Genotyping Market Research, 2033

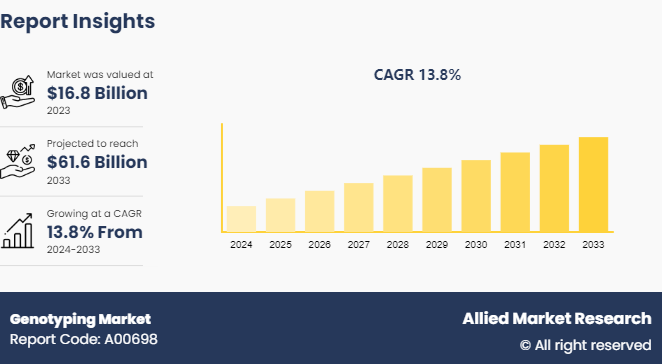

The global genotyping market size was valued at $16.8 billion in 2023, and is projected to reach $61.6 Billion by 2033, growing at a CAGR of 13.8% from 2024 to 2033. Rise in prevalence of genetic disorders, increase in demand for personalized medicine, and advances in technology, such as next-generation sequencing and polymerase chain reaction (PCR) are the major factors which drives the market growth.

Market Introduction and Definition

Genotyping is the process of determining the genetic makeup of an individual by examining DNA sequence using biological assays. It identifies the variations in the genetic code (genotypes) of an organism, focusing on specific genes or loci to understand the genetic differences that may contribute to traits, diseases, or responses to medications. Techniques used for genotyping include polymerase chain reaction (PCR) , DNA sequencing, microarrays, and next-generation sequencing (NGS) . By analyzing single nucleotide polymorphisms (SNPs) and other genetic markers, genotyping can reveal hereditary patterns, diagnose genetic disorders, and aid in personalized medicine. In agriculture and animal breeding, it helps in selecting traits for improved yield or resistance to diseases.

Key Takeaways

The genotyping market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major genotyping industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The genotyping market size is driven by increasing prevalence of genetic disorders worldwide which is driving the demand for genotyping technologies for disease diagnosis, risk assessment, and personalized treatment. In addition, shift towards personalized medicine is driving the adoption of genotyping technologies in healthcare which propels the growth during genotyping market forecast period. Genotyping enables the identification of genetic variations that influence drug metabolism, efficacy, and adverse reactions, allowing for the customization of treatment regimens based on individual genetic profiles. Moreover, expanding applications of genotyping technologies in forensic science and anthropology for human identification, forensic DNA analysis, and ancestry determination further contributes towards the genotyping market growth.

However, the high cost associated with genotyping technologies and the complexity of genotyping data interpretation may limit the market growth. Advanced genotyping methods, such as next-generation sequencing (NGS) and microarray analysis, often require substantial investment in equipment, reagents, and infrastructure. This cost barrier limits access to genotyping services, particularly in resource-limited settings and smaller research institutions.

On the other hand, rapid advancements in genomic research fueled the demand for genotyping technologies and provide lucrative genotyping market opportunity. The completion of the Human Genome Project and subsequent advancements in DNA sequencing technologies have enabled researchers to identify genetic variations associated with diseases, traits, and drug responses. This led to increased investments in genotyping technologies to facilitate large-scale genetic studies aimed at understanding the genetic basis of complex diseases and traits. Furthermore, emerging economies represent lucrative market opportunities for genotyping technologies due to their large and diverse populations, increasing healthcare expenditure, and growing demand for advanced genetic diagnostics and personalized medicine.

Market Segmentation

The genotyping market is segmented into product, technology, application, end user, and region. On the basis of product, the market is categorized into instruments, reagents & kits, and software and services. As per technology, the market is divided into PCR, capillary electrophoresis, microarrays, sequencing, mass spectrometry, and others. On the basis of application, the market is classified into pharmacogenomics, diagnostics and personalized medicine, agricultural biotechnology, animal genetics, and others. On the basis of end user, the market is classified into pharmaceutical and biopharmaceutical companies, diagnostics and research laboratories, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America leads the genotyping market share due to extensive research activities, advanced healthcare infrastructure, and strong government support for genetic studies. Europe follows suit with significant investments in genomics research and well-established biotechnology sectors. Asia-Pacific emerges as a rapidly growing market, fueled by increasing awareness of personalized medicine, expanding healthcare expenditure, and rising genetic research initiatives. Moreover, LAMEA exhibits untapped potential, driven by growing healthcare investments and the adoption of genomics technologies for disease diagnosis and treatment.

According to the Centers for Disease Control and Prevention (CDC) , the percentage of clustered genotyped TB cases during 2020–2022 based on whole-genome sequencing methods was 16.9%, lower than the 19.2% clustering during 2019–2021 based on conventional genotyping methods.

An article published by National Center for Biotechnology and Information (NCBI) in 2022, a study on the pharmacogenomic landscape of the Indian population utilized whole genome sequencing data from 1, 029 unrelated Indian individuals. This study provided insights into genetic variations that could optimize drug treatments for the Indian population, emphasizing the importance of personalized medicine based on genomic data. These initiatives in India reflect a growing emphasis on genotyping and population genomics to enhance public health interventions, drug development, and personalized medicine tailored to the genetic diversity of different populations.

Industry Trends

The Centers for Disease Control and Prevention (CDC) reported a genotype surveillance coverage of 96.0% in 2022 for culture-positive TB cases, using whole-genome multilocus sequence typing to analyze genetic material of Mycobacterium tuberculosis.

According to a Department of Biotechnology Ministry of Science and Technology, Government of India in 2022, India made significant strides in genotyping and population genomics through the GenomeIndia project. This national initiative, funded by the Department of Biotechnology, Ministry of Science and Technology, sequenced the whole genomes of 10, 074 individuals from 99 communities, representing diverse Indian populations. The project aimed to identify and catalogue genetic variations across major ethnic groups in India, laying the foundation for personalized medicine and better understanding of diseases among different ethnicities.

Patent Analysis for the Genotyping Market

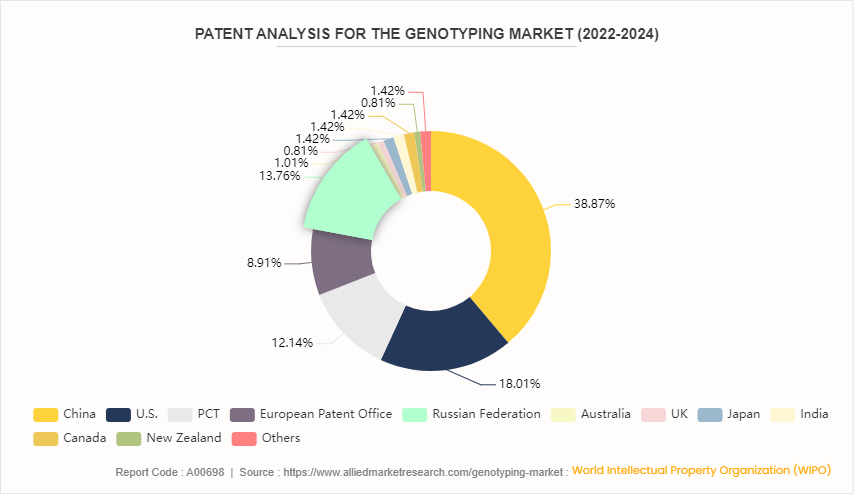

According to the World Intellectual Property Organization (WIPO) patent analysis spanning 2022 to 2024, China dominated the global patent landscape with a commanding share of 38.9%, followed by the U.S. at 18.0%. The Patent Cooperation Treaty (PCT) holds a notable 12.1%, while the European Patent Office and the Russian Federation contribute 8.9% and 13.8%, respectively. Other significant players include Denmark, Poland, Republic of Korea, and Mexico holding 1.4% of the total patents. New Zealand accounts for 0.8%. In the genotyping market, this distribution signifies the geographical concentration of innovation and intellectual property in technologies related to genetic analysis. China's substantial share underscores its growing prowess in biotechnology, potentially impacting genotyping technologies' development and commercialization globally. The U.S. remains a significant contributor, reflecting its strong research and development ecosystem in this field.

Competitive Landscape

The major players operating in the genotyping market include Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, F. Hoffmann-La Roche Ltd, Danaher Corporation, Agilent Technologies, Inc, Eurofins Genomics LLC, Bio-Rad Laboratories, Inc., PacBio, and Integrated DNA Technologies, Inc. Other players in genotyping market include Promega Corporation, Agena Bioscience, Inc., and so on.

Recent Key Strategies and Development in Genotyping Market

In August 2022, Thermo Fisher Scientific announced the launch of its Applied Biosystems HIV-1 Genotyping Kit with Integrase, a research use only assay that examines positive samples of human immunodeficiency virus (HIV) to identify genetic variants that resist common antiretroviral therapeutics.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the genotyping market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the genotyping market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global genotyping market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Genotyping Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 61.6 Billion |

| Growth Rate | CAGR of 13.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 231 |

| By Product |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Agilent Technologies, Inc, Danaher Corporation, F. Hoffmann-La Roche Ltd, Illumina, Inc., PacBio, QIAGEN , Integrated DNA Technologies, Inc., Thermo Fisher Scientific Inc., Eurofins Genomics LLC, Bio-Rad Laboratories, Inc. |

Loading Table Of Content...