Frozen Chicken Market Research, 2032

The global frozen chicken market was valued at $22.2 billion in 2022, and is projected to reach $46.5 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.Frozen chicken refers to chicken meat that has been subjected to freezing temperatures to preserve its freshness and extend its shelf life. The process involves lowering the temperature of the chicken to below freezing point, typically around -18 degrees Celsius (0 degrees Fahrenheit) or lower. This rapid freezing helps to slow down or halt the growth of microorganisms, including bacteria, that can spoil the meat. Frozen chicken is a convenient and widely available food product that can be stored for an extended period without significant loss of quality.

Frozen chicken products have a longer shelf life compared to fresh poultry. This feature allows consumers to stock up on chicken without worrying about spoilage, reducing the frequency of shopping trips. Frozen chicken is easy to store, requiring minimal preparation. Consumers can buy in bulk and store the products in their freezers, making it a convenient option for those with limited time for frequent grocery shopping. Moreover, frozen chicken products often come pre-cut, marinated, or seasoned, making meal preparation quicker and simpler. This is a significant advantage for busy individuals or families with hectic schedules. Frozen chicken market growth helps reduce food waste since it can be stored for an extended period without the risk of spoilage. Consumers can use the portions they need, leaving the rest in the freezer for future use. The frozen chicken market offers a wide range of products, including pre-cooked options, nuggets, strips, and various flavored varieties. This diversity caters to different consumer preferences and allows for versatile meal planning.

The frozen chicken market heavily relies on efficient and reliable supply chains. Transportation is a critical aspect of the frozen chicken supply chain. Any disruptions, such as delays, breakdowns, or capacity issues in transportation systems, can lead to delays in delivering products to the market. Frozen chicken requires specific temperature conditions during transportation to maintain its quality and safety. If there are temperature control failures or fluctuations during transit, it can result in product spoilage or degradation. Moreover, cold storage facilities are essential for preserving the quality and safety of frozen chicken. Power outages, equipment malfunctions, or inadequate infrastructure can lead to failures in cold storage, affecting the overall supply chain. Cross-border trade and international supply chains are expected to face challenges related to customs procedures, regulatory compliance, and documentation requirements. These barriers are projected to lead to delays in the transport of frozen chicken products.

The market for frozen chicken has a sizable opportunity due to the development of the improved freezing and packaging technologies that can help extend the shelf life of frozen chicken products. Implementing IQF technology allows each piece of chicken to freeze individually, preventing the formation of ice crystals and maintaining better texture and flavor upon thawing. Packaging that controls the atmosphere around the product can extend shelf life and preserve the quality of frozen chicken by adjusting the levels of oxygen, carbon dioxide, and nitrogen. Enhanced vacuum-sealing techniques can remove air from packaging, reducing the risk of freezer burn and maintaining the freshness of frozen chicken. Incorporating sensors or indicators into packaging to monitor temperature, freshness, and potential spoilage can reassure consumers and improve product quality. These major factors are projected to offer growth opportunities for key players operating in the market during the forecast period.

Segment Overview

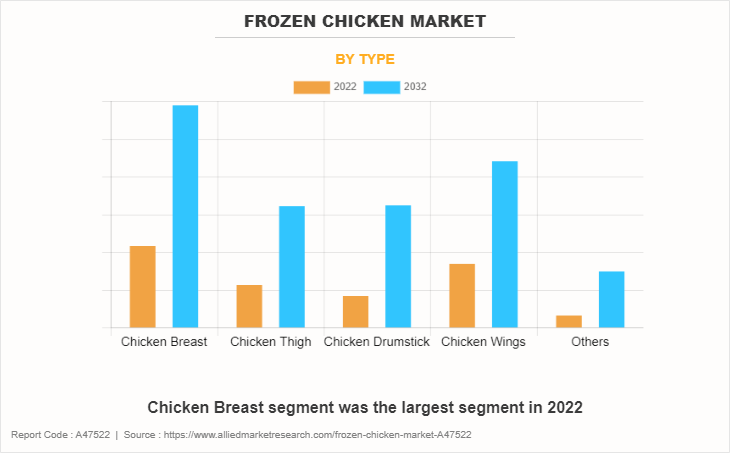

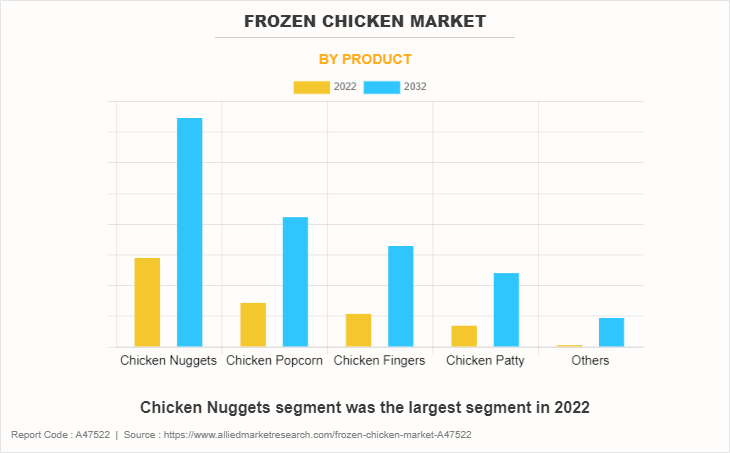

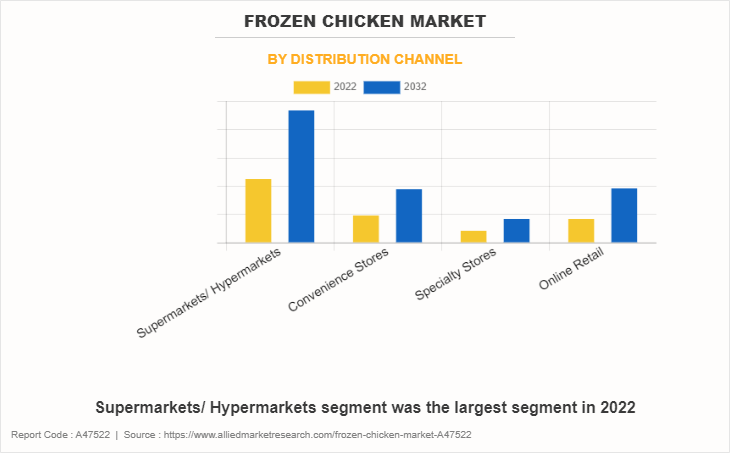

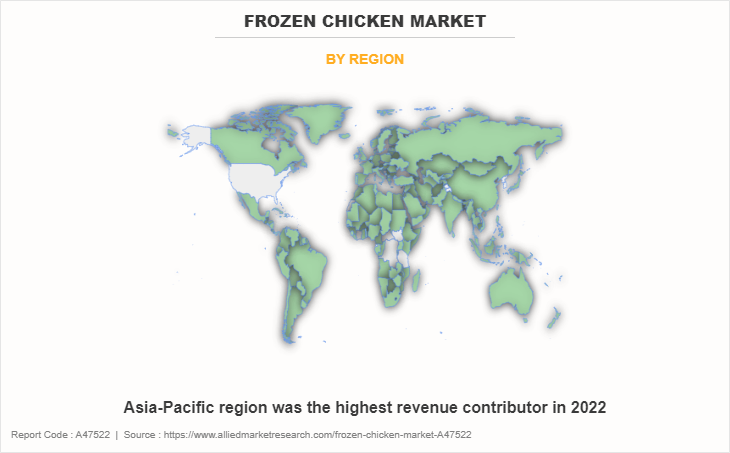

The frozen chicken market is segmented on the basis of type, product distribution channel, and region. By type, the market is divided into chicken breast, chicken thigh, chicken drumstick, chicken wings, and others. By product, the market is classified into chicken nuggets, chicken popcorn, chicken fingers, and chicken patty. By distribution channel, the market is classified into supermarkets/hypermarkets, convenience stores, specialty stores, and online retail. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

By type, the chicken drumstick sub-segment dominated the market in 2022. Frozen chicken drumsticks offer convenience as they are pre-cut and ready to cook. This appeals to consumers looking for quick and easy meal solutions, especially those with busy lifestyles. Chicken drumsticks are versatile and can be prepared in various ways, such as grilling, baking, frying, or barbecuing. This versatility makes them popular among consumers seeking diverse and flavorful meal options. Moreover, chicken drumsticks are often more affordable than other cuts of chicken, making them an attractive option for price-conscious consumers. This affordability is predicted to drive higher sales volumes, particularly in price-sensitive markets. Chicken is generally considered a lean source of protein, and consumers may consider chicken drumsticks as a healthier option compared to other meats. These are the major factors predicted to drive the frozen chicken market size during the forecast period.

By Product

By product, the chicken nuggets sub-segment dominated the market in 2022. Chicken nuggets are known for their convenience and ease of preparation. They are a quick and simple meal option, making them attractive to busy consumers who seek convenient and time-saving food solutions. Modern lifestyles often involve hectic schedules, leading to an increase in demand for convenient and ready-to-eat food options. Chicken nuggets fit well into this trend, catering to consumers looking for quick and hassle-free meal solutions. Chicken nuggets are versatile and can be served as a standalone snack, part of a meal, or even in various recipes. This versatility appeals to consumers looking for flexibility in their food choices. Moreover, chicken nuggets are often popular among children due to their small, bite-sized pieces and familiar taste. Therefore, parents are more likely to purchase chicken nuggets as a family-friendly option. These are the major factors predicted to boost the frozen chicken market size during the forecast period.

By Distribution channel

By distribution channel, the supermarkets/hypermarkets sub-segment dominated the global frozen chicken market share in 2022. Supermarkets and hypermarkets are known for offering a wide variety of products. A diverse range of frozen chicken products, including different species, cuts, and preparation styles, attract more consumers. The ability to cater to various tastes and cooking preferences is a significant factor driving the sub-segment growth. Consumers expect high-quality and safe frozen chicken products. Supermarkets and hypermarkets drive sales by ensuring strict quality control, proper labeling, and adherence to safety standards. Certifications such as organic, sustainable, or eco-friendly sourcing can also influence consumer choices. Pricing and promotional strategies play a vital role in attracting consumers. Supermarkets often offer discounts, bundle deals, and promotions to attract shoppers. These strategies significantly impact the sales of frozen chicken products. Consumers value convenience, and supermarkets and hypermarkets are well-equipped to provide it. These products are often competitively priced and can drive sales for the retailer while offering consumers a cost-effective option.

By Region

By region, Asia-Pacific dominated the global frozen chicken market in 2022. Urbanization and busy lifestyles have contributed to the rising preference for convenient and ready-to-cook food options, including frozen chicken products. Consumers in urban areas often seek convenient and time-saving solutions in their meal preparation, making frozen chicken a convenient choice. Improvements in cold chain infrastructure and logistics have helped maintain the quality and safety of frozen chicken products during transportation and storage. Advanced freezing technologies have allowed for better preservation of the texture and flavor of chicken, contributing to the overall appeal of frozen food. Increased globalization has facilitated the import and export of frozen chicken products across borders. This has led to a diverse range of frozen chicken being available in the regional market. Trade agreements and partnerships have further opened up markets and increased the variety of frozen chicken market demand products accessible to consumers.

Competitive Analysis

The key players profiled in this report include Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, Farbest Foods, Perdue Farms, Sanderson Farms, Inc., Hormel Foods Corporation, Inghams Group Limited, BRF S.A., and Pilgrim's Pride Corporation. Investment and agreement are common strategies followed by major market players.

Impact of COVID-19 on the Global Frozen Chicken Industry

The COVID-19 pandemic had a significant impact on the frozen chicken market. The pandemic led to disruptions in global supply chains, including the frozen chicken industry. Lockdowns, restrictions on transportation, and closures of processing facilities affected the availability of frozen chicken products. This disrupted the supply chain, leading to shortages and fluctuations in prices.

- As people stayed home more during lockdowns and avoided crowded places like restaurants, there was a shift in consumer behavior. Many consumers turned to cooking at home, leading to an increase in demand for frozen chicken products as they are convenient and have a longer shelf life.

- With concerns about virus transmission, consumers became more conscious regarding food safety. Frozen chicken products are generally considered safe because they are processed and frozen quickly after harvesting. This led to increased consumer trust and demand for frozen chicken. International trade in frozen chicken was also affected. Export restrictions and logistical challenges hindered the movement of frozen chicken products across borders, impacting both importers and exporters.

- Many restaurants, especially those specializing in frozen chicken, had to close or operate at reduced capacity during the pandemic. This led to decreased demand from the foodservice sector, which is a significant market for frozen chicken. E-commerce and direct-to-consumer sales of frozen chicken products saw significant growth during the pandemic. Consumers turned to online shopping for groceries, and many frozen chicken companies adapted by offering home delivery services.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the frozen chicken market forecast segments, current trends, estimations, and dynamics of the frozen chicken market analysis from 2022 to 2032 to identify the prevailing frozen chicken market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen chicken market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen chicken market trends, key players, market segments, application areas, and market growth strategies.

Frozen Chicken Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 46.5 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Type |

|

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | BRF S.A., Pilgrim's Pride Corporation, Perdue Farms, Inc., Cargill, Incorporated, Sanderson Farms, Inc., JBS S.A., Hormel Foods Corporation, Inghams Group Limited, Farbest Foods, Tyson Foods, Inc. |

The global frozen chicken market size was valued at USD 22.2 billion in 2022, and is projected to reach USD 46.5 billion by 2032.

The global frozen chicken market is projected to grow at a compound annual growth rate of 7.8% from 2023-2032 to reach USD 46.5 billion by 2032.

The key players profiled in the reports includes Tyson Foods, Inc., JBS S.A., Cargill, Incorporated, Farbest Foods, Perdue Farms, Sanderson Farms, Inc., Hormel Foods Corporation, Inghams Group Limited, BRF S.A., and Pilgrim's Pride Corporation.

Asia-Pacific dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

The rising consumer preferences for convenient and ready-to-cook food products, along with the desire for healthy and protein-rich options, has led to an increase in demand for frozen chicken, which is estimated to generate excellent opportunities in the frozen chicken market.

Loading Table Of Content...

Loading Research Methodology...