OLED market forecast in the North American region and is expected to grow at a significant CAGR during the forecast period of 2019-2031. The U.S., holds a dominant position in the flexible OLED market, owing to the rise in investment by prime vendors to boost the flexible OLED for consumer electronics and IT & telecom applications.

In Europe, the rest of Europe dominated the flexible OLED market size, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's flexible OLED with a notable CAGR, due to advancement in the automotive industry which drives the usage of microelectronics in the country and thus creates lucrative growth opportunities for the flexible OLED market share in Germany.

In Asia-Pacific, China is expected to emerge as a significant market for the flexible OLED industry, owing to new product developments and a significant rise in investment by prime players and government institutions. For example, DISCO Corporation, one of the major key players in the Asia-Pacific region on 5 December 2022, developed two types of grinding wheels, the Poligrind PW21 Series for Si wafers including memory ICs and logic ICs, and the GFSC Series for SiC wafers.

In the LAMEA region, the Middle East country garner significant market share in 2021 due to the adoption of new technologies, digital transformation and connectivity are reshaping the future of the automotive and consumer electronics industry in the Middle East.

Moreover, the Latin America region is expected to grow at a significant CAGR from 2022 to 2031, owing to shifts in artificial intelligence, industry 4.0, and smart technological changes in recent years, which is expected to reshape the growth of the flexible OLED in the Middle East.

Today, OLEDs are primarily found in mobile devices, including several high-end smartphones. Annual production of OLED panels exceeds 500 million by several display manufacturers, and the industry is expanding as a result of OLEDs' superior image quality, smaller form factors, and flexibility, which are difficult to achieve with LCDs.

OLEDs can also be utilized to create TVs; some of the best TV panels available are made using cutting-edge OLED technology. OLED technology is used by different TV manufacturers to create award-winning premium OLED TVs with exceptional image quality and ultra-thin form factors. Other competitors are anticipated to enter this market soon with innovative products including inkjet printer OLEDs and hybrid OLEDs with quantum dots.

For instance, in June 2022, LG Display created a new market with cutting-edge OLED solutions. The company launched upgraded versions of G2 and C2 televisions. Both versions use updated OLED technology to create an even better visual image. Therefore, screens can produce greater brightness, clarity, and detail. The new sizes of the G2 series are presented together with three other sizes (55", 65", and 77"). The C2 series has a total of 6 screen sizes.

Top Impacting Factors

The most important factors that are projected to drive the flexible OLED display market growth during the forecast period are the growing use of smartphones and new, innovative products. An increase in smartphone penetration along with innovative product launches and numerous advantages provided by OLED technology are the major factors driving the market growth.

The market will encounter growth restrictions during the anticipated period due to the high manufacturing costs of OLED displays. Furthermore, the growing rivalry between OLED and LCD technology is anticipated to provide profitable opportunities in the flexible OLED market growth.

Competitive Analysis

The global flexible OLED market is highly competitive, owing to the strong presence of existing vendors. Vendors of the flexible OLED market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

LG Display Co., Ltd., Samsung Electronics Co. Ltd., BOE Technology UK Limited, OSRAM GmbH, Sony Group Corporation, AU Optronics Corporation, Corning, Visionox Company, Universal Display Corporation, and Ritdisplay Corporation are the key players in the flexible OLED market.

Top market players have adopted various strategies, such as acquisition, agreement, business development, business expansion, collaboration, product launch, innovation, and product expansion to expand their foothold in the flexible OLED market.

In May 2022, LG Display Co. Ltd announced bringing its next-generation OLED solutions to the 2022 Society for Information Display (SID) conducted in San Jose, California. The products included OLED.EX to Bendable and Foldable OLED panels. This innovation is expected to solidify the company’s OLED leadership in the market studied.

In June 2022 - Samsung electronics co ltd acquired Cynora Gmbh. Cyonara is developing a new type of organic emitting materials for OLED displays based on TADF (Thermally Activated Delayed Fluorescence) technology. With this technology, the company will be able to commercialize the first high-efficiency blue emitting material on the market, which is the most sought-after material by OLED display makers.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the flexible OLED market analysis from 2021 to 2031 to identify the prevailing flexible OLED market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the flexible OLED market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global flexible OLED market trends, key players, market segments, application areas, and market growth strategies.

Flexible OLED Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 117.7 billion |

| Growth Rate | CAGR of 40.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 327 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sony group corporation, LG Display Co.,Ltd., BOE Technology UK Limited, Visionox Company, OSRAM GmbH., Ritdisplay Corporation, AU Optronics corp, Corning Inc, Universal Display Corporation, Samsung Electronics Co. Ltd. |

Analyst Review

Increase in demand for wider viewing angles is expected to significantly drive the revenue growth of the global flexible OLED market in the future. The popularity of smartphones has increased the demand for beautiful and efficient lighting panels. Rapid advances in technology have brought about positive cultural changes in developing countries. Surge in need for social connectivity and entertainment is expected to boost demand for smartphones, which is expected to boost revenue growth of the flexible organic light emitting diode (FOLED) market during the forecast period. In addition, rise in disposable income drives increased adoption of new sleek display smartphones with curved and foldable screens. This is also expected to drive revenue growth in the FOLED market.

For example, Samsung Electronics Co. Ltd. launched the Samsung Z Flip 3 smartphones in 2019 and the Samsung Z Fold 3 smartphones with foldable screens in 2021. In addition, the growing need for high-quality images and brighter displays compared to other displays is expected to increase the demand for flexible OLED displays. Moreover, the growing need for a better viewing experience and lower energy consumption are expected to drive the revenue of the market in the near future.

The Flexible OLED Market is expected to grow at a CAGR of 40.41% from 2022-2031.

The global flexible OLED market share is expected to witness considerable growth, owing to rising technological advancements in electronic devices and rising demand for low energy consumption consumer electronics are some of the key factors expected to drive the growth of the global flexible OLED market during the forecast period.

North America is the largest regional market for Flexible OLED.

The global flexible OLED market was valued at $4.1 billion in 2021, and is projected to reach $117.7 billion by 2031, growing at a CAGR of 40.4% from 2022 to 2031.

The top companies to hold the market share in Flexible OLED are Samsung Electronics Co. Ltd., LG Display Co., Ltd., Sony Group Corporation, OSRAM GmbH, and Visionox Company.

Loading Table Of Content...

Loading Research Methodology...