The France operational technology (OT) security market has witnessed significant growth during the projection period. Primarily, rise in awareness and focus on cybersecurity in France are key drivers behind the expansion of the operational technology (OT) security market. Moreover, rise in digitization of vital infrastructure across industries such as manufacturing, energy, and transportation has intensified the vulnerabilities posed by cyber threats. This increased awareness compels organizations to allocate resources toward operational technology (OT) security solutions and services to protect their operations. Furthermore, the market is reinforced by the implementation of rigorous security measures, as mandated by stringent regulatory compliance requirements.

The swift progression of cyber threats is a significant contributing factor. The intricacy and refinement of cyberattacks have grown exponentially in the past few years, requiring the implementation of advanced security measures. Consequently, companies are obligated to embrace cutting-edge OT security solutions that adjust to the constantly evolving threat environment.

On the other hand, there are several restraining factors that restrict market growth. One of the factors that limits the complete potential of the France operational technology (OT) security market is the shortage of skilled cybersecurity professionals. The complexities of OT security necessitate specialized knowledge and expertise, which is currently lacking. This scarcity of skilled personnel presents a significant obstacle for organizations seeking to safeguard their operational technology. Moreover, hesitation of certain organizations to allocate funds for OT security as a result of financial limitations is perceived as a hindrance. The misperception that implementing cybersecurity measures incurs additional expenses rather than serving as a strategic investment impedes the expansion of the market.

However, the France operational technology (OT) security market, despite its complex dynamics, presents numerous unexplored opportunities. Significantly, opportunity arises from convergence of IT and OT, where organizations are increasingly recognizing the interplay between these domains. Consequently, there is rise in demand for integrated security solutions that bridges the gap between IT and OT. Furthermore, rise of the internet of things (IoT) and widespread use of connected devices in industrial settings provide fertile ground for the development of OT security solutions. Safeguarding the interconnected ecosystem of devices and systems ensures their protection and opens avenues for market growth.

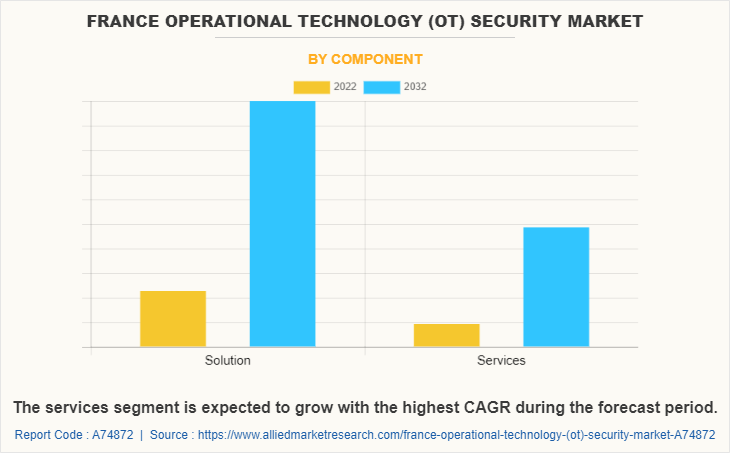

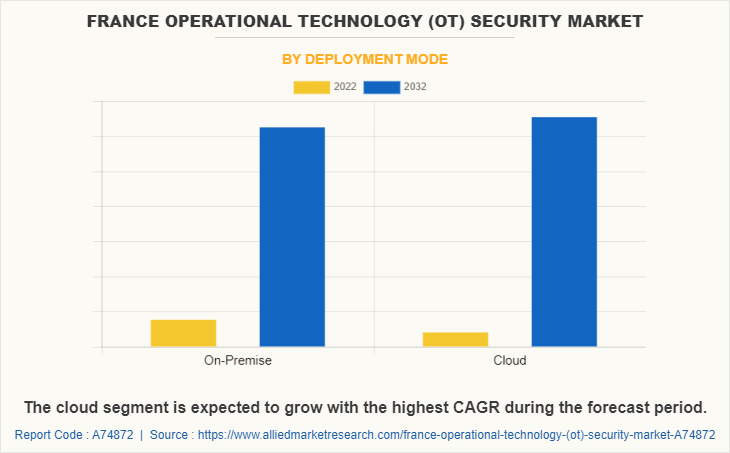

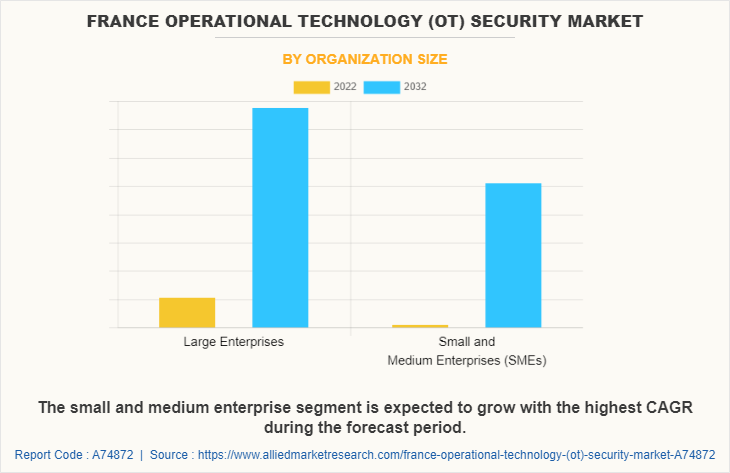

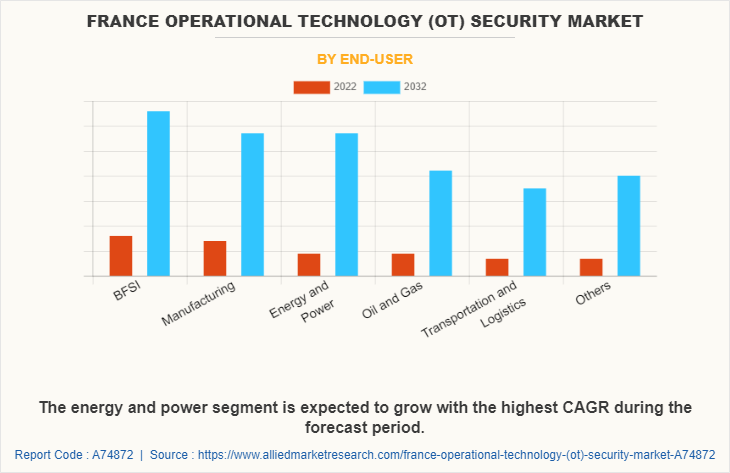

The France operational technology (OT) security market is segmented into component, deployment mode, organization size, and end user. Further, on the basis of component, the market is bifurcated into solution and services. Depending on deployment mode, it is divided into on-premise and cloud. By organization size, the market is classified into large enterprises, small and medium-sized enterprises (SMEs). According to end user, it is fragmented into BFSI, manufacturing, energy & power, oil & gas, transportation & logistics, and others.

The expansion of the market is a direct result of ever-changing threat landscape and rise in financial commitments made by organizations to protect their vital infrastructure. Although it is challenging to accurately forecast specific growth rates, it is reasonable to anticipate that the market is expected to persistently grow, given the ongoing significance of cybersecurity for industries in all sectors.

The Porter’s five forces analysis analyzes the competitive scenario of the France operational technology (OT) security market and role of each stakeholder. These forces include the bargaining power of suppliers, bargaining power of buyers, threat of substitutes, threat of new entrants, and competitive rivalry.

The bargaining power of suppliers in the market, particularly those providing specialized components and services, is considerable and holds a strong position. Organizations aiming to safeguard their OT infrastructure heavily rely on these suppliers to obtain state-of-the-art solutions. On the other hand, the bargaining power of buyers is substantial owing to abundance of choices accessible in the market. They have the ability to negotiate prices and request tailor-made solutions that cater to their unique security requirements.

Although, the threat of new entrants is a constant concern, the intricate nature and specialized knowledge demanded in the field of operational technology (OT) security discourage their entry. Dominant players with a proven history of providing strong and reliable solutions maintain a firm grip on the market. The threat of substitutes emerging in the OT security sector is relatively minimal. Conventional security measures are insufficient in addressing the unique requirements of operational technology, thus rendering dedicated OT security solutions indispensable.

The competitive rivalry in the France operational technology (OT) security market is intense, with a multitude of vendors providing a diverse array of solutions and services, all striving to capture a larger market share. This intense competition fosters innovation and advances in product development, ultimately benefiting end users.

A comprehensive view of the market's internal strengths and weaknesses, along with external opportunities and threats are obtained through a SWOT analysis. The strengths of the market include rise in awareness of the importance of OT security, increase in demand for integrated IT-OT security solutions, and continuous innovation and research in the field of cybersecurity. On the other hand, weaknesses of the market include lack of skilled cybersecurity professionals, reluctance among some organizations to invest in OT security, and lack of uniform standards and regulations across industries.

The opportunities in the market include convergence of IT and OT security, rapid adoption of IoT in industrial settings, and shift toward predictive and proactive security measures. However, the market faces threats such as evolvement of advanced cyber threats, intense competition in the market, and regulatory complexities and compliance challenges. To conclude, the France operational technology (OT) security market is a complex and dynamic landscape, characterized by various challenges and opportunities. The convergence of IT and OT, coupled with the constantly evolving threat landscape, are among the many factors driving the market's evolution.

Key players operating in the France operational technology (OT) security market include Schneider Electric, Siemens AG, Airbus CyberSecurity, Thales Group, Atos SE, Orange CyberDefense, Belden Inc., Palo Alto Networks, Fortinet, Inc., and CyberArk.

Key Benefits For Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in France operational technology (ot) security market.

- Assess and rank the top factors that are expected to affect the growth of France operational technology (ot) security market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the France operational technology (OT) security market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

France Operational Technology (OT) Security Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 81 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By End-User |

|

| Key Market Players | Atos SE, Schneider Electric, Belden Inc., Airbus CyberSecurity, Palo Alto Networks, CyberArk, Fortinet, Inc., Siemens AG, Thales Group, Orange CyberDefense |

The France Operational Technology (OT) Security Market is estimated to reach $3 billion by 2032

Key players operating in the France operational technology (OT) security market include Schneider Electric, Siemens AG, Airbus CyberSecurity, Thales Group, Atos SE, Orange CyberDefense, Belden Inc., Palo Alto Networks, Fortinet, Inc., and CyberArk.

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in france operational technology (ot) security market.

3. Assess and rank the top factors that are expected to affect the growth of france operational technology (ot) security market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the france operational technology (ot) security market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

France Operational Technology (OT) Security Market is classified as by component, by deployment mode, by organization size, by end-user

Loading Table Of Content...

Loading Research Methodology...