Gas Chromatography, Liquid Chromatography, Mass Spectrometry And Spectroscopy Instruments Market Research, 2033

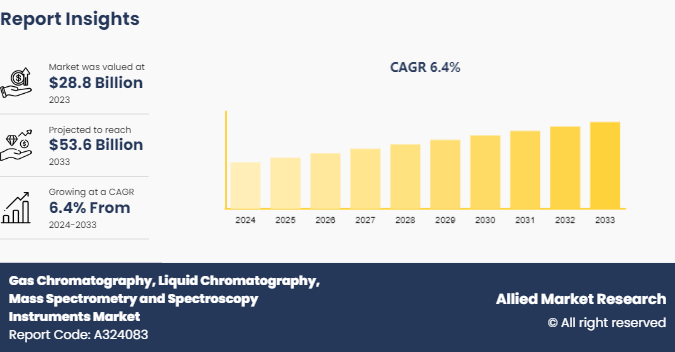

The global gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market size was valued at $28.8 billion in 2023, and is projected to reach $53.6 billion by 2033, growing at a CAGR of 6.4% from 2024 to 2033. The growing focus on personalized medicine also drives the demand for sophisticated analytical instruments to tailor treatments based on individual patient profiles, presenting a burgeoning market opportunity.

Market Introduction and Definition

Gas Chromatography (GC) and Liquid Chromatography (LC) are analytical techniques used to separate, identify, and quantify components in a mixture. GC vaporizes samples and passes them through a column with a carrier gas, while LC uses a liquid mobile phase to transport samples through a column. Mass Spectrometry (MS) detects and quantifies molecules by ionizing chemical compounds and measuring their mass-to-charge ratio, providing detailed molecular information. Spectroscopy Instruments analyze the interaction of light with matter, covering techniques like UV-Vis, IR, and NMR spectroscopy, which measure absorption, emission, and scattering of light to elucidate molecular structure and composition.

Key Takeaways

- The gas chromatography, liquid chromatography, Mass spectrometry and spectroscopy instruments market share study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

One of the primary drivers for this gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market growth is the rising demand for high-throughput and precise analytical techniques in pharmaceutical and biotechnology industries. These industries rely heavily on GC, LC, MS, and spectroscopy instruments for drug development, quality control, and regulatory compliance. The increasing complexity of new drug molecules and the need for stringent quality assurance drive the adoption of advanced analytical instruments. Furthermore, the rise in environmental testing, due to stricter environmental regulations and the need for pollution monitoring, boosts the demand for these instruments. The ability to detect and quantify trace levels of contaminants in air, water, and soil makes these instruments indispensable in ensuring environmental safety.

However, the high cost of these instruments poses a significant restraint to market growth. Advanced analytical instruments, such as high-resolution mass spectrometers and multi-dimensional chromatography systems, require substantial investment, making them less accessible to small and medium-sized laboratories and research institutions. Additionally, the operational and maintenance costs, along with the need for skilled personnel to operate and interpret the results, add to the overall expenditure. These financial barriers can limit the widespread adoption of these technologies, particularly in developing regions where budget constraints are more pronounced.

Despite these challenges, the market presents significant opportunities, especially with the advent of technological advancements and innovations. The development of miniaturized and portable analytical instruments is one such opportunity. These compact devices offer the same high-performance capabilities as their larger counterparts but at a fraction of the cost, making them accessible to a broader range of users. Additionally, the integration of artificial intelligence and machine learning in analytical instruments enhances data analysis, increasing accuracy and efficiency. This technological integration can streamline complex data interpretation, making advanced analytical techniques more user-friendly and expanding their application across various industries, including food and beverage, healthcare, and forensics.

Patent Analysis for Gas Chromatography

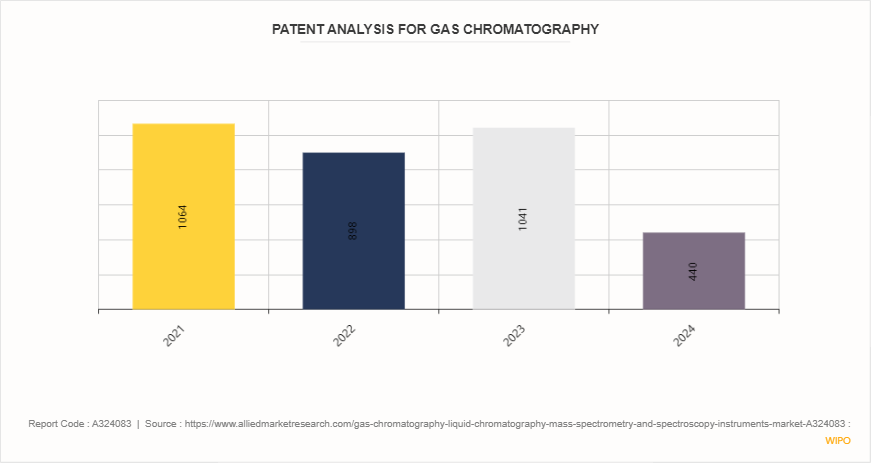

The patent analysis for gas chromatography reveals a fluctuating trend over the years 2021 to 2024. According to the World Intellectual Property Organization (WIPO) patent scope, there were 1, 064 patents filed in 2021, followed by a decrease to 898 in 2022. The number of patents rebounded to 1, 041 in 2023, indicating renewed innovation and interest in this field. However, 2024 saw a significant drop to 440 patents, suggesting potential market saturation, shifts in research focus, or economic factors affecting R&D investments. This data highlights the dynamic nature of patent activity in gas chromatography, reflecting changing industry priorities and technological advancements.

Market Segmentation

The gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market size is segmented into Type, Product Type, End user and region. On the basis of Type, the market is categorized into gas chromatography, liquid chromatography, mass spectrometry, and spectroscopy instruments. On the basis of Product Type, the market is categorized into instruments, and consumables & accessories. The instruments segment is further divided into columns, syringe filters, vials, and others. The consumables & accessories segment is further divided into detectors, pumps and flow meters, and others. On the basis of End user, the market is categorized into Pharmaceutical and biotechnology companies, research and academic institutes, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The market for gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market share shows robust growth across various regions. North America and Europe dominate due to advanced healthcare infrastructure, significant R&D investments, and stringent regulatory frameworks. Asia-Pacific is emerging as a lucrative gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market forecast period, driven by expanding pharmaceutical and biotechnology industries, increasing environmental testing, and rising government initiatives for quality control. Latin America and the Middle East & Africa show moderate growth, fueled by improving healthcare infrastructure and growing industrial applications. Each region's unique economic and industrial landscape shapes the demand and adoption of these advanced analytical instruments.

- In February 2021, Phenomenex, a subsidiary of Danaher Corporation launches new single GC solution for Dioxin analysis.

- In October 2023, Waters Corporation, a biotechnology research company has collaborated with University of San Agustin to establish the first mass spectrometry imaging center in Philippines. The imaging center will help researchers to accelerate drug discoveries and develop therapeutics for the treatment of cancer and infectious diseases.

Industry Trends

- In June 2022, Thermo Fisher Scientific Inc., a global leader in biotechnology industry has announced the co-marketing agreement with TransMIT GmbH Center for Mass Spectrometric Developments to promote the use of mass spectrometry imaging (MSI) , for application in pharmaceuticals and clinical labs.

Competitive Landscape

The major players operating in the Ggas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market include Danaher Corporation, Bio-Rad Laboratories, Inc., Hitachi, Ltd, Agilent Technologies Inc., Merck KGAA, Shimadzu Corporation, Thermo Fisher Scientific, Inc., Restek Corporation, PerkinElmer, and Waters Corporation. Other key players include Bruker Corporation, Kore Technologies, Ltd, Leco Corporation and so on.

Recent Key Strategies and Developments

- In June 2021, Waters Corporation introduced the Waters Arc Premier System, the first liquid chromatography system optimized for chromatographic separations on 2.5 – 3.5-micron columns. The Arc Premier System delivers reproducibility and repeatability for scientists developing methods for stability testing, impurity profiling and product release data in compliance with regulatory requirements.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Thermo Fisher Scientific, Inc

- Waters Corporation

- National Health Mission (NHM)

- Institute for Health Metrics and Evaluation

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Gas Chromatography, Liquid Chromatography, Mass Spectrometry and Spectroscopy Instruments Market Analysis from 2024 to 2033 to identify the prevailing Gas Chromatography, Liquid Chromatography, Mass Spectrometry and Spectroscopy Instruments Market Opportunity .

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Gas Chromatography, Liquid Chromatography, Mass Spectrometry and Spectroscopy Instruments Market Trends, key players, market segments, application areas, and market growth strategies.

Gas Chromatography, Liquid Chromatography, Mass Spectrometry and Spectroscopy Instruments Market , by Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 53.6 Billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By Type |

|

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Danaher Corporation, Shimadzu Corporation, Restek Corporation, Agilent Technologies Inc., Bio-Rad Laboratories, Thermo Fisher Scientific, Inc., Merck KGaA, PerkinElmer, Hitachi, Ltd, Waters Corporation |

The total market value of gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market was $28.8 billion in 2023.

The forecast period for gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market is 2024 to 2033.

The market value of gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market is projected to reach $53.6 billion by 2033

The base year is 2023 in gas chromatography, liquid chromatography, mass spectrometry and spectroscopy instruments market.

Gas Chromatography (GC) and Liquid Chromatography (LC) are analytical techniques used to separate, identify, and quantify components in a mixture. GC vaporizes samples and passes them through a column with a carrier gas, while LC uses a liquid mobile phase to transport samples through a column.

Loading Table Of Content...