Generative AI In Insurance Market Overview

The global generative AI in insurance market was valued at $761.4 million in 2022, and is projected to reach $14.4 billion by 2032, growing at a CAGR of 34.4% from 2023 to 2032. Growing demand for faster claims processing, enhancing customer service with AI chatbots, personalizing policy recommendations, and simulating risk scenarios to optimize premium calculations using historical data contribute to the growth of the market.

Market Dynamics & Insights

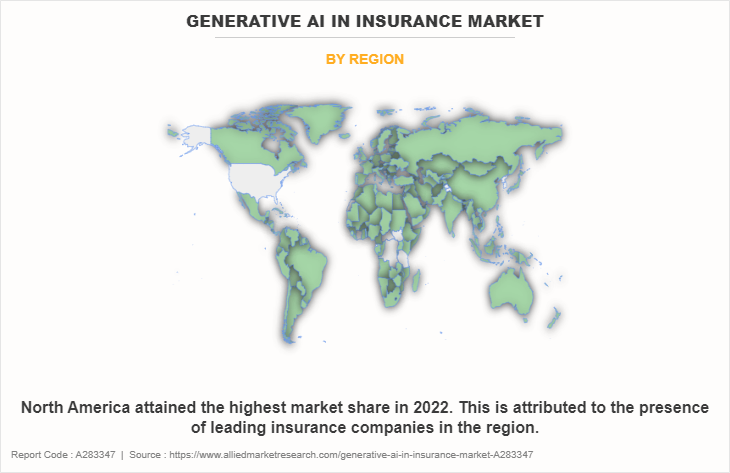

- The generative AI in insurance industry in North America held the largest share of 38% in 2022.

- By component, the solution segment dominated the market, accounting for the revenue share of 68% in 2022.

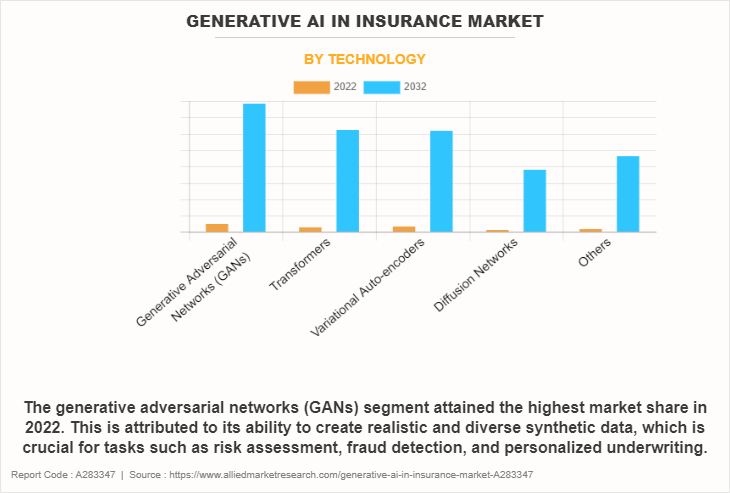

- By technology, the generative adversarial networks (GANs) segment dominated the market, accounting for the revenue share of 34% in 2022.

- By application, the automated underwriting segment held the largest share in the market, accounting for the revenue share of 32% in 2022.

Market Size & Future Outlook

- 2022 Market Size: $761.4 Million

- 2032 Projected Market Size: $14,400 Million

- CAGR (2023-2032): 34.4%

- North America: dominated the market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Generative AI In Insurance

Generative AI is a type of AI technology that allows machines to generate new content, data, or information similar to that produced by humans. Unlike standard AI systems, which rely on pre-defined rules and patterns, generative AI uses advanced algorithms and deep learning models to generate unique and dynamic results. In the insurance industry, generative AI plays a crucial role in redefining various aspects, from customer interactions to risk assessment and fraud detection.

One of the key drivers of the generative AI in insurance market is faster claims processing. Generative AI speeds up the claims process and automates the data analysis process, highlighting any anomalies and ensuring genuine claims by quickly resolving them. Furthermore, generative AI redefines customer interactions with insurers through advanced chatbots and virtual assistants. These AI-powered assistants handle routine queries and engage in sophisticated conversations, understanding complex customer needs and offering personalized recommendations for policies and coverage options. Thus, responsive and efficient customer service is a key driver behind the rapid growth of generative AI in insurance market. In addition, generative AI is used to simulate different risk scenarios based on historical data and calculate the premium accordingly. For instance, by learning from previous customer data, generative models produce simulations of potential future customer data and their potential risks. These simulations can be used to train predictive models to better estimate risk and set insurance premiums, which drives the adoption of the generative AI in insurance industry and accelerates the growth of the generative AI in insurance market.

However, data quality and regulatory challenges have emerged as significant barriers to the growth of the generative AI in insurance market. Moreover, due to the required computational power, generative AI technology may be costly and difficult to implement. Enterprises are facing new challenges when integrating generative AI with their existing technical infrastructures. Thus, high implementation cost of generative AI hampers the growth of the generative AI in insurance market. On the contrary, risk modeling and underwriting advancements, and the adoption of explainable AI (XAI) for transparency are expected to offer lucrative growth opportunities to the market in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the generative AI in insurance market forecast. The study provides porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the generative AI in insurance market outlook.

Generative AI In Insurance Market Segment Review

The generative AI in insurance market is segmented on the basis of component, technology, application, and region. On the basis of component, the market is differentiated into solution and service. On the basis of technology, the generative AI in insurance market is segmented into generative adversarial networks (GANs), transformers, variational auto-encoders, diffusion networks, and others. By application, the generative AI in insurance market is divided into personalized insurance policies, automated underwriting, claims processing automation, fraud detection and prevention, virtual assistants and customer support, and others. Region-wise, the generative AI in insurance market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of technology, the generative adversarial networks (GANs) segment acquired a major generative AI in insurance market share in 2022. The growth of generative adversarial networks (GANs) is primarily driven by their ability to create realistic and diverse synthetic data, which is crucial for tasks such as risk assessment, fraud detection, and personalized underwriting. However, the diffusion networks segment is expected to be the fastest-growing segment during the forecast period, owing to their ability to handle sequential data and model complex dependencies over time.

Region-wise, North America dominated the generative AI in insurance market in 2022, owing to the presence of leading insurance companies in the region. Furthermore, the need to analyze vast amounts of data for better risk assessment, fraud detection, and pricing optimization increased the adoption of generative AI in insurance industry in the region. With the increasing volume of data available, generative AI helps insurers make data-driven decisions to improve their services and stay competitive. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the expanding middle class, urbanization, and increased awareness of insurance products in the region. As the demand for insurance services grows, generative AI enables insurers to automate tasks, enhance customer service, and improve risk assessment.

Competition Analysis

Competitive analysis and profiles of the major players in the generative AI in insurance market include DataRobot, Inc., Microsoft Corporation, Amazon Web Services, Inc., Avaamo, IBM Corporation, LeewayHertz, Persado, Inc., Aisera, Shift Technology, and AlphaChat. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

What are the Recent Partnerships in the Generative AI in Insurance Market

In May 2023, global software solution provider, Sapiens International Corporation, and tech titan Microsoft, formed a strategic partnership aimed at harnessing the power of generative artificial intelligence (AI) in the insurance industry. The partnership’s main objective is to utilize the potential of AI to improve efficiency and customer service in the insurance industry.

What are the Recent Product Launches in the Generative AI in Insurance Market

In June 2023, Simplifai, an AI automation solutions provider, launched Simplifai InsuranceGPT, a world-first custom-built GPT tool, fueled by the company’s revolutionary no-code AI-powered platform. With InsuranceGPT, Simplifai has strengthened its end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI, delivering fast, concise, and accurate responses in a secure way.

In May 2023, Roots Automation, a creator of AI-powered Digital Coworkers, launched InsurGPT, the world's most advanced fine-tuned generative AI model, designed specifically for the Insurance market. InsurGPT further expands the natural language capabilities of Digital Coworkers by utilizing proprietary, fine-tuned Large Language Models (LLMs) to read and accurately extract data across structured documents and unstructured documents.

Market Landscape and Trends

In property insurance underwriting, AI is increasingly leveraged to accelerate processes that make use of an ever-expanding universe of data to accurately assess risk and offer personalized, proactive coverage. Innovations in computer vision, machine learning, geospatial analytics, and other forms of AI have gained profound importance in property insurance underwriting in both personal and small commercial lines.

According to McKinsey, insurers employing modern data and analytics technologies can see loss ratios improve up to 5%, premiums rise 10% to 15%, and retention of their most profitable segments climb as much as 10% relative to other companies. While generative AI and other new forms of artificial intelligence seem to emerge daily, putting distance between top performers and contenders means harnessing AI technologies with a proven track record in insurance underwriting.

What are the Top Impacting Factors in Generative AI In Insurance Market

Faster Claims Processing through Generative AI

A significant shift toward autonomous claims processing is driving the generative AI in insurance market growth. With the integration of advanced computer vision and natural language processing capabilities, AI-powered systems efficiently process and validate claims without human intervention. Customers benefit from quicker and more accurate settlements, reducing the time and effort involved in claim filing and processing. Moreover, this technology has the ability to simplify the complicated web of claims management. By creating automated solutions to basic claim inquiries, generative AI speeds up the claim settlement process and reduces processing time. For instance, in June 2023, Simplifai, an AI automation solutions provider, launched Simplifai InsuranceGPT, a world-first custom-built GPT tool, fueled by the company’s revolutionary no-code AI-powered platform. With InsuranceGPT, Simplifai strengthened its end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI, delivering fast, concise, and accurate responses in a secure way. Therefore, such factors provide faster claims processing and drive the growth of the generative AI in insurance market size.

Responsive and Efficient Customer Service

Generative AI redefines customer interactions with insurers through advanced chatbots and virtual assistants. These AI-powered assistants handle routine queries and engage in sophisticated conversations, understanding complex customer needs and offering personalized recommendations for policies and coverage options. Furthermore, to harness the full potential of generative AI, insurers are increasingly collaborating with technology companies, data providers, and insurance tech startups. These partnerships facilitate access to cutting-edge technologies, extensive data sources, and improved customer experience, enabling insurers to accelerate innovation and stay ahead in a competitive generative AI in insurance market. For instance, in May 2023, global software solution provider, Sapiens International Corporation, and tech titan Microsoft, formed a strategic partnership aimed at harnessing the power of generative artificial intelligence (AI) in the insurance industry. The collaboration utilizes the potential of AI to improve efficiency and customer service in the insurance industry. Therefore, these factors contribute to the substantial growth of the generative AI in insurance market.

Adoption of Explainable AI (XAI) for Transparency

The emergence of generative AI has significantly impacted the insurance industry, delivering a multitude of advantages for insurers and customers alike. From automating business processes and enhancing operational efficiency to providing personalized customer experiences and improving risk assessment, generative AI has proven its potential to redefine the insurance landscape. Furthermore, as the adoption of generative AI in insurance grows, the demand for Explainable AI (XAI) will intensify. XAI techniques will be crucial in ensuring transparency, compliance, and trust in AI-generated decisions. Insurers will need to explain how AI algorithms arrive at specific recommendations or decisions, enabling better customer understanding and regulatory compliance. Thus, such factors provide growth opportunities to the generative AI in insurance market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the generative AI in insurance market analysis from 2022 to 2032 to identify the prevailing generative AI in insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the generative AI in insurance market segmentation assists to determine the prevailing opportunities.

- Major countries in each region are mapped according to their revenue contribution to the generative AI in insurance market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as generative AI in insurance market trends, key players, market segments, application areas, and market growth strategies.

Generative AI in Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.4 billion |

| Growth Rate | CAGR of 34.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 274 |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | AlphaChat, Persado, Inc., Shift Technology, Avaamo, LeewayHertz, Aisera, Amazon Web Services, Inc., DataRobot, Inc., IBM Corporation, Microsoft Corporation |

Analyst Review

The digital transformation of insurance companies has increased speed, efficiency, and accuracy across every branch of insurance. Generative AI, for instance, significantly accelerates digitization for insurers. It can assist companies in assessing risk, detecting fraud, and reducing human error in the application process. AI is revolutionizing the insurance industry by enabling automation, optimizing claims, and developing effective customer engagement strategies.

Key players in the generative AI in insurance market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in September 2022, Simplifai, an AI automation solutions provider, launched Simplifai InsuranceGPT, a world-first custom-built GPT tool, fueled by the company’s revolutionary no-code AI-powered platform. With InsuranceGPT, Simplifai has strengthened its end-to-end business process automation capabilities, providing enriched communication between insurers and their customers through the power of generative AI, delivering fast, concise, and accurate responses in a secure way. Therefore, such strategies adopted by key players propel the growth of the generative AI in insurance market.

The COVID-19 pandemic had a positive impact on the generative AI in the insurance market. During the pandemic, the insurance industry faced challenges such as an increase in claims due to health issues, travel cancellations, and business interruptions. This led insurance companies to adopt generative AI to streamline their processes. AI was used to assess claims faster, automate underwriting, and detect fraudulent activities. As a result, generative AI played a crucial role in helping insurance companies cope with the surge in demand for their services during the pandemic.

The key players in the generative AI in insurance market include DataRobot, Inc., Microsoft Corporation, Amazon Web Services, Inc., Avaamo, IBM Corporation, LeewayHertz, Persado, Inc., Aisera, Shift Technology, and AlphaChat. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for generative AI in insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The generative AI in insurance market is segmented into component, technology, application, and region. On the basis of component, the market is differentiated into solution and service. On the basis of technology, the market is segmented into generative adversarial networks (GANs), transformers, variational auto-encoders, diffusion networks, and others. By application, the market is divided into personalized insurance policies, automated underwriting, claims processing automation, fraud detection and prevention, virtual assistants and customer support, and others. Region-wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for generative AI in insurance.

The generative AI in insurance market size was valued at $761.36 million in 2022 and is projected to reach $14,368.49 million by 2032, growing at a CAGR of 34.4% from 2023 to 2032.

The key players operating in the generative AI in insurance market include DataRobot, Inc., Microsoft Corporation, Amazon Web Services, Inc., Avaamo, IBM Corporation, LeewayHertz, Persado, Inc., Aisera, Shift Technology, and AlphaChat

Loading Table Of Content...

Loading Research Methodology...