Food Colors Market Research, 2032

The global food colors market size was valued at $2.3 billion in 2022, and is projected to reach $7.8 billion by 2032, growing at a CAGR of 13.2% from 2023 to 2032.

Food colors are produced synthetically to achieve bright and reliable hues in bakery products, without affecting the product’s taste stability. Food colors are accessible in marketplaces in both fluid and granulated forms. dish quality is determined by the color of the dish. Food coloring does not necessarily indicate that the components are organic; nevertheless, in a few circumstances, it indicates that fewer substances are utilized. The fewer ingredients added, the more natural the food product is. Thus, consumers demand natural and organic ingredients in food colors for a better lifestyle and to minimize the risk of diseases that are caused due to artificial food colors. Natural food colors are generally considered to be safer and healthier than synthetic food colors, which are made from chemicals. They are also more appealing to consumers who are looking for natural and clean-label products, thus creating a huge demand in the market. To meet demand, food producers are heavily investing in the creation of novel products and technical developments.

Furthermore, changes in lifestyle trends in Asia-Pacific developing nations such as India and China boost consumer interest in high-quality items for a comfortable existence. This, in turn, boosts the demand for bakery food products, thereby driving the food colors market growth. Moreover, significant economic growth and hectic routine of people encourage the usage of high-quality and healthy bakery products, which, in turn, provides opportunities for the food colors market growth.

Furthermore, manufacturers are focusing on introducing new colors and innovative packaging to appeal consumers. Cookies & biscuits serve as a standard choice for gifting along with other confectionery items such as chocolates. In addition, low-calorie cookies & biscuits are gaining high popularity among health-conscious consumers, which fuels the growth of the bakery & confectionery segment, thereby supplementing the growth of the food colors sector.

Moreover, food colors have various functions, such as they enhance the appearance of the food, replace the colors loss during the process of cooking, and others. Food colors enhance color that occur naturally in foods, and impart color to colorless foods, making them more appealing. The aim of adding color in dairy applications is to make the products appealing, enhance their quality, prevent loss of color during processing, and influence consumers to buy dairy products. Dairy products contain various pigment-producing microorganisms. For instance, Monascus sp. is a mold, which produces purplish-red nontoxic pigments that can be used as food colorants in dairy products, such as flavored milk and yoghurt. Moreover, Monascus sp. enhances the flavor of food and acts as a food preservative.

Food color has become a primary factor affecting consumers’ purchasing decision of dairy products. Product development and innovation in the global market has led to increase in use of natural and synthetic color in several applications. For instance, Roha Dyechem Pvt. Ltd., an India-based food company, launched Natracol Ultra Cran red color, which is applicable in dairy products. This food color has the ability to disperse in dairy liquids to produce a vibrant shade and provides various shades of red from light pink, orange to red.

Increase in beverage consumption has driven the food colors market demand. Moreover, rise in the preference of consumers toward beverages with natural ingredients is expected to boost the demand for natural food colors. In addition, consumers are preferring organic ingredients, such as carmine and other related products, which have no ill effects on the body and are allergen free. In North America, beverages companies are considering the regulatory constraints while formulating naturally derived colors. For instance, although safflower is an approved stable yellow color in Europe, it is not approved for various applications in the U.S.

Moreover, key players in the market are offering superfood spirulina, which has high nutrient content, antioxidant properties, and vibrant color, to deliver 100% organic ingredients in the food color products. For instance, Naturex, a global leader in producing natural colors, antioxidants, and related products, developed in 2020, is an extraction line of spirulina-based food color to meet the rise in demand for natural green and blue shades in confectionery & beverages applications. Prices of food colors in North America are lowers as compared to Middle East, owing to increase in focus on identification of new botanical sources to improve shade range in products and the final cost. Moreover, rise in adoption of new technologies in processing, extraction, and stability enhancement is anticipated to play an essential role to optimize the final price.

Rise in demand for various food color products from target customer creates opportunities for manufacturers to innovate colors used in various applications. For instance, Lycoreds, a leader in R&D of carotenoid-based wellness products, derived its natural color from lycopene and beta carotene, which has extended the shelf life of surimi seafood products, by as much as three months. This factor is projected to drive the growth of the natural color segment in the coming years.

Food & beverage manufactures are constantly improving their products to meet the consumer standard by eliminating the use of artificial colors in their products. This has further served as a strategy to increase the market share globally and gain a competitive edge in the market. For instance, Chr. Hansen, a global leader in natural color, probiotics, and food culture, expanded its range of food coloring to offer new experience to consumers.

Moreover, increase in convenience offered in terms of time saving and less efforts required for the preparation of these meals drives the market growth. Moreover, consumers are preferring bright cherry-red color of fresh meat products while buying, which has created major traction for food colors in the market.

Carmine, annatto, curcumin, and betanin are some of the major colors used in meat products to enhance its appearance, texture, and taste. Color manufacturers are continuously developing innovative solutions to replace artificial colors in meat products. For instance, Givaudan acquired Activ International, a provider of various natural and organic colors & flavors, marine extracts, seafood, and vegetable-based culinary solutions in 2017, to expanded Givaudan’s flavors & colors division.

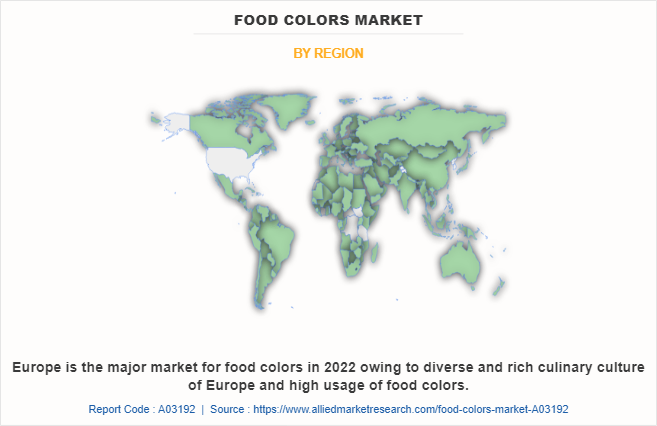

Europe has witnessed higher demand for different types of food colors, owing to increase in demand for food color from the food & beverage industry. Some of the key macroeconomic factors such as, rise in internet penetration rate and surge in per-capita income play an important role in contributing to the overall growth of the market. Moreover, the market trends is driven by increase in demand for natural food color products, owing to rise in health consciousness among consumers. Moreover, upsurge in prevalence of diseases caused by artificial colors has encouraged people to opt for natural colors, thus boosting the growth of the market. However, Asia-Pacific is expected to exhibit significant growth rate in the future, owing to rise in demand for different types of foods color made by naturally occurring substances. In addition, the region has witnessed considerable surge in the number of millennials population, who are the leading consumers of food. Therefore, rise in millennial population is anticipated to offer remunerative opportunity for the market growth.

Segmental Overview

The food colors market is segmented on the basis of type, application, and region. By type, the food colors market is classified into natural colors and artificial colors. By application, it is categorized into meat products, beverages, dairy, bakery and confectionery, processed food and vegetables, oils and fats, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

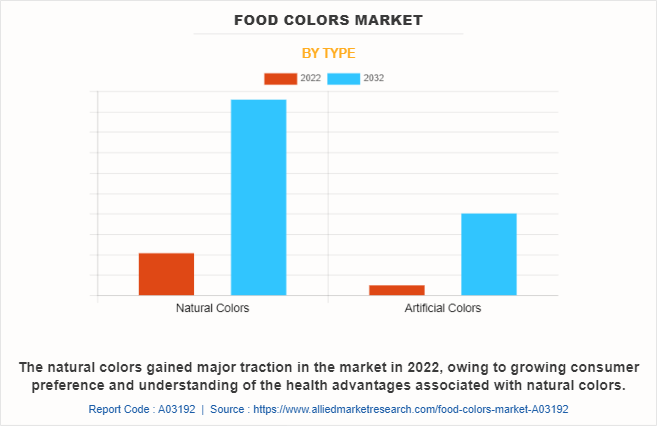

By Type

Depending on type, the natural colors segment dominated the market in 2022, garnering around three-fifth of the market share and is expected to grow at the highest CAGR of 13.3% from 2023 to 2032. In addition, due to growing consumer preference and understanding of the health advantages associated with natural colors, there is increase in demand for natural colors in the food and beverages industry. For instance, turmeric-based colors help prevent cognitive decline while carotenoid-based colors counteract age-related muscle deterioration. In addition, the implementation of strict food and beverage regulations surrounding the use of artificial food colors is anticipated to benefit the expansion of the global food colors market. The demand for natural food colors is also being significantly fueled by rise in awareness of the negative effects of artificial colors and the chemicals used in their production across a variety of end-use industries.

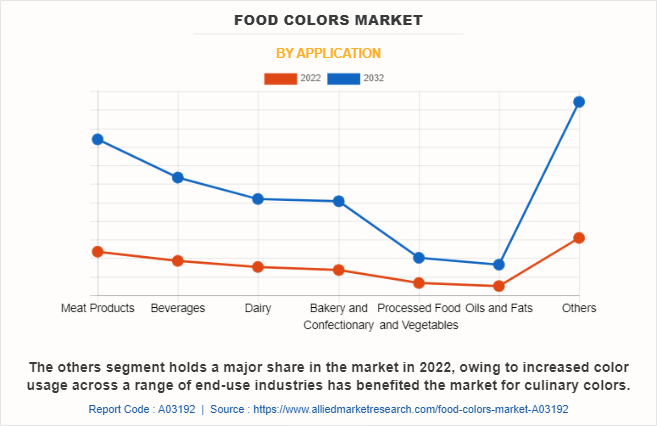

By Application

On the basis of application, the others dominated the market in 2022, garnering majority of the market share; however, the bakery and confectionary segment is expected to grow at the highest CAGR of 14.2% during the food colors market forecast period. In addition, increased color usage across a range of end-use industries has benefited the market for culinary colors. In addition, rise in consumer expenditure on pet food and cosmetics, along with increase in disposable income, has contributed to the market growth. As majority of the food colors are water-soluble and provide appealing look to the food and beverages, various colors like tartrazine, sunset yellow FCF, quinoline yellow WS, allura red AC, and carmoisine are frequently used in seafood applications. In addition, a number of small and large market participants are creating natural colors to provide pets healthy food that are made with natural substances, thus creating growth opportunities for the food colors market.

By Region

Region-wise, Europe dominated the market in 2022, garnering a market share of 33.5%. The Europe market prefers natural colors due to growing consumer knowledge of the side-effects of synthetic colors. Europe has a long history of having a diverse and rich culinary culture. Due to the variety of cultures and eating customs, the food coloring sector has enjoyed a booming market. The Europe food colors market is anticipated to experience considerable expansion during the forecast period. Germany is the largest market for food coloring in Europe due to millennials' growing desire for dairy, seafood, bakery & confectionary items, and fresh & natural food colors.

Competitive Analysis

Players operating in the food colors industry have adopted various developmental strategies to expand their food colors market share, increase profitability, and remain competitive in the market. Key players profiled in the report AromataGroup SRL (Fiorio Colori SPA), Givaudan (Naturex S.A.), Kalsec, Inc., Archer Daniels Midland Company, Chr. Hansen A/S, D.D. Williamson & Co. Inc. (DDW), Dohler Group, International Flavors & Fragrances, Koninklijke DSM N.V., Sensient Technologies Corporation., GNT Group, FMC Corporation, Lycored, Roha Dyechem, BASF SE, Ajinomoto Co., Inc., Kolorjet Chemicals Pvt Ltd, Mane, Sethness Products Company, Kancor Ingredients Limited, Biocon Colors, Dynemic Products Ltd., Vinayak Ingredients India Pvt. Ltd., Aarkay Food Products Ltd., and Neelikon Food Dyes and Chemicals Ltd.

Examples of acquisition in the global food colors market

- In December 2021, Archer Daniels Midland Company acquired flavor infusion international to expand its business globally to meet the rise in demand for its customers.

- In July 2021, Sensient Technologies Corporation acquired Flavor Solution Inc., to expand its product portfolio in the food colors market.

Examples of partnerships in the global food colors market

- In February 2021, International Flavors & Fragrances partnered with Dupont Nutrition & Bioscience to offer multiple ingredients such as, sweeteners, probiotics, textures, colors, flavors, preservatives, and cultures.

Examples of expansion in the global food colors market

- In May 2021, Chr. Hansen Natural Colors‐¯A/S expanded its business by changing its name to‐¯Oterra. Moreover, this rebranding has expanded its reach to new customers across the globe.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food colors market analysis from 2022 to 2032 to identify the prevailing food colors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food colors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global food colors market trends, key players, market segments, application areas, and market growth strategies.

Food Colors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.8 billion |

| Growth Rate | CAGR of 13.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 252 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | International Flavors & Fragrances Inc., Kalsec Inc., Archer-Daniels-Midland Company, Givaudan SA, Koninklijke DSM N.V., Sensient Technologies Corporation, Dohler GmbH, Nactarome S.p.A., Oterra A/S, GNT International B.V. |

Analyst Review

According to top-level CXOs, innovation in food color ingredients is the key factor for the growth of the global food colors market. Rise in demand for various natural colors from target customer provides manufacturers to innovate food colors, which is anticipated to boost the growth of the food colors market.

The CXOs further added that manufacturers are focusing on displaying transparency of the ingredients that are added in the product, as majority of the consumers choose products by reading the ingredients list used in processing the product. Moreover, increase in curiosity of millennial to try innovative food boosts the growth of the food colors market. Furthermore, rise in internet penetration around major parts of the globe allows manufacturers to initiate several key online marketing programs. These online platforms are one of the easiest ways to create awareness about the specifications and features of the organic ingredients among the target customers. Hence, tapping into such markets is expected to create potential opportunities for the expansion of the global food colors market.

One of the primary drivers for the increase in demand for food colors is increased demand for healthy food and beverages by the consumers from across the globe. Many new market players are expected to enter the food colors market during the forecast period, attracted by profitable growth and high-profit margins.

The global food colors market size was valued at $2.3 billion in 2022, and is projected to reach $7.8 billion by 2032

The global Food Colors market is projected to grow at a compound annual growth rate of 13.2% from 2023 to 2032 $7.8 billion by 2032

Key players profiled in the report AromataGroup SRL (Fiorio Colori SPA), Givaudan (Naturex S.A.), Kalsec, Inc., Archer Daniels Midland Company, Chr. Hansen A/S, D.D. Williamson & Co. Inc. (DDW), Dohler Group, International Flavors & Fragrances, Koninklijke DSM N.V., Sensient Technologies Corporation., GNT Group, FMC Corporation, Lycored, Roha Dyechem, BASF SE, Ajinomoto Co., Inc., Kolorjet Chemicals Pvt Ltd, Mane, Sethness Products Company, Kancor Ingredients Limited, Biocon Colors, Dynemic Products Ltd., Vinayak Ingredients India Pvt. Ltd., Aarkay Food Products Ltd., and Neelikon Food Dyes and Chemicals Ltd.

Region-wise, Europe dominated the market in 2022, garnering a market share of 33.5%.

Loading Table Of Content...

Loading Research Methodology...