Food Flavor Market Research, 2033

Market Introduction and Definition

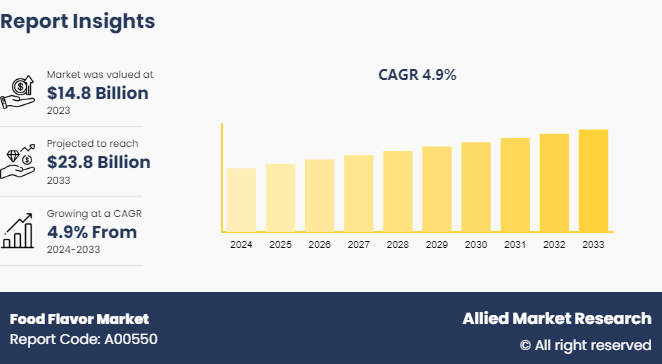

The global Food Flavor Market Size was valued at $14.8 billion in 2023, and is projected to reach $23.8 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033. The manufacturing, distribution, and sale of substances meant to improve or alter the flavor of food and drinks is referred to as the food flavor market. Food flavors are essential elements in the culinary and food processing industries to provide distinctive sensory experiences and satisfy customer preferences. They can be produced using natural sources such as fruits, vegetables, herbs, and spices, or artificially. They are extensively used in different food and beverage applications, such as snacks, confections, dairy products, beverages, and savory food.

Key Takeaways

The food flavor market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literature, industry releases, annual reports, and other such documents of major food flavor industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The market for food flavors is shaped by various fundamental factors that influence its expansion and development. The regulatory environment, economic circumstances, consumer preferences, and technological developments impact the growth of the market.

The food flavor market is expanding primarily due to consumer demand for novel tastes and sensory experiences. Manufacturers are under pressure to innovate and create new flavor profiles to capture consumers' palates as consumers seek out unique flavors and textures in the food and beverage options they choose. The increasing popularity of ethnic cuisines, cultural influences, and shifting nutritional preferences contribute to this innovative movement.

Technological developments in flavor synthesis, encapsulation, and extraction have transformed the market and allowed producers to produce various flavors with better authenticity, stability, and consistency. Technological advancements have increased the possibilities of developing flavors while satisfying regulatory constraints and customer desires for clean-label products. These developments range from natural extracts to artificial flavor components.

Market dynamics are also influenced by the regulatory frameworks controlling food additives, flavorings, and labeling specifications. Adhering to safety requirements, labeling laws, and consumer transparency initiatives are critical factors for flavor producers and food processors. Stricter rules about environmental sustainability, health and safety, and ethical sourcing methods impact market tactics and product compositions.

The demand for products and services on the market and consumer behavior are influenced by economic factors, including levels of disposable income, spending habits, and macroeconomic trends. The production costs and profit margins of flavor producers can be impacted by fluctuations in raw material prices, disruptions in the supply chain, and fluctuations in foreign exchange rates. These factors can also have an impact on pricing strategies and market competitiveness. This means that the market for food flavors is dynamic and subject to changes due to technical advancements, consumer tastes, economic factors, and regulatory compliance.

Value Chain Analysis of the Global Food Flavor Market

The global food flavor market value chain analysis includes multiple significant phases, beginning with the procurement of raw materials and concluding with the delivery of the product to final customers. Essential elements including artificial chemicals, natural extracts, and flavor enhancers are supplied by raw material providers. These components are then used by flavor producers in extraction, synthesis, and formulation procedures to create a wide variety of flavor characteristics. Flavors are supplied to food and beverage producers so they can use them in their products after they are produced. Finally, people purchase these finished goods from retailers and food service companies. Research and development, quality control, marketing, logistics, and quality control are just a few of the activities that are essential to assuring product quality, innovation, and market success throughout the value chain.

Market Segmentation

The food flavor market is segmented into type, end user, and region. By type, it is bifurcated into natural and artificial flavors. By end user, it is divided into beverages, dairy, nutrition & health, savory, sweet goods, and others. The beverages segment is further segmented into alcoholic beverages, hot non-alcoholic beverages, cold non-alcoholic beverages (RTD Coffee, RTD juices, and others) , and alcoholic-free beverages. The dairy segment is further segmented into cheese, dairy drinks (flavored milk, yogurt drinks, and others) , and dairy foods. The nutrition & health segment is further segmented into weight management, infant & baby nutrition, maternal health, and sports nutrition (Sports protein & sports non-protein) . The savory segment is further segmented into bakery, snacks, soups, sauces & dressings, and others. The sweet goods segment is further segmented into bakery sweets, confections, and desserts. By region, it is analyzed across North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

Regional/Country Market Outlook

The food flavor market's outlook varies significantly by location and nation, which is a reflection of different consumer tastes, legal systems, and market dynamics. Innovation is driven by the growing demand for natural and clean-label flavors in developed countries such as North America and Europe, while urbanization, rising disposable incomes, and changing eating habits are driving rapid Food Flavor Market Growth in emerging economies in Asia-Pacific and Latin America. China and India are emerging as significant growth markets, driven by their significant populations and rapidly growing food and beverage sectors. Tailored market strategies are necessary for success due to regional variances in taste preferences, cultural influences, and regulatory landscapes. This emphasizes the significance of market intelligence and localized techniques in effectively navigating the unique opportunities for Food Flavor Market Forecast period.

Industry Trends:

In January 2024, FlavorCo Inc. announced the introduction of a new range of natural fruit flavors aimed at satisfying the beverage industry's increasing need for clean-label products.

In March 2024, TasteMasters Ltd. increased its savory taste portfolio and fortified its position in the snack sector by acquiring a local flavoring company.

In February 2024, FlavorPlus Co. partnered with a top food and beverage firm to develop novel regional flavors catered to the preferences of Chinese consumers to increase its market share in the region.

In March 2024, FlavorFusion Pty. Ltd. extended its activities into Southeast Asia by constructing a distribution center in Singapore to meet the rise in demand for premium flavors in the region.

Competitive Landscape

The major players operating in the food flavor market include Firmenich SA, Frutarom Industries Ltd., Givaudan International SA, Huabao International Holdings Limited, Kerry Group, Plc., Robertet SA, S H Kelkar and Company Limited., Sensient Technologies Corporation, Symrise AG, Takasago International Corporation, and Synergy Flavors.

Recent Key Strategies and Developments

In July 2021, one of the top manufacturers and developers of plant-based stevia sweeteners and flavors for the food and beverage industry globally, PureCircle Limited was acquired by Ingredion Incorporated. This development helped them to gain Food Flavor Market Share.

In February 2022, Comhan, one of the top distributors of flavors in South Africa, was acquired by Archer Daniels Midland Company. After working with the local company for several years, ADM's formal acquisition now provides more direct access to its vast portfolio and network of experts for both new and existing clients.

In January 2023, the launch of CHOOZIT VINTAGE in the U.S. and Canada markets was announced by IFF, a well-known participant in the food ingredients and flavors sector. For cheddar cheese producers, CHOOZIT VINTAGE was essential in helping them avoid unfavorable taste development over aging, streamline the cheesemaking process, and provide the dependable flavors and textures that customers appreciated.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food flavor market analysis from 2023 to 2033 to identify the prevailing food flavor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food flavor market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the Global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as Global food flavor market trends, key players, market segments, application areas, and market growth strategies.

Food Flavor Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 23.8 Billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Firmenich SA, Robertet SA, Frutarom Industries Ltd., Sensient Technologies Corporation, S H Kelkar and Company Limited., Kerry Group, Plc., Symrise AG., Synergy Flavors Inc., Takasago International Corporation, Givaudan International SA, Huabao International Holdings Limited |

Analyst Review

Rapid urbanization and globalization along with rise in disposable income play a major role in changing the dietary preferences across the globe, which in turn fuel the demand for animal and dairy products, vegetables, fruits, and fats & oils. Rise in disposable incomes trigger a huge demand for rich food products such as butter, cheese, milk, and dairy items such as chocolates and ice creams. Globalization and interaction between different cultures boost the demand for tasty and highly nutritious food products. Westernization of diets in developing countries is most prevalent in the middle-class population. The quick spread of global market chains and fast food restaurants is strengthening the aforementioned patterns. Innovation of enhanced flavors and consistent improvement in the technology fuels the growth of the global food flavors market. Many companies with their promising R&D initiatives are expecting a positive response from the food flavor industry. However, stringent regulatory framework and rise in health awareness among people are expected to hamper the market growth during the forecast period.

There have been instances that exhibit unfavorable impacts of processed foods, particularly of the flavors utilized as part of processing. Numerous governments and regulatory bodies across the globe are implementing regulatory rules to manage the global food flavors market. Such regulations, particularly in Europe and North America, have rendered moderate development for the food flavor industry, especially artificial flavors. There are regulations concerning the raw materials and their preparation, ingredients, packaging and labeling. Growth in economies offer new markets and increased sales that boost the demand for the food flavors market. Thus, food flavoring companies are targeting developing nations to increase the scope of their business and profitability ratio.

The global food flavor market size was valued at USD 14.8 billion in 2023, and is projected to reach USD 23.8 billion by 2033

The global food flavor market is projected to grow at a compound annual growth rate of 4.9% from 2024-2033 to reach USD 23.8 billion by 2033

The key players profiled in the reports includes Firmenich SA, Frutarom Industries Ltd., Givaudan International SA, Huabao International Holdings Limited, Kerry Group, Plc., Robertet SA, S H Kelkar and Company Limited., Sensient Technologies Corporation, Symrise AG, Takasago International Corporation, and Synergy Flavors.

North America and Europe lead the market

Consumer Preferences and Sensory Experiences, Technological Developments, Regulatory Environment, Health and Wellness Trends, Cultural Influences and Globalization majorly contribute toward the growth of the market.

Loading Table Of Content...