Gas Turbine MRO Market Research, 2032

The global gas turbine MRO market size was valued at $14.5 billion in 2022, and is projected to reach $20.4 billion by 2032, growing at a CAGR of 3.5% from 2023 to 2032.

Report Key Highlighters:

- The gas turbine MRO market is highly fragmented, with several players including Baker Hughes Company; Doosan Enerbility; Mitsubishi Heavy Industries, Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Energy AG; General Electric Company; Solar Turbines Incorporated; Ansaldo Energia SPA; Sulzer Ltd.; and Metalock Engineering.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value during the forecast period 2022-2032 is covered in the gas turbine MRO market report.

Gas turbine MROs (maintenance, repair, and overhaul) refer to activities and services such as maintenance, repair, and overhaul for gas turbines. In different industries, such as aeronautics, energy generation, oil and gas, marine transport or industrial applications, gas turbines are widely used.

MRO services for gas turbines are critical to ensure their optimal performance, reliability, and safety. These services involve a range of activities, such as inspections, testing, repairs, component replacements, and performance enhancements. The primary goals of gas turbine MROs are to extend the operational life of the turbines, minimize downtime, and ensure compliance with regulatory standards.

The rising demand for electricity and the growing adoption of gas turbines in various industries, including power generation, aviation, and oil and gas, drive the need for maintenance and repair services to ensure reliable and efficient turbine operations.

The growth of population, urbanization and industrialization continues to increase global demand for energy. In view of their efficiency and relative emission reduction compared to other alternative fossil fuels, gas turbines are a preferred option for power generation. Besides, many gas turbine operators prefer to outsource their maintenance and repair needs to specialized MRO service providers. Outsourcing allows companies to focus on their core operations while leveraging the expertise of MRO professionals. In addition, gas turbines offer grid stability and flexibility, making them a suitable choice for integrating intermittent renewable energy sources into the power grid. The growing use of gas turbines for grid balancing drives the demand for MRO services.

However, the high cost associated with gas turbine MRO is expected to act as a major restraint for gas turbine MRO market growth. Nevertheless, innovation and technological advancement is anticipated to offer ample market growth in coming years. For instance, Artificial Intelligence (AI) and Machine Learning algorithms are employed to analyze vast amounts of operational data from gas turbines, identifying patterns and trends. These insights help optimize turbine performance, improve fuel efficiency, and enhance reliability.

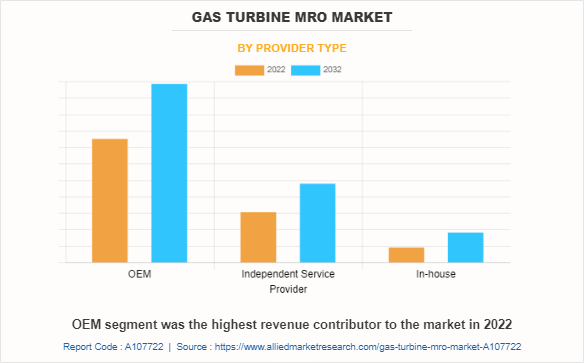

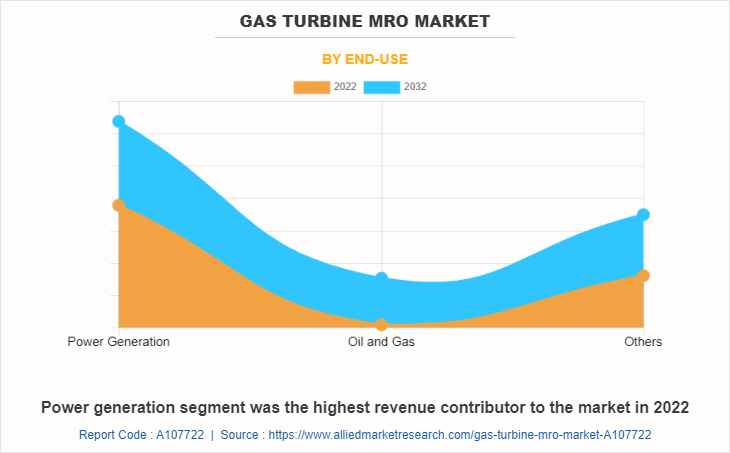

The gas turbine MRO market scope is segmented on the basis of technology, type, provider type, end-use, and region. By technology, the market is categorized into heavy duty, light industrial, and aeroderivative. By type, the market is categorized into maintenance, repair, and overhaul. By provider type, the market is divided into OEM, independent service provider, and in-house. By end-use, the market is divided into power generation, oil and gas, and others. By region, the gas turbine MRO market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players in the gas turbine MRO industry include Baker Hughes Company; Doosan Enerbility; Mitsubishi Heavy Industries, Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Energy AG; General Electric Company; Solar Turbines Incorporated; Ansaldo Energia SPA; Sulzer Ltd.; and Metalock Engineering. Other key players operating in the market but not profiled in the report include Rolls-Royce, Wood Group, Solar Turbines, Sulzer, Aerotech Herman Nelson International Inc., P&W, Lufthansa Technik, Safran Aircraft Engines, and others.

Asia-Pacific dominated the market in 2022. The Asian Pacific region is experiencing strong economic growth and increasing demand for energy. In order to meet growing electricity demand, gas turbines are widely applied for the production of power. The maintenance and reliability of gas generators is essential in order to ensure a stable and secure power supply. In addition, gas turbines are being increasingly used across a wide range of sectors such as oil and gas, petrochemicals, production or other fields in the rapidly industrialised region. Gas turbine MRO services are essential for supporting the continuous operation of these turbines in industrial processes.

Asia-Pacific countries are investing heavily in infrastructure projects, such as airports, ports, and power plants, which often utilize gas turbines. MRO services are crucial to support the long-term performance and efficiency of these infrastructure assets. Besides, the region has significant offshore oil and gas operations, and marine vessels that utilize gas turbines. MRO services are essential to maintain the reliability of gas turbines operating in challenging offshore and marine environments.

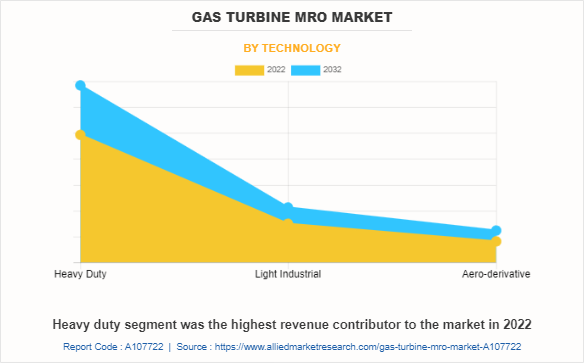

Heavy duty segment was the highest revenue contributor to the market in 2022. The rising demand for electricity and energy in both developed and emerging economies has led to an increase in the installation of heavy-duty gas turbines for power generation. With the surge in installation of heavy-duty gas turbines, the need for MRO services in order to maintain and optimize their performance is witnessing growth. Besides, many existing heavy-duty gas turbines have been in operation for several years and require regular maintenance and repairs to ensure their continued optimal performance. As the gas turbine fleet ages, the demand for MRO services increases.

Further, economic growth and industrialization in various sectors lead to increased energy demands. Heavy-duty gas turbines are often chosen for large-scale power generation in industries such as oil and gas, petrochemicals, and manufacturing, which are driving the need for MRO services.

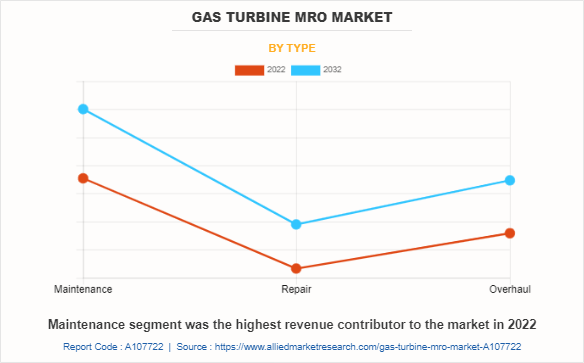

Maintenance segment was the highest revenue contributor to the market in 2022. Preventive maintenance involves systematic inspections and servicing of gas turbines to identify and address potential issues before they escalate into significant problems. It helps extend the operational life of the turbines and minimizes downtime.Corrective maintenance involves addressing issues identified during inspections or in response to unexpected turbine failures. This may include repairing or replacing faulty components to restore the turbine's functionality.

Gas turbines operate at high temperatures, and the hot sections, including turbine blades and combustors, require regular inspections to assess their condition and performance. Besides, the combustion system, including fuel nozzles, combustion liners, and flame detectors, is crucial for efficient and stable combustion. Maintenance of the combustion system ensures proper fuel efficiency and emissions control.

OEM segment was the highest revenue contributor to the market in 2022. Original Equipment Manufacturers (OEMs) have extensive knowledge of their gas turbine products, including their design, engineering, and performance characteristics. This expertise allows them to provide specialized MRO solutions tailored to their own equipment, enhancing the overall effectiveness of the maintenance processes.

Further, OEMs often offer long-term service agreements (LTSA) or maintenance contracts that cover regular maintenance, repairs, and technical support. These agreements can provide customers with predictable maintenance costs and a dedicated support team. As gas turbine technology continues to evolve, OEMs may offer upgrades and enhancements to their existing products. MRO services by the OEMs may incorporate these advancements, allowing operators to improve the performance and efficiency of their existing gas turbines.

Power generation segment was the highest revenue contributor to the market in 2022. Effective gas turbine MRO is critical in power generation as it ensures continuous and reliable electricity production. Regular maintenance ensures that the power plant is safe from disruption, minimises operating risks and maximises its efficiency in terms of cost savings and even more sustainable operation. The power generation is a critical sector, and gas turbines are widely used as an important source of energy production.

Ensuring the reliability and efficiency of gas turbines through MRO activities is vital to maintaining a stable and continuous power supply. Besides, gas turbines are favored in power generation due to their ability to provide fast startup times, flexibility in fuel choices (including natural gas and renewable fuels), and relatively lower emissions compared to some other power generation technologies. As the use of gas turbines increases, the demand for MRO services rises.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gas turbine MRO market analysis from 2022 to 2032 to identify the prevailing gas turbine MRO market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gas turbine MRO market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gas turbine MRO market trends, key players, market segments, application areas, and market growth strategies.

Gas Turbine MRO Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.4 billion |

| Growth Rate | CAGR of 3.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Technology |

|

| By Type |

|

| By Provider Type |

|

| By End-use |

|

| By Region |

|

| Key Market Players | Kawasaki Heavy Industries, Ltd., General Electric Company, Doosan Enerbility, Metalock Engineering, Baker Hughes Company, Solar Turbines Incorporated, Siemens Energy AG, Mitsubishi Heavy Industries, LTD, Sulzer Ltd., Ansaldo Energia SPA |

Analyst Review

According to the opinions of various CXOs of leading companies, the gas turbine MRO market is expected to witness increased demand during the forecast period. Maintenance and repair services are needed to maintain efficient operation of gas turbines, due to the increasing demand for electricity coupled with a growing use of gas turbines in power generation, aviation as well as other sectors. In addition, there is an increased demand for power generation and other industrial applications that use gas turbines in emerging economies due to rapid economic development.

Furthermore, technological advancements in gas turbine MRO (maintenance, repair, and overhaul) have been instrumental in improving the efficiency, safety, and overall effectiveness of maintenance practices. Advanced sensors and monitoring systems are now integrated into gas turbines to continuously monitor their performance and health. This data is analyzed using advanced algorithms and artificial intelligence to predict potential issues and enable predictive maintenance. By addressing problems before they escalate, downtime is minimized, and maintenance becomes more efficient. Also, remote monitoring capabilities allow MRO technicians and engineers to access real-time data from gas turbines from a centralized location. This enables quicker response times, remote troubleshooting, and early identification of problems, reducing the need for on-site visits and saving time and costs.

The growing use of gas turbines for grid balancing contributes to the demand for MRO services. Besides, economic growth and industrialization in emerging economies lead to increased energy demands and the expansion of gas turbine installations in various industries, fostering the need for MRO services.

Power generation is the leading application of Gas Turbine MRO Market.

The global gas turbine MRO market was valued at $14.5 billion in 2022, and is projected to reach $20.4 billion by 2032, growing at a CAGR of 3.5% from 2023 to 2032.

The top companies to hold the market share in Gas Turbine MRO include Baker Hughes Company; Doosan Enerbility; Mitsubishi Heavy Industries, Ltd.; Kawasaki Heavy Industries, Ltd.; Siemens Energy AG; General Electric Company; Solar Turbines Incorporated; Ansaldo Energia SPA; Sulzer Ltd.; and Metalock Engineering.

Asia-Pacific is the largest regional market for Gas Turbine MRO.

Loading Table Of Content...

Loading Research Methodology...