Gift Cards Market Overview

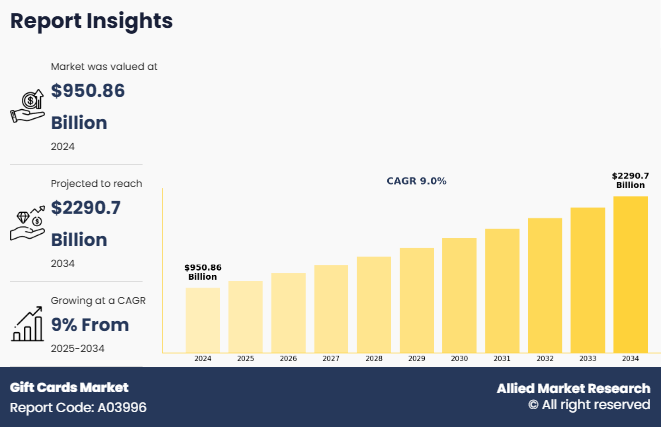

The global gift cards market was valued at $950.86 billion in 2024, and is projected to reach $2,290.7 billion by 2034, growing at a CAGR of 9.0% from 2025 to 2034. The rising use of smartphones, digitalization, expansion of e-commerce, and contactless payments, enabling instant, personalized, and global gifting, enhancing convenience for consumers and strategies for businesses, contribute to growth of the market.

Market Dynamics & Insights

- The gift cards industry in Asia-Pacific held a significant share of 38% in 2024.

- By card type, the close-looped card segment dominated the segment in the market, accounting for the revenue share of 60% in 2024.

- By end user, the individual segment dominated the industry in 2024 and accounted for the largest revenue share of 62%.

- By form, the physical card segment dominated the market, accounting for 60% in 2024.

Market Size & Future Outlook

- 2024 Market Size: $950.86 Billion

- 2034 Projected Market Size: $2,290.7 Billion

- CAGR (2025-2034): 9.0%

- Asia-Pacific: dominated the market in 2024

- LAMEA: Fastest growing market

What is Meant by Gift Cards

A gift card is a prepaid card loaded with a specific monetary value, which can be used by the recipient to purchase goods or services, typically at a specific retailer or online store. It is a popular gift option as it allows the recipient to choose what they want from the designated store or platform. Many gift cards are for use at a single retailer, or a specific group of retailers owned by the same company. Some gift cards, often issued by banks or payment processors, can be used at a wider range of merchants. These are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees.

Key Takeaways:

- By Card Type, the close-looped card segment held the largest share in the gift cards market for 2024.

- By End User, the individual segment held the largest share in the gift cards market for 2024.

- By Form, the physical card segment held the largest share in the gift cards market for 2024.

- Region-wise, Asia-Pacific held the largest share for gift cards market in 2024. However, LAMEA is expected to witness the highest CAGR during the forecast period.

Factors such as the rise in adoption of digital payment and expansion of e-commerce sector positively impact the growth of the gift card market. In addition, the increase in corporate gifting trends, especially during festive seasons and employee recognition programs, is expected to fuel the growth of the market during the forecast period. Furthermore, the surge in the adoption of personalized and customizable gift cards, addressing individual preferences and enhancing the gifting experience, is providing lucrative growth opportunities for the market during the forecast period. Moreover, the integration of advanced technologies such as AI and blockchain for enhanced security and tracking of gift cards, along with the growing demand from millennials and Gen Z consumers, creates lucrative opportunities for growth of the gift cards market.

Gift Cards Market Segment Review

The gift card market is segmented into card type, end-user, form, and region. On the basis of cart type, the gift cards market is divided into closed-loop card and open-loop card. By end-user, the gift cards market is classified into individual and businesses/corporates. As per form, the gift cards market is bifurcated into physical card and digital card. Region wise, the gift cards market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of card type, the global gift cards market share was dominated by the closed-loop card segment in 2024 and is expected to maintain its dominance in the upcoming years, owing to the increase in the the integration of closed-loop cards across both in-store and online platforms, enabling a seamless shopping experience. In addition, there is a growing trend toward incorporating gift cards with mobile wallets such as Apple Pay and Google Wallet, aligning with the digital preferences of modern consumers. However, the open-loop card segment is expected to experience the highest growth during the gift cards market forecast period. This segment is experiencing increase in consumers' preference for the flexibility of open-loop cards that are not restricted to a single brand, allowing for greater choice and convenience.

Region wise, Asia-Pacific dominated the gift cared market share in 2024. This is due to the widespread use of smartphones, increase in internet penetration, and government-led initiatives promoting cashless economies in countries such as India, China, and Indonesia driving the demand for gift cards, contributing significantly to the region’s market growth. However, LAMEA is expected to experience the fastest growth during the forecast period. The region is experiencing increase in the adoption of digital payment systems and increasing internet and smartphone penetration, presenting numerous opportunities for retailers, fintech companies, and corporate gifting solution providers to tap into emerging consumer segments, which is expected to support the growth of the gift cards market in the region.

Competition Analysis

The report analyzes the profiles of key players operating in the gift cards market include Amazon.com Inc., Walmart Inc., Fiserv, Inc., InComm Payments LLC, Shift4 Payments, LLC, Qwikcilver Solutions Pvt Ltd., PayPal, Inc., American Express Company, Blackhawk Network, Starbucks Corporation, Sephora USA, Inc., Target Brands, Inc., Visa Inc., Mastercard, Valve Corporation, Best Buy, EBIXCASH WORLD MONEY INDIA Ltd, and Home Depot. These players have adopted various strategies such as strategic partnerships and collaborations, mergers and acquisitions, product innovation, geographic expansion, and the enhancement of digital platforms, and strengthen their market presence in the gift cards industry.

What are the Recent Developments in the Gift Cards Market

- In April 2025, Starbucks Japan launched a new range of pink-themed drinkware and gift cards for Mother’s Day 2025. The collection features floral and pastel designs, celebrating the holiday with a stylish and seasonal touch. These limited-edition items are available in stores and online, offering customers a thoughtful and visually appealing way to show appreciation to mothers.

- In August 2024, Shift4 acquired Givex Corp., a global provider of gift card, loyalty, and point-of-sale (POS) solutions. This strategic acquisition aims to expand Shift4’s reach in the hospitality and retail sectors by integrating Givex’s robust platform, which supports over 122,000 active merchant locations across more than 100 countries. The deal enhances Shift4’s capabilities in omnichannel commerce, particularly in the areas of stored value and customer engagement technologies, strengthening its position in the global payments and commerce ecosystem.

- In March 2023, Woolworths’ payments arm, Wpay, partnered with Qwikcilver Solutions as its technology provider for gift card issuance and distribution. This collaboration enables Woolworths to enhance its gift card offerings across physical and digital formats, leveraging Qwikcilver’s robust platform for seamless management, scalability, and customer engagement. The partnership supports Woolworths’ goal of delivering a more flexible and efficient gifting experience across its retail network.

What are the Top Impacting Factors in Gift Cards Market

Driver

Rise in adoption of digital payment

Rise in adoption of digital payment, including mobile wallets and contactless transactions, is a significant factor driving the growth of the gift card market. The increase in the demand for convenience and speed offered by digital payments, allowing consumers to quickly purchase and redeem gift cards without the need for physical cash or cards, drives the growth of the market. In addition, the surge in e-commerce and online shopping has led consumers to opt for digital gift cards as a preferred gifting option, which contributes toward gift cards market growth. Consumers are increasingly favoring E-gift card platforms for their ease of use and instant delivery, enhancing the overall gift cards market outlook. Furthermore, the upsurge in the integration of gift cards with popular mobile wallets and apps has simplified the user experience, making digital gift card storage, access, and redemption more seamless and convenient for consumers. This is expected to fuel the growth of the gift cards market.

Moreover, businesses are increasingly adopting digital gift cards for employee rewards and customer loyalty programs, aligning with the growing preference for seamless, contactless experiences and favoring digital payment modes. In addition, continuous innovations in payment technologies, including blockchain and NFC, have enhanced the efficiency and appeal of digital payments, making digital gift cards more secure, accessible, and attractive to both consumers and businesses. For instance, in April 2025, Blackhawk Network (BHN) launched a new suite of exclusive branded payment services designed to help brands build, manage, and scale their payment programs more effectively. These services aim to enhance customer engagement and loyalty by offering tailored solutions across digital gifting, prepaid cards, and branded payment platforms. BHN’s innovation reflects its commitment to transforming how businesses connect with consumers through flexible and impactful payment experiences. This is expected to further accelerate the adoption of digital gift cards by providing businesses with more versatile and scalable tools to engage customers, strengthen brand loyalty, and drive repeat purchases in an increasingly digital-first economy. By focusing on digital gifting and prepaid card solutions, BHN is redefining consumer engagement and brand loyalty strategies, thus positively impacting the gift cards market size.

Restraints

Limited awareness in emerging markets

The major challenge for the growth of the global gift card market is limited awareness regarding the benefits and usage of gift cards in emerging markets. While gift cards have gained significant popularity in developed countries due to their convenience, flexibility, and ability to drive customer loyalty, many consumers and businesses in emerging economies remain unfamiliar with how they work and the value they can offer. This lack of awareness often stems from limited exposure to digital financial tools, lower levels of internet penetration, and a general preference for cash-based transactions, which restrain the growth of the gift cards industry. Moreover, a significant portion of the population in these regions may not have access to banking services or digital wallets, which further restricts the adoption of gift cards. In addition, many small and medium-sized enterprises (SMEs) in emerging markets may not yet understand how gift card programs can help increase customer engagement, boost sales, and improve brand visibility. Retailers might also be hesitant to invest in the infrastructure or technology required to support gift card systems due to cost concerns or lack of technical expertise. Cultural factors and trust issues related to prepaid financial products can also hinder adoption, as many consumers may be wary of non-traditional forms of spending, impeding the growth of the gift cards market. Addressing these barriers requires targeted awareness campaigns, government support, and partnerships with local financial institutions to promote digital financial literacy.

Opportunity

Personalized and customizable gift cards

The increase in the adoption of personalized and customizable gift cards presents a significant gift cards market opportunity to enhance customer engagement, boost brand loyalty, and differentiate offerings by addressing to individual preferences, driving higher sales and repeat usage. As consumers increasingly seek unique and meaningful gifting experiences, traditional gift cards are being replaced by options that allow personalization through custom messages, images, and designs. The increase in technological advancement such as mobile apps, digital wallets, and blockchain technology enhancing the security, accessibility, and convenience of gift cards presents remunerative growth opportunities for gift cards market growth. Advanced customization tools allow users to personalize cards with ease, while integration with e-commerce platforms streamlines the purchasing and redemption processes. In addition, the surge in integrating technologies such as artificial intelligence and data analytics enables businesses to offer targeted recommendations and personalized experiences, boosting customer engagement and loyalty.

Moreover, the upsurge in use of personalized gift cards in the corporate sector serve as effective incentives and rewards, incorporating company branding alongside personal messages to strengthen relationships with employees, clients, and partners. This trend creates a niche market focused on customizable corporate gifting solutions tailored to business requirements. In addition, retailers are capitalizing on this trend by integrating personalized gift cards into their e-commerce and omnichannel platforms, aligning customization options with special occasions such as birthdays, holidays, and anniversaries to boost sales and customer loyalty, creating numerous opportunities for the growth of the gift cards market. For instance, in December 2024, On Me secured a five-year partnership with Mastercard and raised $1.7 million in venture capital to develop a tailored digital gift card platform. Unlike traditional single-brand cards, On Me’s gift cards are themed around interests or hobbies such as running or cooking and can be redeemed at multiple relevant retailers like Nike or Reebok. These all-digital cards offer personalization features such as videos and GIFs, and leverage open-loop restricted authorization networks, allowing broader but controlled usage. The platform also integrates security features like two-factor authentication and mobile encryption to reduce fraud, aiming to modernize and personalize the gifting experience. This is expected to transform corporate gifting by offering more personalized, secure, and flexible options that boost engagement and satisfaction, supporting gift cards market expansion.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gift cards market analysis from 2024 to 2034 to identify the prevailing gift cards market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis of gift cards market highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the gift cards market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global gift cards market trends, key players, market segments, application areas, and market growth strategies.

Gift Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 2.3 trillion |

| Growth Rate | CAGR of 9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 250 |

| By Card Type |

|

| By End User |

|

| By Form |

|

| By Region |

|

| Key Market Players | Visa Inc., Qwikcilver Solutions Pvt Ltd., The Home Depot, EBIXCASH WORLD MONEY INDIA Ltd., Starbucks Corporation, Valve Corporation, Fiserv, Inc., Best Buy, Shift4 Payments, LLC, Amazon.com Inc., InComm Payments LLC, Blackhawk Network, American Express Company, Walmart Inc., PayPal, Inc., Sephora USA, Inc., Target Brands, Inc., Mastercard |

Analyst Review

The gift card market is experiencing significant growth, driven by rise in consumer demand for flexible, convenient gifting options and the rapid shift toward digital and e-commerce platforms. The market continues to expand across various sectors as businesses increasingly adopt gift cards for customer engagement, loyalty programs, and employee incentives**. In addition, digital gift cards are gaining traction due to their ease of use, personalization features, as well as instant delivery. Furthermore, the growing preference for cashless transactions, coupled with technological innovations and improved fraud prevention, is accelerating market growth. The gift card market is poised for sustained growth in the upcoming years with strong support from retailers, fintech companies, and evolving consumer behavior.

Furthermore, technological advancements in digital payment solutions, mobile wallets, and e-commerce platforms are significantly driving the growth of the gift card market. Modern gift card systems offer features such as instant digital delivery, customizable designs, seamless integration with loyalty and rewards programs, and real-time balance tracking. These innovations enhance convenience for both consumers and businesses, making gift cards a preferred choice for personal gifting and corporate incentives. The rise of fintech and payment tech startups, along with increasing collaboration between retailers, digital platforms, and financial institutions, is enabling the development of more secure, user-friendly, and versatile gift card solutions. The adoption of digital gift cards is expanding rapidly across global markets as consumer demand for flexible and contactless payment options continues to grow.

Moreover, supportive government initiatives and evolving regulatory frameworks aimed at promoting digital payments and financial inclusion are significantly boosting the growth of the gift card market. Policies encouraging cashless transactions, tax incentives for digital payments, and fintech innovation hubs are fostering a favorable environment for gift card adoption. In many regions, public and private sector collaborations are driving the development of secure, accessible, and user-friendly digital gift card platforms. However, challenges such as fraud risks, lack of standardization, and unequal digital infrastructure across regions hinder widespread adoption of gift card. Additionally, varying consumer awareness and preferences can impact market penetration. Despite these challenges**, the gift card market is expected to grow steadily, especially in emerging economies, driven by demand for flexible, digital-first gifting and payment solutions.

The gift cards market is expected to witness notable growth due to rise in adoption of digital payment, expansion of e-commerce sector, and emerging trends in corporate gifting.

The gift cards market is estimated to grow at a CAGR of 9.0% from 2025 to 2034.

The gift cards market is projected to reach $2,290.7 billion by 2034.

The key players profiled in the report include Amazon.com Inc., Walmart Inc., Fiserv, Inc., InComm Payments LLC, Shift4 Payments, LLC, Qwikcilver Solutions Pvt Ltd., PayPal, Inc., American Express Company, Blackhawk Network, Starbucks Corporation, Sephora USA, Inc., Target Brands, Inc., Visa Inc., Mastercard, Valve Corporation, Best Buy, EBIXCASH WORLD MONEY INDIA Ltd, and Home Depot.

The key growth strategies of commercial display market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...