Gallic Acid Market Research, 2033

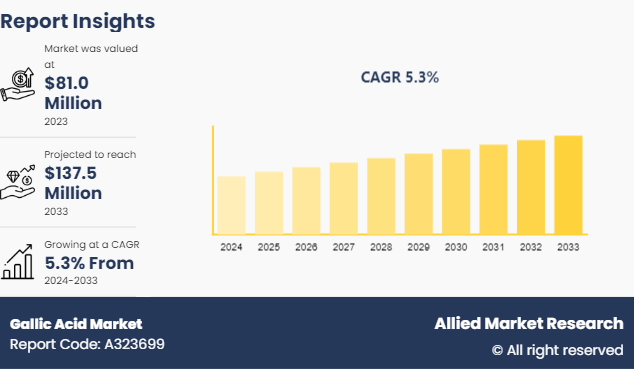

The global gallic acid market was valued at $81.0 million in 2023, and is projected to reach $137.5 million by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

Market Introduction and Definition:

Gallic acid is a type of phenolic acid that is found abundantly in various plants such as gallnuts, sumac, tea leaves, and grapes. It holds diverse applications across several industries owing to its antioxidant, anti-inflammatory, and antimicrobial properties. In the pharmaceutical sector, gallic acid serves as a key component in medications due to its ability to combat oxidative stress and inflammation, thereby potentially aiding in the treatment of various diseases. In addition, it is utilized in skincare formulations for its ability to protect against UV radiation and its potential anti-aging effects. Gallic acid finds applications in the food industry as a food additive and preservative, contributing to the extension of shelf life and maintenance of food quality. Moreover, it shows promise in the field of materials science for its role in the synthesis of novel materials with desired properties.

Key Takeaways:

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence, and key strategic developments by prominent manufacturers.

The gallic acid market is fragmented in nature among prominent companies such as Cayman Chemical, LKT Laboratories, Inc., MedChem Express, Hubei Tianxin BiotechCo., Ltd, EXTRASYNTHESE, Zunyi City Bei Yuan Chemical Co., Ltd, Gallochem Co., Ltd., Wufeng Chicheng Biotech Co., Ltd., and Qingdao ECHEMI Digital Technology Co., Ltd.

The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

Latest trends in global gallic acid market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

More than 1, 600 gallic acid-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global gallic acid market.

Key Market Dynamics:

In the pharmaceutical industry, gallic acid is preferred for its potent antioxidant, anti-inflammatory, and antimicrobial properties. It plays a crucial role in the development of medications aimed at combating oxidative stress-related diseases such as cancer, cardiovascular diseases, and neurodegenerative disorders. The increase in prevalence of such ailments globally drives demand for gallic acid as researchers explore its therapeutic potential in drug formulations. According to a report published by the National Investment Promotion and Facilitation Agency of India in 2023, the pharmaceutical industry in India is expected to reach $65 billion by 2023. In addition, the rise in consumer awareness regarding natural remedies and the shift toward herbal supplements further fuels the demand for gallic acid-based pharmaceutical products.

Moreover, gallic acid serves as a versatile ingredient in the food and beverage industry, contributing to flavor enhancement, preservation, and nutritional value. Its antioxidant properties make it a popular choice as a natural food additive and preservative, helping to extend the shelf life of products while maintaining their quality and freshness. With the rise in consumer preference for clean-label and natural ingredients, the demand for gallic acid in the food and beverage sector has witnessed a steady increase. According to a report published by the U.S. Department of Agriculture in March 2024, the food and related industries contributed to around $1.53 trillion to the U.S. gross domestic product (GDP) in 2023. Moreover, its use in functional food and beverage formulations, particularly in products marketed for their health benefits, further drives market growth.

Moreover, in the personal care and cosmetics industry, gallic acid is valued for its skin-friendly properties and potential anti-aging effects. It is incorporated into skincare formulations such as creams, serums, and lotions due to its ability to protect against UV radiation, reduce oxidative stress, and promote collagen synthesis, thereby aiding in maintaining youthful skin. As consumers become more conscious of the ingredients in their personal care products and seek natural alternatives, the demand for gallic acid as a key component in skincare formulations continues to rise. According to an article published by East West Bank in January 2022, China is projected to account for almost 70% of the beauty and personal care market within Asia-Pacific by 2025. Furthermore, the expanding beauty and cosmetics market, especially in emerging economies, presents lucrative opportunities for gallic acid manufacturers and suppliers.

However, one of the primary restraints in the gallic acid market is the production challenges associated with sourcing raw materials and the extraction process. Gallic acid is predominantly derived from natural sources such as gallnuts, sumac, tea leaves, and grapes. However, fluctuations in the availability and quality of these raw materials, influenced by factors such as climate change, environmental conditions, and agricultural practices, disrupt the supply chain and affect production volumes. In addition, the extraction process of gallic acid from plant sources involves complex procedures and requires specialized equipment and expertise, leading to production inefficiencies and increased costs. As a result, manufacturers encounter challenges in maintaining consistent supply and meeting market demand, thereby restraining market growth.

On the contrary, beyond traditional uses, gallic acid holds promise in emerging applications such as materials science, nanotechnology, and biotechnology. Researchers explore its potential in the synthesis of novel materials with unique properties, including biocompatibility, conductivity, and antimicrobial activity, for applications in biomedicine, electronics, and environmental remediation. Gallic acid-based nanoparticles, coatings, and composites offer opportunities for innovation in diverse industries, including healthcare, electronics, packaging, and environmental engineering. Moreover, advancements in extraction and purification technologies enable the production of high purity gallic acid and its derivatives, expanding opportunities for commercialization and value-added applications.

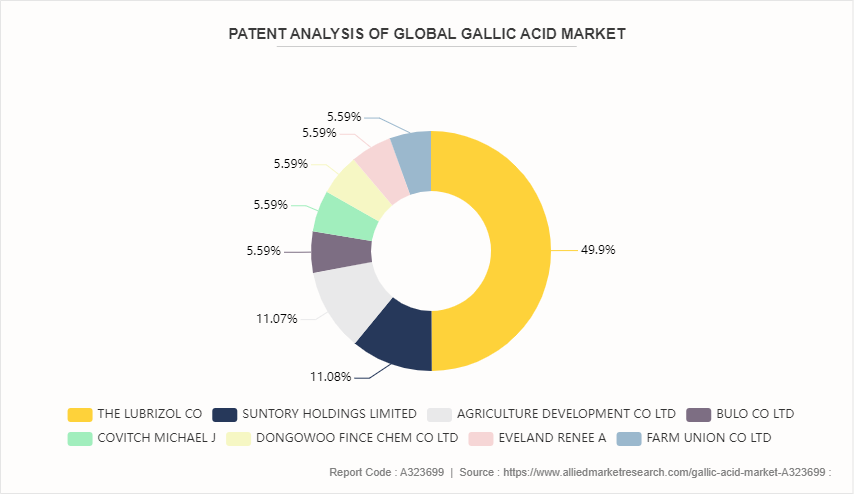

The analysis includes patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future outlook within the gallic acid market. Patent filings related to gallic acid have shown a steady increase over the past decade, indicating growing interest and investment in gallic acid research and development. The majority of patents focus on pharmaceutical applications, particularly in the development of medications targeting oxidative stress-related diseases. In addition, patents related to food & beverage formulations, personal care products, and textile treatments have witnessed notable growth.

Key patent holders in the gallic acid market include pharmaceutical companies, research institutions, universities, and chemical manufacturers. Companies such as THE LUBRIZOL CO, SUNTORY HOLDINGS LIMITED, and ANHUI YUANWO ECOLOGICAL AGRICULTURE DEVELOPMENT CO LTD hold significant patent portfolios covering various aspects of gallic acid production, formulation, and applications. Research institutions and universities contribute to patent filings related to novel uses and synthesis methods of gallic acid.

Market Segmentation:

The gallic acid market is segmented into grade, application, end-use industry, and region. By grade, the market is classified into industrial grade, pharmaceutical grade, food, grade, and others. By application, the market is categorized into medical, biological activity, antioxidants, food additive, reagent, and others. By end-use industry, the market is classified into cosmetics & personal care, pharmaceutical, ink & dye, food & beverages, nutraceuticals, and others. Region-wise the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape:

The major players operating in the gallic acid market include Cayman Chemical, LKT Laboratories, Inc., MedChem Express, Hubei Tianxin BiotechCo., Ltd, EXTRASYNTHESE, Central Drug House, Otto Chemie Pvt. Ltd., BRAHMANI ENTERPRISE, SRL, Alpha Chemika, and Alfa Chemistry. Other players in the gallic acid market include Santa Cruz Biotechnology, Inc., United States Biological, Molekula Americas LLC, Wego Chemical Group Inc, Parchem, and Kao Corporation.

In January 2024, Kao Corporation developed a fermentative production technology that uses microorganisms to produce bio gallic acid from glucose. This strategic product development boosts the potential application of gallic acid as a raw material in a wide variety of end-use sectors.

Regional/Country Industry Outlook:

North America represents a significant market for gallic acid, driven by robust demand from the pharmaceutical and food industries. In the pharmaceutical sector, gallic acid is valued for its antioxidant and anti-inflammatory properties, making it a key ingredient in medicines and dietary supplements. The pharmaceutical industry in the U.S. is one of the largest and prominent industries worldwide as there is increase in consumer awareness of health benefits associated with natural ingredients in the region, which contributes to market growth. Moreover, the food and beverage industry utilizes gallic acid as a food additive and preservative, further fueling demand in the region. The region's stringent regulatory standards and rise in consumer preference for natural ingredients drive demand for gallic acid in pharmaceutical formulations, dietary supplements, and functional foods.

In addition, regulatory agencies in North America, such as the Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) , have been supportive of the use of natural ingredients in consumer products. This regulatory environment encourages manufacturers to explore natural alternatives such as gallic acid and facilitates the approval process for products containing these ingredients. Favorable regulations contribute to market growth by reducing barriers to entry for gallic acid-based products.

Key Industry Trends:

In October 2022, researchers from the University of Texas developed an innovative disinfectant through light enhanced antimicrobial treatment method by exposing gallic acid to ultraviolet-C (UV-C) light.

In March 2023, researchers from China found that gallic acid can be used to manage several neurological diseases and disorders, such as Alzheimer’s disease, Parkinson’s disease, strokes, sedation, depression, psychosis, neuropathic pain, anxiety, and memory loss, as well as neuroinflammation.

In October 2023, the Global Institute of Pharmacy referred gallic acid as a wonderful remedy in the medicinal field that is used as an assortment of medicinal benefits on inflammation, obesity, cancer, the heart, neurological system, and the proliferation of cells. In more recent research conducted by the organization, the anti-cancer effects of gallic acid via biological mechanisms such as angiogenesis, migration, metastasis, cell cycle arrest, and apoptosis have also been demonstrated.

Key Sources Referred:

National Promotion and Facilitation Agency

BioMed Central

U.S. Development Authority

East West Bank

Science Direct

U.S. Food and Agriculture Organization (U.S. FAO)

Invest In India

Press Information Bureau

Malaysian Palm Oil Council

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gallic acid market analysis from 2023 to 2033 to identify the prevailing gallic acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gallic acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gallic acid market trends, key players, market segments, application areas, and market growth strategies.

Gallic Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 137.5 Million |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 500 |

| By Grade |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Hubei Tianxin BiotechCo., Ltd, Central Drug House, Otto Chemie Pvt. Ltd., Cayman Chemical, EXTRASYNTHESE, BRAHMANI ENTERPRISE, LKT Laboratories, Inc., Glentham Life Sciences Limited, Alpha Chemika, SRL |

Loading Table Of Content...