Fluoropolymers Market Research, 2033

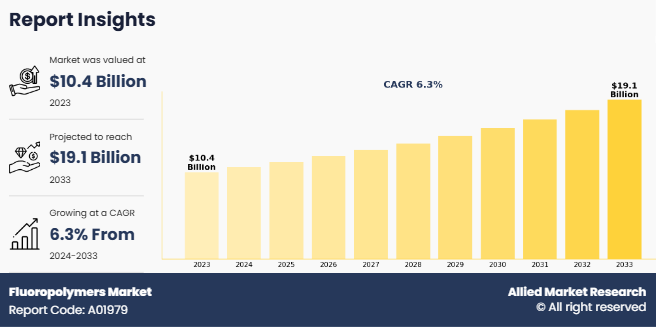

The global fluoropolymers market was valued at $10.4 billion in 2023, and is projected to reach $19.1 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. Fluoropolymers are a class of high-performance plastics characterized by their unique properties, mainly derived from the strong carbon-fluorine (C-F) bonds in their molecular structure. These bonds impart exceptional chemical resistance, high thermal stability, excellent electrical insulation properties, and a low coefficient of friction. Due to these distinctive characteristics, fluoropolymers find extensive use across a variety of industries, including chemical processing, automotive, aerospace, electrical and electronics, medical, and consumer products. They are considered indispensable materials for applications that demand performance under extreme conditions.

Introduction

The outstanding chemical resistance of fluoropolymers is one of their defining features, making them highly resistant to acids, bases, solvents, and corrosive chemicals. This quality stems from the carbon-fluorine bond's strength, which is one of the strongest in organic chemistry. Additionally, fluoropolymers exhibit high-temperature stability, with some grades capable of withstanding temperatures up to 260°C (500°F) or even higher. Their non-stick nature is another key attribute, which is why they are used in applications like non-stick cookware coatings and industrial equipment where reduced friction and sticking are required.

In the chemical processing industry, fluoropolymers are used extensively due to their exceptional resistance to aggressive chemicals and high temperatures. Equipment such as pumps, valves, pipes, and tanks are often lined or coated with fluoropolymers to prevent corrosion and extend the life of the equipment. Polytetrafluoroethylene (PTFE), the most well-known fluoropolymer, is frequently employed in the construction of gaskets and seals that need to maintain their integrity in harsh chemical environments. These materials are also crucial for maintaining the purity of fluids and gases in chemical plants.

Key Takeaways

- The fluoropolymers market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (tons) for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global fluoropolymers markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The fluoropolymers market is forecast, with several players including DuPont, SABIC, Arkema, DONGYUE GROUP, Solvay, Mitsubishi Chemical Group, DAIKIN INDUSTRIES, Ltd, The Chemours Company, 3M, Saint-Gobain and others. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the fluoropolymers market.

Market Dynamics

Growth demand in automotive and electronics is expected to drive the growth of fluoropolymers market. The automotive industry's adoption of fluoropolymers is driven by their exceptional chemical and thermal resistance. These materials are critical in ensuring the durability and efficiency of components such as fuel hoses, O-rings, seals, and gaskets. As vehicles operate under increasingly demanding conditions, including higher temperatures and exposure to aggressive fuels and chemicals, fluoropolymers offer a reliable solution. Their ability to withstand extreme environments contributes significantly to enhancing the safety and longevity of automotive systems. This makes them indispensable, especially with the ongoing development of electric and hybrid vehicles, which often require advanced materials to maintain optimal performance. In February 2024, Infineon Technologies AG and Honda Motor Co. Ltd entered into a memorandum of understanding (MoU) to establish a strategic collaboration. Honda has chosen Infineon as its semiconductor partner to synchronize their future product and technology roadmaps. The agreement includes ongoing discussions to ensure supply stability and promote the exchange of expertise between both companies, aiming to accelerate the development and market introduction of new technologies.

In the electronics sector, the role of fluoropolymers is equally vital. They are used extensively as insulation materials for cables and wires, owing to their excellent electrical insulation properties and resistance to flame and moisture. With the continuous miniaturization of electronic devices and the rise of high-frequency applications, the demand for high-performance materials like fluoropolymers has surged. They also play a key role in the semiconductor industry, where their chemical inertness and purity are crucial for the manufacturing of chips and other components. As the electronics landscape evolves, fluoropolymers are expected to remain a cornerstone of innovation, enabling the development of more efficient and reliable electronic devices.

However, environmental and regulatory concerns is expected to hamper the growth of fluoropolymers market. Environmental and regulatory concerns are a significant challenge for the fluoropolymers market, as the production and disposal of these materials can have adverse environmental impacts. Manufacturing processes often involve the release of greenhouse gases and other harmful byproducts that contribute to pollution. As a result, governments and regulatory bodies around the world have been implementing stricter regulations to minimize these effects. Compliance with these regulations not only increases operational costs but also limits the production capacity for manufacturers, affecting overall market growth. The use of perfluorinated chemicals, such as per- and polyfluoroalkyl substances (PFAS), is under increased scrutiny due to their potential health and environmental risks. These substances are known for their persistence in the environment, earning them the nickname "forever chemicals" because they do not break down easily.

Moreover, Increasing fluoropolymers in renewable energy is expected to offer growth opportunities in the market. The renewable energy sector is poised to experience significant advantages from the increased use of fluoropolymers, especially in applications involving solar panels and wind turbines. These materials are known for their exceptional weather resistance, a property that makes them particularly well-suited for outdoor environments where renewable energy systems operate. Solar panels, for instance, are continuously exposed to fluctuating weather conditions, including intense sunlight, rain, humidity, and extreme temperatures. Fluoropolymers help protect these panels, reducing the risk of material degradation over time. According to the Global Wind Energy Council (GWEC), the global offshore wind sector added around 11 GW of new capacity in 2023. In the same year, China led the world in onshore wind installations, with approximately 69.3 GW of new capacity. Additionally, China accounted for over 58% of the global offshore wind capacity added, connecting more than 6.3 GW of new offshore wind grids in 2023.

Segments Overview

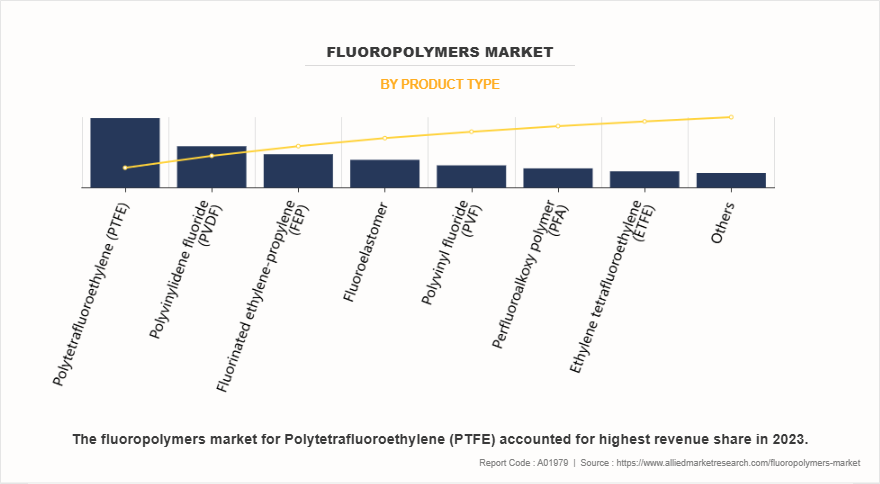

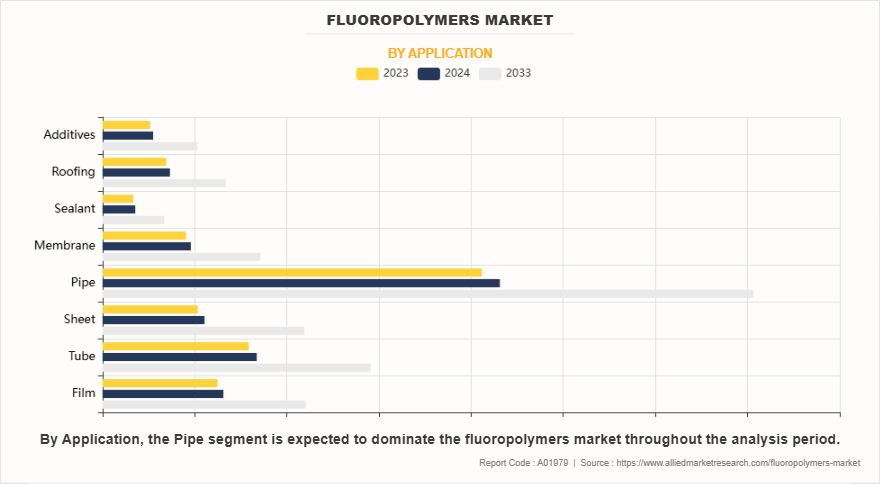

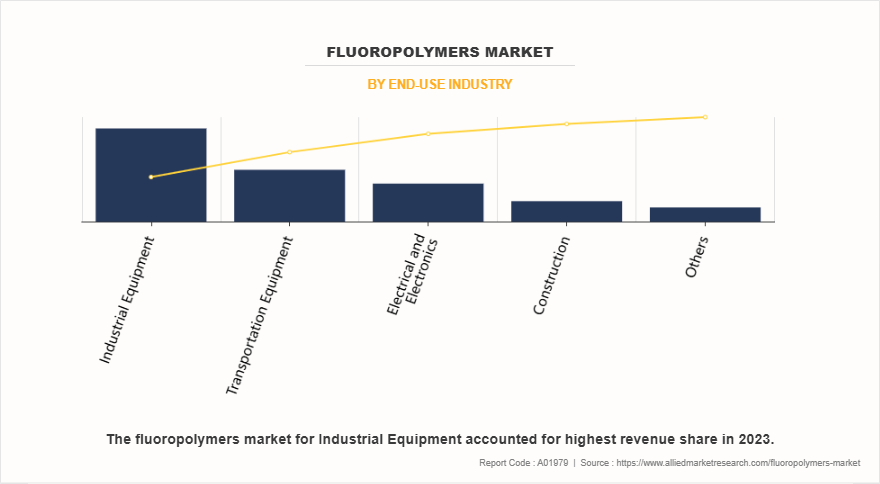

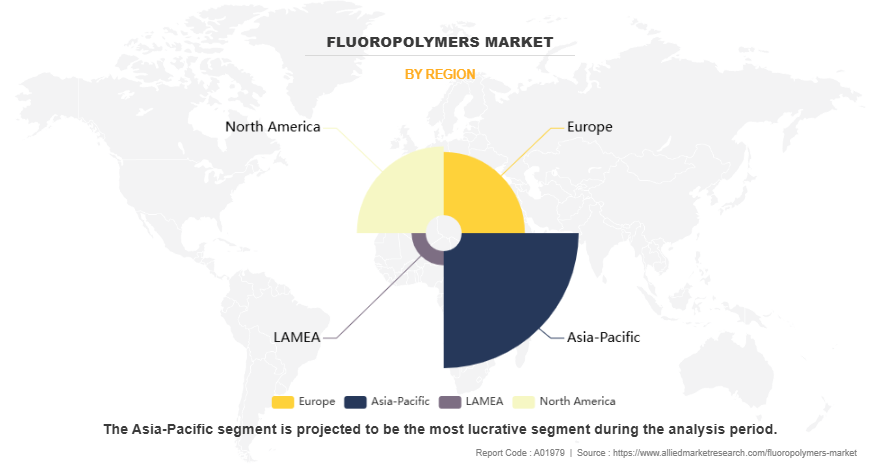

The fluoropolymers market is segmented into product type polytetrafluoroethylene (PTFE), fluorinated ethylene-propylene (FEP), polyvinylidene fluoride (PVDF), fluoroelastomer, polyvinyl fluoride (PVF), perfluoroalkoxy polymer (PFA), ethylene tetrafluoroethylene (ETFE), and others. On the basis of application the market is categorized into film, tube, sheet, pipe, membrane, sealant, roofing, additives, and others. On the basis of end-use industry the market is divided into transportation equipment (automotive vehicles, aerospace, and others), electrical and electronics (wire and cable, photovoltaic modules, batteries, and fuel cells), construction, industrial equipment, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By product type, the polytetrafluoroethylene (PTFE) segment dominated the fluoropolymers market growing with the CAGR of 5.5% during the forecast period. Polytetrafluoroethylene (PTFE) is a widely used fluoropolymer known for its exceptional properties that make it ideal for various industrial applications. One of its most prominent characteristics is its high chemical resistance, which allows PTFE to withstand aggressive chemicals, acids, and bases. This makes it highly valuable in industries such as chemical processing, pharmaceuticals, and food production, where equipment is exposed to harsh substances. PTFE is commonly used for linings in pipes, tanks, and reactors to prevent corrosion and contamination, thereby improving the durability and safety of these systems. PTFE is also recognized for its excellent thermal stability. It can operate at extreme temperatures, ranging from -200°C to +260°C, without losing its mechanical integrity. This property is crucial in high-temperature applications like automotive, aerospace, and electrical insulation.

On the basis of application, pipe segment was the highest revenue contributor in the fluoropolymers market n 2023. One of the primary benefits of using fluoropolymers in pipes is their exceptional chemical resistance. Fluoropolymers are virtually inert, meaning they can withstand exposure to a wide range of aggressive chemicals without degrading. This makes them ideal for transporting corrosive fluids, including acids, bases, solvents, and other hazardous materials, without the risk of pipe corrosion or contamination. In many industrial processes, this chemical inertness is crucial for maintaining the purity of the fluids being transported and for extending the lifespan of the piping system. Fluoropolymers have a smooth, non-stick surface that reduces the buildup of materials inside the pipes. This reduces flow resistance and helps prevent clogs or blockages, particularly in systems where viscous or sticky substances are transported. The smooth surface also reduces the risk of corrosion or scaling, which can degrade pipe performance and reduce system efficiency.

Based on end-use industry, the industrial equipment segment dominated the fluoropolymers market representing the CAGR of 5.9% in 2023. Fluoropolymers are widely used in industrial equipment due to their exceptional chemical resistance, thermal stability, and low friction properties. In chemical processing, fluoropolymer coatings are applied to equipment to protect against corrosion and extend the life of components. For instance, PTFE-lined pipes and tanks are widely used to handle corrosive liquids and gases, ensuring the integrity of the system over time. The low friction properties of fluoropolymers also help reduce wear and tear on moving parts, such as in bearings, seals, and other friction-sensitive components found in industrial machinery.

Based on region, Asia-Pacific dominated the fluoropolymers market in 2023. Fluoropolymers are widely used across various industries in Asia-Pacific (APAC) due to their unique properties, including high chemical resistance, thermal stability, and excellent electrical insulating capabilities. These properties make them ideal for applications in industries such as automotive, electronics, chemicals, and energy. In countries like Japan, China, South Korea, and India, the demand for fluoropolymers has been steadily increasing, driven by the expansion of industrial activities and the growing need for high-performance materials. In October 2022, Evonik formed collaborations with two new distribution partners for its high-performance polymers. TER Chemicals became responsible for distributing VESTOSINT polyamide 12 powders throughout Europe, the Middle East, and Africa (EMEA). Meanwhile, Biesterfeld Performance Rubber GmbH took on the distribution of VESTENAMER rubber additives across the EMEA region, excluding Italy.

Competitive Analysis

Key players in the fluoropolymers industry include DuPont, SABIC, Arkema, DONGYUE GROUP, Solvay, Mitsubishi Chemical Group, DAIKIN INDUSTRIES, Ltd, The Chemours Company, 3M, Saint-Gobain and others. These players have adopted several strategies to make strong their market position in the market.

- In January 2022, Arkema revealed its decision to increase the capacity expansion of its fluoropolymer production at the Changshu site in China. Initially set at 35%, the expansion was revised to 50% in response to the growing demand for materials used in lithium-ion batteries.

- In October 2022, Dongyue Group finalized the construction of its PVDF project in China, with an annual production capacity of approximately 10,000 tons. This addition brought the company’s total PVDF production capacity to 25,000 tons per year.

Key Regulations of Fluoropolymers Market:

European Union Regulations

- REACH Regulation: Under the REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) framework, fluoropolymers are included in the broader category of PFAS. This means they could face market restrictions in Europe unless their unique properties are adequately highlighted in regulatory proposals.

- PFOA Restrictions: As of July 4, 2020, the EU has banned the use of perfluorooctanoic acid (PFOA) in concentrations above 25 parts per billion (ppb) in any product, including fluoropolymers. Specific exemptions were made for certain applications involving polytetrafluoroethylene (PTFE) and poly(vinylidene fluoride) (PVDF), particularly in high-performance contexts like medical textiles and filtration systems.

United States Regulations

- EPA Initiatives: The U.S. Environmental Protection Agency (EPA) has implemented stewardship programs targeting PFOA and related substances. Manufacturers are encouraged to phase out these chemicals and explore safer alternatives.

- State-Level Actions: Various states have enacted their own regulations concerning PFAS, which include stricter limits on PFOA levels in products and drinking water. These state regulations can vary significantly from federal guidelines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fluoropolymers market analysis from 2023 to 2033 to identify the prevailing fluoropolymers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fluoropolymers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fluoropolymers market trends, key players, market segments, application areas, and market growth strategies.

Fluoropolymers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 19.1 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Product Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | 3M, Solvay, SABIC, DuPont, The Chemours Company, Arkema, Mitsubishi Chemical Group Corporation, Saint-Gobain, DONGYUE GROUP, Daikin Industries, Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the fluoropolymers market is expected to witness significant growth in the upcoming years. An increase in demand for high-performance materials is expected to drive the growth of fluoropolymers market. The growing demand for high-performance materials is one of the primary drivers fueling the fluoropolymer market. Fluoropolymers are known for their outstanding durability, which makes them suitable for extreme conditions where other materials might fail. Their remarkable resistance to heat, chemicals, and electrical conductivity gives them a significant edge in industries that require robust and reliable materials. For instance, in the aerospace sector, fluoropolymers are used in applications where materials need to withstand high temperatures and intense chemical exposure without degrading, such as in fuel systems, seals, and gaskets. The automotive industry also relies on fluoropolymers for parts like fuel lines, hoses, and gaskets, where resistance to heat and chemical exposure is essential for maintaining performance over the long term.

However, the environmental impact of manufacturing and disposing of fluoropolymers is expected to hamper the growth of fluoropolymers market in 2023. Environmental concerns surrounding the manufacturing and disposal of fluoropolymers present significant challenges to the growth of the market. One of the key issues is the use of perfluorooctanoic acid (PFOA), a chemical compound historically employed in the production of certain fluoropolymers, including Teflon. PFOA has been identified as a persistent environmental pollutant that can accumulate in water, soil, and living organisms. It is known for its potential to cause long-term environmental damage and is linked to health concerns, including cancer, liver damage, and reproductive issues. As a result, its widespread use has prompted growing scrutiny from regulatory bodies worldwide. In response to these environmental risks, many countries have implemented stringent regulations aimed at reducing or eliminating the use of PFOA and other harmful chemicals in the production of fluoropolymers. For example, the European Union and U.S. have set limits on PFOA emissions and are encouraging manufacturers to adopt safer alternatives.

The global fluoropolymers market was valued at $10.4 billion in 2023, and is projected to reach $19.1 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

The report covers profiles of key industry participants such as DuPont, SABIC, Arkema, DONGYUE GROUP, Solvay, Mitsubishi Chemical Group, DAIKIN INDUSTRIES, Ltd, The Chemours Company, 3M, Saint-Gobain and others.

Asia-Pacific is the largest regional market for fluoropolymers.

Pipe is the leading application of fluoropolymers market.

Rising demand for electrification in transportation are the upcoming trends of fluoropolymers market.

Loading Table Of Content...

Loading Research Methodology...