Gas Compressors Market Research, 2032

The Global Gas Compressors Market Size was valued at $5.9 billion in 2022, and is projected to reach $9.4 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032.

A gas compressor is a mechanical device designed to increase the pressure of gas by compressing the gas volume. This technique includes trapping a specific volume of gas and mechanically reducing the gap it occupies, causing a growth in pressure. Gas compressors play a crucial role in diverse industries, from powering pneumatic tools and air conditioning systems to facilitating gas transportation and processing in oil & fuel operations. The compression of gases is essential for enhancing their utility and enabling their efficient use in distinctive applications.

Technological Aspect

The advancement and improvement in the gas compressors equipment have drastically improved their efficiency, reliability, and applicability throughout numerous industries. Recently, the integration of smart sensors and automation technologies has revolutionized the tracking and compression of gas compression processes. These smart structures offer real-time facts on key parameters, which include pressure, temperature, and vibration, permitting proactive maintenance and minimizing downtime. In addition, using superior materials and precision engineering strategies has improved the performance and durability of compressor components, contributing to longer service life and decreased maintenance costs. Such factors are expected to augment growth of gas compressors market.

Furthermore, the initiation of digitalization and the Industrial Internet of Things (IIoT) has facilitated the development of smart compressors that can be remotely monitored and managed. This connectivity allows operators to optimize the overall performance of compressors, troubleshoot issues, and make data-driven decisions to enhance overall operational performance. Computational fluid dynamics (CFD) simulations and modeling strategies have a key role inside the layout and optimization of compressor components, leading to improved aerodynamics and power efficiency.

In the area of environmental sustainability, there is a rise in awareness of eco-friendly compressor technologies, consisting of making use of alternative refrigerants and improving energy restoration systems. These technological advancements effectively deal with environmental concerns and make a contribution to achieving higher level of energy performance in gas compression techniques. The technological evolution of gas compressors underscores a commitment to efficiency, sustainability, and flexibility to meet the evolving demands of industries such as chemical and automobile.

Market Dynamics

The surge in demand for compressed natural gas (CNG) as an alternative and cleaner gasoline source in transportation is expected to drive the gas compressors market growth. With a surge in emphasis on reduction of carbon emissions and transitioning toward more sustainable strength solutions, CNG has emerged as a feasible choice for powering vehicles. Gas compressors play a pivotal role in compressing natural gas to high pressures suitable for storage and transportation, allowing its use as a fuel for buses, trucks, and even some passenger cars.

The adoption of CNG facilitates lower greenhouse gas emissions and diversifies the power mix within the transportation sector. This driver is especially significant in regions wherein there is a concerted attempt to promote cleaner fuels and decrease dependency on traditional fuel and diesel. Gas compressors producers have an opportunity to capitalize in this trend by means of developing revolutionary and efficient compression solutions tailored to the particular necessities of CNG applications, thereby contributing to the broader goals of environmental sustainability and the promoting of cleaner transportation alternatives worldwide.

Factors such as an increase in hydrogen consumption from end-user industries and the construction of hydrogen pipeline infrastructure are expected to boost the growth of gas compressors market . Furthermore, the demand for oil-based lubricating gas compressors has been witnessed to increase significantly in recent years. This is attributed to the fact that oil-based lubricating gas compressors are more efficient than oil-free gas compressors, as oil functions as a cooling medium, eliminating around 80% of the heat generated by the compressor during compression. Thus, this factor is expected to notably contribute toward the gas compressors industry growth during the forecast period. However, the risk of early wear and tear of gas compressor components, owing to inadequate lubrication, potentially increases the maintenance cost of oil-based lubricating gas compressors.

In addition, high purchasing and maintenance costs of gas compressors hamper market growth. Several firms develop and launch new products. In addition, various key players in this market have adopted strategies such as an agreement to develop new hydrogen compressors with the latest technology. For instance, in February 2021, Burckhardt Compression signed an agreement with Switzerland-based company, GRZ Technologies. The aim of this agreement is to develop new hydrogen compression technology.

Technological advancements in gas compressors system, which include improvements in compression performance and the development of compact and transportable devices, present producers with opportunities to provide more powerful solutions for numerous industrial applications. This increase in demand for gas compressors aligns with the broader tendencies of industrialization and urbanization, creating a positive environment for gas compressor manufacturers to cater to the evolving energy necessities and contribute to the improvement of strong and dependable compression systems for a huge range of programs across a couple of sectors. Such factors are expected to offer lots of opportunities for growth of gas compressors market during the forecast period.

Segmental Overview

The gas compressors market is segmented on the basis of technology, lubrication type, end-user industry, and region. By technology, the market is categorized into positive displacement and dynamic displacement. On the basis of lubrication type, it is bifurcated into oil-based and oil-free. As per end-user industry, the market is classified into oil & gas, chemical, automotive, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

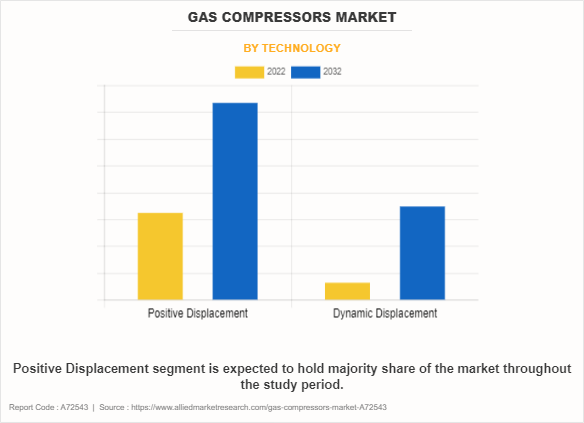

By Technology:

The gas compressors market is divided into positive displacement and dynamic displacement. The positive displacement segment includes reciprocating compressors, rotary screw compressors, rotary vane compressors, and others. The dynamic displacement segment includes centrifugal compressors and axial compressors. In 2022, the positive displacement segment dominated the gas compressors market, in terms of revenue and dynamic displacement segment is anticipated to grow with a higher CAGR during the forecast period.

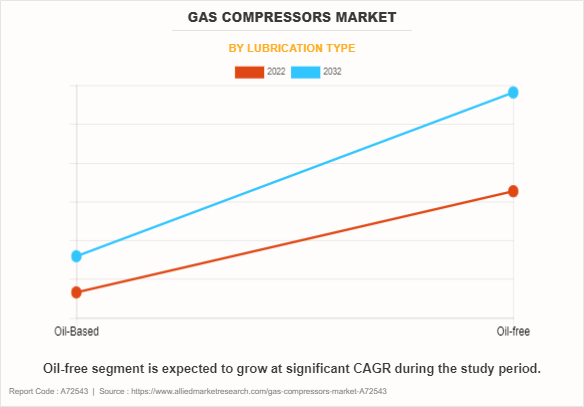

By Lubrication Type:

The gas compressors market is bifurcated into oil-based and oil-free. In 2022, the oil free segment dominated the gas compressors market, in terms of revenue, and is expected to maintain this trend during the forecast period. In applications such as fuel cells, semiconductor manufacturing, and certain industrial processes, maintaining high-purity gas is crucial for optimal performance. Oil-free compressors eliminate the risk of oil contamination, ensuring the purity of compressed gas, which drives the demand for these compressors in industries that require ultra-clean gas. In addition, oil-free compressors mitigate safety concerns associated with oil-based compressors.

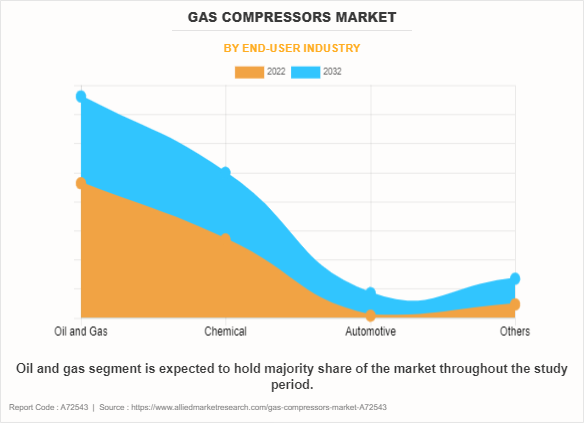

By End-User Industry:

The gas compressors market is categorized into oil & gas, chemical, automotive, and others. In 2022, the oil & gas segment dominated the gas compressors market, in terms of revenue, and is expected to maintain this trend during the forecast period. However, the automotive segment is expected to exhibit the highest CAGR during the forecast period.

The increase in investment in the oil & gas sector is likely to boost the demand for gas compressors. In addition, surge in adoption of hydrogen fuel cell vehicles is expected to positively influence the demand for gas compressors. For instance, a Combined Hybrid Solution of Metal Hydride and Mechanical Compressors (COSMHYC), a research project funded by the Fuel Cell and Hydrogen Joint Undertaking of the European Commission, developed an innovative metal hydride compressor prototype, and started its testing. In the preliminary tests, the COSMHYC metal hydride compressor prototype achieved high-pressure values of more than 430 bar.

Expansion of the oil & gas sector in the Middle East region has created demand for gas compressors and thus is anticipated to drive market growth. For instance, in May 2022, Abu Dhabi National Oil Company (ADNOC) announced a plan to construct a new liquefied natural gas plant in Fujairah that would more than double its export capacity, with production of as much as 9.6 million tons a year. The newly formed UAE Hydrogen Alliance between ADNOC, Abu Dhabi Developmental Holding Company (ADQ), and Mubadala is projected to offer opportunities to include potential partnership, production, storage, gas transportation, and other technologies. Moreover, Asia-Pacific is expected to be a major market for gas compressors in the coming years, on account of the favorable government policies for boosting the manufacturing sector in countries such as China, Japan, and India. China is one of the largest and fastest growing gas compressors market in Asia-Pacific, owing to the development of its oil & gas sector in recent years.

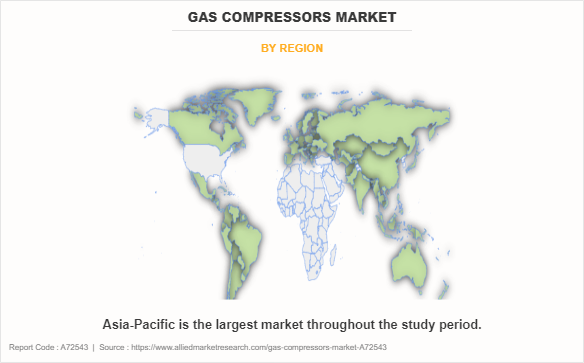

By Region:

The gas compressors market forecast is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific accounted for the highest market share in 2022 and North America expected to exhibit the highest CAGR during the forecast period. Asia-Pacific constitutes the fastest growing manufacturing hubs such as China, Japan, India, South Korea, and Thailand, which acts as a key driving force for market expansion. In addition, the availability of labor and rapid industrialization drive market growth in Asia-Pacific. Moreover, China is the largest producer and exporter of hydrogen compressors in Asia-Pacific, followed by Japan and India, which are still expanding its manufacturing capabilities.

Furthermore, rapid industrialization and government initiatives for upliftment of manufacturing sector in automotive and chemical industries drive the growth of the gas compressors market share in Asia-Pacific. For instance, in March 2022, Sinopec, China’s second-largest oil company invested $476 million in hydrogen technology R&D and has planned a number of pilot green hydrogen projects. The company is expected to prioritize the development of renewable-energy projects, particularly those involving hydrogen, in its transition to a low-carbon business structure. Hence, such factors provide lucrative opportunities for growth of gas compressors market.

Competition Analysis

Competitive analysis and profiles of the major players in the gas compressors market, such as ARIEL CORPORATION, Atlas Copco AB, BAUER COMPRESSORS, INC., Burckhardt Compression Holding AG, HAUG Sauer Kompressoren AG, Hitachi Ltd., IDEX CORPORATION, Ingersoll Rand Inc., KAESER KOMPRESSOREN, and Siemens Energy are provided in this report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the gas compressors market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas compressors market analysis from 2022 to 2032 to identify the prevailing gas compressors market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas compressors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas compressors market trends, key players, market segments, application areas, and market growth strategies.

Gas Compressors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.4 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 210 |

| By Technology |

|

| By Lubrication Type |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | Siemens Energy, Burckhardt Compression Holding AG, Atlas Copco AB, Kaeser Kompressoren SE, Ingersoll Rand Inc., Ariel Corporation, BAUER COMPRESSORS, INC., IDEX Corporation, HAUG Sauer Kompressoren AG, Hitachi Ltd. |

Analyst Review

Gas compressors are used in different industries such as the chemical industry, oil & gas industry, and automobile industry. Several types of gas compressors exist in the market, including reciprocating compressors, rotary screw compressors, rotary vane compressors, centrifugal compressors, and axial compressors, which are chosen depending on the application.

Gas compressors are used in oil & gas, chemical, and automotive industries. A few key players have improved their product portfolio by launching gas compressors. For instance, in May 2021, Ariel Corporation launched API 618 moderate speed compressors for refueling stations, which are a series of hydrogen compressors that operate in piston comparable speed ranges to long-stroke, slow-speed compressors. These new products are more technologically sophisticated and work more efficiently and effectively than their prior product line. Hence, they are extensively employed in several end user industries. Such factors are expected to offer lucrative opportunities for market growth during the forecast period.

The global gas compressors market was valued at $5,922.0 million in 2022, and is projected to reach $9,399.8 million by 2032, registering a CAGR of 4.8% from 2023 to 2032.

The forecast period considered for the global gas compressors market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global gas compressors market report can be obtained on demand from the website.

The base year considered in the global gas compressors market report is 2022.

The major players profiled in the gas compressors market include ARIEL CORPORATION, Atlas Copco AB, BAUER COMPRESSORS, INC., Burckhardt Compression Holding AG, HAUG Sauer Kompressoren AG, Hitachi Ltd., IDEX CORPORATION, Ingersoll Rand Inc., KAESER KOMPRESSOREN, and Siemens Energy.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on end-user industry, the oil and gas segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...