Genomics Services Market Research, 2033

The global genomics services market size was valued at $8.3 billion in 2023, and is projected to reach $24.0 billion by 2033, growing at a CAGR of 11.2% from 2024 to 2033. AI-driven genomic research can accelerate the discovery of new biomarkers and therapeutic targets, opening new avenues for drug development and improving patient outcomes and driving the market growth.

Market Introduction and Definition

Genomic services include a range of advanced techniques and technologies used to analyze and interpret an organism's complete set of DNA, including its genes and sequences. These services include DNA sequencing, genotyping, gene expression analysis, and bioinformatics. They are crucial for research in personalized medicine, disease diagnosis, and therapeutic development. By providing detailed insights into genetic variations and functions, genomic services enable the identification of disease markers, the development of targeted treatments, and the advancement of precision medicine. These services support various sectors, including healthcare, agriculture, and biotechnology, driving innovations and improving outcomes.

Key Takeaways

- The genomics services market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected genomics services market forecast period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major genomics services industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

One of the primary drivers for the genomics services market growth is rise in demand for personalized medicine. Personalized medicine tailors treatment plans based on an individual's genetic makeup, improving efficacy and reducing adverse effects. Advances in genomic technologies, such as next-generation sequencing (NGS) , have made genetic analysis more accessible and affordable, accelerating the adoption of personalized medicine. In addition, the growing prevalence of chronic diseases, such as cancer and cardiovascular conditions, necessitates precise diagnostic and therapeutic approaches, further driving the demand for genomic services.

However, high cost of genomic testing and data analysis hinders the genomics market growth. Despite technological advancements that have reduced costs over time, comprehensive genomic analyses can still be expensive, limiting accessibility for many patients and healthcare providers. Moreover, the complexity of genomic data requires sophisticated infrastructure and highly skilled personnel for accurate interpretation, adding to the overall cost. These financial barriers can slow the widespread adoption of genomic technologies, particularly in resource-constrained settings and developing regions.

Furthermore, an exciting opportunity for the genomics market lies in the integration of artificial intelligence (AI) and machine learning (ML) with genomic data analysis. AI and ML can handle vast amounts of genetic data more efficiently, identifying patterns and correlations that might be missed by traditional analysis methods. This integration can enhance the accuracy of disease diagnosis, predict disease susceptibility, and personalize treatment plans.Rise in collaboration between tech companies and genomic research institutions is likely to drive innovation and expand the applications of genomics in healthcare.

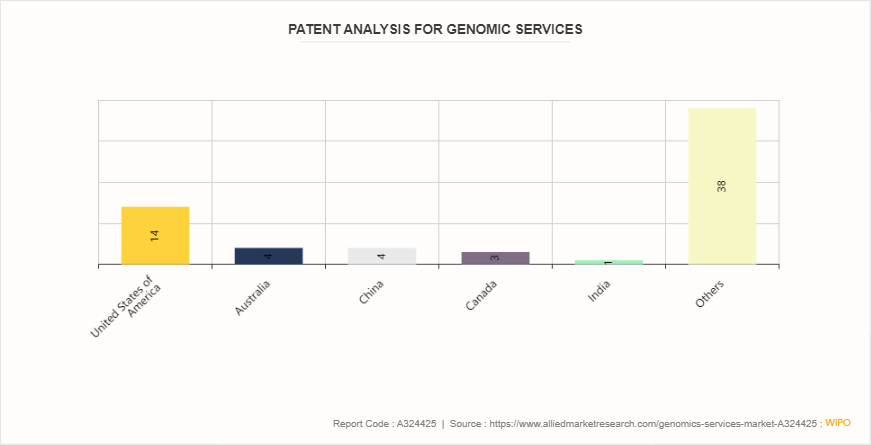

Patent Analysis for Genomic Services

According to the WIPO patent scope, the genomic services market has a diverse range of patents filed across various countries. The U.S. leads with 14 patents, reflecting its robust investment in biotechnology and genomic research. Australia and China each have 4 patents, indicating significant advancements and interest in these regions. Canada follows with 3 patents, showcasing its growing contribution to genomic innovation. India has 1 patent, suggesting emerging research activities in the genomic sector. The category "Others" includes 38 patents from various countries, highlighting the global interest and collaborative efforts in advancing genomic services and technologies worldwide.

Market Segmentation

The genomics services industry is segmented into service type, technology, end user and region. On the basis of service type, the market is categorized into gene expression services (RNASeq) , epigenomics services, genotyping, next-generation sequencing, sanger sequencing, and others. On the basis of technology, the market is categorized into polymerase chain reaction (PCR) , next-generation sequencing (NGS) , microarray, sanger sequencing, and others. On the basis of end user, the market is categorized into research institutes, healthcare facilities & diagnostic centers, pharmaceutical & biotechnological companies, and contract research organizations (CROs) . Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The genomics services market share exhibits significant regional variations. North America leads the market due to substantial investments in research and development, advanced healthcare infrastructure, and presence of major biotechnology firms. Europe follows, driven by strong regulatory support and increasing adoption of personalized medicine. The Asia-Pacific region is experiencing rapid growth, fueled by rise in healthcare expenditures, expanding genomic research activities, and government initiatives supporting biotech innovations. Countries such as China and India are emerging as key players with increasing investments in genomics. Latin America and the Middle East & Africa are gradually adopting genomic services, supported by improving healthcare systems and growing awareness of genomic applications in medicine.

- In December 2021, BGI Genomics in partnership with the Institute of Molecular Genetics and Genetic Engineering (IMGGE) at the University of Belgrade, helped design and set up the Center for Genome Sequencing and Bioinformatics, the very first genome sequencing hub in Serbia.

Industry Trends

- In April 2021, the U.K. Health Secretary Matt Hancock announced $51.4 million in funding for genomics and data projects to bolster the life sciences sector. This funding was allocated through the Genome U.K. Implementation Plan and the U.K. Functional Genomics Initiative.

Competitive Landscape

The major players operating in the genomics services market size include Illumina, Inc., QIAGEN, PerkinElmer Inc., Eurofins Scientific, Macrogen, Inc., GENEWIZ, LGC Limited, Q2 Solutions, and Bio Rad Laboratories, Inc. Other key players include Eurofins Scientific SE, Agilent Technologies, and so on.

Recent Key Strategies and Developments

- In July 2023, Eremid Genomic Services, LLC (“Eremid”) announced a significant expansion of its in-house sequencing capabilities with the installation of PacBio’s latest HiFi sequencing platform, the Revio. This powerful new sequencing system is the newest addition to Eremid’s suite of high-end genomics tools, and affirms the Company’s commitment to supporting larger scale and more diverse genomics projects.

Key Sources Referred

- World Health Organization (WHO)

- Centers for Medicare & Medicaid Services (CMS)

- WIPO

- National Health Service (NHS)

- National Health Mission (NHM)

- Institute for Health Metrics and Evaluation

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the genomics services market analysis from 2024 to 2033 to identify the prevailing genomics services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the genomics services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global genomics services market trends, key players, market segments, application areas, and market growth strategies.

Genomics Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.0 Billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 216 |

| By ServiceType |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bio Rad Laboratories, Inc, LGC Limited, QIAGEN, Agilent Technologies, Macrogen, Inc, Eurofins Scientific SE, PerkinElmer Inc., Illumina, Inc., Eurofins Scientific, Q2 Solutions |

The total market value of genomics services market was $8.3 billion in 2023.

The forecast period for genomics services market is 2024 to 2033.

The market value of genomics services market is projected to reach $24.0 billion by 2033

The base year is 2023 in genomics services market.

Genomic services include a range of advanced techniques and technologies used to analyze and interpret an organism's complete set of DNA, including its genes and sequences.

Loading Table Of Content...