The global fourth party logistics market was valued at $57.9 billion in 2021, and is projected to reach $111.7 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

Fourth party logistics, also known as 4PL, is a model where the business owner outsources its supply chain and logistics to an external service provider. This provider is responsible for the assessing, designing, planning, building, running, and even tracking an integrated comprehensive supply chain solution on the behalf of the firm. They are also called lead logistics providers. The external provider can either have his own warehouse or tie up with warehouse companies. Therefore, fourth party logistics represents a higher level of supply chain management for the client.

Businesses, nowadays are manufacturing diverse products and have activities spread globally. All of this has brought in a staggering amount of complexity to supply chain management for manufacturers. Hence, these external providers (4PL) offer innovative and end-to-end services to meet their clients’ requirements. For instance, in May 2019, DSV launched a fourth party fourth party logistics product under the name “Lead Logistics”, which uses cloud-based technology & supports the supply chain design, implementation, and management across all modes, geographies, and currencies. Such solutions empower the 4PL service providers with hands-on-approach to the entire operations involved in a supply chain ranging from order management to warehousing, and compliance regulations to supplier management.

Increase in demand for an easy & effective supply chain system and increase in the complexities in the operation process drive the growth of the fourth party logistics market. In addition, rise in demand for customized solutions is also expected to drive the market growth. However, factors such as reluctance of companies to outsource the logistics function and changes in logistics regulations in different countries are expected to hinder the growth of the market. Further, increase in demand for consumer electronics and growth in the e-commerce market are factors that are anticipated to foster the market growth.

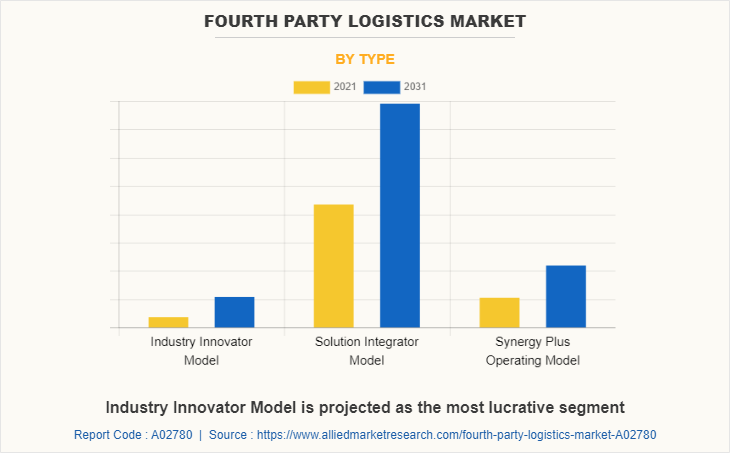

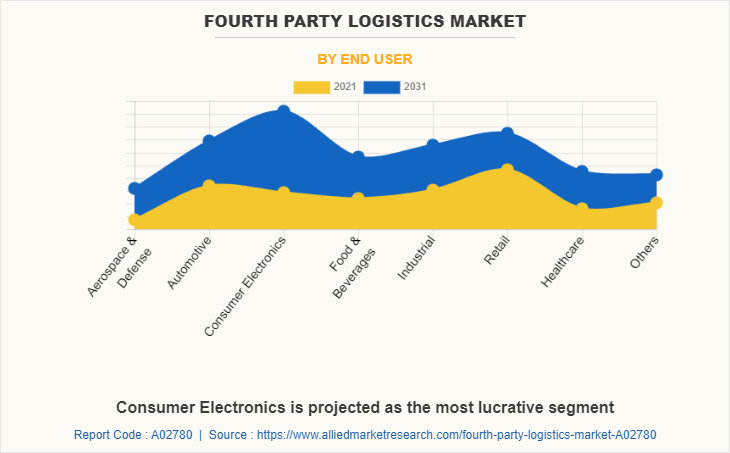

The fourth party logistics market is segmented into type, end-user, and region. On the basis of type, the market is categorized into industry innovator model, solution integrator model, and synergy plus operating model. On the basis of end user, it is divided into aerospace & defense, automotive, consumer electronics, food & beverages, industrial, retail, healthcare, and others. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the fourth party logistics (4PL) market are 4PL Group, 4PL Central Station, 4PL Consultancy Ltd., A.P. Moller – Maersk, Accenture, Allyn International Services, Inc., C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker, Deutsche Post AG, DSV, GEFCO, GEODIS, Global4PL, Logistics Plus Inc., Orkestra SCS, Phoenix Freight Systems, Primary Connect, Rhenus Group, and XPO Logistics Inc.

Increase in the need for easy and effective supply chain system

Businesses, nowadays are manufacturing various products and have activities spread globally. Thus, due to expanded network, connections, and experience in supply chain solutions, organizations have to handle multiple logistics arrangements across online and offline channels and constantly strive for faster deliveries and cheaper logistics costs. Hence, the emergence of the fourth party logistics (4PL) concept has been a move towards removing all the bottlenecks from the complex global supply chain environment. 4PL acts as an intermediate that readies, coordinates, and manages all the different partners in the logistics process. For instance, in 2020, XPO Logistics, Inc. signed a long-term partnership agreement with Mercedes-Benz Parts Logistics. This agreement is expected to allow the XPO Logistics, Inc. to manage the distribution of parts in UK with an integrated and digitally controlled transportation network. With this, the 4PL providers handle all the operations with sophisticated resources to optimize and deliver valuable service to their customers. Thus, increase in demand for an easy and effective supply chain system drives the growth of the fourth party logistics (4PL) market.

Rise in demand for customized solutions

Smart and innovative IT solutions have developed the logistics industry and transformed the future of business. Thus, with growing expectations, several warehouse management software providers have started to take on a role as 4PL providers as well. Moreover, the adoption of web integration or information systems as a primary coordinator in the supply chain helps organizations to focus on leaner production and inventory management. The customized 4PL supply chain solutions are connected with warehouse management, revenue & expense management, process automation, freight tracking, customer relationship management, and supplier tracking systems.

Owing to this, companies can minimize inefficiencies in their supply chain with 4PL logistics solutions and pay more attention to their product. It becomes easy and possible to manage delivery time and order fulfilment, decreasing unnecessary costs for customers and companies. For instance, in January 2020, UPS and Henry Schein, Inc. announced an agreement to explore and test various drone-delivery applications. These applications are expected to examine the possibility of unmanned aerial vehicles in business-to-business (B2B) operating models. This initiative was anticipated to begin in 2020. Hence, rise in demand for customized solutions in the logistics sector with the adoption of IT solutions & software propels the fourth party logistics market during the forecast period.

Reluctance of companies to outsource logistics function

Unwillingness to share business information slows down the entire supply chain management outsourcing. Furthermore, most companies just refuse to embrace the 4PL concept because of the fear that they will not have complete control over the supply chain. It means the manufacturer’s supply chain management will be almost entirely managed by another company. This can cause a high dependency of manufacturers towards their logistics operator's work, which is often considered a logistics mate or a strategic partner rather than a regular provider. On the other hand, hiring a 4PL service can be expensive for small and medium-sized companies whose purchasing capabilities are not comparable to larger ones. Hence, the higher cost of hiring and the reluctance of companies to outsource their logistic functions hinder the 4PL market growth.

Increase in demand for consumer electronics

The consumer electronics (CE) industry is quite dynamic in nature as trends come and go at a faster pace. Some of the leading players in the consumer electronics market are investing heavily in R&D activities to facilitate improvements in current electronic technologies and processes to increase efficiency and reduce cost. Thus, rise in requirement for smart accessories, smart home devices, and others, coupled with increase in environmental awareness, encourages the adoption of energy-efficient products that guarantee more performance efficiency in cost-effective ways. As a result, consumer electronics manufacturing companies have flourished owing to the surge in demand for various wearable, smart home, and other consumer electronic devices. Meanwhile, the growing consumer electronics market influences the CE manufacturers to invest in 4PL services and offer doorstep delivery to customers. Furthermore, the explosive growth of the consumer electronics industry can be attributed to the rising popularity of technologically advanced devices, changing lifestyle of the population, and increasing per capita income, among others. Thus, the growing consumer electronics market significantly creates lucrative opportunities for the fourth party logistics market during the forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global fourth party logistics market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall fourth party logistics market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global fourth party logistics market with a detailed impact analysis.

- The current fourth party logistics market is quantitatively analyzed from 2021 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Fourth Party Logistics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Allyn International Services, Inc., Accenture Consulting, 4PL Group, XPO Logistics, Inc., Global4PL Supply Chain Services, DAMCO, GEFCO Group, Logistics Plus Inc., Deloitte, DB Schenker, Deutsche Post AG, 4PL Insights, CEVA Logistics, C.H Robinson Worldwide, Ltd., United Parcel Service, Inc., Panalpina World Transport |

Analyst Review

The current business scenario of the fourth party logistics (4PL) market has witnessed significant growth owing to rise of tech-driven logistics services, increasing adoption of IoT-enabled connected devices, and rise in reverse logistics operations. Furthermore, global shift toward dynamic logistics, especially in consumer goods, food and beverage, and medical equipment, presents a large-scale opportunity for the fourth party logistics market growth. For instance, in March 2021, XPO Logistics Inc. & Nestlé, the world's largest food and beverage company, announced their flagship distribution center & technology hub in UK to deliver the high volume of retail products associated with Nestlé's food, dairy, nutrition, beverage, and confectionery ranges. Sustainability with advanced technology is the core consideration to accommodate the highest throughput of any warehouse in Nestlé's global network.

Increasing investments by prominent vendors in product capabilities and business expansion is expected to fuel the market growth during the forecast period. For instance, in February 2022, GEODIS planned to open a new multi-user logistics facility in Coswig, Germany to offer customers a wide range of services. These include inbound & outbound logistics, value-added services, after-sales, and return logistics, as well as high-tech services. Furthermore, the growing number of fourth party logistics market players across regions is expected to drive market growth. Many market players are finding lucrative opportunities in emerging economies, such as China, Japan, and India, where the large population is coupled with new innovations in numerous industries. For instance, in April 2020, Japanese logistics giant, Yamato Holdings and Tokyo-based value chain firm, Global Brain raised a $46.5 million fund to promote digital transformation in the logistics industry in Japan. The fund focuses on investing in Japanese & foreign startups with technologies and business models evolving logistics & supply chain management. Hence, the digitization of infrastructure & improved customer service propels the fourth party logistics market growth globally.

Increase in demand for an easy & effective supply chain system and increase in the complexities in the operation process drive the growth of the fourth party logistics market. In addition, rise in demand for customized solutions is also expected to drive the market growth. However, factors such as reluctance of companies to outsource the logistics function and changes in logistics regulations in different countries are expected to hinder the growth of the market. Further, increase in demand for consumer electronics and growth in the e-commerce market are factors that are anticipated to foster the market growth.

Among the analyzed regions, Asia-Pacific is the highest revenue contributor, followed by North America, Europe, and LAMEA. On the basis of forecast analysis, Europe is expected to maintain its lead during the forecast period, owing to the booming e-commerce industry in emerging economies, infrastructural development, and increased adoption of outsourced logistics services in the region.

Increased demand for same day delivery of products are the upcoming trends of Fourth Party Logistics Market in the world

Consumer Electronics is the leading application of Fourth Party Logistics Market

Europe is the largest regional market for Fourth Party Logistics

The global fourth party logistics market was valued at $57.86 billion in 2021, and is projected to reach $111.67 billion by 2031, registering a CAGR of 6.7% from 2022 to 2031

4PL Group, 4PL Central Station, 4PL Consultancy Ltd., A.P. Moller – Maersk, Accenture, Allyn International Services, Inc., C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker, Deutsche Post AG, DSV, GEFCO, GEODIS, Global4PL, Logistics Plus Inc., Orkestra SCS, Phoenix Freight Systems, Primary Connect, Rhenus Group, and XPO Logistics Inc. are the key market players operating in the fourth party logistics (4PL) market.

Loading Table Of Content...