Forensic Accounting Market Research, 2031

The global forensic accounting market size was valued at $5.13 billion in 2021, and is projected to reach $11.68 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Growth in demand for work from home and remote working policies Rise in demand for work from home and remote working policies during the period of the COVID-19 pandemic led to growth of global remote and automated accounting solutions during the period, hence empowering demand for forensic accounting solutions. Moreover, with sudden economic imbalance and large corporations increasing their market share during the period positively impacted the need for forensic accounting solutions. However, data privacy and sharing risks associated with forensic accounting solutions and services hamper the forensic accounting market growth. On the contrary, integration of advanced tools such as machine learning and data analytics with forensic accounting solutions suites are expected to offer remunerative opportunities for expansion of the forensic accounting market during the forecast period.

Forensic accounting, often known as forensic accountancy or financial forensics, is a subset of accounting that analyzes whether organizations (or a specific employee) are participating in financial reporting frauds. Forensic accountants use various tools and methodologies to establish if financial reporting fraud has occurred.

Segment Review

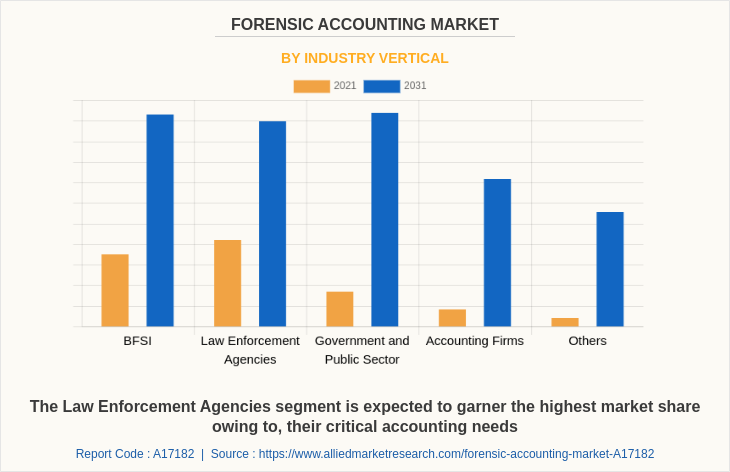

The forensic accounting market is segmented on the basis of component, deployment model, enterprise size, industry vertical, and region. On the basis of component, the industry is divided into solution and service. Depending on deployment model, the market is classified into on premise and cloud. Based on enterprise size, the market is bifurcated into large enterprises and SMEs. The industry vertical covered in the study include BFSI, law enforcement agencies, government and public sector, accounting firms, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the forensic accounting market analysis are Arbutus Software Inc., AccessData, BDO Global, CaseWare IDEA, Cellebrite, Cygna Labs Corp, Deloitte Touche Tohmatsu Limited, e-fense, Ernst & Young Global Limited, Fulcrum Management., Galvanize, KPMG International, Nuix, OpenText, Passware, PwC, and Sama Audit Systems & Software Pvt Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the forensic accounting industry.

Depending on industry vertical, the law enforcement agencies segment dominated the forensic accounting market share in 2021, and is expected to continue this trend during the forecast period, owing to growth in number of financial frauds and tax evasions, which are incentivizing law enforcement agencies to invest in effective forensic accounting solutions for their organization. However, the government & public sector segment is expected to witness highest growth in the upcoming years, owing to rise in technological investments and up scaling of the sector, which is expected to aid in driving investments in forensic accounting industry.

Region wise, the forensic accounting market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of forensic accounting solution vendors. This is expected to drive the market for forensic accounting solutions within the region during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid economic and technological transformation of the region, which is expected to the growth of forensic accounting solutions in the coming few years.

The report focuses on growth prospects, restraints, and analysis of the global forensic accounting market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global forensic accounting market share.

Top Impacting Factors

Rise demand for cloud-based forensic accounting solutions

The demand for cloud-based forensic accounting solutions is increasing owing to the rising demands for better security and real updates. With the help of cloud-based forensic accounting solutions, businesses can monitor their accounts and business spendings anytime, anywhere, from any device. In addition, cloud-based forensic accounting solutions makes it easier to collaborate and access all financial information from anywhere. Moreover, transparency and accountability in accounting services are now much easier to establish due to cloud technology. Furthermore, cloud-based forensic accounting solutions provides flexibility and scalability to boost business operations. Thus, surge in demand for cloud-based forensic accounting solutions notably contributes toward the market growth.

Adoption of innovative technology to increases business productivity

The future of forensic accounting solutions depends on their powerful and robust integration with modern accounting tools and advanced technologies such as artificial intelligence and machine learning. Forensic accounting solutions that can effortlessly integrate with other software or tools is essential in today's evolving business environment. Furthermore, the accounting industry is focused on advanced technologies such artificial intelligence (AI) and blockchain to streamline the business process. In addition, industries are adopting optical character recognition (OCR) technology to help businesses by reduce processing time as well as enhance business productivity. For instance, QuickBooks software has already begun to integrate with 600+ business applications such as Google Calendar and PayPal, which drives the market growth.

COVID-19 Impact Analysis

The global COVID-19 pandemic has drastically affected businesses and economies across the world. Moreover, the COVID-19 pandemic also had significant effect on the forensic accounting solutions and service market as supply chain disruptions, economic situations, fluctuations in consumer demands, among other effects of the COVID-19 pandemic caused economic disbalance, which further fueled the demand for forensic accounting solutions. However, with the closing down of courts and major business disruptions during the period made it difficult for financial forensic solutions and services to function during the early stages of the global pandemic.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the forensic accounting market forecast, current trends, estimations, and dynamics of the forensic accounting market analysis from 2021 to 2031 to identify the prevailing forensic accounting market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the forensic accounting market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global forensic accounting market trends, key players, market segments, application areas, and market growth strategies.

Forensic Accounting Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Passware, BDO Global, Arbutus Software Inc.,, AccessData, Ernst & Young Global Limited, e-fense, Sama Audit Systems & Software Pvt Ltd, Deloitte, Fulcrum Management, Galvanize, Nuix, Cygna Labs Corp, CaseWare IDEA, Cellebrite, OpenText |

Analyst Review

Demand for forensic accounting solutions has been on rise for past few years and the market is expected to continue this trend in the coming years as well, owing to growth in number of businesses and adoption of advanced technologies such as machine learning and artificial intelligence. These are promising new opportunities for growth of forensic accounting solutions as they can provide accounting management and taxation solutions for businesses and corporations.

Key providers of the forensic accounting market such as Ernst & Young Global Limited, Fulcrum Management., and KPMG International account for a significant share of the market. With larger requirements for forensic accounting tools and services, various companies are establishing partnerships to increase their forensic accounting capabilities. For instance, in July 2022, Center for Audit Quality (CAQ) announced a collaboration with various publicly listed companies in the U.S. to help gather observations on a range of topics, including the overall health of economy, business transformation, and quality of corporate disclosures. With such collaborations CAQ aims at simplifying the process of company audits for their clients with pre-existent market data for comparison.

In addition, with increase in demand for forensic accounting, various companies are expanding their current product portfolio with increasing diversification among customers. For instance, in April 2021, Botkeeper, a leading machine learning-powered bookkeeping solution purpose-built for accounting firms announced launch of a new pricing model intended to break down cost barriers, increase scale, and provide greater access for firms of all sizes. Its packaging has been reworked into a scaling model that provides a more consumable approach to Botkeeper offering, bringing greater value and flexibility to accounting firms that want to use the powerful solution.

Moreover, market players are expanding their business operations and customers by increasing their acquisitions. For instance, in May 2022, TMF Group, a leading provider of compliance and administrative services announced acquisition of Isobel Audit Consulting. With this acquisition, TMF aims to expand its presence in France and Europe.

Growth in demand for work from home and remote working policies Rise in demand for work from home and remote working policies during the period of the COVID-19 pandemic led to growth of global remote and automated accounting solutions during the period, hence empowering demand for forensic accounting solutions.

Region wise, the forensic accounting market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of forensic accounting solution vendors. This is expected to drive the market for forensic accounting solutions within the region during the forecast period.

The global forensic accounting market size was valued at $5.12 billion in 2021, and is projected to reach $11.68 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

The key players profiled in the forensic accounting market analysis are Arbutus Software Inc., AccessData, BDO Global, CaseWare IDEA, Cellebrite, Cygna Labs Corp, Deloitte Touche Tohmatsu Limited, e-fense, Ernst & Young Global Limited, Fulcrum Management., Galvanize, KPMG International, Nuix, OpenText, Passware, PwC, and Sama Audit Systems & Software Pvt Ltd.

Loading Table Of Content...