Gas Lift System Market Research, 2032

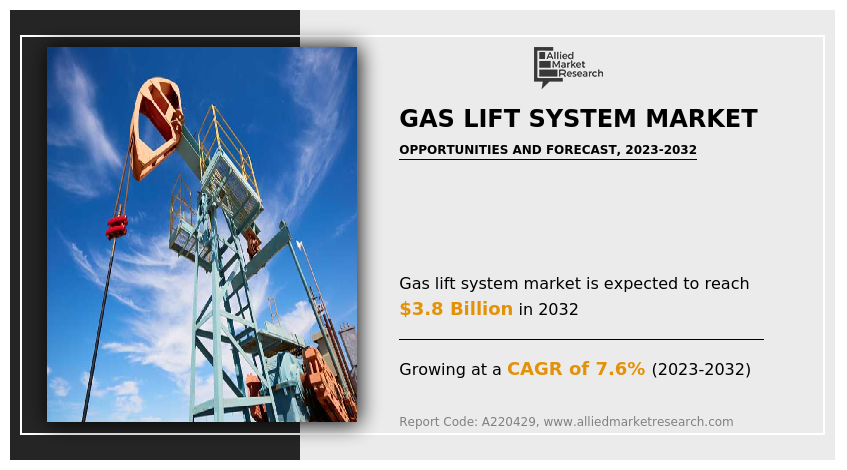

The global gas lift system market was valued at $1.8 billion in 2022, and is projected to reach $3.8 billion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

The gas lift system market plays a pivotal role in the oil and gas industry, just as artificial lift techniques do, by significantly enhancing production rates from oil and gas wells. This method effectively reduces the bottomhole pressure (BHP) to increase the flow of hydrocarbons from the reservoir.

Gas lift systems, such as modern progressive cavity pumps (PCPs) or downhole centrifugal pumps, often integrated into electrical submersible pump (ESP) systems, are instrumental in achieving this goal. These systems reduce the density of the fluid in the tubing, enabling the efficient lifting of hydrocarbons to the surface by injecting gas into the wellbore.

Gas lift systems not only lower the bottomhole pressure but also boost the flow rate, making them indispensable tools for well operators. In the ever-evolving landscape of the energy sector, the remarkable gas lift system market growth is driven by the increase in global demand for energy, industrialization, urbanization, and population growth.

Furthermore, the industry has pivoted toward unconventional sources, necessitating artificial lift systems to optimize production and exploration activities as conventional oil and gas sources decline. This trend is set to drive sustained growth in the gas lift system market forecast, meeting the escalating demand for hydrocarbon extraction with efficiency and effectiveness.

Impact of gas lift system on oil and gas industry and world economy:

Gas lift system market size exert a profound impact on the oil and gas industry by continually pushing the boundaries of production efficiency. They have become an integral part of the quest of the industry for cost-effective and sustainable hydrocarbon extraction. The ability of gas lift systems to extend the lifespan of mature oil fields is particularly noteworthy.

Gas lift technology steps in to boost oil recovery rates, postponing the inevitable cessation of production and providing operators with valuable extra years of revenue as these fields approach their natural decline. This not only safeguards investments but also reduces the need for new drilling, with positive economic and environmental implications. Moreover, the adaptability of gas lift systems is instrumental in harnessing unconventional resources, such as shale oil and gas, contributing to the energy security of nations and promoting economic stability.

On the global stage, the impact of gas lift systems reverberates through the world economy. The efficient extraction of hydrocarbons facilitated by these systems influences the price of oil, which, in turn, has cascading effects across various sectors. Consumers benefit from stabilized or lower oil prices, reducing the cost of energy and transportation. Furthermore, the revenues generated by the oil and gas industry, partly made possible by gas lift systems, underpin economic growth, infrastructure development, and job creation in oil-producing nations, often serving as the lifeblood of their economies. In addition, these systems foster innovation and investment, not only within the oil and gas sector but also in ancillary industries related to energy technology and environmental stewardship, positioning gas lift systems as essential tools for both the industry and the global economy in the 21st century.

The gas lift system market scope is segmented on the basis of lift type, component, application, gas lift type, well type, and region. On the basis of lift type, the market is bifurcated into gas lift, and others. On the basis of component, the market is segmented into mandrels, valves, and packers. On the basis of application, it is bifurcated into onshore and offshore. On the basis of gas lift type, it is bifurcated into continuous flow and intermittent flow. On the basis of well type the market is bifurcated into horizontal and vertical. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The global gas lift system market analysis covers in-depth information about the major gas lift system industry participants. The key players operating and profiled in the report include Baker Hughes Company, ChampionX, Weatherford International plc, Schlumberger Limited, Saudi Arabian Oil Co. (Saudi Aramco), National Oilwell Varco, Inc., Tendeka, Emerson Electric Co., Spoc Automation, Inc., and Tally Energy Services. In addition to the abovementioned companies Halliburton, Wood Group, General Electric (GE), NOVOMET, and OleumTech Corporation are some major companies which play vital role in the market.

Historical overview of gas lift systems

The historical development of gas lift systems is a testament to human innovation in the oil and gas industry. Here is a brief historical overview of gas lift systems:

Early 1900s: The concept of gas lift for oil production began to take shape in the early 20th century. Initially, it was used as a means to alleviate wellbore pressure and improve the flow of oil to the surface.

1920s: Gas lift technology gained traction in the oil industry, particularly in the U.S., as a cost-effective and efficient method for enhancing oil recovery from wells. The first patents related to gas lift systems were granted during this decade.

1930s: Gas lift systems saw increased use during the 1930s, driven by the growth in understanding of their potential benefits. Initially, they were primarily used in onshore oil wells.

1940s-1950s: The development and deployment of gas lift systems expanded further during and after World War II. Innovations in equipment design and gas injection methods improved system efficiency and reliability. The technology was applied to both onshore and offshore wells.

1960s-1970s: The use of gas lift systems continued to grow, aided by advancements in materials and control systems. These decades witnessed increased offshore drilling and the application of gas lift technology to maximize production from deepwater and ultra-deepwater wells.

1980s-1990s: The 1980s and 1990s marked a period of increased automation and computerization in the oil and gas industry, leading to more precise control and optimization of gas lift systems. This era also saw the development of intelligent well systems for better monitoring and management of gas lift operations.

2000s-Present: Gas lift systems have continued to evolve with the integration of advanced sensors, real-time data analysis, and improved downhole and surface equipment. These advancements have made gas lift systems more efficient, cost-effective, and environment friendly. Technology has been widely adopted globally, including in unconventional resource plays.

Currently, gas lift systems are a crucial artificial lift method in the oil and gas industry, playing a vital role in optimizing production rates from wells of various types, including onshore, offshore, conventional, and unconventional reservoirs. The historical journey of gas lift systems reflects the ongoing commitment of industry to innovation and efficiency in hydrocarbon extraction.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas lift system market analysis from 2022 to 2032 to identify the prevailing gas lift system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas lift system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas lift system market trends, key players, market segments, application areas, and market growth strategies.

Gas Lift System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.8 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 299 |

| By Application |

|

| By Gas Lift Type |

|

| By Well Type |

|

| By Lift Type |

|

| By Component |

|

| By Region |

|

| Key Market Players | Emerson Electric Co., Weatherford International plc, Spoc Automation, Inc., Saudi Arabian Oil Co. (Saudi Aramco), Tendeka, Schlumberger Limited, National Oilwell Varco, Inc., Tally Energy Services, Baker Hughes Company, ChampionX |

Analyst Review

According to the CXOs, the surge in demand for production and exploration activities, spanning both onshore and offshore locations, has been catalyzed by the recovery of crude oil prices and the escalating global appetite for this vital energy source. Recognized global market leaders such as Baker Hughes Company, Weatherford International Inc., and ChampionX have strategically harnessed various growth strategies to bolster their market standings. These industry giants have directed their efforts towards acquisitions and product launches, illustrating their commitment to meeting the soaring demand for gas lift systems and preserving their dominance within the global market landscape.

Among the examined regions, North America is poised to maintain its supremacy in revenue generation throughout the forecast period, closely followed by the LAMEA, Europe, and Asia-Pacific regions, underlining the global reach and significance of the gas lift system industry. The report focuses on the growth prospects, restraints, and trends of the gas lift system market.

The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, in the gas lift system market. Among the analyzed regions, North America accounted for the highest revenue in the global market in 2022. However, LAMEA is expected to grow at a higher rate, predicting lucrative opportunities for the key players operating in the gas lift system market.

Onshore is the leading application of gas lift system market.

North America is the largest regional market for gas lift system market.

$3.8 billion is the estimated industry size of gas lift system market.

Schlumberger Limited Baker Hughes Company Weatherford International plc Halliburton National Oilwell Varco, Inc. (NOV) are the top companies to hold the market share in Gas Lift System

Loading Table Of Content...

Loading Research Methodology...