Global Gasification Market Research, 2032

The global gasification market was valued at $472.2 billion in 2022, and is projected to reach $836.6 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032. The thermochemical conversion of organic or fossil-based raw materials into hydrogen and carbon monoxide gas with a negligible amount of carbon dioxide and water is known as gasification. The raw materials used in this process are primarily carbonaceous. Syngas is the by-product of this process. The syngas produced through gasification has several applications. It can be used as a fuel in industrial processes, power generation, and as a chemical feedstock for the production of various chemicals and fuels. The syngas can also be further processed to remove impurities, such as sulfur and particulate matter, before utilization or conversion into other valuable products.

Global population growth, rapid industrialization and urbanization, the emergence of chemical manufacturing facilities, the expansion of the coal industry, and rising power demand are major factors expected to drive the growth of the gasification market during the forecast period. Increased interest in gasification as a clean energy replacement is a result of rising environmental awareness and knowledge of sustainability. Gasification procedures are being installed in production and manufacturing facilities due to rapid industrialization, developing electricity, chemical, and oil & gas sectors, as well as technological advancements. The widespread use of gasification for waste disposal and the recycling of complex compost, the demand for gasification in the municipal sector is rapidly rising. Gasifiers are a flexible, dependable, and effective option for thermal applications as they can be easily retrofitted into already-existing gas-fueled machinery, such as furnaces and boilers, to replace fossil fuels with syngas.

However, the high installation costs related to the deployment of gasification systems is projected to restrain the growth of the global gasification market. Gasification projects also require significant operational costs. The capital expenditure involved in building gasification plants, implementing carbon capture and storage, and ensuring compliance with environmental regulations can be substantial. Gasification's widespread adoption may be hampered by its high costs, especially in areas where alternative energy sources are less expensive.

The demand for cleaner and more effective energy generation technology in commercial and residential applications is anticipated to drive the market expansion. Gasification can utilize a variety of feedstocks, including coal, biomass, and municipal solid waste. This flexibility allows for the utilization of diverse and abundant resources, reducing dependency on a single feedstock and providing a more sustainable energy mix. Gasification processes can achieve high energy efficiency compared to conventional combustion technologies. By converting feedstocks into syngas, gasification maximizes the utilization of energy content and minimizes waste. The produced syngas can be used for electricity generation, heat production, and even the synthesis of liquid fuels, improving overall energy efficiency. also referred to as producer gas, is the process' end product and has a higher calorific value than fossil fuels. Gasification offers the potential for significant emission reductions compared to traditional combustion processes. Through gasification, feedstocks are converted into syngas, which can be cleaned and conditioned to remove impurities such as sulfur and particulate matter. This enables the production of cleaner syngas, resulting in reduced emissions of pollutants and greenhouse gases. The fact that biodegradable materials are used as raw materials in the process is another significant factor that makes traditional combustion technology obsolete. The method is frequently used in various industries to generate electricity. The gasification technology presents a range of opportunities in energy production, including feedstock diversification, improved energy efficiency, emission reduction, waste management, and integration with carbon capture technologies.

The key players profiled in this report include Royal Dutch Shell, Air Liquide, General Electric, Mitsubishi Heavy Industries, SEDIN Engineering Company Limited, Siemens, CB&I, KBR, Thyssenkrupp AG, and Synthesis Energy Systems Inc. For instance, in April 2020, Wuhan Engineering Ltd. in China placed an order with Larsen & Toubro for coal gasification machinery. To create urea, the plant will use pet coke and coal with a high ash concentration as feedstock.

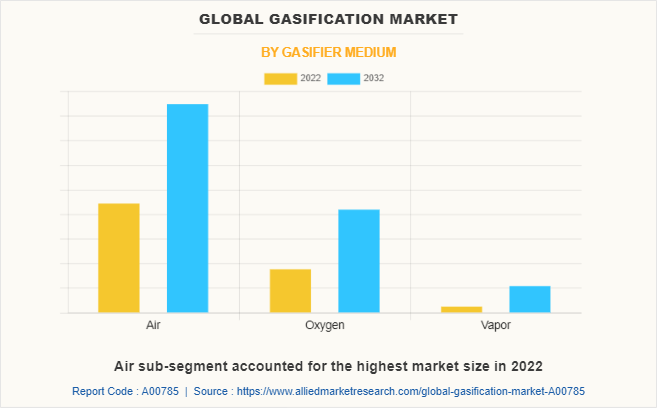

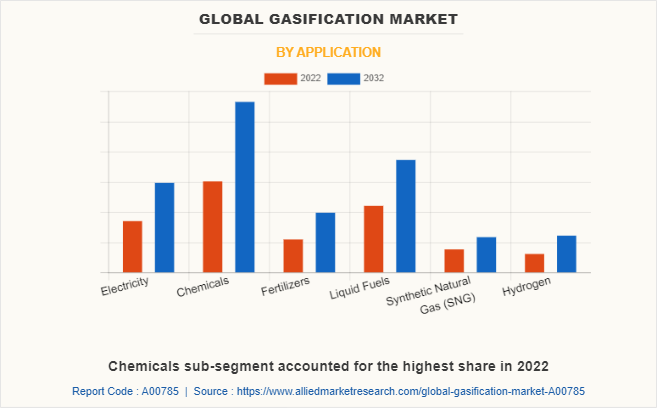

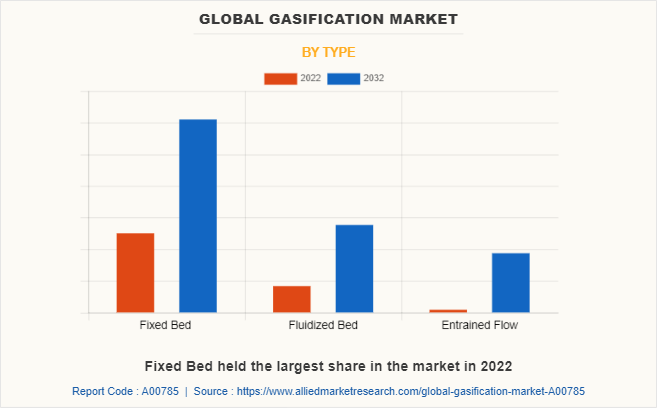

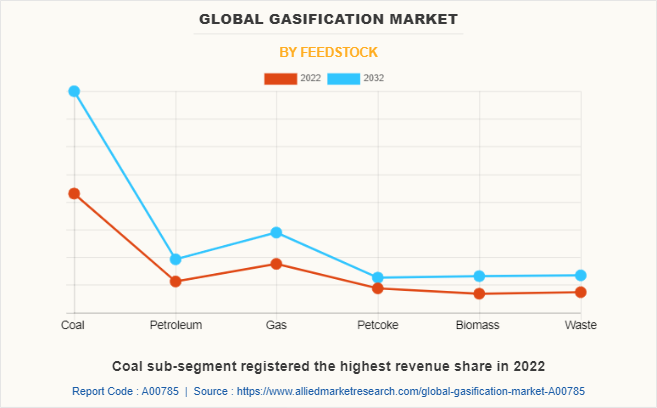

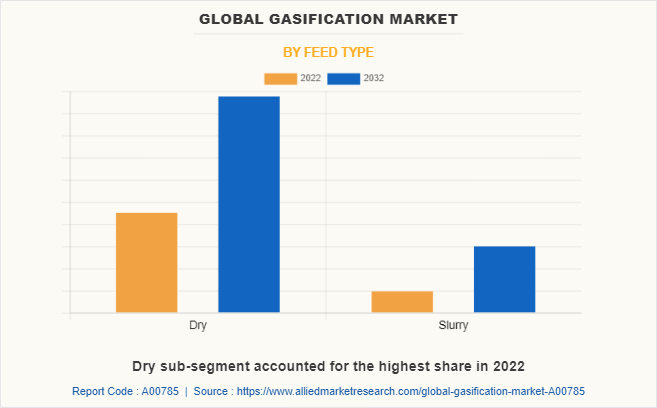

The gasification market is segmented on the basis of type, feedstock, feed type, gasifier medium, application, and region. By type, the market is divided into fixed bed, fluidized bed, and entrained flow. By feedstock, the market is classified into coal, petroleum, gas, petcoke, biomass, and waste. By feed type, the market is classified into dry feed and slurry. By gasifier medium, the market is classified into air, oxygen, and vapor. By application, the market is classified into electricity, chemicals, fertilizers, liquid fuels, SNG, and hydrogen. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By gasifier medium, the air sub-segment dominated the global market share in 2022. Air is abundantly available and relatively low-cost compared to other sources of oxygen, such as pure oxygen or steam. This makes air gasification economically attractive for large-scale gasification plants. Moreover, air gasification offers flexibility in terms of the types of feedstocks that can be used. It can handle a wide range of carbonaceous materials, including coal, biomass, and municipal solid waste. In addition, air gasification technology can be scaled up or down to meet different capacity requirements. Air gasification can be designed with various environmental controls to mitigate emissions. While gasification still produces carbon dioxide (CO2), it is typically less carbon-intensive than conventional combustion processes. In addition, advanced gasification technologies can incorporate carbon capture and storage (CCS) techniques to reduce greenhouse gas emissions further.

By application, the chemicals sub-segment dominated the global gasification market share in 2022. The gasification offers an attractive option for chemical production as it enables the utilization of low-value feedstocks, including biomass and waste materials, which reduces dependence on fossil fuels. This aligns with the rising global focus on reducing greenhouse gas emissions and transitioning to a circular economy. Gasification technology also provides flexibility in terms of feedstock selection, allowing for the production of a variety of chemicals. The syngas produced from gasification can be processed using various catalytic and chemical reactions to generate chemicals such as methanol, ammonia, dimethyl ether, synthetic natural gas, and higher alcohols. These chemicals are used in industries such as fertilizers, plastics, pharmaceuticals, and fuels. In addition, the increasing demand for clean and renewable energy sources is driving the growth of the gasification market. Gasification can be integrated with other processes such as combined heat and power (CHP) and integrated gasification combined cycle (IGCC) systems to produce electricity and heat. This integrated approach allows for the efficient utilization of the syngas while minimizing emissions.

By type, the fixed bed sub-segment dominated the market in 2022. Fixed bed gasifiers can process a wide variety of feedstocks, including coal, biomass, and municipal solid waste. This flexibility allows industries to choose the most suitable feedstock based on availability, cost, and environmental considerations. Fixed bed gasifiers are known for their robust design and stable operation. They can handle variations in feedstock quality and have a higher tolerance for impurities compared to other gasification technologies. This reliability is crucial for industries that require uninterrupted gasification processes. Moreover, fixed bed gasifiers have high thermal efficiencies, typically ranging from 70% to 80%. This means they can convert a significant portion of the feedstock's energy content into syngas, resulting in better energy utilization and cost savings for the end users. These are predicted to be the major factors driving the gasification market size during the forecast period.

By feedstock, the coal sub-segment dominated the market in 2022. Coal is widely available in many regions of the world, providing a stable and secure energy source for gasification. Countries with abundant coal reserves, such as the U.S., China, and India, often utilize coal gasification to diversify their energy mix and reduce dependence on imported fuels. Moreover, coal is generally a more affordable feedstock compared to other alternatives such as natural gas or biomass. The lower cost of coal makes it an attractive option for gasification, especially in regions where coal is abundant and inexpensive. Furthermore, many regions already have well-established coal mining and transportation infrastructure in place. This infrastructure can be leveraged for the coal gasification process, reducing the need for significant additional investments in logistics and supply chain. Coal gasification can be integrated with carbon capture and utilization technologies to reduce greenhouse gas emissions. By capturing and utilizing carbon dioxide emitted during gasification, coal can align with environmental goals and regulations related to reducing carbon emissions.

By feed type, the dry feed sub-segment dominated the global market in 2022. Dry feed gasification allows for the use of a wide range of feedstock, including coal, biomass, and municipal solid waste. Dry feed gasification technologies have evolved to become more energy efficient over time. They enable efficient conversion of feedstock into syngas, which can be further processed for various applications, such as power generation, chemical production, and fuel synthesis. Moreover, dry feed gasification has certain environmental advantages over other gasification processes. It can help reduce greenhouse gas emissions by capturing and sequestering carbon dioxide generated during the gasification process. The ability to address environmental concerns, such as reducing carbon footprints and complying with emission regulations, is driving the adoption of dry feed gasification technologies.

By region, Asia-Pacific dominated the global market in 2022 and is projected to be the fastest growing region during the forecast period. Asia-Pacific, including countries such as China, India, Japan, and South Korea, have experienced rapid economic growth in recent years. This growth has led to an increase in demand for energy, including cleaner and more efficient sources such as gasification. Furthermore, many countries in the region heavily rely on imported fossil fuels for their energy needs. Gasification offers a way to diversify their energy sources and reduce dependence on external suppliers, enhancing energy security. Asia-Pacific faces significant environmental challenges due to population growth, urbanization, and industrialization. Gasification provides a cleaner alternative to traditional fossil fuel combustion by converting coal, biomass, or waste into synthesis gas (syngas), which can be used for power generation or as a feedstock for chemicals and fuels.

Impact of COVID-19 on the Global Gasification Industry

- Due to lockdowns, travel restrictions, and supply chain interruptions, the pandemic created delays in project development operations. Construction activities, equipment procurement, and site inspections all were delayed or suspended, causing gasification projects to stall

- COVID-19 generated major price swings in energy commodities such as oil, natural gas, and coal. These price changes had an impact on the economics of gasification projects because they can alter the cost competitiveness of gasification-derived fuels and products versus traditional fossil fuels

- Governments worldwide shifted their priorities and resources towards managing the pandemic and supporting public health measures. This reallocation of resources and attention resulted in delays or changes in policy support for gasification projects, potentially impacting their development and deployment

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global gasification market trends along with the gasification market forecast

- The report elucidates the gasification market opportunities along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts

- Porter’s five forces analysis helps analyse the potential of the buyers & suppliers and the competitive scenario of the market for strategy building

- The report entailing the gasification market analysis maps the qualitative sway of various industry factors on market segments as well as geographies

- The data in this report aims on market dynamics, trends, and developments affecting the gasification market growth

Gasification Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 836.6 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 308 |

| By Gasifier Medium |

|

| By Application |

|

| By Type |

|

| By Feedstock |

|

| By Feed Type |

|

| By Region |

|

| Key Market Players | Synthesis Energy Systems Inc., Shell Plc., CB&I, ThyssenKrupp AG., Mitsubishi Heavy Industries, KBR Inc., Air Liquide, SEDIN Engineering Company Limited, General Electric, Siemens |

Gasification provides a means of reducing reliance on conventional fossil fuels and diversifying sources of energy. It offers an alternate path for the synthesis of mobility fuels, heat, and power from a range of based on carbon feedstocks, such as coal, biomass, and waste products. By lowering reliance on scarce or politically sensitive energy supplies, this diversification contributes to improving energy security. These are the major driving factors projected to create several growth opportunities in the market.

The gasification market has leading applications in the chemicals industry.

Asia-Pacific is the largest regional market for the global gasification industry.

The global gasification market is estimated to reach $836.6 billion by 2032.

The major growth strategies adopted by gasification market players are investment and agreement.

Royal Dutch Shell, Air Liquide, General Electric, Mitsubishi Heavy Industries, SEDIN Engineering Company Limited, Siemens, CB&I, KBR, Thyssenkrupp AG, and Synthesis Energy Systems Inc. are the major players in the gasification market.

The coal sub-segment of the feedstock acquired the maximum share of the global gasification market in 2022.

Loading Table Of Content...

Loading Research Methodology...