Glass Fiber Reinforced Plastics (GFRP) Composites Market Research, 2032

The global glass fiber reinforced plastics (GFRP) composites market was valued at $19.8 billion in 2022, and is projected to reach $37.2 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.

Report Key Highlighters:

- Quantitative information mentioned in the global glass fiber reinforced plastics (GFRP) composites market includes the market numbers in terms of value ($Million) and volume (Kilotons) with respect to different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on resin type, process, and end-use industry The study will also contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Owens Corning, Johns Manville, Sancom Composites LLP, Asahi Kasei Corporation, PPG Industries, Inc., hold a large proportion of the glass fiber reinforced plastics (GFRP) composites market.

- This report makes it easier for existing market players and new entrants to the glass fiber reinforced plastics (GFRP) composites business to plan their strategies and understand the dynamics of the industry, which ultimately helps them make better decisions.

Glass fiber reinforced plastic composites, commonly known as fiberglass composites, represent a class of materials composed of a polymer matrix reinforced with glass fibers. These composites are vital in a variety of sectors because of their outstanding strength, durability, and adaptability. Glass fibers, which are thin strands made from melted glass, are mixed with a polymer like epoxy, polyester, or vinyl ester resin to create these composites.

This combination results in a material with remarkable properties, blending the lightweight nature of polymers with the high strength-to-weight ratio of glass fibers. This composite has several applications including aerospace and automotive, as well as construction, marine, sports equipment, and consumer goods. The unique properties of fiberglass composites, including corrosion resistance, electrical insulation, and thermal stability, contribute to their widespread use and the continued search for innovative solutions in a wide range of sectors.

The surge in global infrastructure projects has become a major factor driving the GFRP composite market.

Governments and private companies throughout the globe are making significant investments in different building, transportation, and utility enterprises. GFRP composites are being chosen as the preferred material for these projects because of their remarkable qualities, which include a high strength-to-weight ratio, corrosion resistance, and longevity. They provide structurally robust, cost-effective, and sustainable solutions that satisfy the changing requirements of contemporary infrastructure development. The versatility of GFRP composites allows them to be used in a variety of infrastructure areas. They are used in the construction of building facades, reinforcing bars, bridge decks, railway components, utility poles, and other structural parts.

Furthermore, the design freedom of GFRP composites allows for the production of complicated forms and structures in infrastructure projects, permitting creative and aesthetically beautiful designs. Architects and engineers may use the composites' adaptability to build custom-made components, unique architectural aspects, and specialized structural characteristics that would be difficult or impossible to achieve with traditional materials.

The growing need for glass fiber reinforced plastics (GFRP) composites has boosted their demand within the aerospace and automotive industries, driving market expansion.

In the automotive sector, there's been a noticeable uptick in employing GFRP composites across various components. These materials offer advantageous properties like exceptional strength, resistance to corrosion, and flexibility in design. This versatility allows GFRP composites to be used in manufacturing automotive body panels, various vehicle parts, interior components, and even structural elements. Similarly, in the aerospace industry, there's been a considerable increase in utilizing GFRP composites in crafting critical aircraft components such as wings, fuselage sections, and internal structures.

The primary driving force behind this adoption is the remarkable strength-to-weight ratio offered by these composites. This specific quality enables the creation of aircraft components that are both robust and lightweight, a crucial combination in the aerospace sector. Industries are continuously striving to enhance performance metrics, diminish fuel consumption, and meet stringent requirements. Consequently, this has led to an escalating need for GFRP composites, owing to their capability to fulfill these criteria effectively.

The lightweight and high-strength properties of glass fiber reinforced plastics (GFRP) composites play a vital role in fueling the growth of their market due to their significant advantages and applications across various industries.

Glass fiber reinforced plastics (GFRP) composites are an impressive combination of strength and lightweight characteristics, making them a standout choice. This combination is crucial in industries like aerospace, automotive, marine, and transportation, where weight reduction without losing toughness is critical. By being lightweight, these composites help to save energy and improve overall operating effectiveness.

The ability of GFRP composites to offer both robustness and lighter weight is an important development, as it directly impacts fuel efficiency and enhances performance across various sectors. Furthermore, the high strength-to-weight ratio of GFRP composites makes them a desirable alternative for a variety of structural applications. Their capacity to endure significant loads and strains while being lightweight is a crucial element driving their use in various industries.

However, these composites have high corrosion resistance in many situations, but they may degrade when exposed to UV light over an extended period. Ultraviolet radiation can degrade the polymer matrix, resulting in loss of mechanical property and structural collapse. Because of this restriction, UV-resistant coatings or additives must be used to reduce the effects of extended exposure to sunlight, particularly in outdoor applications such as building or marine constructions. These factors are restraining the growth of the glass fiber reinforced plastic composite market.

Furthermore, the increasing adoption of GFRP composites in emerging sectors such as renewable energy and electric vehicles presents a promising avenue for future growth. GFRP materials are utilized in wind turbine blades, solar panel frames, and components for electric vehicles due to their lightweight, durable, and corrosion-resistant properties. As the global shift towards renewable energy sources and sustainable transportation intensifies, the demand for GFRP composites in these sectors is expected to escalate, opening up new avenues for market expansion.

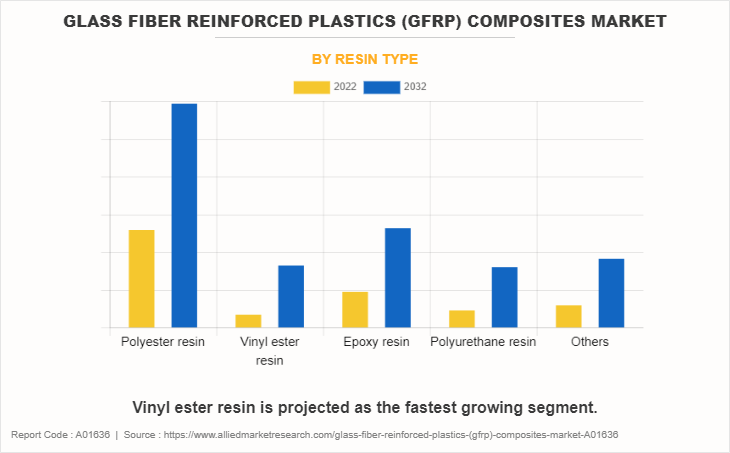

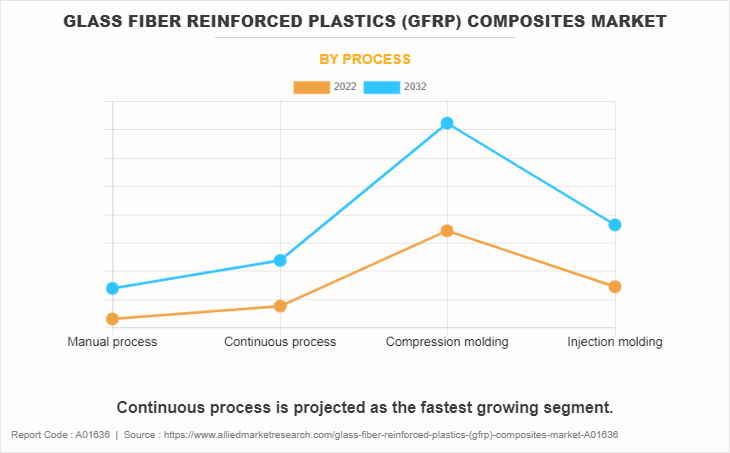

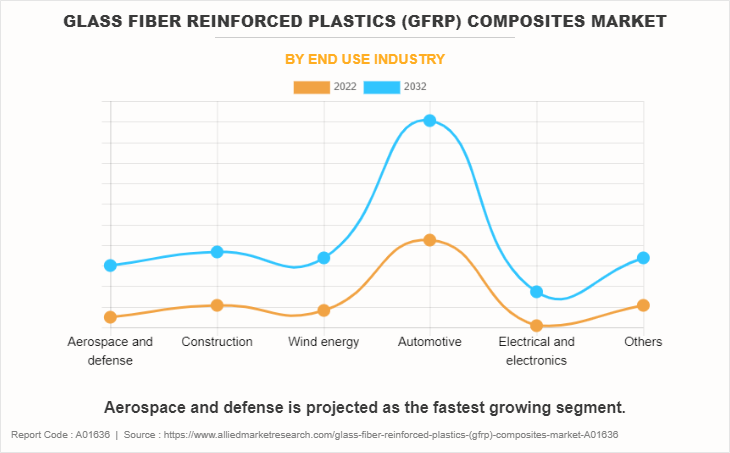

The glass fiber reinforced plastics (GFRP) composites market is segmented based on resin type, process, end-use industry, and region. By resin type, the market is divided into polyester resin, vinyl ester resin, epoxy resin, polyurethane resin, and others. Based on the process, it is categorized into manual process, continuous process, compression molding, and injection molding. Depending on the end-use industry, the market is segregated into aerospace and defense, construction, wind energy, automotive, electrical and electronics, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The epoxy resin segment accounted for the largest share in 2022. The demand for epoxy resin is on the rise due to its versatile applications in industries such as construction, electronics, and automotive. Epoxy's excellent adhesive properties, high strength, and resistance to chemicals make it a preferred choice. Additionally, its increasing use in composites, coatings, and adhesives for manufacturing processes contributes to the growing demand, driven by the need for durable and efficient materials in various sectors.

Vinyl ester resin is expected to register the highest CAGR of 7.0%. The increasing demand for vinyl ester resin can be attributed to its exceptional corrosion resistance, mechanical strength, and versatility. Industries such as construction, automotive, and marine favor vinyl ester resin for its superior performance in harsh environments. Additionally, its compatibility with various reinforcing materials and cost-effectiveness further contribute to the rising demand, making it a preferred choice in composite applications.

The compression molding segment accounted for the largest share in 2022. The demand for compression molding processes is on the rise due to several key factors. Firstly, it offers cost-effective production for large quantities of intricate parts. Additionally, the process allows for the utilization of a wide range of materials, promoting versatility in manufacturing. Its ability to produce high-strength and durable products further contributes to its increasing popularity in industries seeking efficient and reliable molding solutions.

Continuous process is expected to register the highest CAGR of 6.9%. Continuous processes see increased demand due to their efficiency, cost-effectiveness, and reduced resource consumption. Continuous production minimizes downtime, ensuring a steady output and consistent quality. This method is particularly advantageous in industries requiring high-volume, standardized output, such as chemicals and pharmaceuticals.

The Automotive segment accounted for the largest share in 2022. The automotive industry experiences increased demand due to factors such as rising population and urbanization, leading to greater mobility needs. Technological advancements, including electric vehicles and autonomous driving, contribute to consumer interest. Economic growth improved disposable incomes, and a growing middle class further boosted demand for automobiles globally.

Aerospace and defense is expected to register the highest CAGR of 7.2%. The aerospace and defense industry experiences increased demand due to geopolitical tensions, rising global security concerns, and technological advancements. Countries invest heavily in defense capabilities, driving demand for cutting-edge aircraft, surveillance systems, and weaponry. Additionally, the growing commercial aviation sector contributes to the industry's expansion, fueled by increased air travel and cargo transportation needs.

Asia-Pacific garnered the largest share in 2022. The glass fiber reinforced plastics (GFRP) composites market in Asia-Pacific is experiencing robust growth, driven by increasing demand across the construction, automotive, and aerospace industries. The region's economic expansion, technological advancements, and emphasis on lightweight materials contribute to GFRP's popularity. Key players are investing in research and development, further fueling market expansion.

The major players operating in the global glass fiber reinforced plastics (GFRP) composites market are Owens Corning, Johns Manville, Sancom Composites LLP, Asahi Kasei Corporation, PPG Industries, Inc., 3B - the fibreglass company, Nippon Sheet Glass Co., Ltd., Nitto Boseki Co., Ltd., Celanese Corporation, and Mitsubishi Chemical Group Corporation.

Other players include SGL Carbon, alformet, Röchling, Amiblu Holding GmbH, Chomarat Group, Saint Gobain Vetrotex, Honeywell International Inc., BASF SE, Reliance Industries Ltd., Advanced Composites Inc., Braj Binani Group, and BGF Industries Inc.

Public Policies:

- Environmental Protection Regulations: Many countries in the Asia-Pacific region have environmental protection laws and regulations governing industrial activities, waste disposal, and emissions.

- Waste Management Policies: Countries often have waste management policies that outline guidelines for the handling, disposal, and recycling of various materials.

- Import and Export Regulations (North America): Depending on the nature of the composite materials and their intended use, there may be import and export regulations, including customs and trade compliance requirements.

- Occupational Safety and Health Administration (OSHA) Regulations (U.S.): OSHA sets workplace safety standards that may apply to the manufacturing and handling of composite materials, with a focus on worker safety and exposure to hazardous materials.

- Research and Development Initiatives: Government-funded research initiatives or grants may support advancements in materials science and composite technologies, indirectly influencing the development of sustainable composite materials, including GFRP composites.

- Circular Economy Action Plan: The EU has launched a Circular Economy Action Plan to transition towards a more sustainable and circular economy.

Russia-Ukraine War Impact:

The Russia-Ukraine war can have various impacts on the glass fiber reinforced plastic composites industry. GFRP composites are advanced materials that are engineered for their exceptional strength, durability, and lightweight properties. These materials find applications in a wide range of industries, including aerospace, automotive, defense, and more.

Instability in the region can lead to price fluctuations for raw materials and energy sources used in the composites industry. Fluctuating prices can affect the cost of manufacturing high-performance composites, which may, in turn, impact the pricing of end products.

Sanctions, trade limitations, or geopolitical tensions between countries involved in the conflict can create uncertainty in international trade. Industries operating within or trading with these regions may face challenges in exporting or importing goods, impacting the global flow of materials used in GFRP composite manufacturing.

The war can lead to damage to infrastructure, including manufacturing facilities and transportation networks in the region, which can disrupt the production and distribution of GFRP composites.

GFRP composites are extensively used in the defense sector for applications like aircraft, vehicles, and armor. The war may lead to increased demand for these materials in military applications, potentially straining the supply for other industries.

Governments may impose export restrictions on high-performance composite materials and technologies, especially those with potential military applications, which can impact global trade and technological development.

War can disrupt the supply chain of critical raw materials and components used in the production of GFRP composites. Interruptions in the supply of raw materials may lead to increased costs, shortages, or delays in production for companies relying on these resources.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the glass fiber reinforced plastics (GFRP) composites market analysis from 2022 to 2032 to identify the prevailing glass fiber reinforced plastics (GFRP) composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the glass fiber reinforced plastics (GFRP) composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global glass fiber reinforced plastics (GFRP) composites market trends, key players, market segments, application areas, and market growth strategies.

Glass Fiber Reinforced Plastics (GFRP) Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 37.2 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Resin Type |

|

| By Process |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Sancom Composites LLP, Owens Corning, Mitsubishi Chemical Group Corporation, 3B - the fibreglass company, Celanese Corporation, Nippon Sheet Glass Co., Ltd, Asahi Kasei Corporation, PPG Industries, Inc., Johns Manville, Nitto Boseki Co., Ltd. |

Analyst Review

According to the insights of the CXOs of leading companies, glass fiber reinforced plastic composites are a popular choice for applications such as aerospace, automotive, and sports equipment due to their superior strength-to-weight ratio, corrosion resistance, and design adaptability. Furthermore, the growing emphasis on fuel efficiency and environmental sustainability drives demand for lightweight composites, lowering transportation carbon footprints and supporting greener manufacturing processes.

However, the complex manufacturing processes, particularly the production of glass fibers and polymer resins, may involve energy-intensive procedures and chemical usage which hinders the growth of the markets.

The CXOs further added that innovations in manufacturing techniques and material formulations offer lucrative growth opportunities. Thus, improved strength combined with weight reduction are expected to open up new dimensions in aerospace, automotive, transportation, and a variety of structural applications where a precise balance of strength and weight is critical.

The global glass fiber reinforced plastics (GFRP) composites market was valued at $19.8 billion in 2022, and is projected to reach $37.2 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.

Automotive is the leading end-use industry of Glass Fiber Reinforced Plastics (GFRP) Composites Market.

The top companies to hold the market share in Glass Fiber Reinforced Plastics (GFRP) Composites are Owens Corning, Johns Manville, Sancom Composites LLP, Asahi Kasei Corporation, PPG Industries, Inc., 3B - the fibreglass company, Nippon Sheet Glass Co., Ltd, Nitto Boseki Co., Ltd., Celanese Corporation, and Mitsubishi Chemical Group Corporation.

Technological advancements in glass fiber reinforced plastic (GFRP) composites is the upcoming trend of Glass Fiber Reinforced Plastics (GFRP) Composites Market in the world.

Glass Fiber Reinforced Plastics (GFRP) Composites Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for Glass Fiber Reinforced Plastics (GFRP) Composites.

The glass fiber reinforced plastics (GFRP) composites market is segmented based on resin type, process, end-use industry, and region. By type, the market is divided into polyester resin, vinyl ester resin, epoxy resin, polyurethane resin, and others. Based on the process, it is categorized into manual process, continuous process, compression molding, and injection molding. Depending on the end-use industry, the market is segregated into aerospace and defense, construction, wind energy, automotive, electrical and electronics, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...