Glass Curtain Wall Market Overview

The Global Glass Curtain Wall Market Size was valued at $44.4 billion in 2020, and is projected to reach $99.5 billion by 2032, growing at a CAGR of 6.8% from 2023 to 2032. The market has experienced strong growth over the past decade, driven by rising construction activities. Continued expansion in residential and commercial construction, along with increasing home renovation and remodeling spending, is expected to boost growth further. Technological advancements and innovations by industry players also contribute to the market’s ongoing expansion.

Market Dynamics & Insights

- The glass curtain wall industry in Asia-Pacific held a significant share of over 44.0% in 2020.

- The glass curtain wall industry in Canada is expected to grow significantly at a CAGR of 8.2% from 2023 to 2032

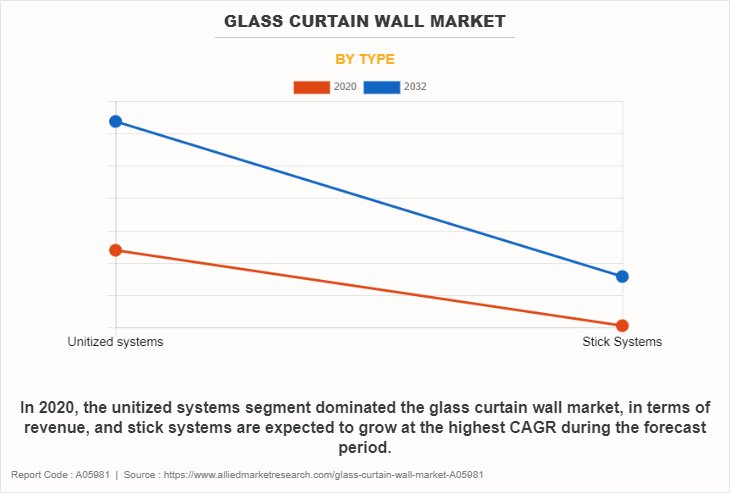

- By type, unitized systems segment is one of the dominating segments in the market and accounted for the revenue share of over 76.5% in 2020.

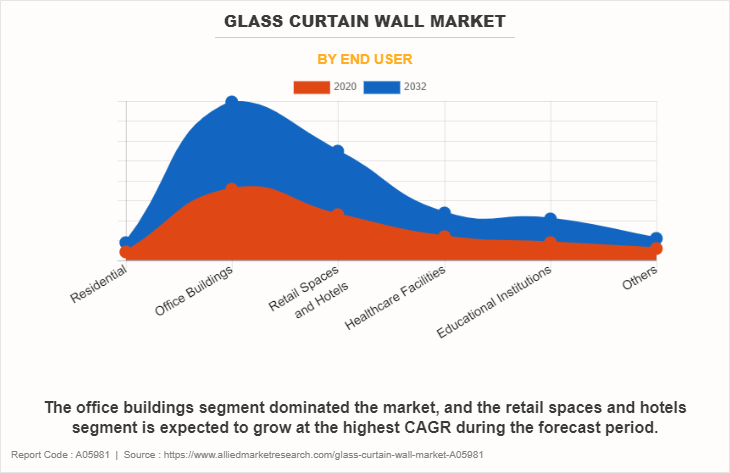

- By end-user, the retail spaces and hotels segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $44.4 Billion

- 2032 Projected Market Size: $99.5 Billion

- CAGR (2023-2032): 6.8%

- Asia-Pacific: Largest market in 2020

- LAMEA: Fastest growing market

What is Meant Glass Curtain Wall

A glass curtain wall is a building covering that is envisioned to resist the influence of environmental forces, which include wind, and to assist only its own weight. It is not intended to support the structural integrity of a building. A glass curtain wall provides robust architectural solutions and features to a building. Further, it entirely changes the look of a refurbished or a new building by making a spectacular design influence.

They are suitable for offices, schools, airports, malls, and other public and commercial buildings, both refurbished and new. In addition, a glass curtain wall helps in meeting energy conservation necessities of building regulations while lowering building running costs and growing comfort for occupants.

Glass Curtain Wall Market Dynamics

Glass curtain walls change the look of a building by creating enormous design influence while reducing energy costs by diminishing solar heat gains, thereby expected to boost the glass curtain wall market growth. In addition, they are suitable for schools, corporate offices, airports, and other public and commercial building structures. In addition, the glass curtain wall market is experiencing a continuous rise, owing to a surge in demand for residential, commercial, and public buildings.

The construction industry is expected to reach $8 trillion by 2030, driven by countries such as China, the U.S., and India. Hence, the construction industry is anticipated to represent a much bigger part of the global economy by 2030. Considering the growth in urban population and increase in construction industries, the requirement for glass curtain wall is projected to grow at a significant rate.

One of the driving factors of the glass curtain wall market is increased investments in interior design. Homeowners, proprietors, and office owners globally hire designers to plan, design, and supervise the interiors of their construction projects. People are concentrating on renovating their homes and offices corresponding to their own style preferences, functional needs, and finances. In addition, the rise in consumer spending on home remodeling in developed economies has driven market growth in recent years.

Furthermore, the glass curtain wall industry has witnessed significant advancements in technology in the past few years. For instance, the use of smart glass that can automatically adapt to varying lighting and climate conditions in the exterior space of the building. Furthermore, the integration of PV cells into glass curtain walls is a major development for advanced building solutions such as Building Integrated Photovoltaics (BIPV). MetSolar, and Onyx Solar Group LLC. offer a wide range of BIPV systems.

Also, LED curtain glass has gained popularity in the past few years owing to its advantageous features such as its availability to enhance building architecture and provide highly transparent glass. Furthermore, LED curtain glass walls can effectively display texts, patterns, and displays. Shenzhen Nexnovo Technology Co Ltd., G-Smatt, and Unilumin are some of the major providers of LED curtain wall displays. Thus, technological advancements are anticipated to provide major opportunities for the growth of the glass curtain wall industry during the forecast period.

Furthermore, the glass curtain walls offer advantageous features such as enhanced attractiveness of the building, increased thermal efficiency, and improved building dynamics. Thereby making it suitable for use in commercial buildings. The commercial real estate industry is witnessing rapid growth in developing economies such as India, China, Vietnam and Brazil.

For instance, the commercial real estate industry in Chennai has grown from 1.7 million square feet to 3.3 million square feet from 2019 to 2020. In addition, in 2021, India had the second-largest market for co-working spaces. These factors are anticipated to boost the glass curtain wall market share in developing economies.

However, fluctuating prices of raw materials are anticipated to restrain the growth of the glass curtain wall market. On the contrary, technological advancements are anticipated to provide major opportunities for the growth of glass curtain wall industry during the forecast period.

The glass curtain wall market witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for glass curtain wall from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. However, the rise in global inflation is a new major obstructing factor for the entire industry.

The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, have introduced volatility in the prices of raw materials used for manufacturing glass curtain wall. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. Moreover, the cost of construction has increased substantially, discouraging builders from initiating new projects, which is expected to negatively affect the glass curtain wall market growth. However, a peace agreement between Ukraine and Russia can be devised, with continued talks between different countries.

Glass Curtain Wall Market Segmental Overview

The glass curtain wall market is segmented into Type, Glazing Application, End User, Sales Type, and region. By type, the market is categorized into unitized systems and stick systems. On the basis of glazing application, it is bifurcated into exterior glazed and interior glazed. On the basis of end user, the market is classified into residential, office buildings, retail spaces & hotels, healthcare facilities, educational institutions, and others. By sales type, the market is segregated into manufacturer and installer. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type:

The glass curtain wall market is divided into unitized systems and stick systems. In 2020, the unitized systems segment dominated the glass curtain wall market, in terms of revenue, and stick systems are expected to grow at the highest CAGR during the forecast period. Unitized curtain wall systems are already completely assembled in manufacturing facilities, and then delivered to the construction site. This eliminates the need for individual installation in the building; thereby, speeding up the construction process.

Moreover, this curtain wall system is made in a controlled environment of the factory, which enhances its quality. In addition, these are popular among the mid- and high-rise buildings, as such buildings are large, and require speedy completion. High-rise buildings are witnessing a rise owing to the ever-increasing urban population, and advancements in construction technologies. This is expected to drive the demand for a unitized glass curtain wall system.

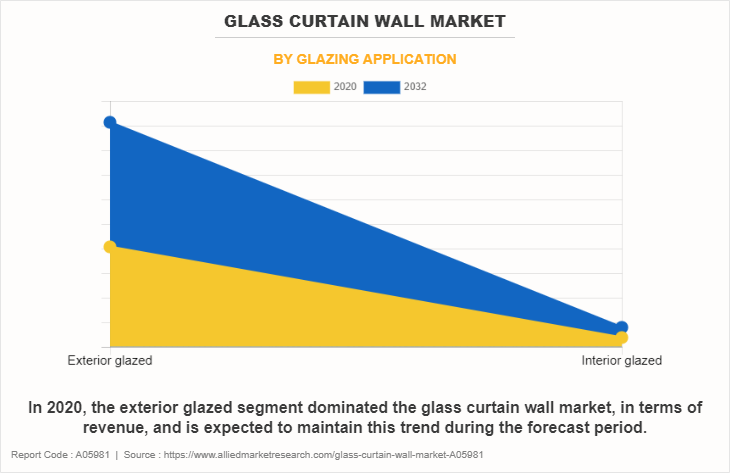

By Glazing Application:

The glass curtain wall market is divided into exterior and interior glazed. In 2020, the exterior glazed segment dominated the glass curtain wall market, in terms of revenue, and is expected to maintain this trend during the forecast period. The exterior glazed system is used in various commercial, residential, and high-rise buildings and is expected to boost the demand for the glass curtain wall systems market. It is mainly used in office buildings, shopping malls, and hotels owing to its various advantages such as protection against environmental elements such as wind, rain, and enhanced attractiveness of the building, increased thermal efficiency, and improved building dynamics. It requires a swing stage, scaffolding, or a man lift to install large sections of glass that are assembled into the framework and then attached to the building’s exterior.

By End User:

The glass curtain wall market is categorized into residential, office buildings, retail spaces and hotels, healthcare facilities, educational institutions, and others. The office buildings segment dominated the market, and the retail spaces and hotels segment is expected to grow at the highest CAGR during the forecast period. Gradual increase in population and rise in disposable income of population in various developing countries, including India and Brazil, boost the growth of the glass curtain wall market.

For instance, Oxford Properties Group announced a plan to construct a mixed-use building complex consisting of four towers which includes office spaces, residential units, and a commercial building. It will be one of the largest mixed-use complexes in Toronto's history. Hence, these kinds of projects are expected to create opportunities for glass curtain wall companies and provide lucrative growth opportunities for the market.

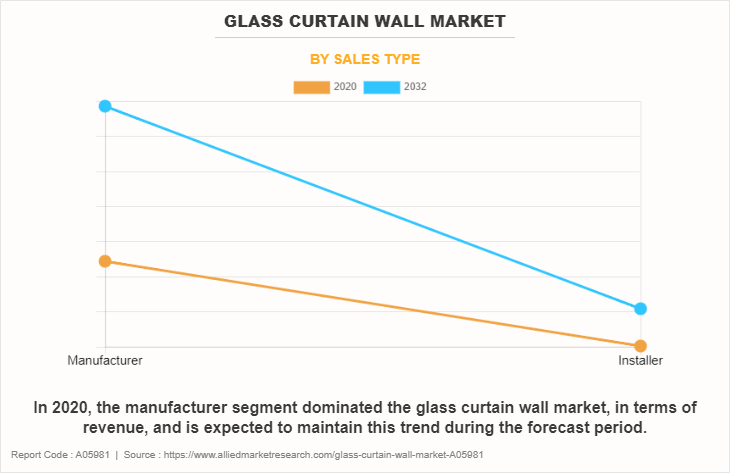

By Sales Type:

The glass curtain wall market is divided into electric manufacturer and installer. In 2020, the manufacturer segment dominated the glass curtain wall market, in terms of revenue, and is expected to maintain this trend during the forecast period. The major manufacturers are available in the market such as AGC Inc., Central Glass Co., LTD, Guardian Industries Corp., Nippon Sheet Glass Co., Ltd, Saint-Gobain group, Schott AG., Vitro, S.A.B. de C.V., Xinyi Glass Holdings Limited, Yuanda China Holdings Limited, Hainan Development Holdings Nanhai Co., Ltd., and others are offering glass curtain wall.

In addition, major players are adopting various strategies such as product launches and acquisitions to sustain the competitiveness of the market. For instance, In April 2022, AGC, a Japan-based glass manufacturer introduced its new BIPV panel equipped with solar cell-embedded laminated safety glass. Dubbed SunJoule, the panel was designed to be adapted to various building requirements, including canopies, facades, and curtain wall systems. The purpose behind the development of these panels is to block the sunlight during the harvest of solar energy, and in turn, decrease heat transmission.

By Region:

The glass curtain wall market is analyzed across North America, Europe, and Asia-Pacific. Asia-Pacific accounted for the highest share in the global glass curtain wall market share, in terms of revenue. Moreover, the market in LAMEA is anticipated to grow with the highest CAGR, owing to growth in the construction industry in the region. Strong economic growth, rapid urbanization, and the presence of a large population base significantly contribute toward the growth of the glass curtain wall market in Asia-Pacific.

In addition, an increase in remodeling and repairing work in developing countries such as China, India, Vietnam, and Indonesia fuel the demand for glass curtain walls. China is one of the most valued construction markets in Asia-Pacific, and its construction expenditure is expected to increase every year until 2030, owing to a rise in income levels and rapid urbanization. Furthermore, the building construction and tourism sectors in countries such as Indonesia, Singapore, and Malaysia are experiencing growth. These factors boost the demand for glass curtain walls as they are extensively used in the construction of residential and non-residential buildings.

Furthermore, an upsurge in demand for glass curtain walls from retail office spaces, and residential, and commercial sectors is expected to fuel market growth. For instance, China is estimated to have 221 cities with more than one million inhabitants by 2025. Moreover, according to the Organization for Economic Cooperation and Development (OECD), the middle-class population is expected to reach one billion by 2030, due to which the demand for glass curtains is projected to increase at a higher pace in the near future, thereby propelling the growth of the market.

Competition Analysis

Competitive analysis and profiles of the major players in the glass curtain wall include Key companies profiled in the glass curtain wall market report include AGC Inc., Central Glass Co., LTD, Guardian Industries Corp., Nippon Sheet Glass Co., Ltd, Saint-Gobain group, Schott AG., Vitro S.A.B. de C.V., Xinyi Glass Holdings Limited, Yuanda China Holdings Limited, and Hainan Development Holdings Nanhai Co., Ltd. are provided in this report. In addition, there are some important players in the market such as AGC Inc., Yuanda China Holding Ltd, Saint Gobain Group and Nippon Sheet Glass Co., Ltd. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the glass curtain wall market.

Which New Products have Been Launched in the Glass Curtain Wall Industry

- In September 2022, Saint-Gobain launched the ORAÉ, which is the very first lowest carbon footprint, setting a new standard at 6.64kg CO2 eq./m². ORAE portfolio includes the solution COOL-LITE XTREME ORAE offers performance and sustainability, reducing both operational and embodied carbon in buildings’ facades.

- In March 2022, Guardian Glass North America launched two new products for the commercial range of double silver-coated glass: SunGuard SNR 35 and SunGuard SNR 50 coated glass.

- In September 2022, AGC Inc. announced that it produces a float glass range featuring a significantly reduced carbon footprint of less than 7 kg of CO2 per m2 for clear glass (4 mm thick). These new low-carbon glass products will deliver the same aesthetics, quality, and technical performance as traditional AGC float glass products.

Acquisition in the market

- In January 2023, Guardian Glass announced the agreement to acquire Vortex Glass, which offers laminated and insulated glass that meets the stringent Florida Building Code for hurricane impacts, and supplies Florida and the Caribbean Islands customers with complete tempered glass packages for residential and commercial construction, including office partitions, shower doors and glass railings.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging glass curtain wall market trends and dynamics.

- In-depth glass curtain wall market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the glass curtain wall market outlook is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The glass curtain wall market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the glass curtain wall market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the glass curtain wall industry.

Glass Curtain Wall Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 99.5 billion |

| Growth Rate | CAGR of 6.8% |

| Forecast period | 2020 - 2032 |

| Report Pages | 374 |

| By Type |

|

| By Glazing Application |

|

| By End User |

|

| By Sales Type |

|

| By Region |

|

| Key Market Players | Vitro, S.A.B. de C.V., Yuanda China Holdings Limited, Saint-Gobain group, Guardian Industries Corp., CENTRAL GLASS CO., LTD., Xinyi Glass Holdings Limited., Schott AG., Hainan Development Holdings Nanhai Co., Ltd., Nippon Sheet Glass Co., Ltd, AGC Inc. |

Analyst Review

The glass curtain wall market has witnessed significant growth in the past few years, owing to a surge in the number of residential and commercial facilities, along with increasing demand for environment-friendly materials such as glass.

The glass curtain walls are used in commercial, public, as well as residential buildings. The demand for glass curtain walls has increased due to the rise in residential and commercial activities globally. Leading companies, such as Saint-Gobain and Nippon Sheet Glass Co., Ltd, have witnessed significant growth and expansion of their overall consumer base, as they offer numerous types of glass curtain walls, in different sizes and functions. Moreover, innovative marketing and positioning strategies have positively impacted the growth of the global glass curtain wall market.

Further, major players have introduced highly efficient exterior glazed glass curtain walls in the market. For instance, in September 2022, Saint-Gobain launched the ORAÉ, which is the very first lowest carbon footprint, setting a new standard at 6.64kg CO2 eq./m². ORAE portfolio includes the solution COOL-LITE XTREME ORAE offers performance and sustainability, reducing both operational and embodied carbon in building facades.

Asia-Pacific is expected to be the highest revenue contributor; however, LAMEA is anticipated to provide remunerative growth opportunities to key players in this market. Besides, the glass curtain wall market holds high growth potential in the residential and public sectors due to development in the construction industry and a surge in focus of individuals toward affordable buildings. Moreover, the present business scenario experiences rapid growth in the adoption of glass curtain walls exhibiting the readiness to accept this technology, in regions such as North America and Asia-Pacific. Improved efficiency and prolonged durability of glass curtain walls are some of the major drivers of market expansion. However, the rise in the costs of raw materials impedes the growth of the market. On the contrary, the support offered by governments of different countries is anticipated to be opportunistic for the market.

The global glass curtain wall market was valued at $44,415.5 million in 2020 and is projected to reach $99,466.2 million by 2032, registering a CAGR of 6.8%.

The base year considered in the global glass curtain wall market report is 2022.

Rise in construction activities are the upcoming trends of the Glass Curtain Wall Market in the world.

Exterior glazing is the leading glazing application of Glass Curtain Wall Market.

Asia-Pacific is the largest regional market for Glass Curtain Wall.

AGC Inc., Central Glass Co., LTD, Guardian Industries Corp., Nippon Sheet Glass Co., Ltd, Saint-Gobain group, Schott AG., Vitro S.A.B. de C.V., Xinyi Glass Holdings Limited, Yuanda China Holdings Limited, and Hainan Development Holdings Nanhai Co., Ltd. are the top companies to hold the market share in Glass Curtain Wall.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

The report contains an exclusive company profile section, where the leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...