Geographic Information System (GIS) Software Market Research, 2033

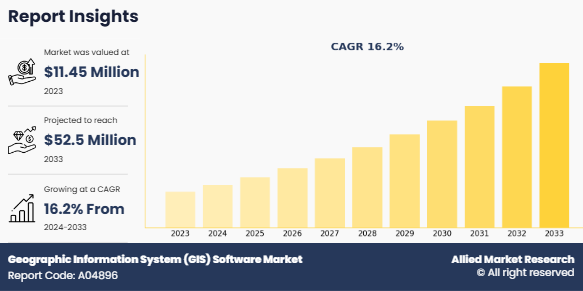

The global geographic information system (GIS) software market was valued at $11.5 million in 2023, and is projected to reach $52.5 million by 2033, growing at a CAGR of 16.2% from 2024 to 2033. The Geographic Information System (GIS) software market refers to the industry that focuses on the development, sale, and implementation of software tools and platforms designed to capture, store, manipulate, analyze, manage, and visualize spatial or geographic data. GIS software allows users to map and interpret spatial information, providing insights into geographic patterns and relationships that are crucial for decision-making. The market offers range of GIS solutions, from desktop-based applications to cloud-based platforms, and caters to different sectors, including urban planning, agriculture, environmental management, defense, transportation, and utilities.

GIS software integrates data from multiple sources such as maps, satellite imagery, sensors, and other geospatial information to offer both visual and analytical capabilities. It enables users to perform complex spatial analysis, such as route optimization, resource management, land use planning, and risk assessment. The GIS software market has experienced significant growth due to the increasing need for geospatial intelligence across industries and the growing reliance on location-based services (LBS) to make data-driven decisions. In addition to traditional GIS uses, the software is increasingly being integrated with emerging technologies such as artificial intelligence (AI), machine learning (ML), big data analytics, and cloud computing to enhance its capabilities and provide real-time geospatial insights.

Growing adoption of IoT and smart cities, increased use of GIS in government and public sector and rising demand for spatial data analytics are the factors expected to propel the growth of the global geographic information system software market. Moreover, growth in remote sensing and satellite data, and integration with artificial intelligence (AI) are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, high implementation cost and data privacy and security concerns hamper the growth of the geographic information system software market.

Key Takeaways:

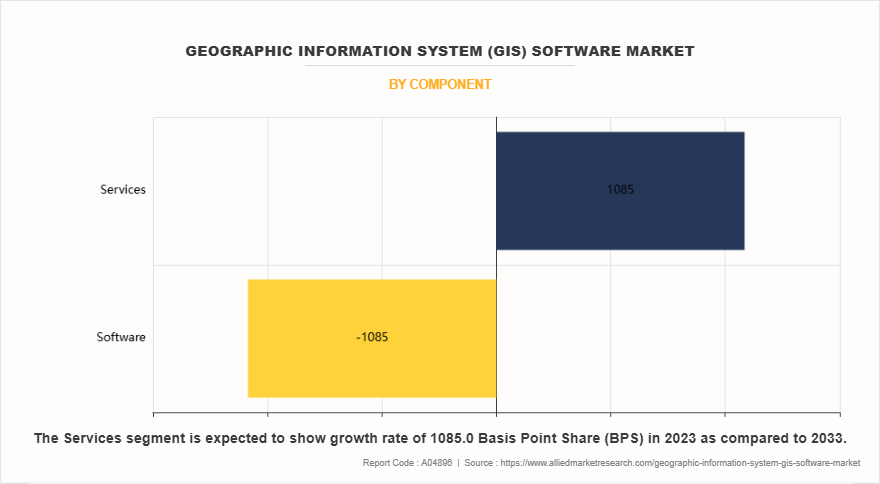

By component, the software segment accounted for the largest GIS software market size in 2023.

By type, the desktop GIS segment accounted for the largest geographic information system software market share in 2023.

By function, the mapping segment accounted for the largest GIS software market size in 2023.

By industry vertical, the smart cities segment accounted for the largest GIS software market share in 2023.

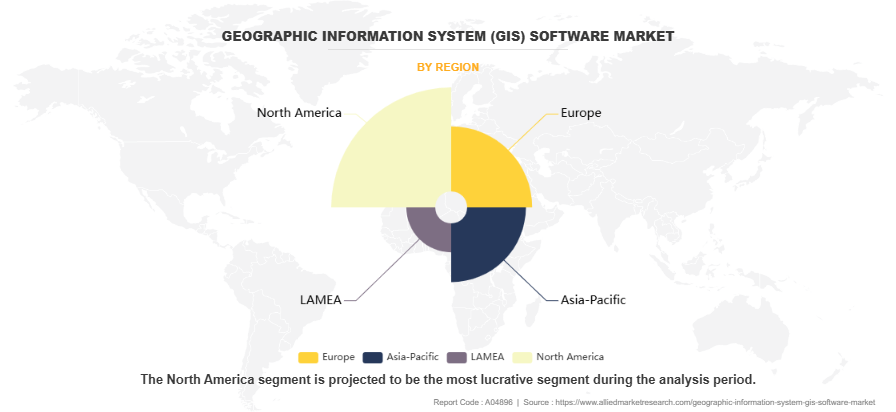

Region wise, North America generated the highest revenue in 2023.

Segment review

The geographic information system software market is segmented on the basis of component, type, function, industry vertical, and region. Depending on component, the market is divided into software and services. On the basis of type, it is segregated into desktop GIS, server GIS, developer GIS, mobile GIS, and others. As per the function, it is fragmented into mapping, surveying, location-based services, navigation & telematics, and others. By industry vertical, it is classified into automotive, energy and utilities, government, defense and intelligence, smart cities, insurance, natural resources, others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on component, the software segment dominated the GIS software market share in 2023 and is expected to continue this trend during the forecast period, owing to various applications of GIS software solutions, such as predictive analysis, analysis of customer behavior, pattern recognition modeling, and fraud detection. However, the services segment is expected to witness the highest growth in the future, due to the fact that GIS services are faster and cost-effective alternatives for enterprises with limited geospatial analysis needs.

Region wise, the geographic information system software market was dominated by North America in 2023, and is expected to retain its position during the forecast period, owing to increase in demand for automated spatial analytics, surge in transportation, rise in incident & disaster management, and improvement in decision making for businesses. This is likely to drive the geographic information system software industry during the geographic information system software market forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the increase in mobility and surge in transportation. The report focuses on growth prospects, restraints, and analysis of the global ERP market trend. The study provides Porter‐™s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market share.

Competition Analysis:

Competitive geographic information system software market analysis and profiles of the major players in the geographic information system software market are Autodesk Inc., Bentley System, Caliper Corporation, Computer Aided Development Corporation Limited (Cadcorp), ESRI, General Electric Co., Hexagon AB, Pitney Bowes Inc., SuperMap Software Co., Ltd., and Trimble Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help drive the growth of the geographic information system software market globally.

Recent developments in the geographic information system software Industry:

In October 2023, CentralSquare Technologies, an industry leader in public sector technology, partnered with DATAMARK, the public safety geographic information systems (GIS) team of Michael Baker International and the go-to authority on GIS data for public safety. CentralSquares partnership with DATAMARK helped public safety agencies fully realize the potential of their GIS mapping data to better prepare, plan and respond to emergency incidents by using the most accurate location-based information available.

In September 2023, Hexagon's Manufacturing Intelligence division announced the nine manufacturing startups chosen for its third Sixth Sense cohort. The selected companies were chosen from a highly competitive pool of hundreds of applicants, distinguishing themselves with groundbreaking solutions addressing critical manufacturing challenges, with a focus on sustainability and digital reality. The selected startups, which hail from seven countries, bring unique approaches to some most critical manufacturing challenges, such as improving product sustainability, eliminating waste, capturing real-time data, automating design, and incorporating cobots into production lines.

Top Impacting Factors

Growing Adoption of IoT and Smart Cities

As cities around the world continue to evolve into smart cities, they rely heavily on data and technology to enhance urban life. GIS plays a pivotal role in this transformation by providing a spatial context to the vast amounts of data generated by IoT devices, sensors, and other smart technologies. These technologies collect real-time data on traffic, pollution, energy consumption, water usage, infrastructure conditions, and more, which can be efficiently managed and analyzed through GIS platforms.

In smart cities, GIS software is used to integrate and visualize the data collected from IoT devices, creating a dynamic and real-time digital map of urban areas. For example, traffic management systems can be optimized using GIS by analyzing traffic flow data from sensors and cameras. This allows for real-time adjustments to traffic lights, route planning for commuters, and identification of areas needing infrastructure improvements. Additionally, GIS is critical for urban planners and local authorities to make informed decisions regarding land use, zoning, public services, and resource allocation based on geographic and environmental data.

Furthermore, the rise of IoT in smart cities also fuels the need for sophisticated GIS software to process and interpret the vast volumes of spatial data generated by IoT devices. As these cities become more connected, the need for real-time analysis and predictive insights grows, driving the geographic information system software market demand for GIS solutions that can handle large datasets, integrate with other systems, and provide actionable insights for decision-makers. As a result, the integration of IoT and GIS not only enhances the functionality of smart cities but also drives the growth of the GIS software market, making it a key enabler of urban development in the digital age.

Increased Use of GIS in Government and Public Sector

Governments at various levels (local, regional, national) are increasingly adopting GIS technology to enhance public service delivery, improve infrastructure planning, and support decision-making processes. GIS enables governments to better manage public resources by providing a detailed, spatial view of geographic areas, which is crucial for effective planning, policy-making, and resource allocation.

In urban planning and development, GIS allows authorities to manage land use, zoning, and building permits with greater accuracy. It helps public sector entities assess the suitability of different areas for development, monitor land usage, and identify regions requiring new infrastructure, such as roads, schools, and hospitals. Additionally, GIS is widely used in environmental management, helping governments track and mitigate environmental impacts, monitor pollution levels, and manage natural resources more efficiently. It also plays an essential role in disaster management by providing tools for hazard mapping, risk assessment, and emergency response planning. By analyzing geographic data, authorities can predict disaster-prone areas, plan evacuation routes, and allocate resources for better crisis management.

Moreover, GIS is crucial for public health initiatives as it enables governments to track disease outbreaks, plan healthcare resource distribution, and ensure better emergency response. The integration of GIS with real-time data from sensors and other sources further strengthens these initiatives, allowing public agencies to respond to health crises and natural disasters in a more timely and effective manner.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the geographic information system (GIS) software market analysis from 2023 to 2033 to identify the prevailing geographic information system (GIS) software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the geographic information system (GIS) software market segmentation assists to determine the prevailing market opportunities and geographic information system software market trends.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global geographic information system (GIS) software market trends, key players, market segments, application areas, and geographic information system software market growth strategies.

Geographic Information System (GIS) Software Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 231 |

| By Component |

|

| By Type |

|

| By Industry vertical |

|

| By Region |

|

| Key Market Players | Pitney Bowes Inc., Autodesk, Inc., Bentley Systems, Computer Aided Development Corporation Ltd., Trimble Inc., Caliper Corporation, Esri, L3Harris Technologies, Hexagon AB, General Electric Co. |

The global geographic information system (GIS) software market was valued at $11.5 million in 2023, and is projected to reach $52.5 million by 2033, growing at a CAGR of 16.2% from 2024 to 2033.

Growth in adoption of IoT and smart cities and increase in use of GIS in government and public sector, and rise in demand for spatial data analytics.

Remote sensing and satellite data is the leading application of Geographic Information System (GIS) Software Market.

North America is the largest regional market for Geographic Information System (GIS) Software.

Autodesk Inc., Bentley System, Caliper Corporation, Computer Aided Development Corporation Limited (Cadcorp), ESRI, General Electric Co., Hexagon AB, Pitney Bowes Inc., SuperMap Software Co., Ltd., and Trimble Inc. are the top companies to hold the market share in Geographic Information System (GIS) Software.

Loading Table Of Content...

Loading Research Methodology...