Free-to-air (FTA) Service Market Insights, 2032

The global free-to-air (FTA) service market was valued at $120.3 billion in 2022 and is projected to reach $337.3 billion by 2032, growing at a CAGR of 11.2% from 2023 to 2032.

The rise in adoption of Internet Protocol Television (IPTV) and the increase in number of subscribers are driving the growth of the market. In addition, the surge in the integration of government initiatives in digital broadcasting and FTA services is fueling the growth of the free-to-air services market. However, the lack of content security and data piracy limit the growth of this market. Conversely, the emergence of Over-the-top (OTT) platforms with free streaming services is anticipated to provide numerous opportunities for the expansion of the free-to-air service market forecast.

Free-to-air service is an expression used to describe both radio and television broadcasts that are not encrypted. This allows any individual with a satellite dish to access these programs without subscribing to a cable company. Free-to-air is often used for international broadcasting, making it a video equivalent to shortwave radio. Most FTA retailers list free-to-air channel guides and content available for free-to-air use. Further, the convenience of FTA services in commercial and residential areas varies depending on the location. In some areas, it may be a limited number of FTA channels available or only accessibility to terrestrial FTA services, however, in other areas, there may be a wider selection of channels or accessibility to both terrestrial and satellite FTA services. Hence, FTA services are gaining significant momentum in residential and commercial applications to provide a free and easy way to watch television and radio.

The report focuses on growth prospects, restraints, and analysis of the global free-to-air service market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global free-to-air service market analysis.

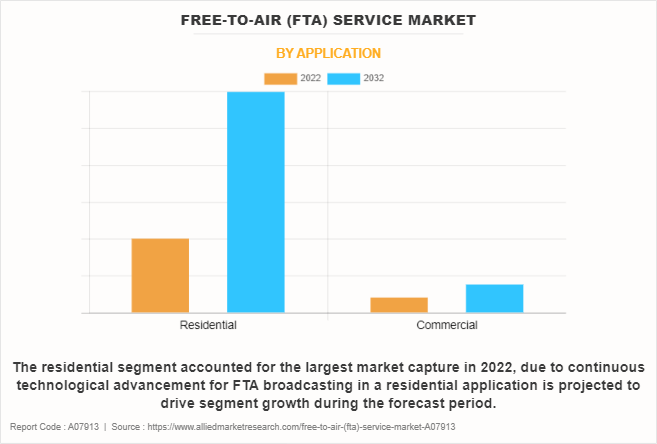

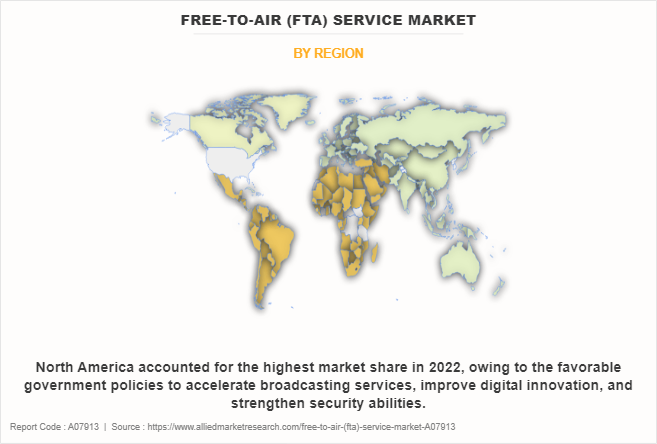

The global free-to-air services market is segmented into device type, application, and region. Depending on the device type, the market is divided into cable television, satellite television, mobile TV, and radio. Based on application, it is categorized into residential and commercial. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on application, the residential segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to the increase in adoption rate of FTA television channels among residential areas due to free and easy accessibility features, which further helps in expanding the growth outlook of the market. However, the commercial segment is expected to witness considerable growth in the upcoming years, owing to the need to promote local businesses by providing advertising opportunities, as well as create a sense of community, which boost the adoption of the free-to-air service market size among commercials.

Region-wise, the free-to-air service market was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the increased interest of consumers in OTT solutions and streaming platforms such as Netflix, Amazon, and others along with favorable government support and initiatives in the region. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to an increase in digital markets in Central and Southern Asia, new regulatory requirements, and the rise in need for high bandwidth for both regional and inter-continental connectivity.

The global free-to-air services market is dominated by key players such as AMC Networks, Inc., British Broadcasting Corporation, BT Group Plc, Deutsche Telekom AG, Eutelsat, ITV Plc, Mediaset S.p.A., ProSiebenSat.1 Media SE, RTL Group, and Sky Plc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors -

Rise in adoption of Internet Protocol Television (IPTV)

The rise in demand for Internet Protocol Television (IPTV) for improving video-on-demand services and high-definition channels is directly influencing the growth of the global free-to-air service market. The popularity of IPTV lies in the fact that the entire world is turning toward digitalization, as well as government authorities and companies are investing substantial amounts of funds in broadcasting and streaming services. For instance, in 2023, the New Zealand government invested US$25.7 million funds in Radio New Zealand (RNZ), of which US$12 million was allocated to maintain public media services, US$12 million for a new digital platform, and US$1.7 for Amplitude Modulation (AM) transmission. These investments are expected to reinforce news and current affairs coverage through a free multi-media digital platform to reach new target audiences. Hence, such strategic investments are progressively boosting the growth of the free-to-air service market.

Furthermore, consumer electronic devices are well-connected to the cyber web and are capable of performing better through broadband networking technologies, such as free-to-air services, which eventually provide better accessibility to their favorite TV shows and movies anytime, anywhere. Hence, the constant rise in demand for consumer electronics, such as smartphones and tablets, is significantly driving the move toward the growth of the free-to-air service industry.

Increase in Number of Subscribers

New trends and technological advancements such as IPTV, are increasing the demand for the free-to-air service market. People are now opting for high-quality devices owing to the growing technological advancements in TVs such as the utilization of data analytics to gain insights regarding public preference, which is boosting the free-to-air service industry. The ongoing digital television transition, the introduction of high-definition (HD) picture format, internet penetration, and the increase in number of subscriptions are boosting the demand for the free-to-air service market.

Therefore, free-to-air service gained wider traction among end-users, which in turn, contributes to robust market growth. In addition, rising investment in media content has led to the creation of new content offerings, which is indeed strengthening the number of subscribers. In this case, developing countries such as India are becoming content hubs, with a wealth of material being developed for consumption locally and worldwide. These aforementioned factors are projected to pave the demand for the free-to-air (FTA) service market across the world.

Digital Capabilities

Free-to-air services have evolved over time and incorporated a range of digital capabilities to stay competitive in the marketplace and meet the changing needs of viewers. The relevance of free-to-air services in digital broadcasting technologies, such as High-Definition (HD) and Ultra High-Definition (UHD) Content, Video-On-Demand (VOD), and satellite tuners, is growing, owing to their advantages like efficient content delivery and immersive viewing experience. For instance, in 2022, the Bureau of Indian Standards (BIS) finalized a standard for digital television receivers with built-in satellite tuners to ensure the viewers get all free-to-air channels operated by the state broadcasters, Doordarshan without installing a set-up box. Such strategic developments in the field of digital broadcasting are anticipated to pave the growth outlook of the free-to-air services market.

In addition, numerous companies are incorporating advanced and innovative solutions, as well as providing better content quality to promote cultural diversity and attract a wide customer pool in online streaming. For instance, in March 2022, Curiosity, a company that runs Curiosity Stream, partnered with LG to unveil Curiosity Now, a free, ad-supported streaming channel. The new channel will enable newer models to deliver a library of original and curated documentaries, shows, and series about history, nature, travel, science, and more. Curiosity is described now as a significant part of an improved subscriber acquisition strategy and a better means of strengthening brand partnerships. These aforementioned key factors create numerous opportunities for high growth of the free-to-air service market.

Moreover, digital FTA services include electronic program guides (EPGs) that enable viewers to easily browse and schedule recordings of upcoming shows. EPGs also deliver additional information about programs, such as descriptions and schedules, making a prominent technological breakthrough in the free-to-air services industry. These digital capabilities enhance the overall viewer experience and enable FTA services to remain relevant in a digital and on-demand media landscape, which in turn, reinforces the market growth over the forecast period.

End-User Adoption

The growing digitalization in the broadcasting industry by several radio and television broadcasters is accelerating end-user adoption. The end-users for the FTA service market include homes, hotels, villages, condominiums, living quarters, and accommodation clusters, along with corporates and commercial segments. Terrestrial broadcasting, satellite broadcasting, internet streaming, and mobile apps are some common FTA services for the end-users. In order to achieve an immersive viewing experience, FTA broadcasters facilitate direct-to-home and cable networks, ensuring that viewers across the country can easily access its content. On the other hand, digitization improves the speed and accuracy of the various processes, allowing for, among other benefits, universal accessibility, greater information reachability, and cost-free access.

Further, the commercial application of the free-to-air service market includes the use of FTA TV channels in shopping malls and local stores. The use of FTA services for commercial purposes is a complex issue that varies from country to country, however, it may be a good option for reaching a large target audience and promoting their product and services. Hence, such remarkable benefits of FTA service in the commercial segment are expected to contribute to its high demand, and eventually result in numerous opportunities for market growth.

In addition, vendors are focused on partnerships and acquisitions with other vendors or solution providers to enhance their product and service offerings. For instance, in November 2022, the Ministry of Information & Broadcasting approved the new guidelines for channels to telecast content of national interest and public importance, as well as the uplinking and downlinking of TV channels, including commercial applications. Such advancements and the expansion of FTA services are expected to drive the implementation of the FTA service market.

Government Initiatives

In recent years, tactical initiatives taken by government authorities have played a significant role in the free-to-air (FTA) services market, often with the aim of ensuring that FTA services remain accessible, diverse, and able to accomplish their public service and cultural objectives. Many governments support public broadcasting organizations (for example, British Broadcasting Corporation (BBC) in the UK, Public Broadcasting Service (PBS) in the U.S., and more) through funding and regulatory support. Public broadcasters often provide FTA services with a focus on educational, cultural, and public interest content.

In fact, numerous corporate and government bodies have further recognized the importance of broadcasting operations in the digital age and have integrated proactive measures to subsidize set-top boxes and offset the large upfront costs of switchover. Furthermore, government policies have undertaken increased initiatives to embrace advanced technology, with plans for integrating new digital security solutions. For instance, in January 2023, India’s Ministry of Information and Broadcasting commenced the funding of $308 million from 2025 to 2026, aiming to develop the infrastructure for public service broadcasters, Prasar Bharati - All India Radio (AIR) and Doordarshan (DD). The funding is expected to deliver financial support to Prasar Bharati for expenses pertaining to its expansion and upgradation of its broadcasting infrastructure, organizational-related civil work, and content development. Therefore, free-to-air service gained wider traction among end-users, which in turn, contributes to robust market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the free-to-air services market analysis from 2021 to 2031 to identify the prevailing free-to-air services industry opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the free-to-air service market growth assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global free-to-air service market share, key players, market segments, application areas, and market growth strategies.

Free-to-air (FTA) Service Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 233 |

| By Device Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | MEDIAFOREUROPE N.V., RTL Group, AMC Networks, Inc., ITV plc, ProSiebenSat.1 Media SE, Eutelsat, Deutsche Telekom AG, BT Group plc, Sky, BBC. |

Analyst Review

The global free-to-air services market is witnessing decent growth, due to the increasing number of subscribers and the favorable government policies and mandates for FTA broadcasting service. According to CXOs of the leading companies in the market, residential and commercial users have perceived various changes in business processes, operations, and industrial automation.

This is driven by a rapid shift toward digitalization, an increase in mobile and Internet penetration, hyperconnectivity, and various other related trends. These factors eventually create a significant deployment of free-to-air service. Further, the launch of new TV channels is due to the robust presence of existing vendors, making the free-to-air service market more competitive globally. The competitive environment is often expected to intensify with the rise in technological innovations, product extensions, and different strategies adopted by key vendors.

Key players in the free-to-air service market such as AMC Networks, Inc., BT Group Plc, British Broadcasting Corporation, Deutsche Telekom AG, and Sky Plc, account for a significant share of the market. With larger requirements for free-to-air services, companies introduced various strategies to strengthen their market position capabilities. For instance, in January 2021, AMC Networks unveiled five free add-supported streaming channels of Vizio SmartCast TVs, providing access to millions of Vizio viewers on the SmartCast platform. Such strategic initiatives by the market players are expected to contribute to significant growth of the free-to-air service market across the globe. Moreover, market players have expanded their business operations by enhancing their product portfolio by introducing new FTA channels for TVs.

Similarly, in August 2022, the UK telco. BT Group Plc launched a streaming-only option for Freeview channels without the need for a terrestrial antenna. The streaming option will give access to the main Freeview channels from the UK’s public service broadcasters, and a range of other channels, but will not include all the channels currently available over the air on Freeview. Such factors and strategic advancements propel the growth of the free-to-air service market.

The rise in adoption of Internet Protocol Television (IPTV) and the increase in number of subscribers is expected to drive the growth of the market. In addition, the surge in integration of government initiatives in digital broadcasting and FTA services fuels the growth of the free-to-air service market.

Depending on application, the residential segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to the increase in adoption rate of FTA television channels among residential areas due to free and easy accessibility features.

Region-wise, the free-to-air service market was dominated by North America in 2022 and is expected to retain its position during the forecast period due to the increased interest of consumers in OTT solutions and streaming platforms such as Netflix, Amazon, and others.

The Free-to-air (FTA) Service Market was valued at $120.28 billion in 2022 and is estimated to reach $337.30 billion by 2032, exhibiting a CAGR of 11.2% from 2023 to 2032.

The global Free-to-Air (FTA) service market is dominated by key players such as AMC Networks, Inc., British Broadcasting Corporation, BT Group Plc, Deutsche Telekom AG, Eutelsat, ITV Plc, Mediaset S.p.A., ProSiebenSat.1 Media SE, RTL Group, and Sky Plc.

Loading Table Of Content...

Loading Research Methodology...