Gastrointestinal Therapeutics Market Research, 2032

The global gastrointestinal therapeutics market size was valued at $39.5 billion in 2022, and is projected to reach $64.5 billion by 2032, growing at a CAGR of 5% from 2023 to 2032. Gastrointestinal therapeutics is a specialized field of medicine focused on diagnosing and treating disorders affecting the gastrointestinal tract. This branch of medicine focuses on addressing conditions that impact organs within the gastrointestinal system, including the stomach, small intestine, large intestine, and rectum. Gastrointestinal therapeutics involve a range of interventions, such as medications aimed at alleviating symptoms, improving the overall function of the gastrointestinal system, and enhancing the quality of life for individuals affected by these conditions.

Market Dynamics

The surge in incidence of gastrointestinal disorders such as gastroesophageal reflux disease (GERD), inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and gastrointestinal cancers is a major factor that drives the market growth. Factors such as unhealthy diets, sedentary lifestyles, and environmental factors contribute to the increase in prevalence, creating a sustained demand for effective treatments and support the market growth. For instance, article published by National Stem Cell Foundation 2023, stated that, nearly 4% of the world population is affected by one of more than 80 different autoimmune diseases, the most common of which include type 1 diabetes, multiple sclerosis, rheumatoid arthritis, lupus, Crohn’s disease, psoriasis and scleroderma. Thus, surge in prevalence of gastrointestinal diseases fuels the gastrointestinal therapeutics market growth.

In addition, a higher proportion of elderly individuals who are more susceptible to gastrointestinal conditions led to a rise in the demand for gastrointestinal therapeutics. For instance, an article published by the National Center for Biotechnology and Information (NCBI) in 2023, the burden of inflammatory bowel disease (IBD) is increasing worldwide, with a particular increase in the prevalence in the elderly population. This increase prevalence can be attributed to two main factors such as the aging of individuals who developed IBD at a young age, and the growing incidence of IBD among elderly patients.

Continuous advancements in pharmaceutical research and development have led to the discovery of new drugs, novel delivery systems, and targeted therapies wjich provide the gastrointestinal therapeutics market opportunity. Biologics, precision medicine, and personalized treatment approaches are expanding the treatment options available for various gastrointestinal conditions. For instance, in June 2023, AbbVie Inc. has announced the positive top-line results from COMMAND, its Phase 3 maintenance study, showing Risankizumab (SKYRIZI, 180 mg or 360 mg subcutaneous achieved the primary endpoint of clinical remission at week 52, as well as key secondary endpoints in adult patients with moderately to severely active ulcerative colitis.

Moreover, the rise in awareness among patients about gastrointestinal disorders, their symptoms, and available treatments is leading to higher rates of diagnosis and rise in demand for therapeutics which is expected to contribute toward the market growth. The pharmaceutical industry is subjected to strict regulatory oversight, which may delay the approval and launch of new gastrointestinal drugs and treatments. Rigorous clinical trial requirements, safety assessments, and lengthy approval processes may hinder market growth. In addition, gastrointestinal medications may have potential side effects and safety concerns lead to decreased patient confidence and regulatory interventions, negatively impacting market growth.

In addition, the pharmaceutical industry may face challenges during a recession, including reduced research and development budgets, delays in clinical trials, and supply chain disruptions. These factors could impact the availability of new and existing gastrointestinal medications. However, recessions may accelerate the adoption of telemedicine and remote healthcare services, which could provide an avenue for patients to receive consultations and prescriptions for gastrointestinal medications without in-person visits that support the market growth.

Segmental Overview

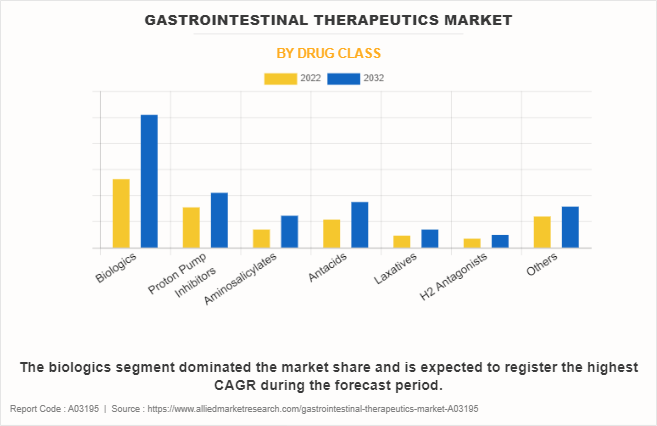

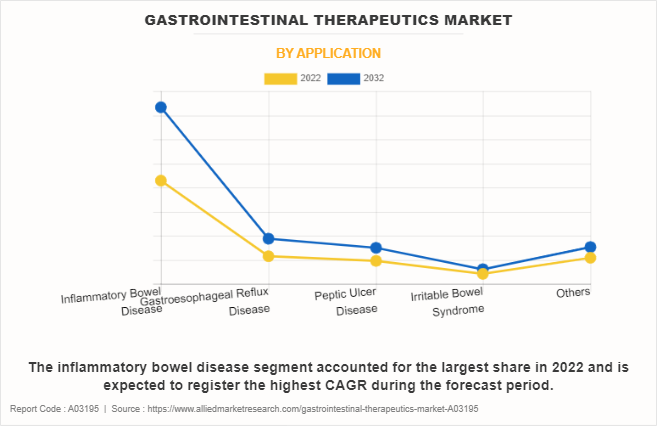

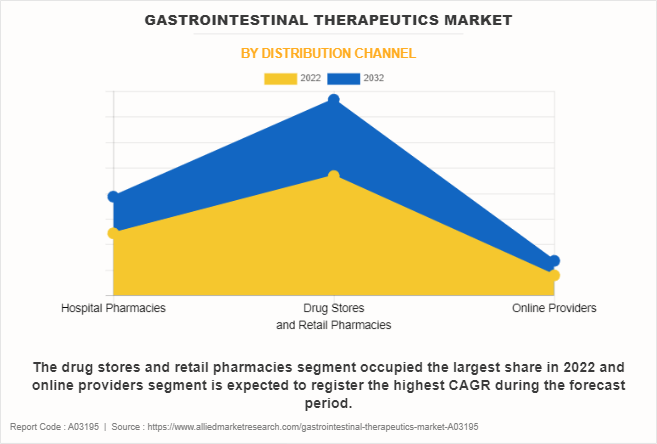

The gastrointestinal therapeutics market size is segmented into drug class, application, distribution channel and region. By drug class, the market is categorized into biologics, proton pump inhibitors, aminosalicylates, antacids, laxatives, H2 antagonists, and others. By application, the market is categorized into inflammatory bowel disease, gastroesophageal reflux disease, peptic ulcer disease, irritable bowel syndrome, and others. The inflammatory bowel disease segment further categorized into Crohn’s disease and ulcerative colitis. The peptic ulcer disease segment further categorized into the gastric ulcer and duodenal ulcer. By distribution channel, the market is categorized into hospital pharmacies, drug stores and retail pharmacies, and online providers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Drug Class

The biologics segment dominated the global gastrointestinal therapeutics market share in 2022 and is expected to remain dominant throughout the gastrointestinal therapeutics market forecast period, owing to widespread usage of biologics as they are highly effective medications for treating various acid-related gastrointestinal disorders such as inflammatory bowel disease. The efficacy, convenience, and relatively favorable safety profile of PPIs, coupled with the rise in prevalence of these conditions globally drive the segment growth.

By Application

The inflammatory bowel disease segment dominated the global gastrointestinal therapeutics market share in 2022 and is anticipated to continue this trend during the forecast period. This is attributed to surge in prevalence of IBD, which includes conditions such as Crohn's disease and ulcerative colitis. In addition, advancements in targeted biologic therapies and personalized treatment approaches have significantly improved the management of IBD which further supports the segment growth.

By Distribution Channel

The drug stores and retail pharmacies held the largest gastrointestinal therapeutics industry share in 2022 and is expected to remain dominant throughout the forecast period, owing to widespread presence of drug stores and retail pharmacies, coupled with their role as accessible points of healthcare service delivery, ensures that patients can easily obtain essential medications and seek advice from pharmacists.

However, the online providers segment is expected to register the highest CAGR during the forecast period. This is attributed to the widespread adoption of e-commerce and digital platforms that has transformed the way consumers access healthcare products, including gastrointestinal medications. In addition, the convenience of ordering medications from the comfort of one's home, enabling easy access to a diverse range of gastrointestinal therapeutics further supports the segment growth.

By Region

The gastrointestinal therapeutics industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the gastrointestinal therapeutics market in 2022 and is expected to maintain its dominance during the forecast period. Presence of several major players, such as AbbVie Inc. Bayer AG, Bausch Health Companies Inc., and Pfizer Inc. in the region drive the growth of the market.

In addition, the presence of well-established healthcare infrastructure, high purchasing power, and rise in adoption rate of gastrointestinal therapeutics are expected to drive the market growth. Furthermore, product launches and product approvals adopted by the key players in this region boost the growth of the market. For instance, in April 2023, AbbVie announced the European Commission (EC) approved RINVOQ (upadacitinib, 45 mg [induction dose] and 15 mg and 30 mg as the first oral Janus Kinase (JAK) inhibitor for the treatment of adult patients with moderately to severely active Crohn's disease.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to rise in prevalence of gastrointestinal disorders due to changing dietary habits, urbanization, lifestyle shifts, and an aging population. Conditions such as gastroesophageal reflux disease (GERD), inflammatory bowel disease (IBD), and irritable bowel syndrome (IBS) are becoming more common, driving the demand for effective treatments.

Asia-Pacific offers profitable opportunities for key players operating in the gastrointestinal therapeutics treatment market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, as well as well-established presence of domestic companies in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the gastrointestinal therapeutics treatment, such as AbbVie Inc., Pfizer Inc., AstraZeneca plc, Bayer AG, Takeda Pharmaceutical Company Limited, Organon Group of Companies, Bausch Health Companies Inc., Cosmo Pharmaceuticals N.V., Biogen, Teva Pharmaceutical Industries Limited, and Bristol-Myers Squibb Company are provided in this report. There are some important players in the market such as Coherus BioSciences, Inc. Biogen, Bristol-Myers Squibb Company, and others. The major players have adopted product launch, product approval, and clinical trials as key developmental strategies to improve the product portfolio of the gastrointestinal therapeutics market.

Recent Product Approvals in the Gastrointestinal Therapeutics Market

- In May 2023, AbbVie announced that the U.S. Food and Drug Administration (FDA) has approved RINVOQ (upadacitinib) for the treatment of adults with moderately to severely active Crohn's disease who have had an inadequate response or intolerance to one or more TNF blockers.

- In April 2023, AbbVie announced the European Commission (EC) approved RINVOQ (upadacitinib, 45 mg [induction dose] and 15 mg and 30 mg [maintenance doses]) as the first oral Janus Kinase (JAK) inhibitor for the treatment of adult patients with moderately to severely active Crohn's disease.

- In November 2022, AbbVie announced the European Commission (EC) approved SKYRIZI (risankizumab, 600 mg intravenous [IV] induction and 360 mg subcutaneous [SC] maintenance therapy) as the first specific interleukin-23 (IL-23) inhibitor for the treatment of adults with moderately to severely active Crohn's disease.

- In January 2021, AstraZeneca and Daiichi Sankyo Company, Limited announced the U.S. approval for Enhertu (trastuzumab deruxtecan) for the treatment of adult patients with locally advanced or metastatic HER2-positive gastric or gastroesophageal junction (GEJ) adenocarcinoma who have received a prior trastuzumab-based regimen.

- In September 2021, Takeda Pharmaceutical Company Limited announced that it has received approval from the Japan Ministry of Health, Labour and Welfare to manufacture and market Alofisel (darvadstrocel) for the treatment of complex perianal fistulas in patients with non-active or mildly active luminal Crohn’s disease (CD).

- In May 2021, Bristol Myers Squibb announced that the U.S. Food and Drug Administration (FDA) approved Zeposia (ozanimod) 0.92 mg for the treatment of adults with moderately to severely active ulcerative colitis (UC), a chronic inflammatory bowel disease (IBD).

Recent Product Launch in the Gastrointestinal Therapeutics Market

- In April 2021, Teva Pharmaceuticals USA, Inc., announced the launch of its 1000 mg strength generic version of Casana (mesalamine) suppository medicine used to treat adults with active ulcerative proctitis (ulcerative rectal colitis), in the U.S.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gastrointestinal therapeutics market analysis from 2022 to 2032 to identify the prevailing gastrointestinal therapeutics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gastrointestinal therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gastrointestinal therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Gastrointestinal Therapeutics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 64.5 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 320 |

| By Drug Class |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

This section provides various opinions of gastrointestinal therapeutics market. The increase in demand for gastrointestinal therapeutics and rise in awareness about importance of early diagnosis and treatment is expected to offer profitable opportunities for the expansion of the market. However, stringent government regulations toward approval of biosimilars and patent expiry of drugs hinders the market growth.

CXOs further added that the surge in the prevalence of gastrointestinal diseases and a rise in awareness regarding the potential benefits of gastrointestinal therapeutics drugs. This led to an increase in demand for gastrointestinal drugs across the globe which is expected to fuel market growth during the forecast period. In addition, the surge in geriatric population that are susceptible to gastro related issues further drives the growth of the market.

Furthermore, North America dominated the market share, in terms of revenue, owing to the increase in prevalence of gastrointestinal diseases along with rise in geriatric population and presence of major key players in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in healthcare awareness, and growing geriatric population that are suffering from gastrointestinal diseases.

The total market value of gastrointestinal therapeutics market is $39.5 billion in 2022.

The market value of gastrointestinal therapeutics market in 2032 is $64.5 billion.

The base year is 2022 in gastrointestinal therapeutics market.

The forecast period for gastrointestinal therapeutics market is 2023 to 2032.

AbbVie Inc., Takeda Pharmaceutical Company, Pfizer Inc., and Bausch Health Companies Inc. held a high market position in 2022.

The biologics segment is the most influencing segment in gastrointestinal therapeutics market owing to high in the adoption of biologics in inflammatory bowel disease.

Gastrointestinal therapeutics refer to the range of medical treatments, interventions, and medications designed to diagnose, manage, and treat various disorders and diseases of the gastrointestinal (GI) tract.

Factors driving market growth include the rise in prevalence of gastrointestinal disorders, advances in treatment options such as biologics, increased awareness and diagnosis, changing lifestyles, and ongoing research and development efforts.

Loading Table Of Content...

Loading Research Methodology...