Food Ingredients Market Research, 2031

The global food ingredients market size was valued at $270.2 billion in 2021, and is projected to reach $475.4 billion by 2031, growing at a CAGR of 5.8% from 2022 to 2031.

Food ingredients are additives that are added to food mixtures to obtain the desired result. Food ingredients add taste, color, texture, gloss, viscosity, pH balance, and offer emulsion & stability.

Market Dynamics

Food ingredients such as sweeteners, emulsifiers, thickeners, and stabilizers are essential food ingredients that are used across the processed food & beverage sector for manufacturing packed foods. It provides flavor, texture, and viscosity, and acts as a preservative due to the high osmotic pressure generated by sugar solutions. On the other hand, the global population is growing with time, and individuals' work pressure is increasing, leading them to seek out processed and packaged foods to save time and satisfy their hunger. Moreover, the availability of processed food has increased over the years, which has influenced the eating habits of consumers. According to United Nations Children's Fund (UNICEF) in 2019-2020, school-aged teenagers consumed processed foods: 42% consumed carbonated sugary sodas at least once a day, and 46% ate fast food at least once a week. The increased demand for processed packaged foods is driving the need for sweeteners by the food manufacturing companies to carry on the production to cater to the demand of food ingredient market . The rise in demand and surge in sales of processed food fuel the food ingredients market growth.

Textiles, medicine, paper manufacturing, bioplastics, and many more sectors use starch extensively. The use of starch has been witnessed to increase significantly in food processing, where it functions as both a stabilizer and an emulsifier to improve food quality. Long-term stabilization in food emulsion systems is ascribed to starch-based emulsifiers derived from micro and nanoparticles, hence increasing food structure, and preserving ability. These starch-based emulsifiers were created using a variety of processes, including hydrolysis, cold gelatinization, dissolution-precipitation, sedimentation, encapsulation, and the addition of hydrophobic components. As a result, starch-based emulsifiers that successfully bind emulsion interfaces are produced. These emulsifiers effectively stabilize ”Pickering” emulsions, which are well-known for their high stability.

An upsurge in demand for natural colors from various end-use industries, including food & beverages, bakery & confectionery, dairy products, meat & poultry, and seafood is expected to have a positive impact on the utilization of natural sources such as carotenoids, curcumin, anthocyanin, and carmine. This factor is expected to significantly contribute to the growth of the market during the forecast period. The clean label trend indicates that the food is prepared with natural colors and flavors. Furthermore, consumers are opting for alternatives to synthetic colors, and their increasing preference for natural colors is expected to drive the demand for clean-label food color ingredients, thereby supplementing the global market growth. Natural colors are free of genetically modified organisms (GMO) and allergens, which act as antioxidants & coloring agents and protect the body against cellular damage, chronic diseases, and the effects of aging. For instance, red sandalwood offers wound-healing properties and is used in Ayurvedic treatment. Thus, the rise in awareness about the health benefits associated with natural colorants provides the opportunity for food ingredients market growth. Moreover, the rise in consumer awareness of the usage of natural colors in food products has increased in the last few years. This factor creates further opportunities for manufacturers to focus on R&D activities for the production of advanced natural colors with superior properties, including pH and heat stability.

The rise in popularity of clean-label color products is attributable to a rise in health concerns among consumers and an increase in awareness concerning the health benefits associated with organic food colors. Consumer perception of organically grown food is that they are healthy and serve as a nutritious alternative to conventionally grown products. The array of organic color products now available and the retail channels through which they are sold have evolved in the market for food color products, which significantly contribute toward food ingredients market expansion. In addition, a rise in awareness of medical advantages associated with organic food colors is anticipated to drive the demand for natural nourishment and drinks. GMO-free content, nutrient richness, zero growth hormones, zero antibiotics, fewer pesticides, improved freshness levels, and better environmental stability are the factors that attract a large consumer base toward these clean-label color products.

Corn and wheat were considered the key raw materials for the production of starch; however, recent years have seen rapid expansion in the raw material base used for the manufacturing of food starch. For instance, pea starch has gained wide traction in the last few years, as it serves as a rich source of amylose. Furthermore, it possesses enhanced thickening and gelling properties as compared to its counterparts. In addition, pea starch has higher temperature & acid resistance as well as superior shear stability. Furthermore, starch is now extracted from rice, as rice starch has high freeze-thaw stability. Thus, expanding the raw material base for manufacturing starch is expected to provide flexibility for the manufacturers and reduce dependency on a limited number of crops, thereby contributing to global market growth.

The global food & beverage industry witnessed an upsurge in demand for clean-label ingredients. According to AMR analysis, more than 60% of Americans consider natural products as better, and more than 51% actively seek natural ingredients in their food products while making food purchase decisions. To cater to the growing demand for clean-label ingredients, engaged stakeholders in the industry are now venturing into the production of clean-label starch. For instance, Beneo-Remy developed natural, native, and clean-label starch having performance comparable to chemically modified starches. Similarly, Cargill is involved in the production of clean-label starch and is actively marketing the same through the SimPure brand. Thus, an increase in the trend of clean-label food products is anticipated to provide remunerative opportunities for the players operating in the food ingredients industry.

The small intestine prevents the digestion of resistant starch; thus, it enters the large intestine where bacteria present in the large intestine ferment it. Resistant starch aids in lowering cholesterol and fats. Furthermore, it decreases the production of new fat cells. In addition, it alleviates irritable bowel syndrome, constipation, diverticulitis, and ulcerative colitis, thus helping in the improvement of digestion. Furthermore, it enhances mineral absorption and prevents the development of abnormal bacterial cells in the colon. Furthermore, resistant starch helps in the improvement of insulin sensitivity via alterations in fatty acid flux between fat cells and muscle. Thus, the advantages offered by resistant starch are anticipated to offer remunerative opportunities for food ingredients market expansion during the forecast period.

Segmental Overview

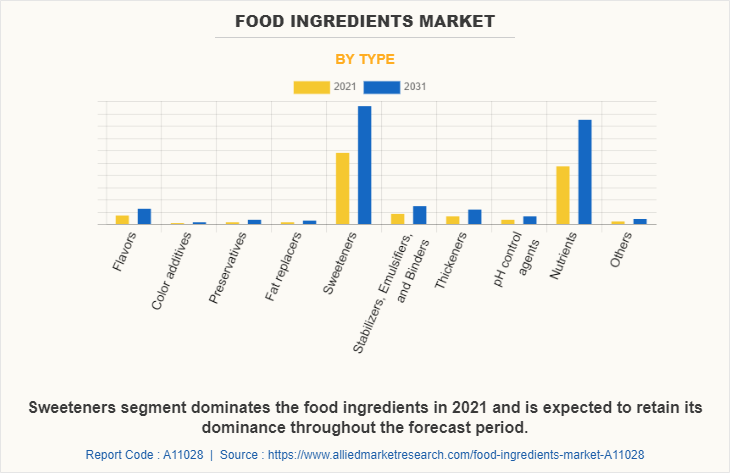

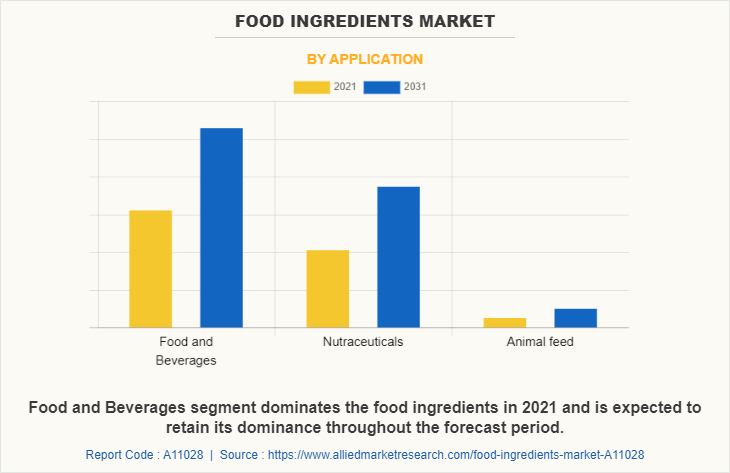

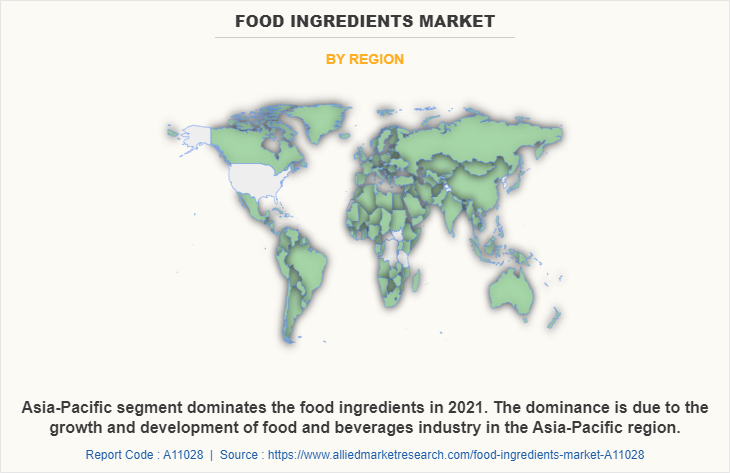

The food ingredients market is segmented into type, application, and region. Depending on the type, the market is classified into flavors, color additives, preservatives, fat replacers, sweeteners, stabilizers, emulsifiers, & binders, thickeners, pH control agents, nutrients, and others. Depending on the application, it is segregated into food & beverages, nutraceuticals, and animal feed. Region-wise, food ingredients market share is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Russia, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, UAE, South Africa, and rest of LAMEA).

By Type

According to the food ingredients market, on the basis of type, the sweetener segment gained a major share in the global food ingredients industry in 2021 and is expected to sustain its market share during the food ingredients market forecast period. Sweeteners are an essential food ingredient that is used across the processed food & beverage sector for manufacturing packed foods. It provides a sweet flavor and acts as a preservative due to the high osmotic pressure generated by sugar solutions. On the other hand, the global population is growing with time, and individuals' work pressure is increasing, leading them to seek out processed and packaged foods to save time and satisfy their hunger. Moreover, the availability of processed food has increased over the years, which has influenced the eating habits of consumers. According to United Nations Children's Fund (UNICEF) in 2019-2020, school-aged teenagers consumed processed foods: 42% consumed carbonated sugary sodas at least once a day, and 46% ate fast food at least once a week.

By Application

According to food ingredients market, on the basis of application, the food & beverages segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. The increasing growth rate of the global population is fueling the demand for food products in the market by consumers. Moreover, the hectic schedule of the consumers, lack of time for food preparation, and increasing work pressure is forcing the consumers to look for fast food alternatives. Fast-food manufacturing companies are trying to improve the quality and shelf life of their products to cater to the food ingredients market demand. Therefore, there is a high requirement for food ingredients in the food & beverages industry to continue their production process which would increase the overall food ingredients market size

By Region

On the basis of region, Asia-Pacific dominated the food ingredients market in 2021 and is expected to remain dominant during the forecast period. The dominance of the market in Asia-Pacific is largely due to the deep product knowledge among the food & nutraceutical companies and the increase in usage of several types of food ingredients in functional foods to entice the interest of the consumers.

Competition Analysis

Players operating in the global food ingredients market share have adopted various developmental strategies to expand their market, increase profitability, and remain competitive in the market. The key players profiled in this food ingredients market report include Ajinomoto, Inc., Archer Daniels Midland Company, Associated British Foods plc, Cargill, Incorporated, Celanese Corporation, DuPont de Nemours, Inc. (Danisco), Ingredion Incorporated (TIC Gums, Inc), Kerry Group, Roquette Freres, Südzucker Group (BENEO), Tate and Lyle PLC, Akzonobel N.V., BASF SE, Clariant AG, Evonik Industries AG, Koninklijke DSM N.V., Solvay SA, Kemin Industries, Inc., Chemelco International B.V., Givaudan International S.A. (Naturex S.A.), Palsgaard A/S, Univar, Inc., Corbion NV, Huber Corporation(CP Kelco U.S., Inc.), Kao Corporation, Nexira SAS, Jungbunzlauer Holding AG, Ashland Global Holdings Inc., Fuerst Day Lawson Limited, ATP Group, Novozymes, Aromata Group S.r.L (Fiorio Colori S.p.A), Kalsec, Inc., Glanbia PLC (Ireland), and Mead Johnson & Company, LLC.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food ingredients market analysis from 2021 to 2031 to identify the prevailing food ingredients market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global food ingredients market trends, key players, market segments, application areas, and market growth strategies.

Food Ingredients Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 475.4 billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 246 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Chemelco International B.V., Akzo Nobel N.V., FDL Ltd, Clariant, Ashland, Evonik, Novozymes A/S, Archer Daniels Midland Company, AromataGroup SRL, Palsgaard A/S, J.M. Huber Corporation, Univar Solutions Inc., Corbion Inc., Sdzucker AG, RECKITT BENCKISER GROUP PLC., Kao Corporation, Solvay, Tate and Lyle, Plc., Glanbia PLC, Jungbunzlauer Suisse AG, Kemin Industries, Inc., Koninklijke DSM N.V., Kerry Group Plc, Celanese Corporation, Givaudan International SA, ATP Group, DuPont de Nemours, Inc., Kalsec, Inc., Nexira, Roquette Freres, Ajinomoto Co., Inc., Associated British Foods plc, BASF SE, Cargill, Incorporated, Ingredion Incorporated |

Analyst Review

According to CXOs, "One sweetener’s loss is another sweetener’s gain." The occurrence of obesity and weight-related concerns in individuals is rapidly growing, prompting people to change toward healthier eating options. Obesity raises an individual's risk of diabetes, cardiovascular mortality, and hypertension. Sugary products are not ideal for long-term consumption; therefore, the popularity of plant-based and artificially synthesized sweeteners is expected to increase in the upcoming years.

Hectic lifestyles of the urban population as well as a surge in the working population have reduced the time available for the consumption of cooked meals. This has encouraged the population to shift toward the consumption of processed food to fulfill hunger. As a result, to meet their calorie requirements, the population is migrating toward the consumption of sugary food.

In the case of emulsifiers, phospholipids are semi-synthetic emulsifiers that are widely employed in the pharmaceutical business as wetting agents, emulsifiers, and builders or components of various lipid mesophases, including liposomes, micelles, mixed micelles, inverted micelles, and cubosomes. These functional qualities are used in a variety of pharmaceutical formulations, including suspensions, emulsions, solid dispersions, lipid nanoparticles, and drug/phospholipid complexes. In terms of their physiological significance, phospholipids exhibit an extremely low toxicity profile and may be administered by any route, including injectable, oral, and topical.

The CXOs further added that manufacturers are focusing on displaying the transparency of the ingredients, which are added to the product, as the majority of the consumers choose products by reading the labels. In addition, consumers prefer products with organic and plant-based ingredients. Moreover, the increasing application of functional food in sports nutrition and clinical nutrition further boost the growth of the functional food ingredients market.

Furthermore, the rise in the rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs. These online platforms are one of the easiest ways to create awareness about the benefits of food fortified with functional ingredients with respect to various diseases including cardiovascular diseases, cancer, and obesity-linked diseases. Hence, tapping into such markets is expected to create potential opportunities for the expansion of the global functional food ingredients market.

The global food ingredients market size was valued at $270.2 billion in 2021, and is projected to reach $475.4 billion by 2031

The global Food Ingredients market is projected to grow at a compound annual growth rate of 5.8% from 2022 to 2031 $475.4 billion by 2031

Clariant, J.M. Huber Corporation, DuPont de Nemours, Inc., RECKITT BENCKISER GROUP PLC., Cargill, Incorporated, Nexira, Celanese Corporation, ATP Group, Kerry Group Plc, Univar Solutions Inc., Kemin Industries, Inc., Ashland, BASF SE, Solvay, Ingredion Incorporated, Givaudan International SA, Chemelco International B.V., Corbion Inc., Kalsec, Inc., Roquette Freres, Evonik, Novozymes A/S, Koninklijke DSM N.V., Archer Daniels Midland Company, Sdzucker AG, Palsgaard A/S, Glanbia PLC, Akzo Nobel N.V., Jungbunzlauer Suisse AG, Ajinomoto Co., Inc., Tate and Lyle, Plc., Associated British Foods plc, FDL Ltd, Kao Corporation, AromataGroup SRL

On the basis of region, Asia-Pacific dominated the food ingredients industry in 2021

Rise in demand for packaged and processed food, an upsurge in the demand for natural food colors from various end-use industries, including food & beverages, bakery & confectionery, dairy products, meat & poultry, and seafood, rise in consumers' need for food, beverages and nutraceuticals due to the growing population, an increase in the demand for functional ingredients, and a rise in disposable income of consumers fuel the growth of the global food ingredients market

Loading Table Of Content...

Loading Research Methodology...