The global fuel cell UAV market size was valued at $1.6 billion in 2022, and is projected to reach $5.4 billion by 2032, growing at a CAGR of 13.4% from 2023 to 2032.

Key Highlighter of This Report

- The fuel cell UAV market report studies more than 16 countries. The research includes a segment analysis of each country in terms of value ($ billion) for the projection period 2022-2032.

- The study integrated high-quality data, professional opinions & analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The market share of fuel cell UAV industry is moderately fragmented, with several players including AeroVironment Inc., Ballard Power Systems, Boeing, Elbit Systems Ltd., EnergyOR, General Atomics, H3 Dynamics, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Israel Aerospace Industries (IAI), ISS Aerospace, Jadoo Power Systems, Inc., MMC-UAV, Northrop Grumman Corporation, Textron Inc., Ultra, and ZeroAvia, Inc.

The fuel cell UAV refers to unmanned aerial vehicles (UAVs) powered by fuel cell systems rather than conventional batteries or combustion engines. Fuel cells generate electricity through an electrochemical reaction, typically using hydrogen and oxygen. When used to power UAVs, they offer benefits such as extended flight times and greater payloads compared to battery-powered UAVs. The fuel cell UAV ecosystem encompasses manufacturers & suppliers of fuel cell systems & components optimized for UAV propulsion, and UAV manufacturers integrating these systems into airframe designs. Key fuel cell UAV applications include military reconnaissance & surveillance, public safety, infrastructure monitoring, agriculture, and environmental research.

Moreover, fuel cell UAVs are electrochemical devices that convert chemical energy from fuels & oxidizers, without combustion, into useful electrical energy that are used to power devices and vehicles. The cell itself does not require charging, instead it requires a steady flow of fuel and oxidizer. Moreover, these fuel cell UAV possess a higher energy-to-mass ratio than the traditional battery systems. These power modules provide over three times more flight endurance to commercial unmanned aerial vehicles.

In addition, the institute working on R&D of renewable energy partnered with aviation companies to work on storage system of fuel cell UAV. For instance, in September 2023, the National Renewable Energy Laboratory (NREL) partnered with Honeywell Aerospace on a one-year effort to prototype and commercialize an innovative hydrogen storage system for unmanned aerial vehicles. The project centers on NREL's fuel additives for solid hydrogen carriers in electric aviation concept to enhance performance of hydrogen-powered drone systems. Initial development of the cartridge-based storage solution stems from NREL research funded by the Department of Energy's Hydrogen and Fuel Cell Technologies Office. By working with Honeywell to mature the technology and assess market applications, the partners aim to scale up the novel approach to supplying hydrogen fuel for longer-endurance commercial and defense UAVs.

The global fuel cell UAV market is characterized by fragmentation, with numerous market participants operating globally. Market participants are focused to develop their sales footprints by entering into long-term contracts & agreements with the military and law enforcement agencies among others. For instance, in November 2021, ZeroAvia, Inc. signed an agreement with ASL Aviation Holdings for the conversion of its ATR 72 freighters with fuel cell powered hydrogen electric engines. Under the deal, Ireland-headquartered ASL is expected to provide a retired ATR 72 freighter for the development effort and to subsequently serve as a demonstrator aircraft. Moreover, rise in public-private partnerships result in faster adoption of fuel cell-based applications.

Government regulations and rules have been imposed by several regulators to control the operations of the unmanned aerial vehicle (UAV) across the globe. Agreements & contracts with law enforcement and military agencies, partnership, product development, and product launch activities are key strategies adopted by market players. For instance, in December 2021, H3 Dynamics launched its hydrogen drone equipped with H3 Dynamics’ AEROSTAK hydrogen fuel cell system, developed by Drone Works and with integration support by Nexty Electronics Co. Ltd., in Japan. The new generation hydrogen drone is equipped with a small composite container for high-pressure hydrogen developed by JFE Container Co. Ltd. & H3 Dynamics.

Factors such as rise in demand for improved surveillance, increase in need for higher payload capacity UAVs, and supportive growth through regulatory compliance are expected to drive the growth of the fuel cell UAV market. However, increase in security issues & cyber threat and high cost of fuel cells for UAV solutions restrain the growth of the market. On the contrary, technological advancements in military applications and rise in public-private partnerships are projected to offer lucrative growth opportunities for the market players.

Segment Review

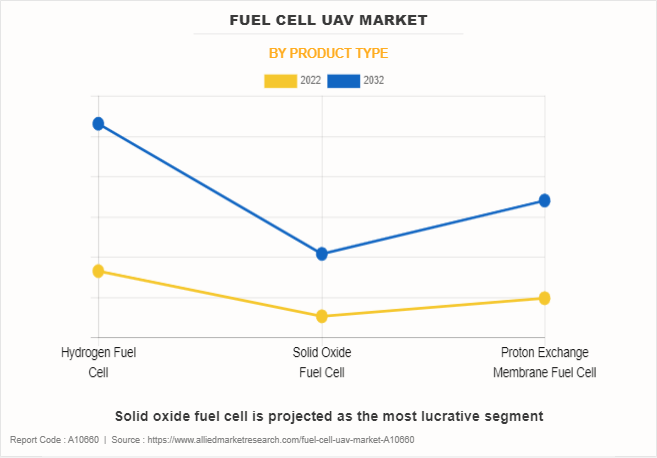

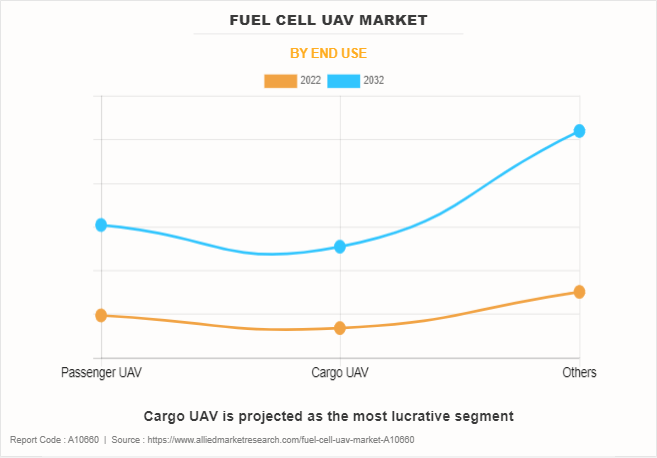

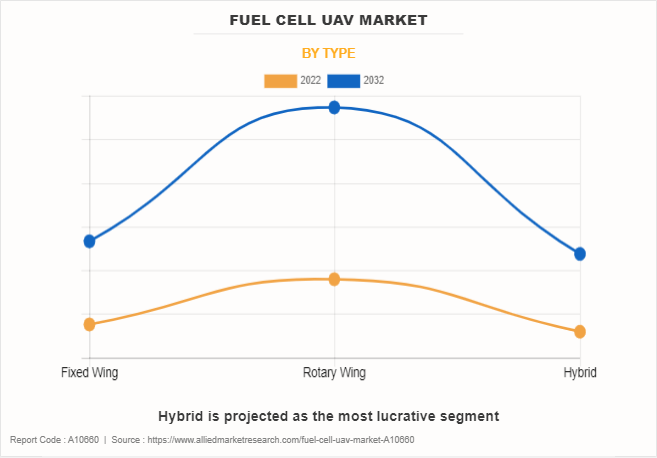

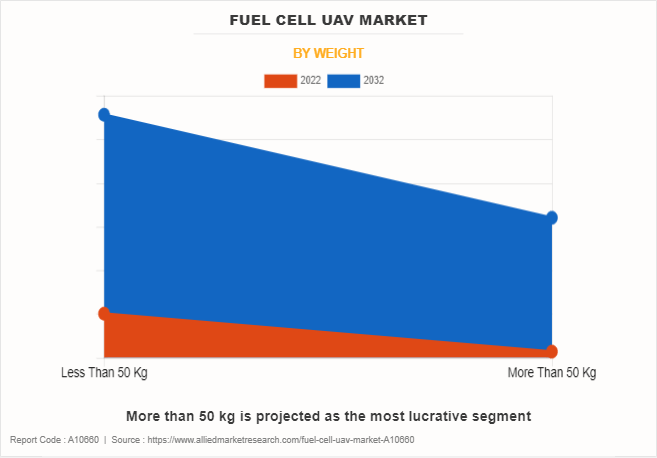

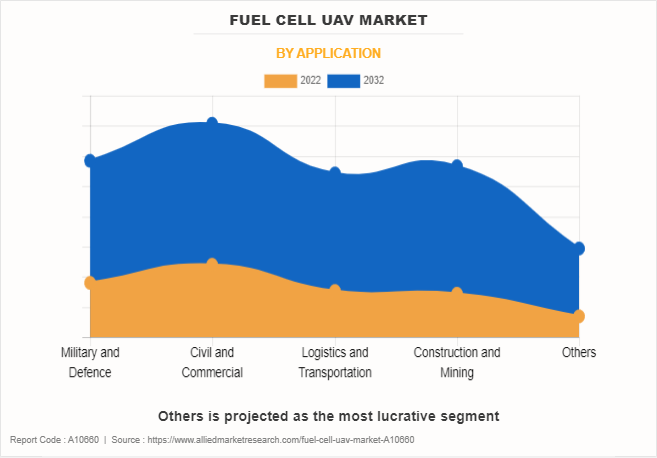

The fuel cell UAV market is segmented into product type, end use, type, weight, application, and region. By the product type, the market is segregated into hydrogen fuel cells, solid oxide fuel cells, and proton exchange membrane fuel cell. Depending on end use, it is categorized into passenger UAV, cargo UAV, and others. According to type, the market is divided into fixed wing, rotary wing, and hybrid. By weight, it is bifurcated into less than 50Kg and more than 50kg. Depending on application, the market is classified into military & defense, civil & commercial, logistics & transportation, construction & mining, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Leading companies profiled in the fuel cell UAV industry report include AeroVironment Inc., Ballard Power Systems, Boeing, Elbit Systems Ltd., EnergyOR, General Atomics, H3 Dynamics, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Israel Aerospace Industries (IAI), ISS Aerospace, Jadoo Power Systems, Inc., MMC-UAV, Northrop Grumman Corporation, Textron Inc., Ultra, and ZeroAvia, Inc.

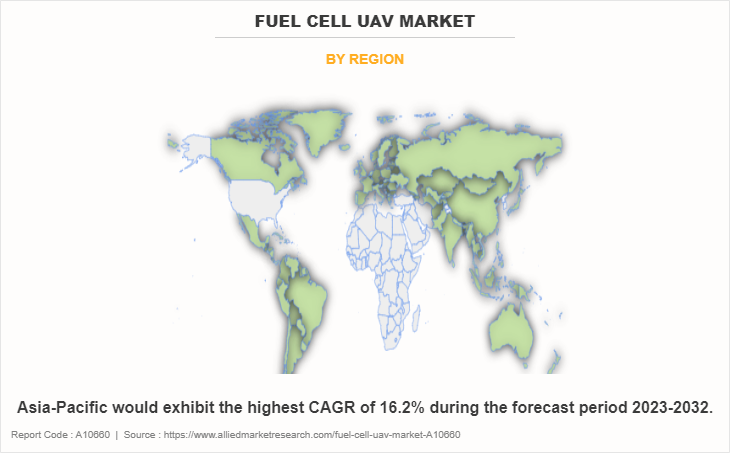

North America is expected to dominate the global fuel cell UAV market during the forecast period, capturing the largest revenue share. The U.S. accounts for most of the North American market owing to sizable defense spending and rise in the adoption of commercial drones across industries such as infrastructure, agriculture, and utilities & more. In December 2023, the Federal Aviation Administration (FAA) released an update on the status of drones in the U.S. According to their report, there are currently 790,918 registered drones in the country, with 369,528 of them being registered as commercial drones.

Moreover, the U.S. institute collaborated with other research institute to develop advanced system to better utilize fuel cells. For instance, in February 2024, Harvard University from U.S. and researchers from Incheon National University in South Korea jointly developed a new membrane material to improve the durability of hydrogen fuel cells. By incorporating a fluoropolymer called perfluoropolyether (PFPE), they created an enhanced membrane that makes fuel cells more resistant to degradation over time. Through testing various PFPE compositions, the team found a 50% PFPE ratio delivered high performance and longevity. This modified membrane lasted 410 hours in trials, compared to 242 hours for an unmodified version. The researchers concluded that the PFPE-enhanced membrane increased overall fuel cell lifespan by 1.7 times.

In addition to environmental footprint, hydrogen UAVs provide greater flight endurance with many multirotor and able to extend mission times from a typical 30 or 40 minutes to several hours. In addition, it is expected to be refilled rapidly, whereas batteries take many hours to fully recharge. For instance, in February 2021, Northwest UAV (NWUAV) completed a prototype hydrogen fuel cell that has been developed in conjunction with the U.S. Naval Research Laboratory (NRL). The fuel cell has been specifically designed to meet the high power-to-weight ratio and different power requirements of a broad range of unmanned systems. Comprehensive fuel cell UAV market analysis reveals promising growth potential and technological advancements.

Growth In Demand for Improved Surveillance

Rise in threat from terrorism and increase in security concerns globally have led to increased government expenditure for fuel cell UAVs. The fuel cell UAV solutions have wide range of applications in military & defense, civil & commercial, logistics & transportation, and construction & mining, and others for effective observations of assets and surveillance of the areas for gaining the optimum operational effectiveness. Such benefits have led to an increase in investments by governments to procure and develop many UAVs globally. For instance, in August 2021, ZeroAvia, Inc. entered a partnership with Octopus Hydrogen, a subsidiary of Octopus Energy Group to power its HyFlyer II project a UK Government-backed programme to develop a certifiable 600 kW hydrogen-electric fuel cell powertrain, which is expected to power a 19-seat aircraft with 500 nautical mile range.

Moreover, security of key institutions has been greatly enhanced with advanced video surveillance and access control systems. The fuel cell UAV is used for tactical planning and surveillance of major events or gatherings in large cities. Such factors are expected to fuel the growth of the global fuel cell UAV market during the forecast period.

Increased Need for Higher Payload Capacity UAVs

Unmanned aerial vehicles (UAVs) are being used for an expanding range of commercial and military applications. Many of these applications, such as aerial surveying, cargo delivery, and battlefield reconnaissance, require the UAV to carry heavy sensor payloads. Battery-powered UAVs have limited flight times that constrain payload capacity and operational range. Fuel cell systems are increasingly being integrated into UAV designs to overcome these limitations.

Moreover, major market players are partnering to develop advanced storage systems for UAVs and improve their service performance. For instance, in September 2023, Honeywell partnered with the National Renewable Energy Laboratory (NREL) in the USA to create a prototype of a special hydrogen fuel storage system for drones. This project, called FLASH, utilizes a new technology developed by NREL that uses a solid material to rapidly release hydrogen gas for use in a fuel cell. This material holds a lot of hydrogen and works well even at low temperatures, around 100°C (212°F). The plan is to connect these hydrogen cartridges to a fuel cell, which allows drones to fly longer distances and carry heavier loads.

Furthermore, fuel cells enable significantly longer flight times than batteries of the same weight. By reducing the battery and power system weight needed for a long duration flight, more capacity is available for sensor, computing, or cargo payloads. Lighter and more capable fuel cell systems tailored for aviation use are driving demand for high payload capacity UAVs. As payloads get larger and missions more complex, fuel cell systems become an enabling technology to support growth in the high payload UAV segment.

Increase In Security Issues and Cyber Threat

The cyber threat to the aviation industry has increased at a considerable rate in the recent past. Instances, such as hacking an aircraft system that includes video surveillance systems have negatively affected the commercial fuel cell UAV market growth. In November 2021, according to Chinese officials, a foreign intelligence agency hacked into several Chinese airlines and stole passenger data. According to the National Aeronautical and Space Administration (NASA), unmanned traffic management (UTM) is a bit different than the air traffic control system used by the Federal Aviation Administration (FAA) for commercial airplanes. In addition, UTM systems share real-time information with fuel cell UAV or drone pilots for operating safely and managing operations according to information.

Such information is transferred through a distributed network of highly automated systems via application programming interfaces (API), excluding voice communication. As a result, cyber threats or data breaches mislead drone operators via UTM systems. Consequently, this has an adverse effect on the expansion of the market.

High Cost of Fuel Cells for UAV Solutions

Fuel cell UAV are quite valuable for defense forces as they are designed to perform a variety of operations, for instance, situational awareness, disarm bombs, provide aid to soldiers on the battleground, and help in search & rescue operations. Currently, various nations globally use UAVs for search operations, surveillance, rescue operations, and transportation. However, they incur huge costs for the military. The high costs of fuel cell UAVs make their adoption limited to the developed nations that have a huge defense spending capability. Hence, this factor is anticipated to hinder the growth of the global fuel cell UAV market during the forecast period.

While fuel cell technology offers extended flight times and higher payload capacities compared to battery-powered UAVs, the fuel cell systems currently integrated into UAV platforms come at a premium cost. Fuel cell solutions require the fuel cell stack that generates electricity and supports subsystems for hydrogen storage & distribution, cooling, humidity control, and power electronics. When these full fuel cell system costs are factored into the total UAV platform price, they become 3-4 times higher than similarly sized battery-powered UAVs. Many commercial and military buyers have thin margins or restricted budgets that make adoption of fuel cell UAVs challenging despite their technical capabilities.

Technological Advancements in Military Applications

Technological advancements in the fuel cell UAV market have been profoundly attracting the military and commercial segments toward the procurement of the latest models. Moreover, incorporation of eco-friendly propulsion systems, such as fuel cells and solar cells is proliferating the growth of the global market. Manufacturers of UAV have been consistently working on reducing the weight of vehicles, since, in a UAV, around 40% of weight is of the power source and fuel tank.

Furthermore, they have launched UAVs that carry light to heavy loads for military applications. For instance, in November 2023, HevenDrones, an Israeli manufacturer, launched two new hydrogen-powered drones known as the H2D200 series. These drones, the H2D200 and H2D250, are designed for various purposes ranging from last-mile delivery to military resupply. The H2D200, the smaller of the two models, carries payloads of up to 10 pounds. It boasts a range of about 275 nautical miles (nm) and a flight time of up to four hours.

In addition, it cruises at a speed of approximately 63 mph (55 knots) with fixed wings and has precision hovering capabilities. The H2D250, on the other hand, provides comparable cruise speed and hovering capabilities as the smaller model, while boasting a greater payload capacity of up to 22 pounds. With a range of 466 nautical miles (405 nm) and an operational time of up to eight hours, it is well-suited for advanced logistics missions. Such developments provide opportunities in the fuel cell UAV industry.

Impact of Russia-Ukraine War on Fuel Cell UAV Industry

The conflict between Russia and Ukraine has disrupted global supply chains, especially for critical materials and components used in the manufacture of fuel cell UAVs. Ukraine is a major producer of raw materials such as titanium, which is essential for aerospace manufacturing. Disruptions in the supply of these materials lead to delays in production and rise in costs for UAV manufacturers. The increase in concerns between Russia and Ukraine has raised geopolitical risks, causing apprehension regarding security and stability in the region. This uncertainty impacts investment decisions and market confidence, affecting the growth prospects of the fuel cell UAV industry. Companies hesitate to expand operations or enter new markets due to unpredictable geopolitical situations.

The Russia-Ukraine conflict has created market uncertainties, including fluctuation in fuel prices, currency exchange rate fluctuations, and changes in regulatory environments. These uncertainties affect the demand for fuel cell UAVs, as customers postpone or cancel orders due to economic instability or geopolitical risks. In addition, uncertainty surrounding trade relations and export controls hinder the international expansion of fuel cell UAV manufacturers. Overall, the Russia-Ukraine war introduces various challenges and risks for the fuel cell UAV industry, including supply chain disruptions, geopolitical concerns, and market uncertainties.

Recent Developments in the Fuel Cell UAV Industry

- In April 2023, DroneUp, the drone delivery company partnered with Walmart, announced plans to conduct tests on new hydrogen fuel cell technology aimed at extending a drone's flight time to between two and five hours. The technology is developed by South Korea's Doosan Mobility Innovation (DMI), which is working on creating one of the first open-source hydrogen-fuel-cell powered motorcycles in collaboration with the Massachusetts Institute of Technology's Electric Vehicle Team.

- In January 2022, Southern California Gas Co. (SoCalGas) partnered with Doosan Mobility Innovation (DMI) and GTI to introduce DMI's innovative hydrogen drone technology at the CES Las Vegas summit. With support from SoCalGas and GTI, DMI showcase its DS30 drone system, which features cutting-edge fuel cell powerpack technology, providing up to 120 minutes of flight time and a maximum payload of up to 11 pounds. Fueled by hydrogen, the DS30 drone efficiently monitors a 1-mile-long pipeline in a single flight. SoCalGas intends to utilize the DS30 drone for natural gas pipeline inspections, leveraging its advanced imagery and aerial mapping capabilities to enhance pipeline system maintenance.

- In June 2022, Intelligent Energy Limited signed a manufacturing agreement with Hogreen Air, a manufacturer of hydrogen fuel cells and intelligent tech products to manufacture hydrogen fuel cells in South Korea. This provided Intelligent Energy Limited the opportunity to offer a wider range of products across drones & automotive segment in South Korea and the Southeast Asian region.

- In March 2021, Insitu, a subsidiary of Boeing developed ScanEagle3, an all-electric UAV powered by a hydrogen-fueled proton exchange membrane (PEM) fuel cell. This unmanned aerial vehicle (UAV) has conducted various test flights over the last few months. It went on its flight mission in December last year (2020) and remained in the air for half an hour.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current fuel cell UAV market trends, estimations, and dynamics of the market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Fuel Cell UAV Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.4 billion |

| Growth Rate | CAGR of 13.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 348 |

| By Product Type |

|

| By End Use |

|

| By Type |

|

| By Weight |

|

| By Application |

|

| By Region |

|

| Key Market Players | Textron Inc., Plug Power Inc., Boeing, Northrop Grumman, Elbit Systems Ltd., AeroVironment Inc., Barnard Microsystems Ltd., ISS Aerospace, Horizon Fuel Cell Technologies, EnergyOR Technologies |

Largest regional market for Fuel Cell UAV is North America.

Leading application of Fuel Cell UAV Market is Civil and Commercial.

Upcoming trends of Fuel Cell UAV Market are technological advancements in military applications and rise in public-private partnerships.

The global fuel cell UAV market was valued at $1.6 billion in 2022, and is projected to reach $5.4 billion by 2032, growing at a CAGR of 13.4% from 2023 to 2032.

Key players operating in the fuel cell UAV market are AeroVironment Inc., Ballard Power Systems, Boeing, Elbit Systems Ltd., EnergyOR, General Atomics, H3 Dynamics, Horizon Fuel Cell Technologies, Intelligent Energy Limited, Israel Aerospace Industries (IAI), ISS Aerospace, Jadoo Power Systems, Inc., MMC-UAV, Northrop Grumman Corporation, Textron Inc., Ultra, and ZeroAvia, Inc.

Loading Table Of Content...

Loading Research Methodology...