Flow Meter Market Research, 2033

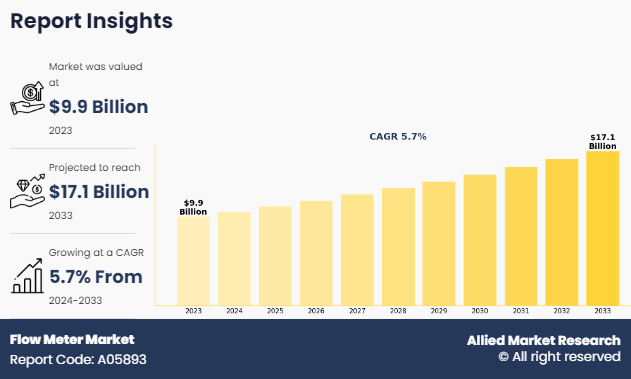

The global flow meter market was valued at $9.9 billion in 2023, and is projected to reach $17.1 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033. The global flow meter market is experiencing growth due to several factors such as increase in demand for water & wastewater management and growth in the oil & gas industry. However, high costs of advanced flow meters and technical limitations of flow meters limit the market expansion. Moreover, rise in adoption in pharmaceuticals and food industries and development of smart and multivariable flow meters provide lucrative opportunities for the flow meter market growth.

Introduction

Flow meters, also known as flow sensors or flow gauges, are devices used to measure the volume or mass of a fluid or gas passing through a pipe or other conduit. They play a crucial role in various industrial and residential applications by providing essential data for monitoring, control, and regulation of fluid flow. Flow meters are used in many sectors such as water treatment, chemical processing, and pharmaceuticals.

Market Dynamics

Increase in demand for water and wastewater management serves as a significant driver for the flow meter market. With rise in urbanization and industrial activities, the need for effective water management systems also increases. Flow meters play an essential role in these systems by providing accurate measurements of water flow, which is crucial for monitoring consumption, detecting leaks, and ensuring the efficient operation of water treatment plants. In addition, stringent regulatory standards regarding water quality and conservation globally compel water utilities to adopt advanced metering technologies. These regulations drive the adoption of sophisticated flow meters that offer precise data and connectivity to ensure compliance and promote sustainable water use practices.

High cost of advanced flow meters serves as a significant restraint in the flow meter market. These advanced meters, often incorporating the latest technologies for enhanced accuracy and reliability, are launched with a premium price tag. Such costs are expected to lead to reduced demand for flow meters in small and medium enterprises (SMEs) or for applications in developing regions where budget constraints are tighter than in developed regions. This pricing barrier limits the widespread adoption of state-of-the-art flow meters, especially in cost-sensitive markets, and slows down the overall growth of the flow meter industry as potential users opt for cheaper, less sophisticated alternatives.

Pharmaceutical and food industries are adopting flow meters due to their crucial role in ensuring precision, hygiene, and quality control in production processes. In pharmaceutical manufacturing, precise flow measurement is essential for maintaining strict chemical proportions and supporting compliance with health regulations. Similarly, in the food industry, flow meters help maintain the consistency and quality of products by accurately measuring the flow of liquids and gases used in various processes. This growing demand creates significant opportunities for the flow meter market as manufacturers develop and offer devices tailored to meet the specific requirements of these highly regulated industries.

Segment Overview

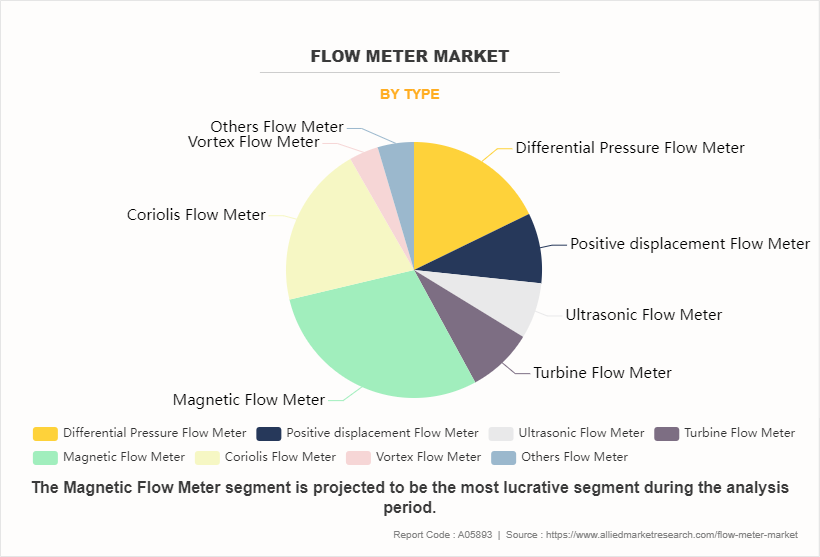

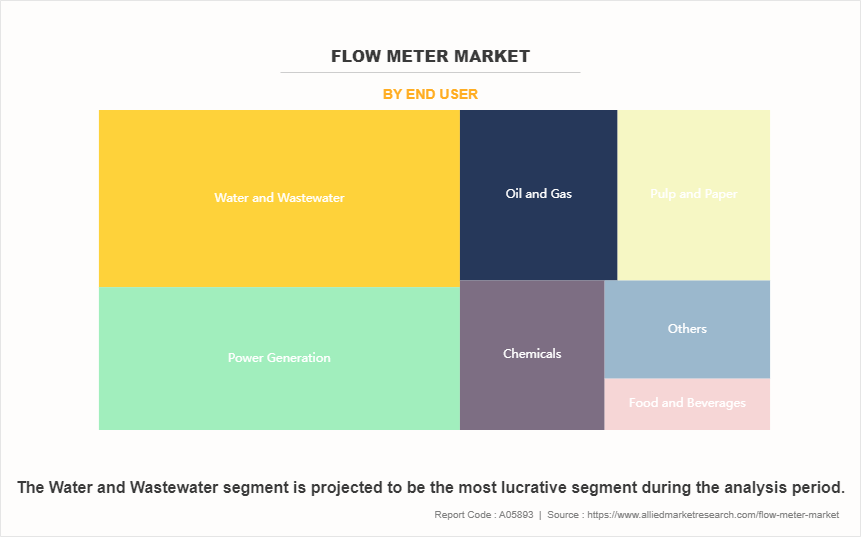

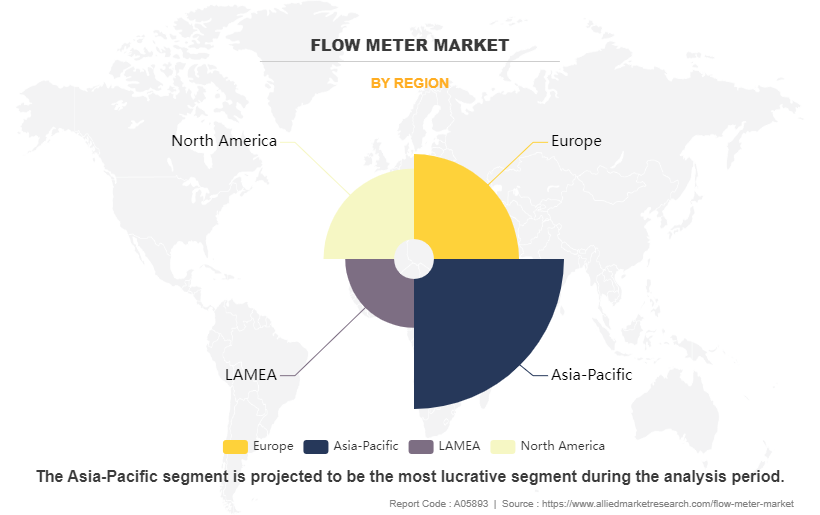

The flow meter market overview is segmented into type, end user, and region. Depending on type, the market is divided into differential pressure, positive displacement, ultrasonic, turbine, magnetic, coriolis, vortex, and others. By end user, it is classified into water & wastewater, oil & gas, chemicals, power generation, pulp & paper, food & beverages, and others. Region-wise, the global market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the magnetic flow meter segment accounted for largest flow meter market size in 2023 due to its wide application in most end-use industries. The magnetic flow meter is perfectly suitable for utilization in the oil & gas industry, most specifically, in natural gas measuring applications. It measures volumetric flow but not mass flow, which makes it favorable in oil & gas measuring applications. The U.S. is one of the major consumers of this type of flow meter where natural gas (shale gas) is produced at a mass scale. Increase in natural gas processing activities across the U.S. is further expected to drive the flow meter market demands for magnetic pressure flow meters.

By end user, the water and wastewater segment accounted for the highest flow meter market share in 2023. Rise in demand for fresh water and increase in the wastewater across the globe owing to a consistent surge in population, increase in urbanization, and development in industrialization has made the water and wastewater segment the major consumer of flow meters.

By region, Asia-Pacific acquired the largest share of the flow meter market owing to increase in industrial output, rise in urbanization, and highest automotive sales & production over other regions. In addition, it is the highly populous region that leads to the consistent demand for food and energy at a rapid pace. Thus, existing power and food processing plants are expanding their operating capacities, driving the demand for flow meters across the region.

Furthermore, Asia-Pacific is home to some of the world's largest economies and energy markets, providing a significant market opportunity for the flow meter industry. The region's strong manufacturing base and technological expertise also contribute to its dominance in the flow meter market, with companies and research institutions driving innovation and commercialization efforts.

Competitive Analysis

The major flow meter market players include Badger Meter Inc., Honeywell International, Krohne Group, Yokogawa Electric Corporation, Schneider Electric SE, Siemens AG, Hitachi, Ltd., ABB Ltd., Emerson Electric Company, and Azbil Group.

Policies Related to the World Bank’s

The policies highlighted in the World Bank's involvement with India's water management issues have significant implications for the flow meter market. These policies and projects, designed to enhance water management and conservation, directly contribute to the demand for and implementation of flow meters across various sectors.

National Mission for Clean Ganga and Other Wastewater Projects: These initiatives focus on reducing pollution and managing water resources more effectively. Flow meters play a crucial role in measuring water quality and quantity, monitoring effluent levels, and ensuring compliance with environmental standards. As investments in wastewater treatment increase, so does the demand for sophisticated flow measurement technologies.

Dam Rehabilitation and Improvement Project: This project aims to improve the safety and performance of dams. Flow meters are essential for monitoring water flow and managing water release from dams efficiently, ensuring that structural integrity and water distribution are maintained according to safety and operational standards.

National Hydrology Project: By enhancing data monitoring and analysis capabilities, this project necessitates the deployment of advanced flow meters that provide accurate real-time data crucial for managing water resources efficiently.

Water Supply and Sewerage Projects (e.g., Shimla Water Supply and Sewerage Service Delivery Reform): These projects emphasize improving service delivery and operational efficiencies in water supply systems. Flow meters are required to manage distribution networks, reduce water losses, and bill consumers based on actual consumption.

Minor Irrigation and Agricultural Projects (e.g., West Bengal Accelerated Development of Minor Irrigation): Flow meters are used in irrigation systems to ensure optimal water usage and to measure water supplied to agricultural fields, facilitating efficient water management tailored to crop requirements.

Overall, these policies promote the deployment of flow meters in essential water management applications, from agricultural irrigation to urban water supply systems and environmental protection efforts. The emphasis on efficient and sustainable water use, reinforced by policy and regulatory measures, underpins the growth of the flow meter market as these devices become critical tools in achieving these goals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current flow meter market trends, estimations, and dynamics of the flow meter market analysis from 2023 to 2033 to identify the prevailing flow meter market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the flow meter market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global flow meter market trends, key players, market segments, application areas, and market growth strategies.

Flow Meter Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 17.1 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 290 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Badger Meter Inc., Hitachi Ltd., Azbil Group, ABB Ltd., Honeywell International Inc., Siemens AG, Schneider Electric, Yokogawa Electric Corporation, Krohne Group, Emerson Electric Co. |

Analyst Review

The global flow meter market is approaching the mature stage in its industry life cycle where it is getting largely affected by the high cost of manufacturing, which further impacts the overall marginal profit. The power generation segment is the largest revenue contributor in the market and growing energy needs from residential as well as the industrial sector result in capacity expansion of the existing power plant. In addition, with the help of the Indian government, new power generation facilities are being installed and this factor is setting a growth trajectory of the market during the forecast period.

Magnetic flow meters are highly recommended in water and wastewater treatment applications, which are anticipated to provide promising growth opportunities during the forecast period. This is due to increase in daily water consumption standards and rise in efforts to build sustainable water and wastewater treatment infrastructure at the global level. The World Water Council predicts a 10% increase in daily water consumption each financial quarter from 2020, leading to increased wastewater generation and potential growth opportunities for magnetic flow meters during the forecast period.

The flow meter market was valued at $9.9 billion in 2023, and is estimated to reach $17.1 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

As of mid-2024, the key trends anticipated in the global flow meter market include: IoT Integration Ultrasonic Flow Meter Advancement Coriolis Flow Meters Multiphase Flow Meters Wireless Communication Technology Environmental Monitoring Hybrid Flow Measurement Solutions Advanced Diagnostics and Predictive Maintenance Energy-Efficient Solutions Miniaturization and Portability

Water and Wastewater is the leading end user of flow meter market in 2023.

Asia-Pacific is the largest regional market for flow meter in 2023.

Badger Meter Inc., Honeywell International, Krohne Group, Yokogawa Electric Corporation, Schneider Electric SE, Siemens AG, Hitachi, Ltd., ABB Ltd., Emerson Electric Company, and Azbil Group are the top companies to hold the market share in Flow Meter.

Loading Table Of Content...

Loading Research Methodology...