Foldable Smartphone Market Insights, 2031

The global foldable smartphone market was valued at USD 17.6 billion in 2021, and is projected to reach USD 174 billion by 2031, growing at a CAGR of 26% from 2022 to 2031.

Increase in demand for advanced consumer electronics and a growing number of internet users is boosting the growth of the market. In addition, the rising demand for Phablet positively impacts the growth of the market. However, the high cost of advanced technology and manufacturing complexity of foldable displays is hampering the foldable smartphone market growth. On the contrary, expanding the product portfolio of smartphone vendors is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

A foldable phone is a smartphone with a special display that can be folded in half. In addition, customers are likely to be attracted by combining the features of a large-screen tablet with the flexibility of smartphones. Samsung and Huawei, as well as other newcomers, also lead the way for this new technology.

Top Impacting Factors

Increase in Demand for Advanced Consumer Electronics

Increased popularity and affordability of advanced consumer electronics has influenced the growth of the global market of foldable smartphone. Consumer electronics such as laptops, tablets, foldable smartphones, and smartwatches require the complex implementation of advance technologies. Moreover, the integration of the Internet of Things and Artificial Intelligence in consumer electronics, and robotics, aerospace & defense sector has enhanced the application of foldable smartphones. These are the major factors behind the growth of the foldable smartphone market during the forecast period.

Rising Demand for Phablet

Phablets are the fastest-growing foldable smartphone category. Phablets have accelerated the trend toward consumer time-spend on visually oriented social media and messaging apps. In addition, larger-screen real estate encourages sustained on-the-go engagement on content-centric social networks and apps, including Facebook, Instagram, Snapchat, and LINE. More than half of activity on phablets is tied to social networks.

For instance, in August 2020, Samsung Electronics Co. launched a new flagship phablet and foldable smartphone with larger screens as the company aims to boost its handset sales amid the novel coronavirus pandemic. The South Korean tech giant unveiled the Galaxy Note 20 phablet and the Galaxy Z Fold 2 foldable smartphone, along with the Galaxy Watch 3 smartwatch, the Galaxy Buds Live wireless earbuds and the Galaxy Tab S7 tablet.

Segment Review

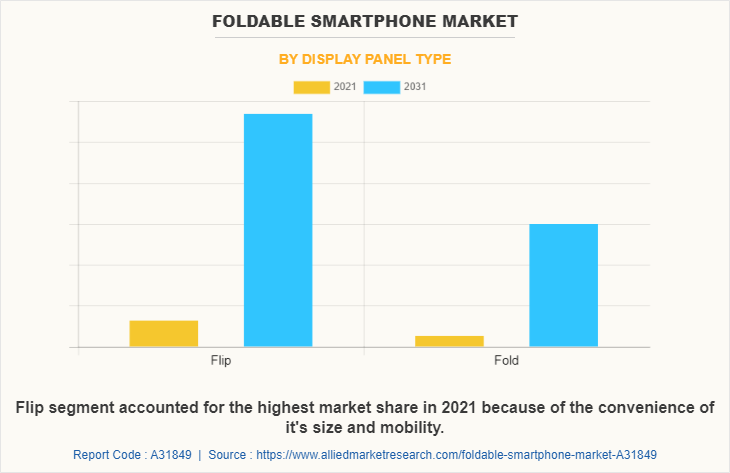

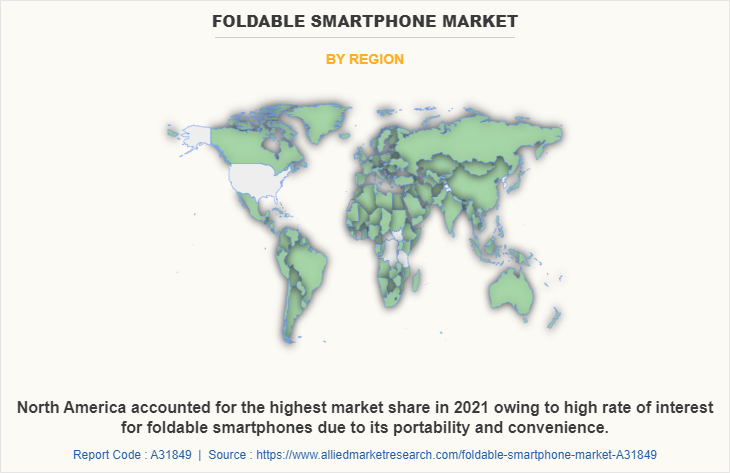

Foldable smartphone industry is segmented on the basis of by display panel type, sales channel, and region. On the basis of the display panel type, the foldable smartphone market is categorized into flip and fold. By sales channel, it is classified into online and offline. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of display panel type, the flip segment holds the highest foldable smartphone market share, owing to the low cost of flip foldable smartphones as compared to foldable smartphones, making it much more affordable. However, the fold segment is expected to grow at the highest rate during the forecast period, owing to the rapidly increasing demand for modern consumer electronics, along with the high adoption of mobile devices in the entertainment and gaming sector.

Region-wise, the foldable smartphone market size was dominated by North America in 2021. The region is expected to retain its position during the forecast period, owing to the presence of various smartphone companies resulting in the easy availability of smartphones at a lower price. This is expected to drive the market for foldable smartphone technology within the region during the forecast period. Asia-Pacific is also expected to witness significant growth during the forecast period, owing to a rise in demand for advanced consumer electronics combined with high adoption in the entertainment and gaming industries.

The key players that operate in the foldable smartphone market are ASUSTeK Computer Inc, Huawei Technologies Co., Ltd, LG Electronics, Microsoft Corporation, Motorola Mobility LLC, Samsung, TCL Technology, Vivo Mobile Pvt Ltd, Xiaomi Corporation, and ZTE Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the foldable smartphone industry.

Digital Capabilities:

A foldable smartphone is a smartphone with a folding form factor. Some variants of the concept use multiple touchscreen panels on a hinge, while other designs utilize a flexible display. In addition, folding screens are constructed using three main materials, timber, paper, and paste. Internally each panel is the same, based on an outer timber framework with a square lattice-like-timber structure within.

Furthermore, the foldable phone uses a different mechanism. A larger display with a larger capacity battery, a hinge that holds the displays together, and most importantly, a screen that can be bent and folded tightly. Most smartphones use LCD displays. These are built on a glass base, with an RGB color panel on the top. Moreover, many end-users are adopting technologies like blockchain has been making rounds for many years.

In addition, it has finally come into action. Blockchain technology provides enhanced solutions of decentralized app development that eliminate any unauthorized access and push transparency. Furthermore, Google has introduced a new technology named Flutter, which is being touted as the future of android development. Flutter is a cross-platform framework that helps in developing beautiful apps with a single codebase. Many developers have been selecting this platform to build mobile apps due to its flexible nature. The primary reasons to choose Flutter are that it is effortless to learn, has a native design, etc.

In addition, foldable smartphone vendors are using APM (Application Performance Management) and EMM (Enterprise Mobile Management) are two primary elements of mobile enterprise development. These technologies are primarily used to reduce mobile apps’ slowness. With the overall rise in mobile application development trends, they have become the quality tester for mobile apps. Foldable smartphone businesses have slowly started to immensely use Beacon technology, as it helps businesses target potential clients uniquely. Beacons are the transmitting gadgets that get connected to mobile devices, in that particular range.

The technology allows companies to send various notifications regarding special offers, nearby users, etc. Beacon technology transformation from a push marketing strategy to an opt-in strategy is useful for many industries. The technology can be applied on-cloud and at-area, which is helping it to gain traction and promote its growth in the coming years. Beacon-based notifications are helping out businesses to connect with their users in a highly contextual manner.

End-user Adoption:

With an increase in competition, major foldable smartphone market players have started partnering with companies to expand their market penetration and reach. For instance, in August 2021 Samsung partnered with Microsoft Corporation to deliver a seamless bridge between Windows PC and mobile devices, and has also expanded to further integrate Microsoft Office, Teams and Outlook into the smartphone experience.

Due to technological advancements across the world and the rise in demand for foldable smartphone, various companies have expanded their current product portfolios and innovations with increased diversification among customers. For instance, in August 2021, Samsung launched Samsung Galaxy Z Fold 3 mobile. The smartphone has a 7.60-inch touchscreen primary display with a resolution of 2208x1768 pixels at a pixel density of 374 pixels per inch (PPI).

Furthermore, it also has a 6.20-inch touchscreen as its secondary display, with a resolution of 832x2268 pixels. The smartphone is powered by an octa-core processor. It features with 12GB of RAM. The Samsung Galaxy Z Fold 3 runs Android 11, operating system and is powered by a 4400mAh battery. The Samsung Galaxy Z Fold 3 supports proprietary fast charging.

For instance, in February 2020, Huawei launched its Mate X2 latest foldable smartphone in China. Like Samsung Galaxy Fold, the company ditched the outward folding design and moved to an inward folding design. For instance, in October 2022, Vivo launched Vivo X Fold it has a leather back and a quad-camera set up in partnership with ZEISS for enabling a superior photography experience.

The right edge of the Vivo X-Fold has a button that looks like an alert slide. The other edge of the device has a volume rocker and a power key. Growing investment from smartphone manufacturers drives demand in the foldable smartphone market. For instance, in August 2022, Xiaomi Inc. announced that the company launched a new foldable smartphone called Mix Fold 2, in China. The predecessor of this phone, the Xiaomi Mi Mix Fold, featured a folding display measuring 8.01 inches and an elongated outer display measuring 6.52 inches with a 27:9 aspect ratio

Moreover, with an increase in competition, major foldable smartphone market players have started acquiring with companies to expand their market penetration and reach. For instance, in September 2022 Apple inc acquired Necessary Patent much needed patent for a display material containing self-healing properties, which the company plans to use for all the foldable smartphones it plans to manufacture in the future.

Government Regulations:

All well-governed industries should be able to demonstrate due diligence to ensure regulatory compliance in applicable fields, including IT. Organizations are increasing adoption of advance electronics heavily influenced by COVID-19. In addition, federal and state governments are improving their track plans for various privacy laws, which are applicable for data that are involved in their operations. For instance, the Gramm-Leach-Bliley Act not only covers banks, but also securities firms, and insurance companies, and companies providing many other types of financial products and services.

For instance, in March 2022, U.S. and European Commission announce New Trans-Atlantic Data Privacy framework to put in place new safeguards to ensure that signals surveillance activities are necessary and proportionate in the pursuit of defined national security objectives. Furthermore, the GDPR act imposed by the European Government mitigates the risk of cyber security and any potential data breaches. Emerging countries of Asia-Pacific are developing stringent regulations, which comprise privacy, government regulatory environment, and intellectual property protection.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of foldable smartphone market forecast along with current trends and future estimations to explain the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on foldable smartphone market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The foldable smartphone market analysis from 2022 to 2031 is provided to determine the market potential.

Foldable Smartphone Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 174 billion |

| Growth Rate | CAGR of 26% |

| Forecast period | 2021 - 2031 |

| Report Pages | 265 |

| By Display panel type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, Xiaomi Corporation, ZTE Corporation, Huawei Technologies Co., Ltd., LG Electronics Inc., Motorola Mobility LLC, AsusTek Computer Inc., samsung, Royole Corporation, vivo Mobile Pvt Ltd |

Analyst Review

A foldable smartphone is a flexible electronic display that differs from typical flat-surface displays. it uses a flexible display technology that can be twisted, rolled up, and folded like paper depending on the requirements. Foldable displays are durable as compared to traditional displays. Foldable displays are a new technology that is predicted to revolutionize the semiconductor and electronics industries shortly. Companies such as Samsung Electronics, LG Display, Huawei, and Visionox have developed numerous types of foldable displays with varying thickness, pixel density, and material characteristics. Foldable displays have been increasingly common in tablets, smartphones, and notebooks in recent years.

The global foldable smartphone market is expected to register high growth due to rise in demand for new and advanced smartphone displays, as well as the rising proliferation of smartphones, particularly in developing economies, and the increasing use of foldable displays for a variety of applications such as smartphone displays are expected to drive industry growth. Thus, an increase in the adoption of foldable smartphones, owing to its flexibility is one of the most significant factors driving the growth of the market.

With surge in demand for a foldable smartphone, various companies have established alliances to increase their capabilities. For instance, in March 2022, Oneplus partnered with Google inc to add new privacy and security feature to the upcoming OxygenOS 13 operating system which is based on Android 13. As the new Android OS will include the work stated in the Android 12L version, it is expected that the OS will work better on devices with larger screen including foldable smartphone.

In addition, with further growth in investment across the world and the rise in demand for foldable smartphone, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in Aug 2022, Samsung Electronics Co., Ltd. introduced two new series of Samsung phones (Galaxy Z Flip 4 and Galaxy Z Fold 4). Both smartphones became available in Aug. 2022. In terms of design, there have been no changes to the design of the Galaxy Z Flip 4. This smartphone comes with two front-facing cameras and a dual-tone effect. The Samsung Galaxy Z Flip 4 is equipped with Snapdragon 8 Gen 1 Plus, running the Android 12 operating system. The phone also has 8 GB of RAM and 512 GB of internal storage. For instance, in February 2020, Huawei had launched its Mate X2 latest foldable smartphone in China. Like Samsung Galaxy Fold, the company ditched the outward folding design and moved to an inward folding design.

The global foldable smartphone market was valued at USD 17.6 billion in 2021, and is projected to reach USD 174 billion by 2031

The global foldable smartphone market is projected to grow at a compound annual growth rate of 26% from 2021-2030 to reach USD 174 billion by 2031

The key players profiled in the report include ASUSTeK Computer Inc, Huawei Technologies Co., Ltd, LG Electronics, Microsoft Corporation, Motorola Mobility LLC, Samsung, TCL Technology, Vivo Mobile Pvt Ltd, Xiaomi Corporation, and ZTE Corporation.

As in2023, the Asia-Pacific region holds the largest share of the foldable smartphone market

Increase in demand for advanced consumer electronics and a growing number of internet users is boosting the growth of the foldable smartphone market. In addition, the rising demand for Phablet positively impacts the growth of the foldable smartphone market.

Loading Table Of Content...