Fluorite Market Research, 2033

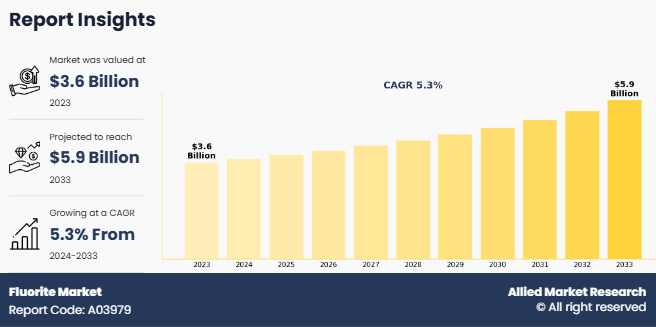

The global fluorite market was valued at $3.6 billion in 2023, and is projected to reach $5.9 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

Introduction

Fluorite possesses distinct physical and chemical characteristics, which make it highly valuable. With a Mohs hardness of 4, it is relatively soft, allowing easy cutting and polishing. Its perfect cleavage enables it to break along well-defined planes, forming highly symmetrical shapes. Fluorite is renowned for its optical qualities, including transparency and birefringence, making it essential for precision optical instruments. In addition, its fluorescence under UV light finds applications in scientific research and decorative uses. Its primary industrial use is as a flux in the steel and aluminum industries. It lowers the melting point of raw materials, facilitating the removal of impurities during the smelting process. This improves the efficiency of metal production and enhances the quality of the final product. In the cement industry, fluorite is used to reduce energy consumption by acting as a mineralizer, aiding in the formation of clinker at lower temperatures.

The chemical industry is one of the largest consumers of fluorite, where it serves as a key raw material for producing hydrofluoric acid (HF). Hydrofluoric acid is a precursor to nearly all fluorine-based chemicals, including refrigerants, solvents, and polymers such as polytetrafluoroethylene (PTFE), commonly known as Teflon. Fluorine compounds are integral to the production of pharmaceuticals, agrochemicals, and high[1]performance plastics. Fluorite plays a significant role in the energy sector, particularly in nuclear power. It is used in the production of uranium hexafluoride (UF₆), a compound essential for uranium enrichment in nuclear reactors. In addition, fluorine-based materials derived from fluorite are used in lithium-ion batteries and solar panels, contributing to renewable energy technologies.

Key Takeaways

- The fluorite market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global fluorite markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the fluorite market are China Zhong Qi Holdings Limited, CHINA KINGS RESOURCES GROUP CO., LTD, Koura, Gujarat Mineral Development Corporation Ltd., MINERSA GROUP, MONGOLROSTSVETMET LLC, ARES Strategic Mining Inc., SepFluor, Sinochem Group, and AMC. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

An increase in demand for fluorite in the electronics sector is expected to drive the growth of market. The electronics industry is a significant driver of demand for high-purity fluorite, owing to its critical role in the production of specialty glasses and optical components. Fluorite, in its purest form, is a key ingredient in manufacturing optical-grade glass, which is essential for precision lenses, display panels, and advanced optical instruments. These specialty glasses are widely used in consumer electronics such as smartphones, tablets, and televisions, where high clarity, durability, and resistance to thermal stress are paramount. The rise of emerging technologies such as augmented reality (AR), virtual reality (VR), and autonomous vehicles has further amplified the need for optical components made from fluorite-based materials. These technologies require precise optical systems that deliver high-resolution imaging and accurate light transmission. Fluorite’s superior refractive index and optical clarity make it a critical component in meeting these demands, positioning it as an essential material in the rapidly evolving electronics landscape. In February 2023, Kanto Denka Kogyo and Orbia's Fluorinated Solutions Business, Koura, signed a technology licensing agreement to supply vital electrolyte salt to the North American battery market. This collaboration underscores the strategic importance of securing a reliable supply of high-purity fluorite for the electronics industry, particularly in the production of lithium-ion batteries.

However, environmental concerns and regulations is expected to hamper the growth of the market. The processing of fluorite also contributes to environmental challenges, as it often requires the use of energy[1]intensive methods and chemicals. These processes release pollutants into the air and water, including toxic fluorine compounds, which pose health risks to workers and nearby populations. The cumulative impact of these activities has prompted governments worldwide to implement stricter environmental regulations, increasing compliance costs for mining companies. For instance, many countries now mandate environmental impact assessments and enforce rehabilitation programs for mined-out areas, which delay project timelines and add to operational expenses. The Central Ground Water Board (CGWB) has been monitoring groundwater quality, identifying areas with high levels of arsenic and fluoride. In December 2023, the CGWB reported that arsenic was detected in groundwater in parts of 230 districts across 25 states, and fluoride was found in 469 districts across 27 states. These findings highlight the ongoing challenges in managing groundwater contamination

Segments Overview

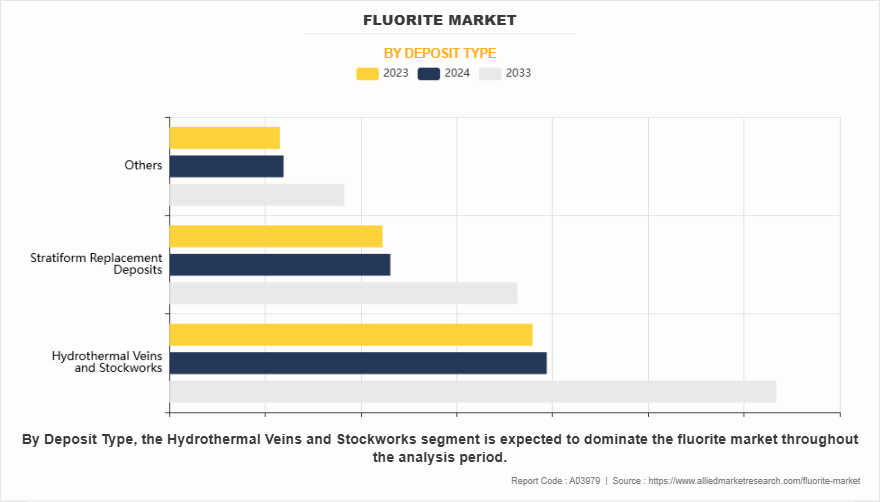

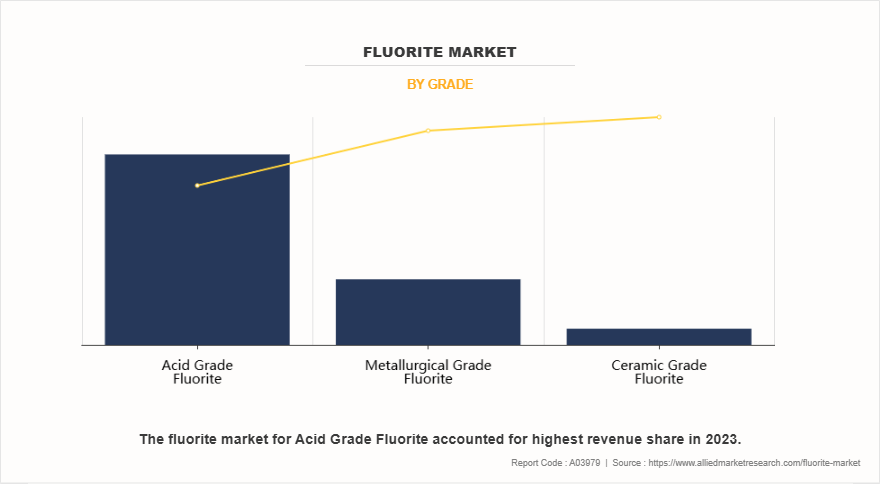

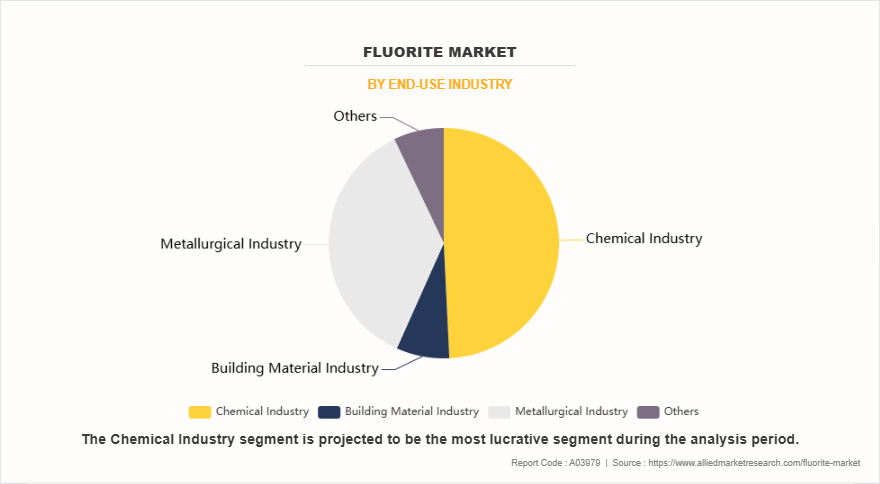

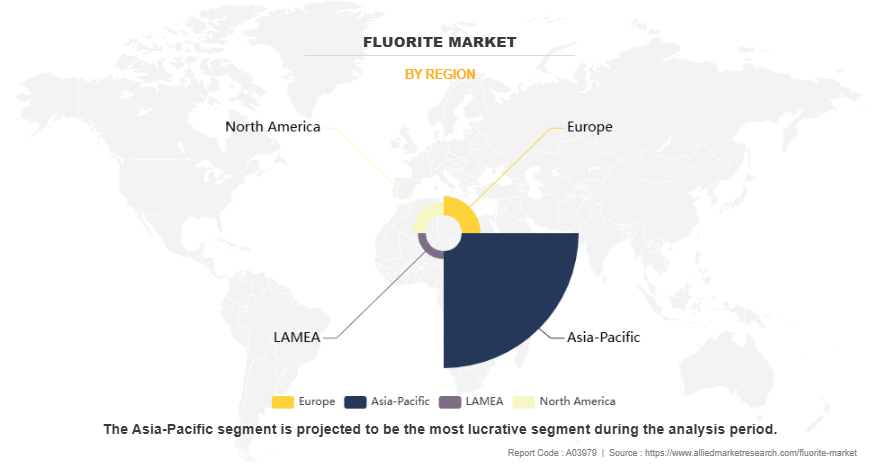

The fluorite market is segmented into deposit type, grade, end-use industry, and region. On the basis of deposit type, the market is classified into hydrothermal veins and stockworks, stratiform replacement deposits, and others. On the basis of grade, the market is categorized into acid grade fluorite, ceramic grade fluorite, and metallurgical grade fluorite. On the basis of end-use industry, the market is fragmented into chemical industry, building material industry, metallurgical industry, and others. By region, the fluorite market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of deposit type, the hydrothermal veins and stockworks segment was the largest revenue generator in 2023 and is anticipated to grow at a CAGR of 5.43% during the forecast period. Fluorite is a crucial mineral commonly found in hydrothermal veins and stockworks, where it often forms alongside minerals like quartz, calcite, and sulfides. Its deposition occurs from hot, mineral-rich fluids circulating through fractures and cavities in host rocks. Fluorite serves as an indicator mineral for hydrothermal activity, often marking zones of significant mineralization. It is extensively used in industrial applications due to its high calcium fluoride content, particularly in steelmaking, aluminum production, and as a flux in smelting. In January 2024, Pampa Metals Corp company announced the identification of an additional zone of undrilled, outcropping porphyry-related quartz-vein stockworks at the Piuquenes Porphyry Copper-Gold Project. This discovery, characterized by geophysical and geochemical anomalies, underscores the potential for multiple discoveries within the broader Piuquenes project area.

Based on grade, the acid grade fluorite segment dominated the fluorite market in 2023. Acid grade fluorite (fluorspar) is a highly pure form of fluorite with a minimum calcium fluoride (CaFâ‚‚) content of 97%. It is primarily used in the production of hydrofluoric acid (HF), a critical chemical employed in the manufacture of fluorocarbons, fluoropolymers, and aluminum fluoride. Hydrofluoric acid serves as a precursor for various applications, including refrigerants, pharmaceuticals, and petrochemicals. In addition, acid grade fluorite finds applications in the glass and ceramics industries as a flux to lower melting points and enhance product quality.

Based on end-use industry, the chemical industry segment dominated the fluorite market in 2023 representing the CAGR of 5.58% during the forecast period. Fluorite plays a vital role in the chemical industry, primarily as a source of fluorine. It is extensively used in the production of hydrofluoric acid (HF), a precursor for numerous fluorine-containing compounds, including refrigerants, pharmaceuticals, and fluoropolymers like Teflon. In addition, fluorite is utilized in the synthesis of aluminum fluoride and cryolite, which are essential in aluminum smelting.

On the basis of region, Asia-Pacific dominated the fluorite market in 2023. Fluorite, a critical mineral in the Asia[1]Pacific region, finds extensive applications across industries such as metallurgy, chemical manufacturing, and ceramics. Its primary use is in steel production as a flux to lower the melting point and enhance the removal of impurities, making it vital for the robust metal industry in countries like China and India.

Region-wise, Asia-Pacific is expected to be the fastest growing region in the fluorite market growing with a CAGR of 5.38% during the forecast period. One of the largest consumers of fluorite in the Asia-Pacific is the steel industry. Fluorite is used as a flux in the production of steel and iron, facilitating the removal of impurities such as sulfur and phosphorus from molten metal. This enhances the quality of the final product while improving energy efficiency. Major steel-producing nations such as China, India, Japan, and South Korea rely heavily on fluorite for efficient steel production, which is a cornerstone of infrastructure development, automotive manufacturing, and construction in the region. In July 2024, Tivan completed a pre-feasibility study for the Speewah project, highlighting its potential to enhance Australia's position in the global fluorite market. The study emphasized the project's strategic significance, aligning with Australia's Critical Minerals Strategy, and its potential to strengthen supply chains across Asia. Tivan aims to commence production by 2027, contributing to the diversification of fluorite sources and reducing reliance on Chinese supplies.

Competitive Analysis

The major players operating in the fluorite market include China Zhong Qi Holdings Limited, CHINA KINGS RESOURCES GROUP CO., LTD, Koura, Gujarat Mineral Development Corporation Ltd., MINERSA GROUP, MONGOLROSTSVETMET LLC, ARES Strategic Mining Inc., SepFluor, Sinochem Group, and AMC.

In September 2022, Gujarat Fluorochemicals Limited company committed approximately USD 304.28 million to expand its fluoropolymer and battery chemical production capacities, including plans to increase its AHF manufacturing capacity from 120 tons per day (tpd) to 220 tpd. Government initiatives, such as the 'Make in India' campaign, further support the chemical industry's growth by emphasizing manufacturing activities and recognizing the sector's potential for economic development and job creation.

In December 2023, the National Green Tribunal (NGT) issued notices to 24 states and four Union Territories regarding the presence of arsenic and fluoride in groundwater, highlighting the serious health hazards posed by these contaminants. The NGT emphasized the need for urgent preventive and protective measures, underscoring the importance of stringent environmental regulations in the mining and processing of minerals like fluorite.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluorite market analysis from 2023 to 2033 to identify the prevailing fluorite market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fluorite market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fluorite market trends, key players, market segments, application areas, and market growth strategies.

Fluorite Market, by Deposit Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.9 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 285 |

| By End-Use Industry |

|

| By Deposit Type |

|

| By Grade |

|

| By Region |

|

| Key Market Players | Koura, SINOCHEM GROUP CO., LTD., AMC, Gujarat Mineral Development Corporation Ltd., China Kings Resources Group Co.,Ltd., SepFluor, MINERSA GROUP, Mongolrostsvetmet SOE, ARES Strategic Mining Inc., China Zhong Qi Holdings Limited |

Analyst Review

An increase in demand for fluorite-based cement and ceramics in construction industries is expected to drive the growth of market. In the cement industry, fluorite acts as a mineralizer, reducing the temperature required for clinker formation during cement manufacturing. This not only lowers energy consumption but also enhances the quality of the final product by improving its strength and durability. Ceramics, another key application area, benefit from fluorite's unique properties. It is used in the production of specialized ceramic products due to its ability to lower the melting point of raw materials and improve the thermal stability and mechanical strength of the end product. High-performance ceramics, such as tiles, sanitary ware, and advanced ceramics used in industrial applications, are in growing demand. In December 2024, the National Council for Cement and Building Materials (NCB) in India signed Memorandums of Understanding (MoUs) to advance decarbonization and innovation in the cement industry. These agreements aim to promote collaborative research on reducing carbon emissions and exploring advanced technologies in cement production.

However, volatility in raw material prices is expected drive the growth of market. The volatility in raw material prices is a significant challenge for the fluorite market, primarily driven by its limited reserves and the complexities associated with mining. Fluorite deposits are geographically concentrated, with a substantial portion of global production originating from countries like China, Mexico, and Mongolia. This geographical concentration makes the supply chain highly susceptible to disruptions caused by local economic policies, labor strikes, or environmental regulations. Additionally, the finite nature of high-grade fluorite reserves means that extraction becomes progressively more expensive as accessible deposits are depleted. Another factor contributing to price fluctuations is the growing demand for fluorite in diverse applications such as steel production, hydrofluoric acid manufacturing, and ceramics. With demand outpacing supply in certain regions, prices can spike unpredictably. For industries heavily reliant on fluorite, these price variations increase operational costs, potentially reducing profit margins and impacting long-term planning.

The global fluorite market was valued at $3.6 billion in 2023, and is projected to reach $5.9 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

The major operating players in the fluorite market include China Zhong Qi Holdings Limited, CHINA KINGS RESOURCES GROUP CO., LTD, Koura, Gujarat Mineral Development Corporation Ltd., MINERSA GROUP, MONGOLROSTSVETMET LLC, ARES Strategic Mining Inc., SepFluor, Sinochem Group, and AMC.

Asia-Pacific is the largest regional market for fluorite.

Hydrothermal veins and stockworks is the leading deposit type of fluorite market.

Advancements in processing technologies are the upcoming trends of fluorite Market in the globe.

Loading Table Of Content...

Loading Research Methodology...