Gas Insulated Switchgear Market Research, 2032

The global gas insulated switchgear market was valued at $23.0 billion in 2022, and is projected to reach $35.2 billion by 2032, growing at a CAGR of 4.3% from 2023 to 2032.

Report Key Highlighters:

- The report outlines the current Gas insulated switchgear market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets along with Gas insulated switchgear market statistics.

- The global Gas insulated switchgear market has been analyzed in terms of value ($ million). The analysis in the report is provided on the basis of voltage, application, technology, 4 major regions, and more than 15 countries.

- The Gas insulated switchgear market is consolidated in nature with few players such as Mitsubishi Electric Co., State Grid Co. Of China, ABB Tech AG, Hitachi Ltd., and Siemens AG, which hold significant share of the market.

- The report provides strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the Gas insulated switchgear market.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global Gas insulated switchgear market.

Gas insulated switchgear (GIS) is a type of switchgear that is used in electrical systems for controlling electrical equipment. They are used for isolating and protecting electrical equipment. The traditional air-insulated switchgear (AIS) uses ambient air as insulation medium and does not use any other special gases. However, GIS uses sulfur hexafluoride (SF6) gas as an insulating medium in its working mechanism. GIS includes several components such as enclosures, insulating gas, switching devices, busbars, and connectors.

Enclosures in GIS are metal-clad structures that are sealed. The metals used in enclosures are steel and aluminum. These enclosures act as a house for switching devices, busbars, and other essential components. These enclosures offer protection from dust, pollutants, and moisture. It helps in gaining reliability and longer life for the switchgear. These enclosures also help to achieve a compact design and improved electrical performance of the switchgear.

The GIS includes insulating gas such as sulfur hexafluoride (SF6) and SF6 free gases. The SF6 gas has a high global warming potential and thus is very harmful for the environment. Thus, the alternative for SF6 gas is researched and experimented with. The SF6 free gas is used in many types of switchgears with different technologies, however, not all SF6 free gases are compatible with existing technologies. Fluoronitirles and fluoroketone gases are under research for use in switchgears along with nitrogen or combination of nitrogen and oxygen gases as insulating gas.

GIS includes switchgears such as circuit breakers, disconnectors, and earthing switches for controlling and isolating electrical circuits. These components are important for smooth function of a GIS. They have the primary function of interrupting electric flow during fault or abnormal operating conditions. They are available in several types such as vacuum, gas-blast, and hybrid circuit breakers. Disconnectors or isolators serve the purpose of isolating or disconnecting the electrical systems during maintenance or during non-operation period. Moreover, there are horizontal and vertical disconnectors available for GIS. Earthing switches are also known as grounding switches, which are used for connecting or disconnecting the electrical equipment with ground. Horizontal and vertical earthing switches are made as per the specific requirements of the GIS.

Busbars and connectors in a GIS are made of conductive materials such as aluminum and copper. Their role is to provide a means for distributing electric current in the switchgear. They help in distribution of power to various components of GIS. Main busbars in the switchgear are supposed to carry the electric current within the systems. However, sectional busbars are used for connecting different sections of the GIS. Connectors are used to establish electric connections between the GIS components such as busbars, circuit breakers, and disconnectors.

Electricity demand has increased over the last decade owing to exponential growth in population. Since there is a growing population, electricity consumption has increased, which has led to increased demand for power. The growing demand for electricity is also propelled by industrialization, urbanization, and electrification of infrastructure. As countries undergo industrialization, there is an increased demand for electricity which is used to power factories, manufacturing processes, and other such small, big industrial activities. Such factors drive the growth for gas insulated switchgear market as these switchgears are used largely in electrical substations for power distribution, compact and space-saving electrical substations, and smart grids.

Gas insulated switchgear is used in high-voltage substations which helps in efficient transmission and distribution of electricity. GIS has compact designs so they can be easily employed in areas with limited access to space. In urban areas, high-capacity substations use GIS to accommodate increased demand for renewable energy integration. GIS is used in grid interconnections for multiple connections of different renewable energy sources to the main power grid. GIS offers seamless integration and hence enhanced reliability in switching. Such benefits drive the gas insulated switchgear market growth.

The high initial cost and maintenance costs associated with GIS restrict the growth for the gas insulated switchgear market. The production cost is high owing to the precision manufacturing processes required for meeting standards to produce a complex design. The cost is also driven by the components such as insulating gas, busbars, and circuit breakers. Moreover, high installation and maintenance costs also restrict the growth for the gas insulated switchgear market.

The gas used in these types of switchgears is usually SF6. The SF6 gas is a greenhouse gas which is harmful for the environment. In addition, there are several regulations and initiatives that target the reduction in use of SF6 gas and/or control its emission. SF6 is thousand times more harmful than CO2, thus through Kyoto Protocol and the Paris Agreement international organizations are pushing for phasing down and eventually phasing out the use of SF6 gas altogether. Alternatives to SF6 gas are limited and thus such concerns over the use of SF6 gas insulated switchgear restrict the market development.

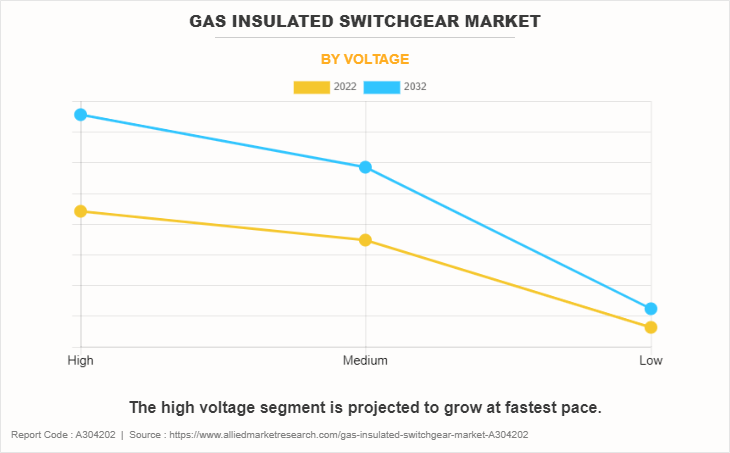

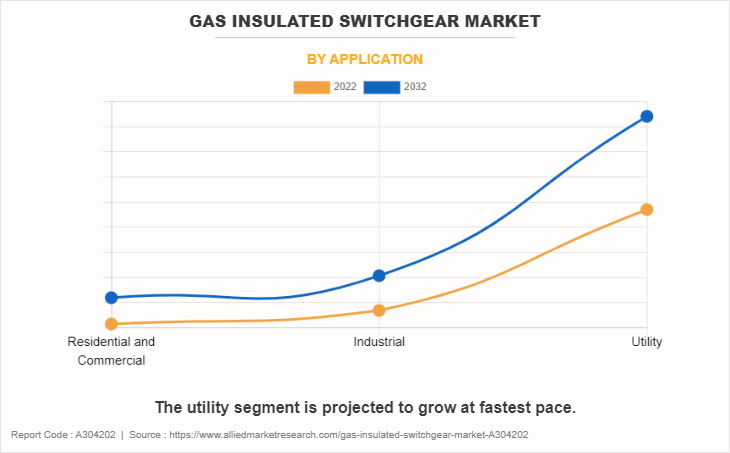

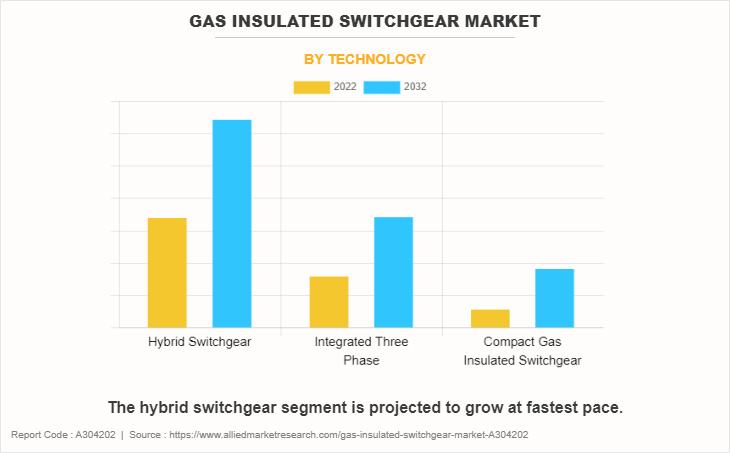

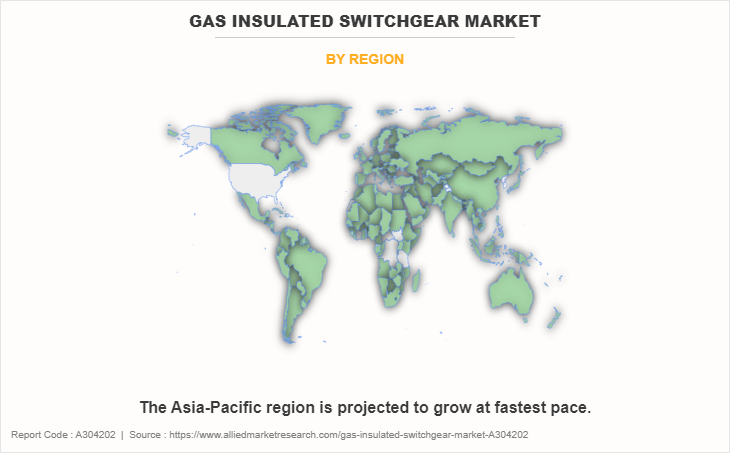

The gas insulated switchgear market size is studied across voltage, application, technology, and region. By voltage, the market is divided into high voltage, medium voltage, and low voltage. On the basis of the application, it is categorized into residential & commercial, industrial, and utility. On the basis of the technology, the gas insulated switchgear market is classified into hybrid switchgear, integrated three phase, and compact gas insulated switchgear. Region-wise, the gas insulated switchgear market analysis is done across North America, Europe, Asia-Pacific, and LAMEA.

Gas insulated switchgear market, by voltage

The high voltage segment accounted for the largest Gas Insulated Switchgear Market Share of 47.0% in 2022. The high voltage switchgears are used in applications such as power generation stations and power distribution networks. Transmissions lines that are used to transmit electricity from power stations to end users such as cities or across states have high voltage switchgears that are used to control or regulate the electric current flow.

Gas insulated switchgear market, by application

The utility segment accounted for the largest share of 58.3% in 2022 and is projected to dominate the market during Gas Insulated Switchgear Market Forecast period. The increase in electricity consumption owed to population growth, industrialization, and urbanization drives the growth for utility segment. Moreover, integration of renewable energy sources to main power generation grids emphasizing on sustainable and stable power sources has led to increased demand for gas insulated switchgears.

Gas insulated switchgear market, by technology

The hybrid switchgear segment accounted for the largest share of 46.8% in 2022. Since the power generation and power distribution utilities are experiencing high electricity demand, the need for reliable and resilient distribution systems is driving the growth for gas insulated switchgear. Hybrid switchgear is a unique combination of both air-insulated and gas-insulated technologies and thus offers high operational efficiency.

Gas insulated switchgear market, by region

Asia-Pacific region garnered the largest share of 44.0% in 2022. The Asia-pacific region‐™s growth is primarily driven by rapid urbanization and industrialization in developing economies such as India and China. Moreover, developed economies such as Japan, Australia, and South Korea are also transitioning toward electrification of infrastructure thus propelling demand for gas insulated switchgear.

The major players operating in the global gas insulated switchgear industry are Mitsubishi Electric Co., State Grid Co. Of China, Abb Tech Ag, Hitachi Ltd., Siemens Ag, Hyundai Heavy Industries Co. Ltd., Toshiba Co., Bharat Heavy Electricals Limited, Schneider Electric, and Crompton Greaves Limited. Other players include Fuji Electric, Eaton Corporation plc, General Electric, Nissan Electric Co. Ltd., Meidensha Corporation, and others.

Strategic Developments Undertaken By Key Players:

- In August 2022, Hitachi and Schneider Electric companies collaborated to accelerate the deployment of sustainable and smart energy management solutions by offering portfolios in medium and high-voltage technologies to provide greater customer value. Through this collaboration, both companies enhanced their product portfolio.

- In April 2022, ABB collaborated with Samsung electronics to create energy-saving and energy-management solutions. Through this agreement, the companies enhanced their ability to serve consumers with better device management, access to home automation technology, and the ability to transfer electrical loads.

- In February 2021, Eaton Corporation plc acquired Royal Power Solutions, a U.S. based company that manufactures electrical connectivity components. Through this acquisition, the company enhanced its product portfolio.

International Standards:

- IEC 62271 Series: High-voltage switchgear and control gear standards:

o IEC 62271-1: Common specifications for high-voltage switchgear and control gear standards.

o IEC 62271-203: Gas-insulated metal-enclosed switchgear for rated voltages above 52 kV.

o IEC 62271-207: Seismic qualification for gas-insulated switchgear assemblies for rated voltages above 52 kV.

o IEC 62271-100: High-voltage alternating-current circuit-breakers.

International Organization for Standardization (ISO) Standards:

- ISO 50001:2018 - Energy management systems: Specifies the requirements for establishing, implementing, maintaining, and improving an energy management system.

European Committee for Electrotechnical Standardization (CENELEC) Standards:

- EN 62271 Series: High-voltage switchgear and control gear standards

o EN 62271-1: Common specifications for high-voltage switchgear and control gear standards.

o EN 62271-203: Gas-insulated metal-enclosed switchgear for rated voltages above 52 kV.

European Union Regulations:

- F-Gas Regulation (EU) No 517/2014: Defines the use of fluorinated greenhouse gases, including sulfur hexafluoride (SF6), and aims to reduce their emissions.

- EU Regulation (EU) 2018/517: Establishes criteria for the use of fluorinated greenhouse gases and outlines measures to reduce emissions.

National Standards:

- National standards and regulations may also exist, depending on the country or region. For example: In the United States, standards from the American National Standards Institute (ANSI) and the Institute of Electrical and Electronics Engineers (IEEE) may be relevant. In Japan, standards from the Japanese Industrial Standards (JIS) may apply.

Industry-Specific Standards:

- IEEE C37.122: IEEE Standard for Gas-Insulated Substations: Provides specifications for gas-insulated substations, including GIS.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas insulated switchgear market analysis from 2022 to 2032 to identify the prevailing gas insulated switchgear market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas insulated switchgear market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas insulated switchgear market trends, key players, market segments, application areas, and market growth strategies.

Gas Insulated Switchgear Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 35.2 billion |

| Growth Rate | CAGR of 4.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Technology |

|

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bharat Heavy Electricals Limited, Hitachi Ltd., Mitsubishi Electric Corporation, ABB, Hyundai Heavy Industries Co Ltd, State Grid Corporation of China Limited, Schneider Electric, TOSHIBA CORPORATION, Siemens AG |

Analyst Review

According to the insights of the CXOs of leading companies, the market for gas insulated switchgear is highly fragmented as there are many players operating in the industry. The growing energy demand driven by urbanization, and electrification in several countries have propelled the demand for gas insulated switchgears. Moreover, integration of renewable energy sources to the power grids has also significantly contributed to driving the gas insulated switchgear market growth. Furthermore, the compact design of switchgear enables them to operate in areas with limited land access that is, switchgears take up only 10% land of the substations and in turn offers great reliability and stability in the power grid connections, thus leading to gas insulated switchgear industry growth.

However, the high upfront cost of production leads to higher product costs, thus the market faces several growth challenges. Moreover, the installation and maintenance cost also add up to the restraining factor and thus limits the growth for gas insulated switchgear. In addition, the environmental concerns regarding the potential global warming effects of the greenhouse gas SF6 used majorly in the gas insulated switchgear and limited availability of alternative gases compatible with existing technologies limits the market growth acting as restraining factor.

Meanwhile, ongoing R&D activities that are aimed at developing SF6 free gas insulated switchgear solutions offer great opportunity for industry growth. The development of such alternatives to minimize or completely phase out the use of SF6 gas is the key innovation opportunity of the market.

$35.3 billion is the estimated industry size of gas insulated switchgear by 2032.

Increased electricity consumption, rapid urbanization, and electrification of transportation & infrastructure are the upcoming trends of Gas Insulated Switchgear Market in the world

Utility sector is the leading application of Gas Insulated Switchgear Market.

Asia-Pacific is the largest regional market for Gas Insulated Switchgear

Mitsubishi Electric Co., State Grid Co. Of China, Abb Tech Ag, Hitachi Ltd., Siemens Ag, Hyundai Heavy Industries Co. Ltd., Toshiba Co., Bharat Heavy Electricals Limited, Schneider Electric, and Crompton Greaves Limited are the top companies to hold the market share in Gas Insulated Switchgear.

Loading Table Of Content...

Loading Research Methodology...