Fresh Sea Food Packaging Market Research, 2033

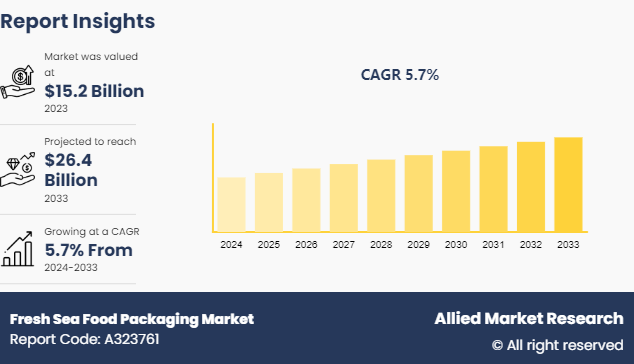

The global fresh sea food packaging market was valued at $15.2 billion in 2023, and is projected to reach $26.4 Billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Market Introduction and Definition

Fresh sea food packaging market refers to specialized packaging solutions designed specifically for fresh seafood products such as fish, shellfish, and other marine creatures. The primary purpose of fresh seafood packaging is to maintain the freshness, quality, and safety of these highly perishable products throughout the supply chain, from processing and transportation to retail display & consumption. Moreover, the market is driven by several factors, including rise in global demand for seafood, increase in consumer awareness of food safety & quality, need for extended shelf life & efficient distribution, and surge in emphasis on sustainability & eco-friendliness.

Key Takeaways

The fresh seafood packaging market study covers 20 countries. Within this research, a thorough analysis of each country is conducted, focusing on the value for the projection period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major fresh seafood packaging industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Rise in awareness of seafood as a valuable source of lean protein, omega-3 fatty acids, vitamins, and minerals has resulted in increase in demand for fresh seafood items. In addition, with rising concerns over lifestyle-related ailments, including obesity and cardiovascular diseases, seafood emerges as a lean protein source with low saturated fats. For instance, a study by the National Fisheries Institute found that 73% of Americans believe seafood is a healthy food choice, indicating a significant awareness of its health benefits. This fresh sea food packaging market forecast has directly translated into the need for packaging solutions that preserve the freshness, quality, and nutritional value of sea food during transportation and storage.

However, rise in occurrences of food contamination poses a substantial restriction to the widespread acceptance of fresh seafood packaging in the market. Such events decline consumer trust, leading to decreased consumption and regulatory scrutiny, demanding costly adherence to strict safety measures. Reputational harm and interruptions in the supply chain serve as restricting factors impeding the market growth, leading to hesitancy from both producers and consumers.

Contrarily, innovations in packaging technologies drive the growth of the fresh seafood market by enhancing product quality, safety, and sustainability. Advanced materials, such as biodegradable films and active packaging, extend shelf life while reducing environmental impact. Smart packaging solutions, equipped with sensors and indicators, monitor freshness and ensure optimal storage conditions throughout the supply chain. In addition, vacuum-sealing and modified atmosphere packaging (MAP) techniques preserve seafood's flavor & texture. These advancements meet consumer demands for convenience and freshness while addressing regulatory requirements, thereby driving market growth, and fostering industry competitiveness in the evolving landscape of seafood packaging.

Demographic Trend and Statistics

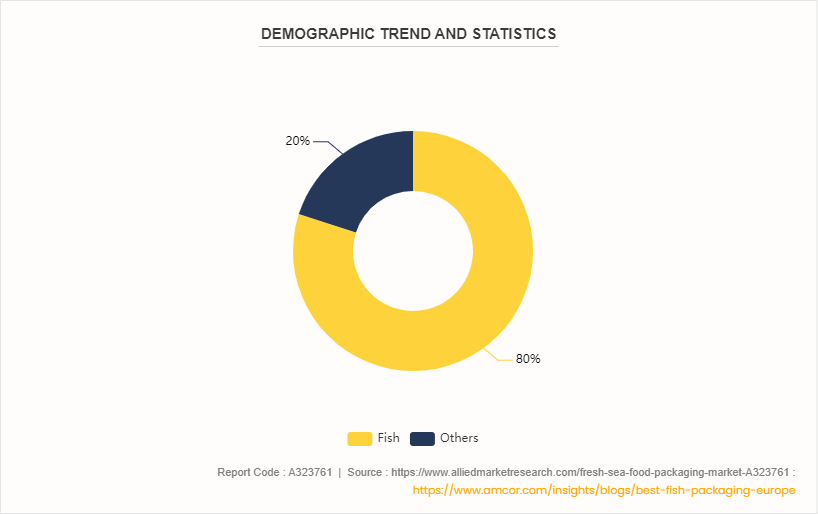

In Europe, 80% of consumers eat fish at least once a week. Total retail sales are predicted to rise by 3% annually. Many consumers opt for purchasing fish that is ready to cook. In fact, over 60% of European consumers state that their priority when buying fish is its convenience in terms of preparation. It's understandable, given that 20% of individuals in the market express a reluctance to deal with fish. The statistic that 20% of European consumers dislike touching fish indicates a need for packaging solutions that minimize direct contact with the product. This is expected to potentially lead to the creation of user-friendly and hygienic packaging designs.

Consumer Trends and Dynamics

The fresh sea food packaging market size is heavily influenced by various consumer trends and dynamics. Understanding these factors is crucial for packaging manufacturers, seafood processors, and retailers to effectively meet the evolving demands of consumers. Here are some key consumer trends and dynamics shaping the fresh seafood packaging market.

Sustainability and eco-friendliness: Consumers are increasingly concerned about the environmental impact of packaging waste. There is a growing demand for sustainable and eco-friendly packaging solutions, such as those made from biodegradable, compostable, or recyclable materials. Brands that prioritize sustainability in their packaging choices are expected to resonate with environmentally conscious consumers.

Transparency and clean labeling: Consumers are seeking greater transparency in food packaging, including information about the product's origin, catch method, and nutritional content. Clear and concise labeling, with minimal use of additives or preservatives, is becoming increasingly important for building consumer trust and loyalty.

Convenience and portion control: Busy lifestyles and changes in household dynamics have led to a demand for convenient, easy-to-prepare, and portion-controlled seafood packaging options. Single-serve packages, resealable containers, and microwavable options are gaining popularity among consumers seeking convenience without compromising on freshness.

Premium and innovative packaging: As consumers become discerning, there is a growing demand for premium and innovative packaging designs that enhance the overall product experience. Brands set themselves apart and captivate consumers in search of a refined seafood experience by incorporating visually appealing graphics, distinctive shapes, and engaging packaging elements.

Food safety and freshness: Consumer concerns about food safety and freshness are driving the demand for packaging solutions that ensure the integrity and quality of seafood products. Technologies such as modified atmosphere packaging (MAP) , active packaging, and temperature-controlled packaging are gaining traction as consumers prioritize freshness and extended shelf life.

Traceability and authenticity: Consumers are increasingly becoming conscious of sustainable seafood practices and have growing concerns about product authenticity. As a result, they are actively seeking enhanced traceability in seafood packaging. Providing detailed information about the product's origin, catch method, and supply chain help build consumer trust and confidence.

Health and wellness: As consumers become more health-conscious, they are seeking seafood products that align with their dietary preferences and nutritional goals. Packaging that highlights the health benefits, nutritional value, and clean ingredient lists resonate with consumers focused on wellness.

Market Segmentation

The fresh seafood packaging market is segmented into product type, material, application, and region. Depending on the product type, the market is divided into rigid packaging, flexible packaging, and others. As per material, it is segregated into plastic, paper, metal, and others. By application, the market is categorized into fish packaging, shrimp packaging, and other seafood packaging. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

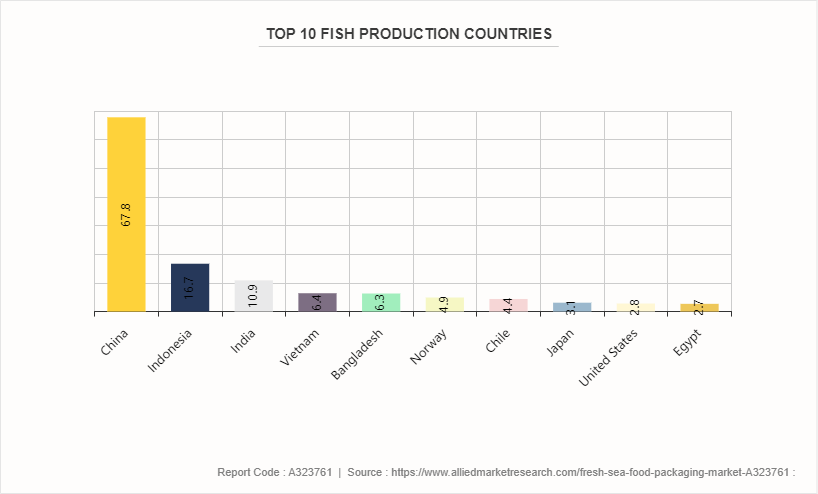

Asia-Pacific is currently dominating the global fresh sea food packaging market. Asia-Pacific accounted for the largest share of around 40% of the global fresh sea food packaging market share in 2020. The dominance of the Asia-Pacific in this market is attributed to various factors. Primarily, the region boasts large coastal populations and strong traditional seafood-centric cuisines in countries such as China, Japan, and Southeast Asian nations, driving a significant demand for fresh seafood products and, consequently, effective packaging solutions. For instance, China is at forefront of fish production globally, yielding 67.8 million tons in 2021. This figure accounts for almost 38% of the total global output. Moreover, rapid increase in demand for seafood is fueled by surge in disposable incomes and urbanization across the region. In addition, presence of major seafood producers and exporters, such as China, Vietnam, and India, has strengthen the fresh seafood packaging market in the Asia-Pacific.

Furthermore, Asia-Pacific is witnessing an increase in adoption of advanced packaging technologies such as modified atmosphere packaging (MAP) and active packaging, which contribute to extending the shelf life and preserving the quality of fresh seafood products. This technological adoption is driven by region's efforts to meet the growing demand and cater to the evolving consumer preferences for fresh and high-quality seafood. For instance, below data is given for top 10 fish producing countries.

Industry Trends:

The fresh sea food packaging industry has experienced significant growth due to rise in aquaculture operations, particularly in the Asia-Pacific. This growth is attributed to utilization of a diverse range of primary and secondary packaging materials. In addition, advancements in modified atmosphere packaging (MAP) and vacuum packaging techniques have driven this progress.

Biodegradable packaging and films are gaining popularity as viable alternatives to conventional plastic packaging. Starch, polyhydroxybutyrate (PHB) , polyhydroxyalkanoates (PHA) , cellulose, PLA, and various other biopolymers are used solely for demonstrative purposes. Plant-based packaging crafted from coconut, sugarcane, hemp, and corn starch is gradually replacing plastic. These improvements are cost-effective for firms to implement and diminish the packaging industry’s environmental impact.

LAM’ON, a Bulgarian business, makes biodegradable and compostable lamination films and foil packaging. PACK’ON, a packaging foil made of polylactic acid (PLA) generated from corn is produced by the company. The solution is ideal for food packaging due to silver nanoparticles as antibacterial additions in the foil and its oxygen barrier qualities. Organic resources such as water, carbon dioxide, and composites erode film and foil. The product’s polymer threads are biaxially aligned, making it more robust and less susceptible to tearing. Moreover, PACK’ON exhibits no oil or other element migration, making it ideal for food and cosmetic packaging.

In terms of packaging advancements in 2022, one instance is flexible packaging solutions, which combines the mechanical and physical properties of many layers of different polymers to create a balance between usefulness, environmental concerns, and commercial concerns for fresh sea food packaging market growth.

Competitive Landscape

Major players operating in the fresh seafood packaging market include Amcor, DuPont, Winpak, Berry Global, Sealed Air, Coveris, Cascades, Kureha, Smurfit Kappa, Crown Packaging and so on.

Recent Key Strategies and Developments

In August 2022, Iceland announced the partnership with Parkside to replace the LDPE bag for the company's product portfolio of frozen seafood with a recyclable paper pouch. The pouch features water-based coatings, which break down during re-pulping.

In July 2022, Grounded Packaging, an Australia-based Company, announced the introduction of a new sustainable packaging solution. The innovative product, Re:Mono, is made up of 83% recycled materials and is specifically designed for packaging meat and seafood items.

In July 2020, Amcor plc launched SkinNova, seafood packaging with 70% less plastic. SkinNova minimizes the use of plastics by over 70% relative to traditional MAP packaging and cuts the carbon footprint by 45%.

Key Sources Referred

Food and Agriculture Organization of the United Nations

L.E.K

Smart Packaging Solutions

Teletype

Medium

Global SeaFoods

Amcor Insights

Adda24

Industrial Packaging

Global Seafood Alliance

TedPack Company Limited

Informa Markets

Packaging World Insights

Hotpack Packaging Industries LLC

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fresh sea food packaging market analysis from 2024 to 2033 to identify the prevailing fresh sea food packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fresh sea food packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fresh sea food packaging market trends, key players, market segments, application areas, and market growth strategies.

Fresh Sea Food Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 26.4 Billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product Type |

|

| By Material Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | COVERIS, Berry Global, Inc, KUREHA CORPORATION, Cascades, Crown Packaging, DuPont, Amcor Limited., Smurfit Kappa, Sealed Air, Winpak Limited |

Fresh sea food packaging market was valued at $15.2 billion in 2023, and is estimated to reach $26.4 billion by 2033.

The global fresh sea food packaging market is projected to grow at a compound annual growth rate of 5.7% from 2024 to 2033 reach $26.4 billion by 2033.

Some of the key players in the fresh sea food packaging market include Amcor, DuPont, Winpak, Berry Global, Sealed Air, Coveris, Cascades, Kureha, Smurfit Kappa, Crown Packaging and so on.

Asia-Pacific region was the highest revenue contributor to the market and is expected to grow at a significant CAGR during the forecast period

The Fresh Sea Food Packaging Market is trending towards sustainable materials, with a focus on recyclable and biodegradable options to reduce environmental impact. Smart packaging technologies, incorporating freshness indicators and QR codes for traceability, are gaining popularity. There's a growing demand for vacuum-sealed and modified atmosphere packaging to extend shelf life. Convenience features like easy-open and resealable packaging are becoming prevalent.

Loading Table Of Content...