Fullerene Market Research, 2031

The global fullerene market was valued at $467.5 million in 2023, and is projected to reach $754.5 Million by 2031, growing at a CAGR of 6.2% from 2024 to 2031

Market Introduction and Definition

Fullerenes are carbon molecules structured in hollow spheres, ellipsoids, or tubes, comprising pentagonal and hexagonal arrangements of atoms. Named after Buckminster Fuller, they exhibit unique properties. Fullerene structures, such as C60, possess high stability due to the arrangement of carbon atoms, making them resistant to high temperatures and pressures. They conduct electricity, exhibit superconductivity, and absorb & emit light. Moreover, their spherical shape enables versatile applications in medicine, electronics, and materials science, including drug delivery systems, nanotechnology, and catalysts. Fullerene derivatives are used in various fields due to their remarkable properties and customizable functionalities.

Key Takeaways

- The Fullerene market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2024-2031.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The expanding medical and pharmaceutical industries are poised to significantly drive the growth of the fullerene market. Fullerene, a unique form of carbon molecule known for its exceptional properties, is increasingly finding applications in various medical and pharmaceutical fields. One of the primary drivers of this growth is the potential of fullerene in drug delivery systems. Fullerene's hollow, cage-like structure allows it to encapsulate drugs, protecting them from degradation and improving their bioavailability. Moreover, research indicates that functionalized fullerenes possess antioxidant properties, which makes them treat conditions related to oxidative stress, such as neurodegenerative diseases and cancer. In addition, fullerene derivatives show potential in diagnostic imaging due to their ability to interact with biomolecules and emit detectable signals, aiding in early disease detection.

Furthermore, fullerene-based nanomaterials have potential use in tissue engineering and regenerative medicine, where they serve as scaffolds for cell growth and differentiation. According to AstraZeneca's study, global pharmaceutical sales are expected to total $2.025 trillion by 2026. The U.S. dominates the majority of the world's pharmaceutical market due to its huge pharmaceutical sector. The overall sales of pharmaceutical items in the U.S. in 2022 was valued at $605 billion, compared to $ 556 billion in 2021. In 2022, the U.S. constituted 49.8% of global sales, compared to 49.7% in 2021. As the demand for innovative healthcare solutions continues to rise, the versatile applications of fullerenes are likely to fuel market growth, positioning them as integral components in the medical and pharmaceutical sectors.

The high price and toxicity of fullerene indeed pose significant challenges to the growth of the market. Fullerene, a unique carbon allotrope with promising applications in various industries such as electronics, medicine, and energy, faces barriers due to its production costs and potential health risks. The complex synthesis process involved in producing fullerene contributes to its high price, limiting its accessibility for widespread commercial use. In addition, concerns about its toxicity are the main challenging factor, especially in fields such as biomedical research where safety is important. While fullerene demonstrates immense potential in areas such as drug delivery systems and renewable energy technologies, its adoption is hindered by these cost and safety issues. To mitigate these challenges, research efforts should focus on developing more cost-effective synthesis methods and thoroughly assess the safety profile of fullerene-based products. Regulatory measures and public awareness campaigns play crucial roles in addressing concerns regarding its toxicity, thereby fostering a more conducive environment for the growth of the fullerene market.

Fullerene's appropriate physical and chemical qualities allow it to be used in many end-use industries. Medical, pharmaceutical, electrical & electronic, cosmetics, energy, and aerospace are among the main sectors. In 2020, according to the European Federation of Pharmaceutical Industries and Associations, North America accounted for 49.0% of global pharmaceutical sales, followed by Europe at 23.9%. Extensive research has been done in the fullerenes to explore potential new industrial applications. Fullerene is used with other materials as an active catalyst. Therefore, the main goal of the research is to determine fullerene's potential in each application and to create more affordable and ecologically friendly products than other commercially accessible alternatives. Among many additional possible uses for fullerene are microscopic ball bearings, neuronal protectors for the treatment of Parkinson's and Alzheimer's disease, and rocket fuels. Thus, its potential use in novel applications and extensive R&D in the field of fullerene is driving offering lucrative opportunities to the growth of the market.

Market Segmentation

The fullerene market is segmented into product type, form, end-user industry, and region. By product type, the market is classified into C60, C70, C76, and others. By form, the market is divided into buckminsterfullerene, endohedral fullerene, herbal fullerenes, buckyball clusters, nanotubes, megatubes, and others. By end-user industry, the market is categorized into medical, aerospace & defense, electrical & electronics, cosmetics, pharmaceuticals, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

Top Fullerene Companies and their Product Offerings Sr.No Company Name Headquarters Product or Service Offerings 1 Nano-C Westwood, MA, U.S. Manufactures carbon nanostructured materials, such as carbon nanotubes and fullerenes for energy and electronics applications. 2 NanoMaterials, Ltd. Yavne, Israel Manufactures fullerene-based nanomaterials for lubrication and surface treatments. 3 Merck KGaA Darmstadt, Germany Manufactures fullerenes and other nanomaterials for research and industrial applications, particularly in electronics and pharmaceuticals. 4 Nanocyl SA Sambreville, Belgium Manufactures carbon nanotubes and fullerenes for applications in electronics, energy storage, and composites. 5 Frontier Carbon Corporation Tokyo, Japan Manufactures fullerenes (C60, C70), fullerene derivatives, and carbon nanotube materials 6 MER Corporation Tucson, AZ, U.S. Manufacturers and supplies fullerenes, fullerene derivatives, endohedral metallofullerenes, and other carbon nanomaterials

The major players operating in the fullerene market include Nano-C, BuckyLabs HealthSpan Plus Labs, , Mitsubishi Chemical Holdings, IoLiTec Ionic Liquids Technologies GmbH, NetScientific PLC, SES Research Inc., Nanografi Nano technology, Luna Industries Incorporated, Neotech Products Pvt Ltd., Solenne BV.

Recent Key Strategies and Developments

- In April 2024, Mitsubishi Corporation (MC) and Denka Company Ltd. formed a strategic partnership to increase their position in the fullerene market, a specialist sector of nanotechnology. Through this collaboration, the discovery and use of fullerenes—carbon compounds with remarkable qualities and boundless potential—is expected to be accelerated.

- In November 2021, the U.S. company Nano-C created carbons for use in energy and electronics. For the layers of its OPV films, ASCA uses materials from the company, such as fullerenes and all its derivatives. The closed, hollow molecules are prepared for OPV applications due to their electrical characteristics and chemical modification of the element carbon. The most recent fullerene-based electron acceptors from Nano-C can be produced roll-to-roll to produce gray OPV modules that satisfy the color requirements of the building and architectural sectors. To fortify their connection going forward, the two businesses have inked a partnership agreement.

- In May 2021, SIDAI declared the release of its newest product, the "SIDAI Fullerene Sanitary Napkin." The list of raw ingredients includes fullerene to produce a clean smell and inhibit bacterial growth, as well as graphene dual-function devices. The business considers it a remarkable accomplishment in the private parts care sector. The company's most recent sanitary napkins are designed with skincare in mind, providing menstruation ladies with a selection of care options that benefited all female customers.

- In July 2020, Nano-C formed a collaboration with Unify Pharmaceuticals, which has begun clinical studies for pharmacological therapy for neurological diseases and COVID-19. Through this collaboration, Unify used Nano-C's fullerene as an active pharmaceutical ingredient for its medicinal uses.

Regional Market Outlook

Asia-Pacific has experienced robust economic growth. The demand for fullerene in the Asia-Pacific region is surging, driven by the expansion of key industries such as aerospace, defense, electronics, medical, and pharmaceuticals in China, India, and Japan. Fullerenes, with their unique chemical properties, are essential in developing advanced materials and technologies. In aerospace and defense, they enhance the performance of composite materials. In electronics, they are pivotal in producing high-performance semiconductors and nanotechnology applications. The medical and pharmaceutical sectors leverage fullerenes for drug delivery systems and innovative therapies. This industrial growth propels the fullerene market, making the Asia-Pacific a significant player in its global demand.

- China is expected to become the world's largest single-country market for civil aircraft manufacturing over the next 20 years. The Boeing Commercial Outlook 2022-2041 projects that 8, 485 new deliveries with a market service value of $ 545 billion will be made in China by 2041.

- Furthermore, by 2041, 4, 255 fresh deliveries with a market service value of $ 245 billion will be made in Southeast Asia. The demand for the fullerene is expected to increase as a result of these fresh deliveries in Southeast Asia.

- India launched a comprehensive campaign to build the nation's ecosystems to produce semiconductors and displays. An announcement of $10 billion (INR 76 thousand crore) was made by the government. The government provides fiscal support for 50% of the project cost to set up semiconductor and display fabs as well as 50% of the capital expenditure for compound semiconductor fabs.

- The explosive growth of the pharmaceutical and medical industries in countries like China, India, and Japan is driving up demand for fullerene in the Asia-Pacific region. China is one of the biggest markets for pharmaceutical products in the Asia-Pacific region. The AstraZeneca analysis projects that the nation's pharmaceutical sales will reach $ 189 billion by 2026, which will raise the need for effective medications.

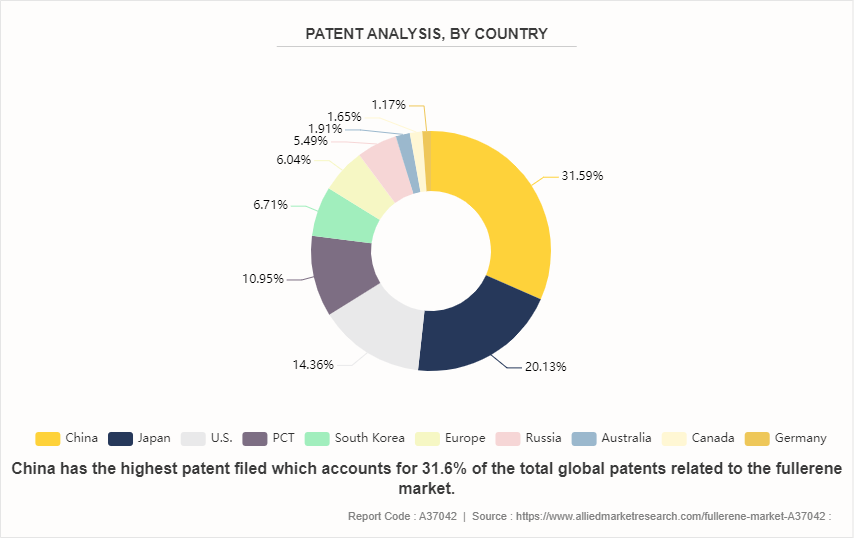

Patent Analysis of Global Fullerene Market, by Country

Patent analysis of the fullerene market reveals a dominant presence of China, accounting for 31.60% of patents, followed by Japan at 20.13% and the U.S. at 14.36%. The Patent Cooperation Treaty (PCT) contributes 10.95%, indicating international interest. Other significant players include the South Korea (6.71%) , Europe (6.04%) , and the Russi (5.49%) . This distribution reflects a strong Asian presence, underscoring regional innovation and investment. Notably, the top countries exhibit a concerted effort in R&D within the fullerene domain, indicating its strategic importance in various technological advancements and industrial applications.

Industry Trends

- Nine GW-scale solar markets have reportedly installed more than 1 GW of solar in 11 different countries, according to Solar Power Europe. According to additional projections, there might be a rapid increase in the number of countries to 16. For example, annual additions to the installed PV capacity in the U.S. reached 15.8 GW in 2023, a 14% increase from the previous year. The fullerene market is anticipated to be driven by the expanding energy (solar) sector during the forecast period.

- The growth of the pharmaceutical and medical sector in the U.S. drives demand for fullerene. For instance, the U.S. Bureau of Labor Statistics projects that the healthcare sector is expected to employ 2.6 million people in the nation by 2030, growing at a rate of 16% between 2020 and 2030. The aging population's growing demand for healthcare services is the primary cause of the U.S.'s healthcare industry's rise.

- According to Commonwealth Fund, the U.S. spends approximately 17% of its GDP on healthcare, which is an expensive system. The need for innovative materials for the pharmaceutical and medical industries in North America has increased due to the expansion of the healthcare sector, the necessity for cutting-edge healthcare procedures, and a rise in healthcare spending.

- Partnerships and collaborations among key players are set to drive the growth of the fullerene market. These alliances enhance R&D, streamline production processes, and expand application areas, thereby boosting market expansion and technological advancements.

- For instance, in May 2023, Voyageur Pharmaceuticals Ltd. and Rain Cage Carbon Inc. announced a ground-breaking development and licensing collaboration. Through the development and production of state-of-the-art nanocarbon/fullerene-based contrast agents, this partnership seeks to transform medical imaging by utilizing Rain Cage's ground-breaking carbon capture technology.

- In February 2023, the Institute of Minerals and Materials Technology (IMMT) , Bhubaneswar in India, and the Andhra Pradesh Mineral Development Corporation (APMDC) in India collaborated to study and commercialize fullerene, a valuable mineral that is abundant in the state. This partnership aims to transform an undervalued resource into a useful one by extracting and refining fullerene from the current mines.

Key Sources Referred

- Solar Power Europe

- Andhra Pradesh Mineral Development Corporation

- European Federation of Pharmaceutical Industries and Associations

- India Brand Equity Foundation (IBEF)

- Boeing Commercial Outlook 2022-2041

- AstraZeneca report

- U.S. Bureau of Labor Statistics

- Commonwealth Fund

- European Federation of Pharmaceutical Industries and Associations

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the fullerene market analysis from 2024 to 2031 to identify the prevailing fullerene market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fullerene market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fullerene market trends, key players, market segments, application areas, and market growth strategies.

Fullerene Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 754.5 Million |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2031 |

| Report Pages | 300 |

| By Product Type |

|

| By Form |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | Mitsubishi Chemical Holdings, NANO-C, Luna Industries Incorporated, Nanografi Nano technology, BuckyLabs HealthSpan Plus Labs, Solenne BV, IoLiTec Ionic Liquids Technologies GmbH, NetScientific PLC, Neotech Products Pvt. Ltd, SES Research Inc. |

Medical is the leading end-user industry of Fullerene Market.

Asia-Pacific is the largest regional market for Fullerene.

Nano-C, BuckyLabs, Mitsubishi Chemical Holdings, IoLiTec Ionic Liquids Technologies GmbH, NetScientific PLC, SES Research Inc., Nanografi Nano technology, Luna Industries Incorporated, NeoTechProducts, Solenne BV. are the top companies to hold the market share in Fullerene.

Emerging applications in energy storage and conversion is the upcoming trend of Fullerene Market in the globe.

Loading Table Of Content...