Gas Meter Market Research, 2033

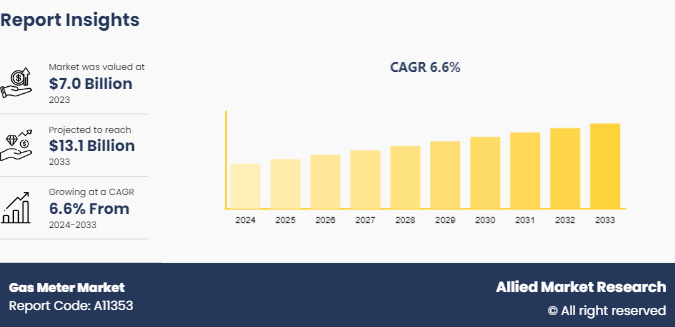

The global gas meter market was valued at $7.0 billion in 2023, and is projected to reach $13.1 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Market Introduction and Definition

A gas meter is a device used to measure the volume of gas consumed by a particular appliance, building, or industrial process. It typically measures the flow rate of gas in cubic meters or cubic feet per unit of time, such as per hour or per day. Gas meters are crucial components in various applications, industries, and products where accurate measurement and monitoring of gas consumption are essential for billing, safety, and efficiency purposes.

In residential applications, gas meters are commonly installed by utility companies to measure the gas consumption of individual households. These meters are usually located outside the home and are connected to the main gas line. They track the amount of gas used for heating, cooking, and hot water, allowing utility companies to bill customers accurately based on their usage. Residential gas meters often utilize diaphragm or rotary meters, which are reliable and cost-effective solutions for measuring relatively low flow rates. Commercial and industrial facilities also rely on gas meters to monitor consumption and ensure efficient operation. In these settings, gas meters may be installed at various points throughout the facility to measure usage by different equipment, processes, or departments. For example, manufacturing plants may use gas meters to monitor the consumption of natural gas for heating, powering machinery, or carrying out chemical processes.

Key Takeaways

The gas meter industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the gas meter market forecast period.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global gas meter market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the gas meter market size.

The gas meter market share is highly fragmented, with several players including Itron Inc., Honeywell International Inc., Landis+Gyr, Xylem, Badger Meter, Inc., EDMI Limited, Dresser Utility Solutions, SLB, SICK AG, and Pietro Fiorentini S.p.a. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the gas meter market growth.

Segment Overview

The gas meter market is segmented into type, end-use, and region. On the basis of type, the market is divided into traditional gas meter and smart gas meter. By end-use, the market is classified into residential, commercial, and industrial. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Integration with renewable energy sources is expected to drive the growth of the gas meter market. Gas meters accurately measure the flow of biogas or hydrogen, allowing for precise monitoring of renewable energy production and consumption. This data can be used to optimize energy generation and distribution. However, high upfront cost of installing gas meters is expected to restrain the growth of the gas meter market. Increase in demand for integrated utility services is expected to provide lucrative opportunities to the market from 2024 to 2033.

The increase in demand for smart meter is expected to boost the demand for gas meter market during the forecast period. Smart meters are equipped with advanced sensors, communication capabilities, and data processing capabilities. They can provide real-time data on gas consumption, allowing utility companies and consumers to monitor usage patterns more accurately and make informed decisions about energy management. Smart meters enable remote monitoring and control of gas usage, eliminating the need for manual meter reading and enabling utilities to detect and address issues such as leaks or tampering more quickly. This enhances operational efficiency and reduces maintenance costs. In March 2023, Itron Inc. revealed a collaboration between Peoples Gas and North Shore Gas, both subsidiaries of WEC Energy Group, and ComEd, a major energy provider serving over 4 million customers. This partnership involves leveraging ComEd's established Itron advanced metering infrastructure (AMI) multi-purpose network. The aim is to implement smart technology for natural gas meter reading, enhancing operational efficiency and reducing carbon emissions.

Smart meters typically have higher upfront hardware costs compared to traditional mechanical meters. These costs not only include the meters themselves but also include associated components such as communication modules, sensors, and data processing units. Installing smart meters often requires specialized equipment and skilled technicians, leading to higher installation expenses compared to traditional metering systems. In addition, retrofitting existing infrastructure to accommodate smart meters may involve additional labor and material costs. Deploying smart meters necessitate upgrades to the existing utility infrastructure, such as communication networks and data management systems, to support the increased data traffic and processing requirements. These infrastructure upgrades can add to the overall installation costs.

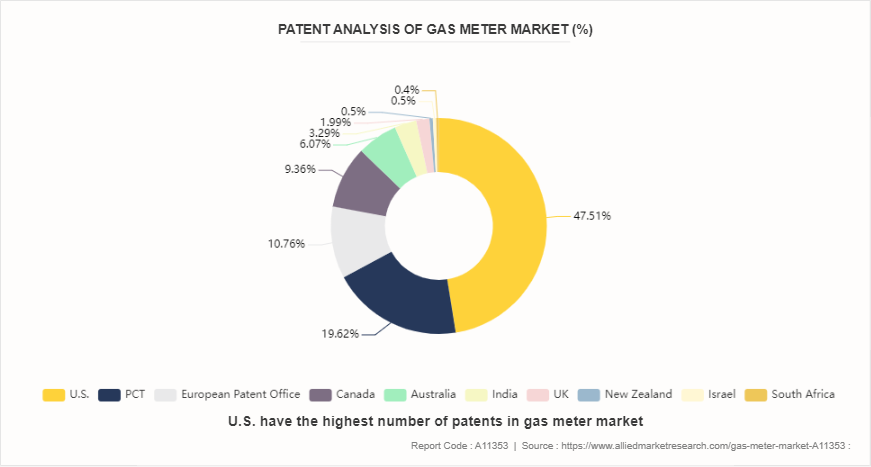

Patent Analysis of Global Gas Meter Market (Country)

The invention discloses an IoT intelligent gas meter and its associated control system, designed to enhance the efficiency and management of gas consumption within various gas supply networks. Comprising a base meter, a CPU control module, and a data transmission module, the gas meter integrates functionalities for adjusting gas consumption criteria and facilitating remote monitoring and control.

Key components include a gas source outlet, gas source inlet with an electromechanical valve, and an EEPROM data storage device within the CPU control module. The data transmission module connects to the IoT for communication with a remote computer management system, enabling real-time feedback on gas consumption information.

Regional Market Outlook

Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In Europe, gas meter usage is also prevalent, with many countries relying on natural gas for heating and electricity generation. The European Union has been promoting energy efficiency and sustainability, leading to the deployment of advanced metering infrastructure (AMI) and smart gas meters in several member states.

In the Asia-Pacific region, gas meter usage varies widely among countries. Developed economies like Japan, South Korea, Australia, and Singapore have extensive gas metering systems, supporting their industrial and residential energy needs. In contrast, some emerging markets in Southeast Asia and South Asia are still expanding their gas infrastructure, with varying levels of metering penetration. The adoption of smart meters is gradually increasing in the region, driven by efforts to modernize energy systems and improve efficiency. In LAMEA, gas meter usage is influenced by economic development, urbanization, and energy policies. In countries such as Brazil, Mexico, Argentina, and South Africa, gas meters are widely deployed to serve residential, commercial, and industrial consumers. However, in some less developed parts of the region, access to natural gas infrastructure and metering systems remains limited, hindering the widespread use of gas as an energy source.

Competitive Analysis

Key market players in the gas meter market include Itron Inc., Honeywell International Inc., Landis+Gyr, Xylem, Badger Meter, Inc., EDMI Limited, Dresser Utility Solutions, SLB, SICK AG, and Pietro Fiorentini S.p.a.

Industry Trends

In March 2023, Landis+Gyr and WEC Energy Group announced a partnership to expand the Advanced Metering Infrastructure (AMI) coverage for gas and electric meters and develop the current managed services agreement through 2038. It includes 210, 000 G480 ultrasonic gas meters, 750, 000 AMI gas modules, and 204, 000 advanced electric meters.

In December 2022, Apator SA unveiled two innovative products tailored for various sectors. Among them was the smartESOX pro, engineered specifically for industrial use. Additionally, they introduced the OTUS 3, a new bidirectional smart meter for electricity. Complementing these offerings were other smart solutions, including the Ultrimis W ultrasonic water meter and the iSMART2 gas.

In July 2022, Italgas, the Italian gas distribution operator, unveiled its implementation of Smart leak detection technology with the introduction of Picarro. This innovative system aims to detect and reduce methane emissions in its networks. Picarro boasts a significantly higher detection rate of approximately 0.8 leaks per kilometer, compared to the 0.03 leaks per kilometer typically identified by traditional gas detection methods.

The Department of Energy and Industrial Policy oversees the UK's comprehensive smart meter deployment plan, according to the National Audit Office. By the offend of 2021, the UK had installed over 27.8 million smart meters, benefiting from its dense population and strong connectivity, resulting in a favorable cost-benefit analysis.

Historic Trends of Gas Meter Market

In 1815, Samuel Clegg, a British engineer, invented the first mechanical gas meter. This pioneering device utilized Bellows mechanism to measure gas consumption accurately. Clegg's invention marked a significant milestone in the history of gas metering, providing a foundational design that would undergo further refinements and improvements in the years to come.

In 1856, the American Gas Light Journal reported the invention of the "wet gas meter" by Cazin. This innovative metering device utilized water to displace the gas and measure its volume, resulting in more accurate readings compared to earlier gas meters.

In the 1900s, significant advancements were made in gas meter technology, rotary meters, also known as positive displacement meters, were introduced during this period. These meters measured gas flow by trapping and rotating a precise volume of gas within a chamber, providing a more accurate method of measurement compared to earlier designs.

In the 1990s, smart gas meters began to emerge, marking a significant advancement in gas metering technology. These meters incorporated digital communication technologies such as Global System for Mobile Communications (GSM) and later, radio frequency (RF) , enabling remote meter reading and real-time consumption monitoring.

Key Regulation Analysis

In the UK, the use and performance of gas meters are governed by Section 17 of the Gas Act 1986 and supporting legislation in the form of Statutory Instruments (SI) . The key documents are the Gas (Meters) Regulations (SI 1983/684) and the Measuring Instruments Regulations (SI 2016/1153) .

Gas meters in the EU are approved under the European Measuring Instruments Directive (MID 2014/32/EU - previously 2004/22/EC) . This directive enables the issuance of a ‘European Type Approval Certificate’ for meters that meet defined accuracy and performance requirements, allowing them to be used in any EU member state.

Regulations in Australia, as outlined in the ATCO Gas Meter Box Location Handbook, emphasize the importance of proper installation and location of gas meter boxes. These regulations include restrictions on where gas meter boxes can be placed, such as not being too close to windows or sources of ignition and ensuring that the line of service is free from hazards and obstructions. The Gas Standard Act 1972, Gas Standards [Gas Fitting and Consumer Gas Installations] Regulations 1999, and Occupational Safety and Health Act 1994 are some of the key safety standards that govern gas meter installation and operation in Australia.

Key Sources Referred

- Department of Energy

- Ministry of Petroleum and Natural Gas

- U.S. Energy Information Administration

- GOV.UK

- Ministry of Consumer Affairs

- Integrity Energy

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas meter market analysis from 2024 to 2033 to identify the prevailing gas meter market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the gas meter market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global gas meter market trends, key players, market segments, application areas, and market growth strategies.

Gas Meter Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 13.1 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Landis+Gyr, SLB, Xylem, EDMI Limited, Badger Meter, Inc., Itron Inc., SICK AG, Dresser Utility Solutions, Pietro Fiorentini S.p.a., Honeywell International Inc. |

The global gas meter market size was valued at $7.0 billion in 2023 and is projected to reach $13.1 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Key market players in the gas meter market include Itron Inc., Honeywell International Inc., Landis+Gyr, Xylem, Badger Meter, Inc., EDMI Limited, Dresser Utility Solutions, SLB, SICK AG, and Pietro Fiorentini S.p.a.

Asia-Pacific is the largest regional market for gas meter.

Commercial building is the leading application of gas meter market.

Increase in demand for smart city initiatives are the upcoming trends of gas meter market.

Loading Table Of Content...