Forex Cards Market Research, 2031

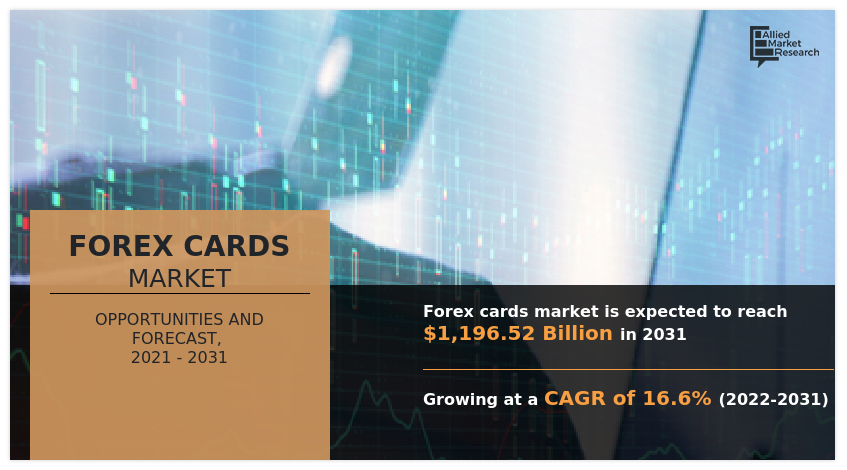

The global forex cards market size was valued at $260.34 billion in 2021, and is projected to reach $1,196.52 billion by 2031, growing at a CAGR of 16.6% from 2022 to 2031.

A Forex card is a prepaid card that the user can use for paying hotel bills, shopping and other transactions when they are travel overseas. These are preloaded and take care of the users foreign currency requirements. Users can use the card to withdraw cash in foreign currency, make payments while shopping, and for checking their balance. This forex card not only lets the user make hassle-free transactions overseas, but it also keeps them safe from any fluctuation in exchange rates. Moreover, users will be instantly notified regarding all their transactions via emails or text messages.

Forex cards protect users from fluctuations in foreign currency prices. In addition, surge in tourism has led to the rise of adoption of forex card among users. Moreover, it protects users from paying additional charges while making transactions in a foreign country. These are the major driving factors for the growth of the market. However, forex card charge ATM withdrawal charges while withdrawing money from any foreign country ATM. In addition, chances of getting the physical card stolen are some of the major factors limiting the growth of the forex card market. On the contrary, rise in demand for cash alternatives among users while travelling to other countries is expected to provide lucrative growth opportunities in the coming years.

The forex cards market is segmented on the basis of type, industry vertical, end user, and region. By type, it is segmented into multi-currency forex card, and single currency forex card. By industry vertical, it is classified into hospitality, consumer goods, education, and others. Based on end user, it is segregated into businesses and individuals. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

The report focuses on growth prospects, restraints, and trends of the forex cards industry. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the forex card market.

The report includes the profiles of key players operating in the forex cards market analysis such as Bank of America Corporation, Charles Schwab & Co., Inc., Citigroup Inc., CREDIT SUISSE GROUP AG, FINNEW SOLUTIONS PVT. LTD., JPMorganChase & Co., Morgan Stanley, Royal Bank of Canada, Thomascook.in, and UBS. These players have adopted various strategies to increase their market penetration and strengthen their position in the forex cards market outlook.

COVID-19 impact analysis

The COVID-19 pandemic had a negative impact on the forex market as the tourism industry came to a halt during the pandemic. Moreover, as people stopped going for vacations to other countries, the demand for forex prepaid card reduced which negatively impacted the market growth. Moreover, the foreign trade experienced a decline which resulted in a decline in the number of travelers going to other countries for business. Therefore, the demand for forex card decreased drastically. Hence, the COVID-19 pandemic had a negative impact on the forex card market during the COVID-19 pandemic.

Top impacting factors

Growth in Tourism

The tourism industry experienced growth over the last few years and it has helped the foreign exchange services and forex card market to grow significantly. Moreover, tourism industry was one of the sectors that was affected the most by COVID 19. However, it was beneficial for the tourism sector as global travel restrictions were lifted off during the post pandemic period. This resulted in the growth of foreign exchange services and forex card demand from travelers that started going on vacations to different countries after the lockdown. In addition, it was easy for travelers to apply for forex card instead of going to banks for currency exchange and money withdrawal. Moreover, looking toward the benefits from forex card, travelers chose forex travel card service over any other foreign currency service for making their travel experience much smoother. Therefore, growth in tourism is one of the major driving factors for the forex cards market growth.

Rise in demand for cash alternatives

The forex card is the most convenient and inexpensive way to carry money abroad. A forex card allows the holder to store and transfer money electronically when travelling abroad. In addition, this helps a holder to make cashless payments instead of looking for ATM’s or banks abroad while travelling, which makes their travel experience much smoother. Furthermore, millennials are rapidly adopting cashless and contactless payments, that’s why forex card is the best option for them. Also, holders get monthly statements giving an idea of how much balance is left on the card. In addition, the rapid adoption of cashless payment methods to reduce the usage of cash is anticipated to provide major lucrative opportunities for the growth of the forex cards industry in the upcoming years.

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the forex cards market share from 2021 to 2031 to identify the prevailing forex cards market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- In-depth analysis of the forex cards market industry assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global forex cards market forecast.

- The report includes the analysis of the regional as well as global forex cards market trends, key players, market segments, application areas, and market growth strategies.

Forex Cards Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Industry Vertical |

|

| By End User |

|

| By Region |

|

| Key Market Players | Royal Bank of Canada, Thomas Cook, Charles Schwab & Co, Morgan Stanley, CREDIT SUISSE GROUP., Niyo Global Card, Citigroup Inc., Bank of America Corporation, JP Morgan Chase & Co., UBS |

Analyst Review

With increased spending capacity, people are now investing in travels more than before. But planning a trip to a foreign country takes a lot of effort. From ticketing to Visa, a lot needs to be organized well in advance. Once that aspect of travelling is taken care of, users need to start planning on the foreign currency and how they will spend it. Earlier, traveler’s check was the go-to option, but due to advancement in technology, users can avail a forex card made just for travelling abroad. Moreover, while travelling in a different country, users don’t have to try to learn the new currency constantly. Figuring out the currency and doing a constant calculation, is hectic. This can be avoided if they use a forex card. In addition, a forex card always gets better exchange rate as opposed to travelers check. Apart from this, they also offer other benefits like free ATM withdrawals, zero cross currency withdrawal, lower transaction rates than a debit or credit card and other benefits.

Furthermore, while the pandemic impacted the travel and tourism industry severely, reports suggest that people are finally going on vacations again. More than 2.2 billion people are expected to travel to foreign countries for leisure, business, and other purposes over the next 10 years, according to World Travel and Tourism Council. As consumer travel spends increase, it will open up a huge market for banks and forex card issuers to work with travel companies and improve the consumer experience. In addition, forex cards are fast emerging as a preferred transaction instrument among international travelers and with growing adoption, the role of these cards has expanded from being a mere store of value to a multi-utility card with add-on functions such as loyalty, card controls, expense management and budgeting. Some of the key players profiled in the report include Bank of America Corporation, Charles Schwab & Co., Inc., Citigroup Inc., CREDIT SUISSE GROUP AG, FINNEW SOLUTIONS PVT. LTD., JPMorganChase & Co., Morgan Stanley, Royal Bank of Canada, Thomascook.in, and UBS. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Surge in tourism has led to the rise of adoption of forex card among users. In addition, forex cards protects users from fluctuations in foreign currency prices.

By type, the multi-currency forex card segment attained the highest growth in 2021. This is attributed to the fact that a multicurrency forex card simplifies payment and makes travel hassle-free. In addition, a multi-currency forex card usually gets a better exchange rate than other options such as cash or traveler’s check (TC). Besides better rates, users stand to benefit from features like waived off ATM access fee withdrawals, zero cross-currency charges and lower transaction charges than international credit or debit cards, with a host of exclusive discounts.

By region, North America attained the highest growth in 2021. This is attributed to the fact that as consumer travel spends increase, it will open up a huge market in North America for banks and forex card issuers to work with travel companies, and improve the consumer experience. Many issuers are AI-enabling customer onboarding to balance the need for these compliance requirements with growing cardholder expectations for a quick and frictionless onboarding process.

The global forex card market size was valued at $260.34 billion in 2021, and is projected to reach $1,196.52 million by 2031, growing at a CAGR of 16.6% from 2022 to 2031.

Bank of America Corporation, Citigroup Inc., CREDIT SUISSE GROUP AG, Thomascook.in, and UBS are the top companies to hold the market share in forex cards market.

The tourism industry experienced growth over the last few years and it has helped the foreign exchange services and forex card market to grow significantly. Moreover, tourism industry was one of the sectors that was affected the most by COVID-19. However, it was beneficial for the tourism sector as global travel restrictions were lifted off during the post pandemic period.

The forex card market is segmented on the basis of type, industry vertical, end user, and region. By type, it is segmented into multi-currency forex card, and single currency forex card. By industry vertical, it is classified into hospitality, consumer goods, education, and others. Based on end user, it is segregated into businesses and individuals. By region, it is analyzed across Asia-Pacific, Europe, North America, and LAMEA.

Loading Table Of Content...