Fraud Detection and Prevention Market Overview

The global fraud detection and prevention market size was valued at USD 29.5 billion in 2022 and is projected to reach USD 252.7 billion by 2032, growing at a CAGR of 24.3% from 2023 to 2032. Factors such as the introduction of big data analytics, cloud computing services, and upsurge in mobile payment bolster the growth of the fraud detection and prevention market. Although continuous technological advancements prevailing in the global fraud detection & prevention market promote market expansion. However, high cost of fraud detection and prevention solution are likely to restrict the fraud detection and prevention market growth.

Key Market Insights

- By component, the service segment registered highest growth rate during the forecast period.

- By region, Asia-Pacific is anticipated to grow at a significant rate during the forecast period.

- By organizational size, the small & medium enterprises segment is expected to exhibit the highest growth during the forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 252.7 Billion

- 2022 Market Size: USD 29.5 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 24.3%

The high implementation cost of advanced fraud detection systems, like AI and big data analytics, can limit the market growth. In addition, integrating fraud detection systems with existing infrastructure, especially legacy systems, can be complex and time-consuming which poses a significant barrier to the market growth. Furthermore, the lack of skilled labor for developing, implementing, and maintaining advanced fraud detection solutions restricts the growth of the fraud detection and prevention market.

On the contrary, the fraud detection and prevention market is expected to offer numerous opportunities for new players. The integration of AI and ML enables enhanced fraud detection by learning from vast data to identify and prevent fraudulent patterns. These adaptive capabilities enhance real-time accuracy and effectiveness in preventing fraud, offering remunerative opportunities for the market growth. In addition, the increase in the demand for cloud computing allows businesses to implement scalable, flexible fraud detection systems without heavy upfront costs, attracting both SMEs and large enterprises. Furthermore, rise in digital transactions and the adoption of mobile payment systems has led to an upsurge in the demand for fraud detection and prevention solutions. This is expected to offer new avenues for the growth of the market.

For instance, on June 25, 2024, ACI Worldwide partnered with RS2 to offer a cloud-enabled platform for acquirers and issuers in Brazil. This platform combined their capabilities to support financial institutions and payment processors, offering real-time fraud management and compliance with local regulations. It enhanced service and fraud protection for various card types.

Moreover, big data analytics allows fraud detection systems to process substantial amounts of transactional data instantly, providing enhanced understanding of fraud trends in fraud detection & prevention market. Combining big data with advanced fraud detection improves decision-making, allowing businesses to deliver advanced and efficient solutions for sectors such as finance, insurance, and retail. In addition, the healthcare industry, targeted by fraudsters for its valuable data and complex insurance claims, faces a growing need for fraud detection solutions. Companies can develop tailored solutions for healthcare, focusing on patient identity verification, billing audits, and insurance fraud prevention. Furthermore, with the rise of cyber threats, organizations are looking for integrated solutions that combine fraud detection with cybersecurity measures. Developing integrated platforms that address both financial and data breaches offers a significant opportunity for the fraud detection and prevention market growth.

For instance, on march 10, 2025, Ooredoo Group partnered with Evina to enhance mobile payment security in the MENA region by implementing new cybersecurity measures. This collaboration provided digital service merchants with advanced fraud detection systems to block fraudulent activities in real-time. This initiative aimed to offer a secure digital experience, minimizing unauthorized charges. Ooredoo emphasized that security and trust are crucial for customer satisfaction and the success of digital payments. The AI-powered solution provided a seamless, secure, and scalable experience, supporting millions of users and setting new security benchmarks for mobile payments.

Fraud Detection and Prevention Market Segment Review:

The fraud detection and prevention market is segmented into component, organization size, deployment mode, industry vertical, and region. Based on component, the FDP market is segmented into solutions and service. By organization size, it is fragmented into large enterprises and small and medium sized enterprises. Based on deployment mode, the fraud detection and prevention market is segmented into cloud and on-premise. Depending on industry vertical, it is segregated into BFSI, IT & telecom, retail, healthcare, government & defense, manufacturing, transportation & logistics, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

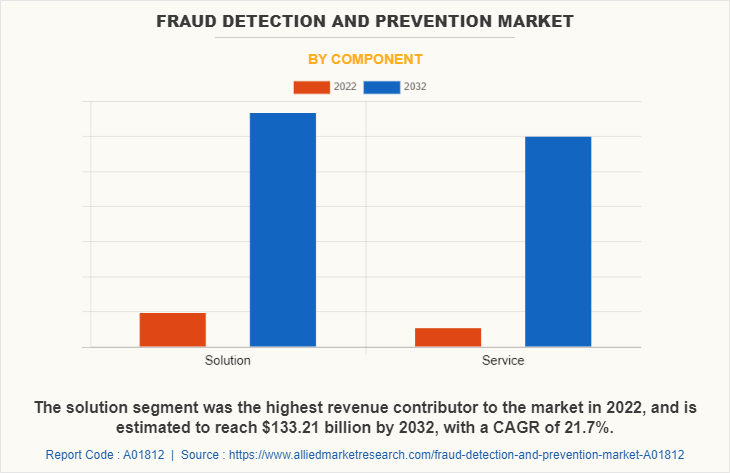

On the basis of component, the solution segment dominated the fraud detection and prevention market size in 2022, and is expected to maintain its dominance during the forecast period. The growth in instances of security breaches and cyber-attacks, alongside a big increase in online frauds are among the key factors that drive the market. However, the service segment registered highest growth rate during the forecast period. The surge in prevalence of cybercrimes and the rise in demand for security services worldwide are anticipated to foster the fraud detection and prevention fdp market during the forecast period.

For instance, on March 10, 2025, Group-IB launched its Fraud Protection solution in AWS Marketplace. This comprehensive solution safeguards businesses against online fraud, financial losses, and reputational damage using advanced AI, real-time threat intelligence, and behavioral analytics. Recognized by Frost & Sullivan as the most complete fraud prevention solution, it offers multi-layered protection across web platforms, mobile apps, and APIs. AWS customers can now access and manage Group-IB's robust fraud prevention capabilities directly within AWS Marketplace.

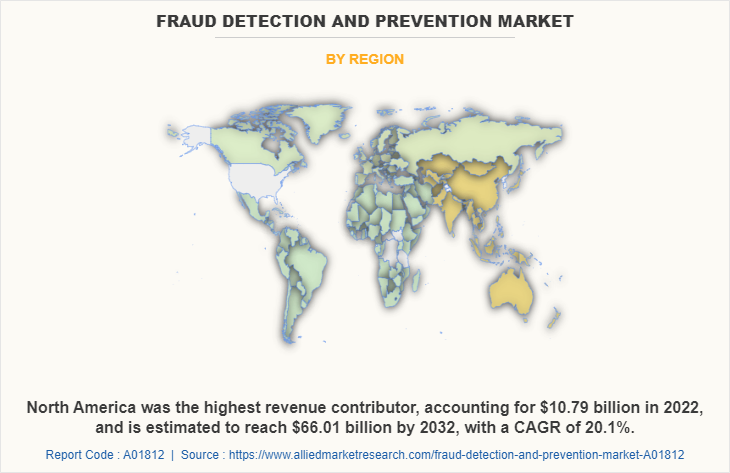

Region wise, the North America dominated the fraud detection and prevention market share in 2022. The major factors that contribute to the growth of fraud detection & prevention solutions in North America include rise in mobile and web usage and growth in dependency on Internet & social media platforms. However, Asia-Pacific is expected to witness the highest growth rate during the forecast period. The major factors that contribute to the adoption of fraud detection and prevention market trends in Asia-Pacific are the surge in usage of mobile data for various applications such as social media and mobile banking.

For instance, On April 17, 2024, Cognizant and FICO announced a cloud-based real-time payments fraud prevention solution for North American banks and payment service providers. This joint offering leveraged AI and ML technologies to provide stronger protection for real-time payments. It aimed to detect and block fraudulent transactions, integrating seamlessly with real-time payment rails like FedNow® Service and SEPA Instant Credit Transfer. The solution was available on a pay-per-use or licensing basis to eliminate upfront costs.

What are the Top Impacting Factors in the Market

Emergence of Big Data Analytics:

Big data analytics plays a key role in the fraud detection and prevention industry. It uses advanced analytics technique such as machine learning, predictive analytics, and data mining to analyze data sets, which may be of different types (such as structured/unstructured and streaming/batch) and different size (terabytes to zettabytes). It allows financial institutions to gain a deeper understanding of suspicious activities, derive patterns, and locate unusual transactions that help in preventing fraud. In addition, analyzing big data allows analysts, researchers, and business users to make better and faster decisions using data that were earlier inaccessible or unusable. Furthermore, by developing predictive models based on both historical and real-time data on wages, medical claims, and voice recordings, companies are in a better position to identify suspected fraudulent claims in the early stages

Rise in Number of Connected Devices:

Connected devices are gaining tremendous popularity. These devices are most vulnerable to threats and malware attacks. Growth in the use of these devices for residential and commercial uses has increased considerably over the years. Furthermore, key fraud detection and preventionmarket players in the market are designing customized solutions for connected devices to increase their revenues. These factors propel fraud detection and prevention market growth.

Furthermore, the COVID-19 pandemic has led to adoption of remote work mechanisms by numerous companies on a large scale, which is beneficial to contain the virus spread however, in turn, increases the risk of cyberattacks, thus resulting in speedy application of fraud detection and prevention solutions by various firms and organizations. Furthermore, the rise in vulnerability of connected devices to cyberattacks and malware attacks increases demand for robust and integrated fraud detection and prevention solutions across commercial, residential, and public sectors.

Growth in Demand for Cloud-based Security Solutions

Cloud Computing Model is widely adopted due to its powerful and flexible infrastructure option. Several organizations are moving to the cloud to simplify the storage of data, as cloud provides remote server access on the internet, which enables access to unlimited computing power. Furthermore, the implementation of cloud-based model enables organizations to manage all the applications, as there is no invisibility with exceptionally challenging analytics running in the background. In addition, the implementation of cloud can enable organizations to combine supplementary infrastructure technologies such as software defined perimeters to create robust and highly secure platforms. It allows organizations to meet cloud security compliance requirements for encryption, separation of duties and access controls for protected data.

Which are the Leading Companies in Fraud Detection and Prevention

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

NCR Corporation

BAE Systems PLC.

ACI Worldwide

SAS Institute Inc.

International Business Machines Corporation

Fair Isaac Corporation (FICO)

Oracle Corporation.

Precisely Holdings

LLC

SAP SE

LexisNexis.

Market Trends Insights:

The fraud and detection market report identifies several key trends. One of the significant trends is the use of biometric authentication, including fingerprint, facial, and voice recognition in fraud detection solutions. It adds a secure layer for identity verification, preventing unauthorized access and identity theft, especially in banking, healthcare, and mobile apps. This method offers a more secure and user-friendly experience compared to traditional passwords.

In addition, there is growing trend toward multi-factor authentication (MFA) across industries as a key security measure, requiring multiple forms of verification to access sensitive information. This significantly reduces unauthorized access risks, making MFA a standard practice in fraud prevention solutions, especially in finance, healthcare, and e-commerce. Furthermore, blockchain technology is becoming a valuable tool for preventing fraud, due to its decentralized and unchangeable characteristics that bolster transaction security. It has the potential to enhance transparency and security across supply chain management, identity verification, and payment processes, making it more difficult for fraudsters to interfere.

For instance, on January 24, 2025, Entrust launched an AI-powered identity verification tool for its IDaaS platform, enabling facial biometric authentication by verifying users against their encrypted identity. This tool aimed to provide compliance and new fraud protection options. Entrust continued to focus on meeting client needs and remaining compliant with industry regulations. Another notable trend the market is expected to witness is the surge in the adoption of behavioral analytics to identify fraudulent activities by examining a user’s usual behaviors, including login habits, transaction records, and device usage. This approach improves the precision of fraud detection by recognizing nuanced patterns of fraudulent activities that may not be detected through traditional rule-based methods.

In addition, there is shift in preferences toward advanced threat intelligence integration with fraud detection systems, providing real-time updates on emerging fraud tactics. This allows systems to quickly adapt and minimize exposure to new threats, staying ahead of fraudsters. Furthermore, there is growing trend toward fraud prevention as a service (FPaaS), offering affordable, cloud-based fraud detection technologies via subscription. This makes advanced fraud prevention accessible and cost-effective for businesses of all sizes, especially SMEs, without significant upfront investments.

For instance, on September 25, 2024, Bharti Airtel launched an AI-powered spam detection solution to combat spam calls and messages. This tool alerted customers in real-time without needing any service requests or app downloads. Developed in-house, the AI algorithm flagged spam accurately and scanned SMS links for malicious content, providing robust protection for Airtel customers. Airtel's solution uses AI to analyze patterns and detect potential fraud, which aligns with the goals of the broader fraud detection and prevention solutions industry.

Modern Fraud Detection & Prevention Techniques

Fraud detection and prevention is a collection of processes & techniques designed to identify, monitor, & prevent fraud. Detecting fraud is the first step in identifying where the problem lies and then it needs to be prevented automatically or manually using fraud detection software. Fraudulent activities cover a wide range of cases such as money laundering, cyber security threats, tax evasion, fraudulent insurance claims, fraudulent bank checks, identity theft, and terrorist financing, which can be found in the financial institutions, government, healthcare, public sector, and insurance industries. So, to combat this growing list of opportunities for fraud, organizations implement modern fraud detection & prevention technologies and risk management strategies that combine big data sources with real-time monitoring and apply adaptive & predictive analytics techniques such as machine learning & AI.

For instance, on November 28, 2024, Paisabazaar introduced an advanced Fraud Detection and Prevention System using machine learning and innovative technologies to enhance trust and responsible lending. This system addressed fraud challenges with advanced data analytics, real-time monitoring, and a robust fraud identification framework. It categorized customers into low, medium, and high-risk groups, restricting high-risk individuals and closely scrutinizing medium-risk users, while allowing seamless access for low-risk customers.

Moreover, fraud detection and prevention solutions are solutions offered by the IT vendors to small & medium enterprises and large enterprises to defend against unwilling or uncertain incidents & help to detect or prevent future occurrences. The current business scenario has witnessed an upsurge in the adoption of fraud detection & prevention solutions in developed as well as the developing regions. Companies adopt efficient techniques in an effort to provide customers with innovative and modernized security offerings.

For instance, on December 9, 2024, DataVisor, the world’s leading AI-powered fraud and risk platform launched a solution that computes hotspot, distinct count, and high-frequency features in real-time with 100% accuracy. This advanced analytics tool helps detect fraud quickly and precisely, maintaining data integrity and meeting regulatory requirements while building customer trust through transparency.

Key Strategies/Development:

The fraud detection and prevention market forecast are shaped by technological developments, reflecting a growing emphasis on advanced, integrated, and scalable fraud prevention technologies across industries and regions. Some are listed below:

On October 3, 2024, Google announced an expansion of Google Play Protect's security with an updated fraud protection feature. This pilot program aimed to scan, analyze, and automatically block suspicious apps. If an app was deemed suspicious, it would be blocked from installation and download. The feature also targeted apps requesting sensitive data, analyzing permissions in real-time to prevent misuse. Additionally, it could detect and block apps capable of illegal device tracking.

On April 9, 2024, NICE Actimize announced the release of IFM 11, an AI-driven fraud management platform. This new version enhanced fraud detection accuracy, agility, and efficiency by leveraging AI and collective intelligence. It provided comprehensive fraud prevention across detection, strategy, investigations, and operations. The platform also built richer entity risk profiles and used advanced analytics to stay ahead of new fraud threats. CEO Craig Costigan highlighted its unique end-to-end capabilities to tackle the evolving digital fraud landscape.

On June 24, 2025, Provenir launched an AI-powered risk decisioning platform to help organizations combat sophisticated fraud threats. The platform integrated multiple data sources and third-party solutions for effective fraud screening, connecting fraud scores, identity checks, and device validation. It aimed to detect and block threats like synthetic fraud and impersonation, providing a holistic view of customers and enhancing fraud detection while minimizing friction in the customer journey.

On July 24, 2024, NTT DATA partnered with Lynx to revolutionize fraud detection in the financial services industry. This collaboration aimed to provide banks and financial institutions across the UK and Europe with Lynx’s advanced AI-powered solutions. Lynx chose NTT DATA for its expertise in the banking sector to scale its innovative fraud prevention technologies. The partnership initially focused on the UK, Ireland, Spain, LATAM, and DACH markets, especially due to upcoming Payment Systems Regulation changes.

On October 22, 2024, HyperPay partnered with ACI Worldwide to advance AI-driven payment innovations in the MENA region. HyperPay's all-in-one platform enabled seamless payment acceptance and risk management. The partnership allowed HyperPay to use ACI’s Payments Orchestration and Fraud Orchestration Platforms, enhancing fraud protection and consumer behavior analytics. This collaboration supported Saudi Arabia's digital transformation goals under Vision 2030.

What are the Key Benefits for Stakeholders:

This study includes the fraud detection and prevention market analysis, fraud detection and prevention market trends, and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and fraud detection and prevention market opportunity.

The global fraud detection and prevention market size is quantitatively analyzed from 2022 to 2032 to highlight the financial competency of the industry.

Porter’s five forces analysis illustrates the potency of buyers & suppliers in fraud detection and prevention industry.

Fraud Detection and Prevention Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 252.7 billion |

| Growth Rate | CAGR of 24.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 415 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | SAP SE, SAS Institute Inc., NCR Corporation, BAE Systems PLC., Fair Isaac Corporation (FICO), International Business Machines Corporation, Oracle Corporation., LexisNexis, ACI Worldwide, Precisely Holdings, LLC |

Analyst Review

In accordance with the insights by CXOs of leading companies, the global Fraud Detection and Prevention market is projected to witness prominent growth, especially in Asia-Pacific and North America. This growth is attributed to increased investments by organizations, governments against cyber-attacks, and adoption of cloud-based fraud detection & prevention solutions. In addition, the adoption of IoT (Internet of Things) based devices globally provides ample growth opportunities for fraud detection and prevention solutions.

Moreover, the current business scenario has witnessed an upsurge in the adoption of fraud detection and prevention solutions in developed as well as developing regions. The companies have adopted efficient techniques in an effort to provide customers with innovative and modernized security options. Fraud incidents are persistently progressing and growing.

However, with each new attack, it becomes mandatory for organizations to implement effective security solutions. The fraud detection solutions provide a strong defense against such incidents and help to detect or prevent future occurrences. Asia-Pacific exhibits the highest adoption of fraud detection solutions. On the other hand, LAMEA is expected to grow at a significant growth rate, due to rise in adoption of fraud detection and prevention solutions, especially in countries such as Brazil, South Africa, and Argentina.

The global fraud detection and prevention market is dominated by key players such IBM Corporation, Oracle Corporation, SAP SE, BAE Systems, and others. In addition, key players have adopted various growth strategies to enhance and develop their product portfolio, strengthen their fraud detection and prevention market share, and to increase their market penetration. For instance, in December 2021, FICO and Sistemas Críticos, a global IT company with presence in Latin America launched BSafe Platform SaaS, which combines the fraud prevention technologies of FICO® Falcon® Fraud Manager and TenS®, a proprietary Sistemas Críticos platform. This is expected to help in fraud detection at early stages. Such an enhancement is expected to provide lucrative growth opportunities for the market in the upcoming years.

The global fraud detection and prevention market size was valued at USD 29.5 billion in 2022, and is projected to reach USD 252.7 billion by 2032

The global fraud detection and prevention market is projected to grow at a compound annual growth rate of 24.3% from 2024-2033 to reach USD 252.7 billion by 2032

The key players profiled in the reports includes IBM Corporation, Oracle Corporation, SAS Institute Inc., Fair Isaac Corporation., SAP SE, BAE Systems, ACI Worldwide, NCR Limited, Precisely Holding LLC, and LexisNexis.

The key growth strategies for Fraud Detection and Prevention include product portfolio expansion, acquisition, partnership, merger, and collaboration.

The North America is the largest market for the Fraud Detection and Prevention.

Emergence of Big Data Analytics, Rise in Number of Connected Devices & Growth in Demand for Cloud-based Security Solutions

Loading Table Of Content...

Loading Research Methodology...