Fluid Management Devices Market Research, 2031

The global fluid management devices market size was valued at $4,563.0 million in 2021, and is projected to reach $13,292.76 million by 2031, registering a CAGR of 11.3% from 2022 to 2031. Fluid management devices improve visibility during endoscopic or minimally invasive operations by carefully transferring fluid pressure to internal cavities. The components of this apparatus include a collection system, a pump, a controller, and a monitor. Fluids are gathered via a collection system during the procedure, and they are subsequently pumped to the controller. Various minimally invasive procedures, such as arthroscopy, laparoscopy, hysteroscopy, and others, require fluid management technologies. The fluid management devices are intended to provide a reliable, precise, and efficient method of fluid control during endoscopic procedures.

Historical overview

The market was analyzed qualitatively and quantitatively from 2021 to 2031. The fluid management devices market size experienced growth at a CAGR of around 11.3% from 2021 to 2031. Most of the growth during this period was derived from North America owing to the rise in the number of key players that manufacture fluid management devices, increase in disposable incomes as well as well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global fluid management devices market growth is majorly driven by rise in the number of minimally invasive surgeries, increase in prevalence of chronic diseases and technological advancement for development of fluid management devices. Minimally invasive surgery (MIS) is a surgical technique that involves the use of small incisions, specialized instruments, and advanced imaging technology to access and treat internal organs and tissues. MIS is designed to limit the trauma to the patient, reduce post-operative complications, and reduce hospital stays. This type of surgery is commonly used in many types of operations, including gynecological, orthopedic, and gastrointestinal procedures.

A fluid management device is a medical equipment used during minimally invasive surgery to improve vision. It works by dilating the operative region, applying fluid pressure to the internal cavities, and washing away blood and debris. Fluid management devices are used in minimally invasive surgeries such as laparoscopy, hysteroscopy, arthroscopy and others. Thus, rise in the adoption of minimally invasive surgeries is anticipated to increase the application and usage of fluid management devices. Thus, this factor is anticipated to drive the growth of market.

In addition, increase in the prevalence of chronic diseases such as endometrial cancer, bladder cancer, gastrointestinal diseases are anticipated to fuel the growth of fluid management devices market. Rise in the prevalence of chronic diseases is attributed to increase in the number of minimally invasive surgeries for diagnosis and treatment purpose, which causes increase in the application and usage of fluid management devices. For instance, fluid management devices are used in the hysteroscopy surgery for purpose of diagnosis and treatment. It is a procedure that allows a surgeon to look inside of the uterus to diagnose and treat the causes of abnormal bleeding.

Hysteroscopy is primarily used to diagnose and treat the causes of abnormal uterine bleeding. In addition, hysteroscopy is thus highly accurate and thereby clinically useful in diagnosing endometrial cancer in women with abnormal uterine bleeding. Thus, increase in prevalence of endometrial cancer is anticipated to drive the demand for minimally invasive surgeries such as hysteroscopy. Thus, this factor is anticipated to rise the usage of fluid management devices and thereby boosts the market growth. For instance, according to the World Cancer Research Fund International, it was reported that, in 2020, around 417,367 female population was diagnosed with endometrial cancer across the globe. In addition, the American Cancer Society estimates for cancer of the uterus in the U.S. for 2023 are about 66,200 new cases of cancer of the uterus (uterine body or corpus) will be diagnosed.

Moreover, rise in the number of people suffering from gastroesophageal reflux disease (GERD) is anticipated to fuel the demand for fluid management devices and drive the growth of market. According to the Journal of Annals of Esophagus, in 2022, around 60 to 70 million American population were reported to have been diagnosed with gastrointestinal disease, every year. Gastroesophageal reflux disease (GERD) is one of the most diagnosed gastrointestinal diseases. Thus, rise in population suffering from GERD, joint disease, and abnormal uterine bleeding is attributed to increase the demand for endoscopy procedure. This boosts the need of fluid management devices.

On the other hand, high cost of minimally invasive surgeries such as laparoscopy, is anticipated to hinder the growth of fluid management devices market. For instance, laparoscopy typically costs between $1,700 and $5,000, depending on the doctor and whether it is just diagnostic or used to treat a condition. In addition, high cost of fluid management devices is attributed to restrain the growth of market. For instance, Olympus America dolphin II fluid management devices costs for $1,304.99. In addition, risk associated with minimally invasive such as laparoscopy is attributed to have a negative impact on market growth. For instance, the most common risks associated with a laparoscopy are bleeding, infection, and damage to organs in the abdomen.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global fluid management devices market. The COVID-19 pandemic has stressed healthcare systems globally. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for the patient diagnosed with COVID-19. Decrease in the number of elective surgeries during COVID-19 pandemic due to lockdown is anticipated to decrease the demand for fluid management devices and have negative impact on market growth. Moreover, decrease in revenue of the market players that manufacture fluid management devices due to COVID-19 pandemic restraints the market growth. In addition, surgeons are more vulnerable for contracting and transmitting the coronavirus. Subsequently, this led to cancellation of many surgical procedures across the globe. Thus, these factors are anticipated to hinder the growth of the market during the pandemic. In addition, cancellation of health check-up camps for chronic disorder in pandemic and decrease in number of consultations for cancer are anticipated to hamper the growth of market.

On the other hand, post pandemic impact of COVID-19 on the fluid management devices market forecast growth is positive owing to rise in the number of surgeries, which were cancelled or postponed during the pandemic. Hospitals and clinics are following proper guidelines of COVID-19 precautions post the pandemic. Also, due to advancement in the minimally invasive procedures, patients do not require to stay for long duration in hospitals. Thus, this factor is anticipated to control infection transmission.

Segmental Overview

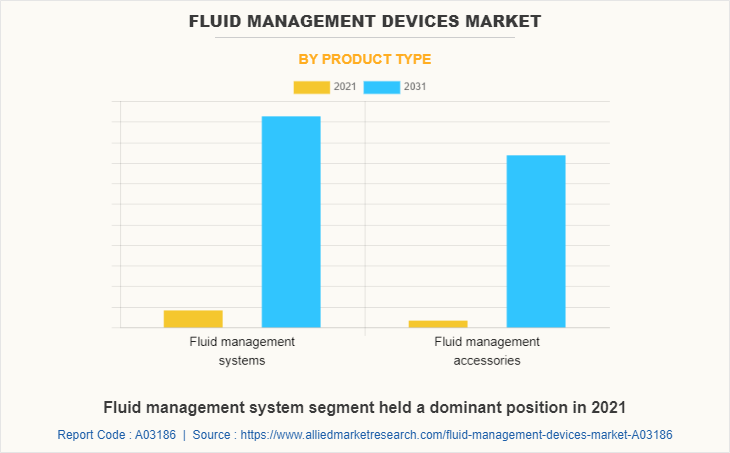

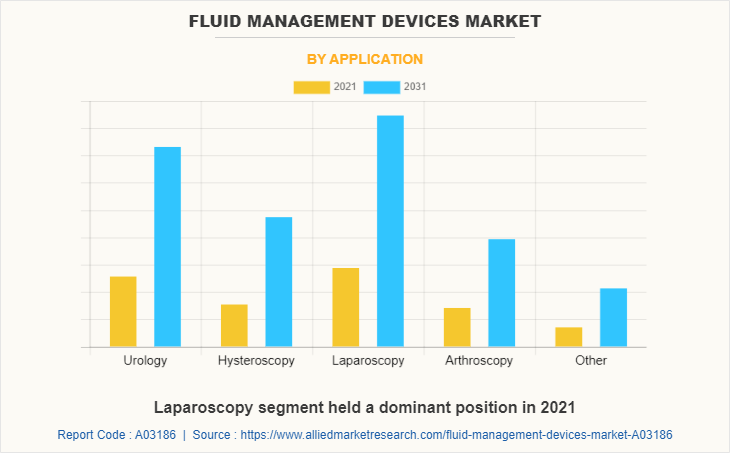

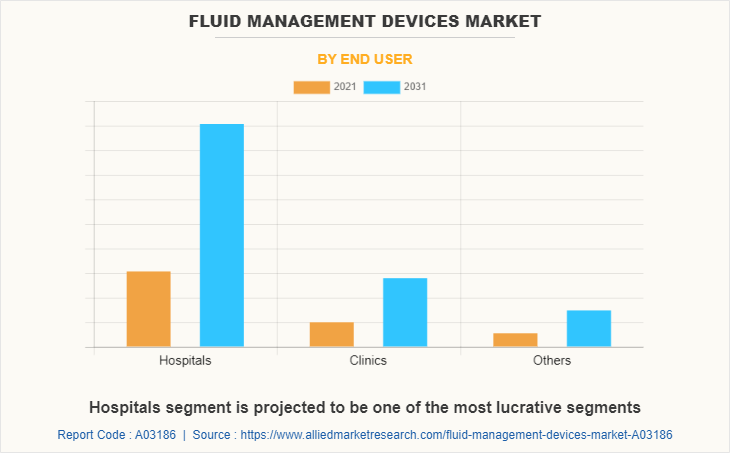

The fluid management devices market share is segmented into product, application, end user, and region. By product, the market is divided into fluid management devices and fluid management disposables and accessories. By application, the market is classified into urology, hysteroscopy, laparoscopy, arthroscopy, and others. By end user, the market segmented into hospitals, clinics, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product type, the market is segmented into fluid management devices and fluid management disposables and accessories. The fluid management devices segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in number of product launch and product approvals for powered fluid management devices.

By application, the market is classified into urology, hysteroscopy, laparoscopy, arthroscopy, and others. The hysteroscopy segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in the prevalence of endometrial cancer and increase in the number of product provision of fluid management devices for hysteroscopy.

By end user, the market is divided into hospitals, clinics, and others. The hospitals segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in number of endoscopic procedures in hospitals and increase in prevalence of chronic diseases.

North America fluid management devices market opportunity is expected to grow during the forecast period owing to rise in the number of populations suffering from chronic disorders such as uterine cancer, bladder cancer, gastrointestinal diseases, and others. For instance, according to the American Cancer Society, it was reported that estimated number of bladder cancer in the U.S. in 2023 is expected to be about 82,290 (about 62,420 in men and 19,870 in women). Thus, this factor is anticipated to drive the application fluid management devices for minimally invasive procedure and boost the market growth. Moreover, increase in prevalence of chronic disorders which require endoscopy procedure such as cancer, orthopedic diseases, and gastroesophageal reflux disease drives the growth of fluid management devices market. For instance, according to the National Cancer Institute, in 2022, around 26,380 new cases of gastric cancer were diagnosed in the U.S. As per the same source, it was reported that gastric cancer ranked 14th in incidence among major types of cancer, in the U.S.

Asia-pacific fluid management devices market is expected to witness growth during the forecast period owing to economic development and low operating costs. The major driving factors for the market growth in this region include surge in prevalence of chronic diseases such as cancer, orthopedic diseases and rise in geriatric population. Moreover, rise in number of market players that manufacture and distribute technologically advanced fluid management system is anticipated to drive the market growth during the forecast period. For instance, Olympus Corporation, a medical equipment manufacturing company, provides disten-u-flo fluid management system, rocaflow fluid management system, hysteroflow/hystero balance II (HFHB-2) for application in urology, gynecology and endoscopy minimally invasive surgeries.

Moreover, the increase in geriatric population of Asia-Pacific is one of the propelling factors that drive the growth of the market. According to the 2020 census, there are approximately 264 million (18.70%) people in China in the application of 60 and over. Moreover, key players in this region focus on expanding their business, which is expected to significantly enhance revenue generation, owing to availability of untapped areas and low cost of services. In addition, rise in awareness among people regarding minimally invasive surgeries such as laparoscopy, endoscopy and hysteroscopy is anticipated to drive the usage of fluid management devices and boost the growth of the market.

In addition, rise in the number of product launch and increase in number of adoptions of key strategies such as acquisition by key players of fluid management devices are anticipated to drive the growth of the market. Moreover, developing healthcare infrastructure, increasing disposable income among population and rising expenditure by government for healthcare sector are attributed to drive the growth of the market in Asia-Pacific.

COMPETITION ANALYSIS

Some of the major companies that operate in the fluid management devices industry include Conmed corporation, Olympus Corporation, Baxter international Inc., Fresenius Medical Care, Stryker Corporation, Medtronic Plc., Karl Storz se and co. kg., Cardinal Health, Bonvisi, and Hologic Inc.

Some examples of product approval in the market

In January 2021, the Hologic, Inc., an innovative medical technology company, announced the launch of fluent fluid management system, in Europe. This product is designed to offer more effective fluid management for physicians in hysteroscopic procedures.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluid management devices market analysis from 2021 to 2031 to identify the prevailing fluid management devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fluid management devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fluid management devices market trends, key players, market segments, application areas, and market growth strategies.

Fluid Management Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 13.3 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 401 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Medtronic plc, Hologic Inc., KARL STORZ SE & Co. KG, Bonvisi AB, Baxter International Inc., Cardinal Health Inc., Stryker Corporation, FRESENIUS SE & Co. KGaA (Fresenius Kabi), Olympus Corporation, CONMED Corporation |

Analyst Review

Fluid management devices play a crucial role in endoscopic operation, by enabling greater visibility and clean operative sites. For internal cavities, it applies a precise fluid pressure. It also aims to minimize the adherence of tissue to endoscopic tools.

Increase in number of product launch and product approvals for fluid management devices and rise in the number of adoption of strategies such as collaboration, acquisition, and partnership by market players drive the market growth. For instance, in January 2021, the Hologic, Inc., an innovative medical technology company, announced the launch of fluent fluid management devices, in Europe. This product is designed to offer more effective fluid management for physicians in hysteroscopic procedures. Thus, an increase in development of advanced fluid management products in emerging nations is expected to propel the growth of the market.

In addition, in June 2021, a leading provider of infection prevention and other procedural products and services announced the acquisition of Cantel medical, a global supplier and manufacturer of infection prevention and control products for endoscopy, dental, dialysis and life sciences customers.

The top companies that hold the market share in fluid management devices market are Conmed corporation, Olympus Corporation, Baxter international Inc., Fresenius Medical Care, Stryker Corporation, Medtronic Plc., Karl Storz se and Co. KG., Cardinal Health, Bonvisi, and Hologic Inc.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of chronic diseases and increase in the number of geriatric populations.

The key trends in the fluid management devices market are rise in number of product launches and product approvals for fluid management devices and increase in the number of surgical procedures.

The base year for the fluid management devices market report is 2021.

There are 10 fluid management device companies are profiled in the report.

The total market value of fluid management devices market is $4,563.0 million in 2021.

The forecast period in the report is from 2022 to 2031.

High cost of fluid management devices and high cost of surgeries are few restraining factors for fluid management devices market.

Loading Table Of Content...