Furniture Market Research, 2034

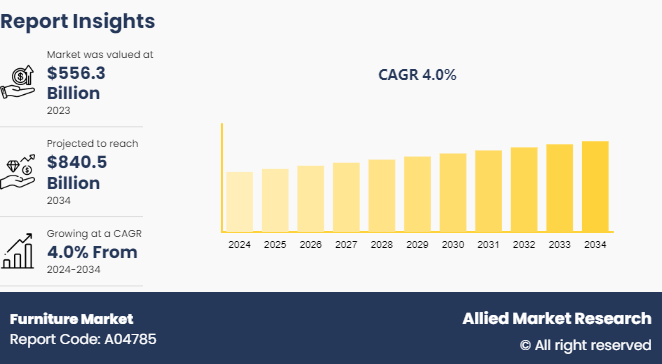

The global furniture market size was valued at $556.3 billion in 2023, and is projected to reach $840.5 billionby 2034, growing at a CAGR of 4.0% from 2024 to 2034. Furniture comprises movable objects designed to support human activities like seating, sleeping, and storage. Furniture is classified in different types which include chairs, tables, beds, sofas, cabinets, and desks. It is used as chairs and sofas provide seating, tables facilitate dining and work, beds offer a place for rest, and cabinets and desks provide storage and organization solutions.

Furniture enhances functionality, comfort, and aesthetic appeal in homes, offices, and public spaces. Furniture design reflects cultural and stylistic trends, often serving as a medium for artistic expression. Quality furniture balances form and function and contributes to the overall atmosphere and usability of a space.

Key Takeaways

The furniture market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Urbanization and housing development is anticipated to significantly boost demand in the market. As more people move to urban areas, the construction of residential buildings increases, creating a higher need for furnishing new homes. This migration often leads to the development of smaller living spaces, prompting consumers to seek multifunctional and space-saving furniture.

Urban dwellers prioritize both aesthetics and functionality, driving demand for modern, stylish, and compact furniture solutions that fit into limited spaces. In addition, housing development projects often include a range of housing types, from affordable apartments to luxury condos, each requiring different styles and qualities of furniture. This diversity expands the market for various furniture segments, including budget-friendly options and high-end designs. Furthermore, urbanization drives the growth of rental markets, where frequent relocation encourages the purchase of new furniture and contributes to the furniture market growth.

The high cost of raw materials restrains the demand for furniture market by directly impacting production expenses. Fluctuations in the prices of materials such as wood, metal, and textiles can lead to increased manufacturing costs, squeezing profit margins for furniture manufacturers. As a result, companies may be forced to either absorb these costs, which eat into their profits, or pass them on to consumers through higher prices, potentially reducing the demand.

Moreover, the volatility of raw material prices can create uncertainty in production planning and budgeting for furniture manufacturers. This uncertainty hinders long-term investment decisions and strategic planning, as companies may be reluctant to commit to large-scale production or expansion projects in the face of unpredictable material costs. In addition, it also led to supply chain disruptions if manufacturers struggle to secure necessary materials at stable prices, further impacting production timelines and availability of products in the market.

Furthermore, the high cost of raw materials presents a complex challenge for the furniture industry which constrain the growth and profitability of furniture market share. Thus, all these factors limit the furniture market demand.

Customization and personalization offer significant opportunities in the market by catering to individual preferences and tastes. Providing customers with the option to tailor furniture pieces to their specific needs allows manufacturers to differentiate themselves from competitors and tap into niche markets. Customization enables consumers to create unique and personalized pieces that align with their aesthetic preferences, lifestyle, and functional requirements, thereby enhancing customer satisfaction and loyalty.

Moreover, offering customization and personalization services also lead to higher profit margins for furniture manufacturers. By allowing consumers to choose specific materials, colors, sizes, and features, companies justify premium pricing for personalized products, potentially increasing revenue per sale. Customization fosters a deeper emotional connection between consumers and their furniture, as individuals feel a sense of ownership and pride in designing pieces that reflect their personal style and identity.

Furthermore, customization and personalization represent a key avenue for furniture companies to innovate, expand their product offerings, and capitalize on diverse consumer preferences in the market.

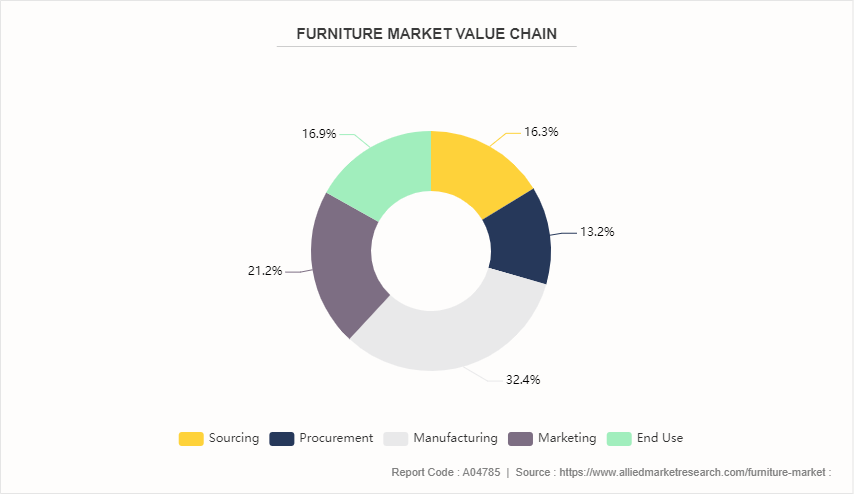

Value Chain of Global Furniture Market

The value chain and furniture market statistics begins with the sourcing of raw materials like wood (solid wood, engineered wood, veneers) , metals (steel, aluminum) , plastics, fabrics, foams, and other required materials from suppliers and vendors. The next stage is design and product development, which involves market research to analyze trends and consumer preferences. Designers then conceptualize new furniture styles and create prototypes and samples for evaluation. Once designs are finalized, the manufacturing phase commences. It starts with wood processing activities like sawing, drying, and treatment. This is followed by cutting, shaping, and joining of components made from wood, metal, or other materials.

In addition, upholstering with fabrics and foams takes place for certain furniture pieces before final assembly. Finishing processes like staining, painting, and polishing are then applied, with stringent quality control and testing measures. The distribution and logistics stage covers warehousing of the finished furniture products and their transportation to retail stores, distribution centers, or direct to customers.

For global market, export and import activities facilitate international trade. Marketing and sales are a crucial phase, involving branding and advertising campaigns to promote furniture lines. In-store merchandising and displays aid product positioning. Furthermore, e-commerce platforms and online marketing efforts also drive sales to residential, commercial, and institutional buyers.

Market Segmentation

The furniture market is segmented into type, material, distribution channel and region. On the basis of type, the market is divided into residential, office and outdoor furniture. As per material, the market is segregated into wood, metal, plastic. On the basis of distribution channel, the market is bifurcated into online sales channels and offline stores. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

The Asia-Pacific region stands out as a prominent and rapidly expanding hub within the global furniture market, driven by robust economic growth and urbanization trends across its diverse nations. A major driver of this growth is the flourishing residential furniture segment, sustained by a surge in new housing developments, renovation projects, and evolving consumer preferences favoring modern and practical furniture designs. The demand is particularly strong for many furniture categories including living room, bedroom, dining room, and kitchen furniture.

Moreover, leading the charge in the Asia-Pacific furniture landscape are powerhouse economies such as China, India, and Japan, each characterized by unique market dynamics, consumer behaviors, and regulatory landscapes shaping furniture demand and sales. Notably, there is a noticeable shift toward sustainability and eco-conscious practices in the region's furniture sector.

Manufacturers are increasingly adopting sustainable materials, greener production techniques, and recycling initiatives in response to growing consumer demand for environmentally friendly furniture options. This evolving focus underscores a broader trend toward sustainability and responsible consumption in the Asia-Pacific furniture market.

Industry Trends:

According to an article published by the Joint Center for Housing Studies (JCHS) of Harvard University in 2021, 71% of homeowners in America who started a DIY project during the pandemic had already planned the project prior to the outbreak. Also, the article further elaborates that though the percentage share of DIY spending as part of home expenditure has been showcasing a decreasing trend in the years between 2011 to 2022, the overall home improvement market is expected to increase strongly in the coming years which is expected to increase the overall spending on DIY activities.

With the rise of smart home technology, there is an increasing interest in furniture with integrated tech features such as wireless charging capabilities, built-in speakers, and IoT connectivity. The smart furniture market is projected to grow in the coming years.

Competitive Landscape

The major players operating in the furniture market include Inter IKEA Group, Ashley Furniture Industries Inc., Durham Furniture Inc., American Signature, Raymour & Flanigan, Jason Furniture (HangZhou) Co., Ltd, Oppein Home Group Inc., La-Z-Boy Inc., Kimball International and Williams-Sonoma, Inc.

Recent Key Strategies and Developments

In February 2023, The Inter IKEA Group launched a new transitional range featuring three collections aimed at inspiring households to adopt more sustainable buying habits. The collections, namely Vivid Wonderland, Glorious Green, and Simple Serenity, are designed to encourage consumers to make eco-friendly choices in their purchases.

In September 2022, Durham Furniture Inc. collaborated with Intiaro, a technology company specializing in 3D solutions, to enhance the online and in-store experience through advanced 3D strategy and visualization tools.

Key Sources Referred

U.S. Bureau

Consumer Product Safety Commission

Environmental Protection Agency

World Metrics Organization

U.S. Department of Agriculture

Euromonitor International

World Bank

International Trade Centre

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the furniture market analysis from 2024 to 2034 to identify the prevailing furniture market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the furniture market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global furniture market trends, key players, market segments, application areas, and market growth strategies.

Furniture Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 840.5 Billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2034 |

| Report Pages | 345 |

| By Type |

|

| By Material |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Inter IKEA Group, Durham Furniture Inc., Jason Furniture (HangZhou) Co., Ltd, Kimball International, Raymour & Flanigan, La-Z-Boy Inc., Ashley Furniture Industries Inc., Williams-Sonoma, Inc., American Signature, Oppein Home Group Inc. |

Analyst Review

The demand for furniture is on the rise across the globe. The market players have adopted key developmental strategies such as product launch to fuel the growth of the wooden floor market. They have introduced advanced designs to boost the demand for furniture. Also, in recent time the growing commercial sector has contributed toward the growth of the furniture market.

The rapid pace of urbanization, increase in single and dual living households, and rise in trend of classy yet compact furniture for enhancing the overall household aesthetics support the adoption of folding furniture. Additionally, minimal use of sustainable material and online retailing of furniture also boosts the market demand among the various income groups.

The trend of online shopping substantially influences the furniture market. Operating players in this market prefer to sell their products through e-commerce platforms for maximizing reach. Tie-ups between furniture manufacturers and interior designers is another trend gaining popularity in the industry and are acting as an emerging sales channel for the manufacturers. Furthermore, eco-friendly furniture is witnessing increased demand due to growing environmental awareness among the consumers in the region. Lack of skilled workforce is the main challenge faced by the operating players in this region. Further, the fluctuating cost of materials such as wood and leather also restricts the market growth.

The global furniture market size was valued at $556.3 billion in 2023, and is projected to reach $840.5 billion by 2034, growing at a CAGR of 4.0% from 2024 to 2034.

The global furniture market is to grow at a CAGR of 4.0% from 2024 to 2034.

The major players operating in the furniture market include Inter IKEA Group, Ashley Furniture Industries Inc., Durham Furniture Inc., American Signature, Raymour & Flanigan, Jason Furniture (HangZhou) Co., Ltd, Oppein Home Group Inc., La-Z-Boy Inc., Kimball International and Williams-Sonoma, Inc.

Asia-Pacific region accounted for the largest furniture market share

The furniture market has experienced rapid growth due to the surge in urban living, where space optimization has become an essential factor. Moreover, the demand for multifunctional and smart furniture has increased, driven by technological advancements and rising consumer interest in personalized home environments.

Loading Table Of Content...