Oil Well Inspection Services Market Research, 2033

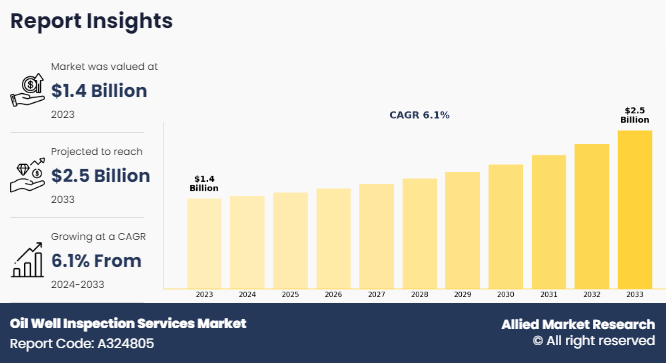

The global oil well inspection services market size was valued at $1.4 billion in 2023, and is projected to reach $2.5 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033. Increase in demand for energy and the need to enhance oil extraction efficiency are significantly driving the market for inspection services. As energy consumption rises globally, the oil industry face pressure to maximize output and operational efficiency, necessitating regular inspections to ensure equipment reliability and minimize downtime. Moreover, the heightened environmental concerns and sustainability initiatives are compelling companies to adhere to stringent regulatory standards and adopt greener practices drive the demand for comprehensive inspection services

Introduction

Well inspection services are specialized activities carried out to assess the condition and performance of oil wells. These services involve the use of advanced techniques and tools to examine various aspects of well integrity, including the structural integrity of the wellbore, casing, and tubing, as well as the functionality of well components such as valves, pumps, and safety devices. The primary objective of well inspection services is to ensure the safe and efficient operation of wells, identify potential issues before they become critical, and maintain compliance with industry regulations and standards.

Key Takeaways

- The global oil well inspection services market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of well type, technology, application, end use, 5 major regions, and more than 15 countries.

- The global oil well inspection services market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the oil well inspection services market are Halliburton, Weatherford, Baker Hughes Inc., Ranger Energy Services, EyeROV (IROV Technologies Pvt Ltd), Metalogic Inspection Services, Zetec, Inc., Kappa Engineering Corporation, Schlumberger Limited, Cereu Ultrasonics, darkvision technologies inc., WellGuard AS, ARCHER, TGT Diagnostics, and PROBE TECHNOLOGIES HOLDINGS, INC.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global oil well inspection services market analysis.

Market Dynamics

The increase in demand for energy and oil extraction efficiency drives the need for well inspection services. As global energy consumption continues to rise, fueled by growing industrialization and population growth, the pressure on oil companies to maximize production from existing wells has intensified. According to the Internation Energy Agency, global oil demand will rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d) which is supported by robust demand from the petrochemical and aviation sectors. Efficient well inspection plays a crucial role in ensuring the operational integrity and safety of these wells. Moreover, regulatory requirements and environmental concerns play a significant role in shaping the demand for well inspection services. All these factors are expected to drive the growth of the global oil well inspection services market during the forecast period.

However, the high initial costs of advanced inspection technologies deter potential clients from opting for comprehensive inspection services. Operators and owners of wells prioritize cost-effectiveness over thoroughness, opting for less sophisticated inspection methods or delaying inspections altogether, which lead to increased risks of equipment failure or environmental damage. In addition, the specialized skills required to operate and interpret data from these advanced inspection tools also contribute to the costs. All these factors hamper the oil well inspection services market growth.

Drones, equipped with high-resolution cameras and sensors access remote and hazardous locations that are difficult for human inspectors to reach. They provide real-time data and imagery, enabling comprehensive visual inspections of infrastructure, pipelines, and equipment without the need for shutdowns or extensive manpower. This capability reduces operational downtime and improves safety by minimizing human exposure to potentially hazardous environments. For instance, remote sensing technologies such as satellite imagery and LiDAR (Light Detection and Ranging) provide comprehensive monitoring of oil fields and infrastructure over large geographical areas. These tools enable continuous surveillance of environmental conditions, pipeline integrity, and land use, supporting compliance with regulatory requirements and minimizing environmental impacts. All these factors are anticipated to offer new growth opportunities for the global oil well inspection services market.

Segments Overview

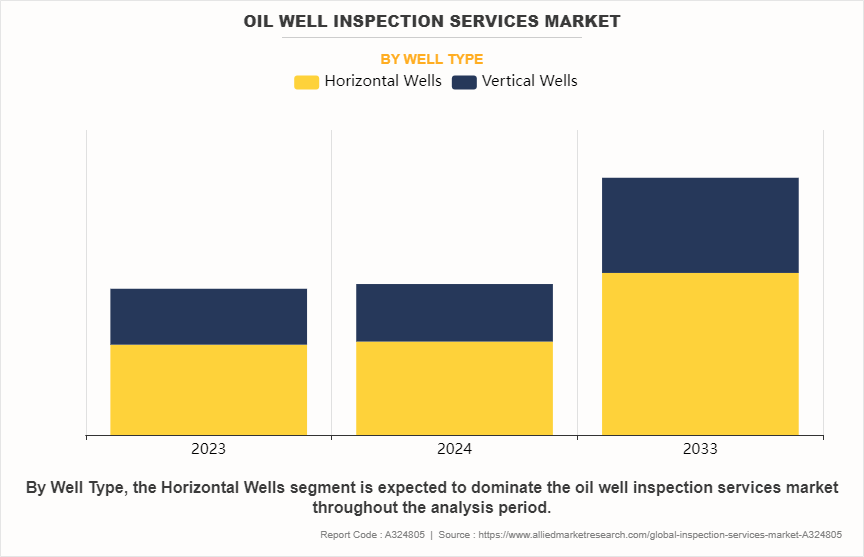

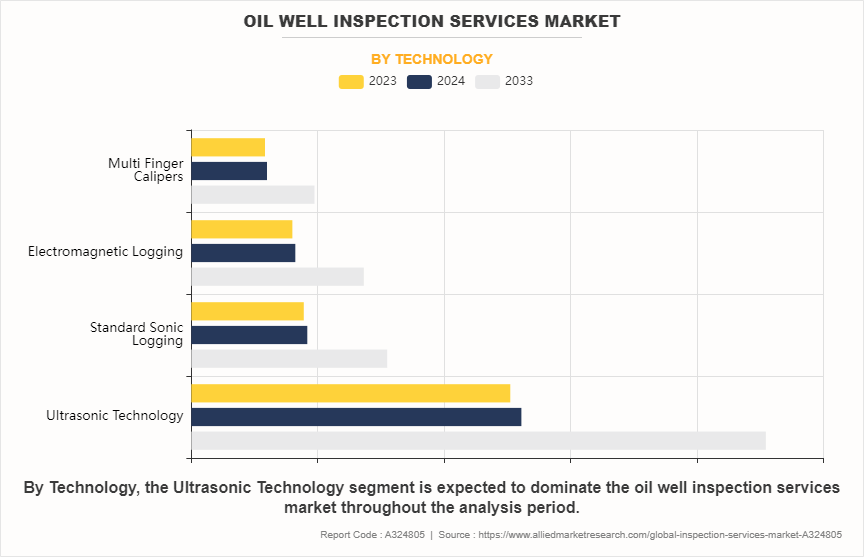

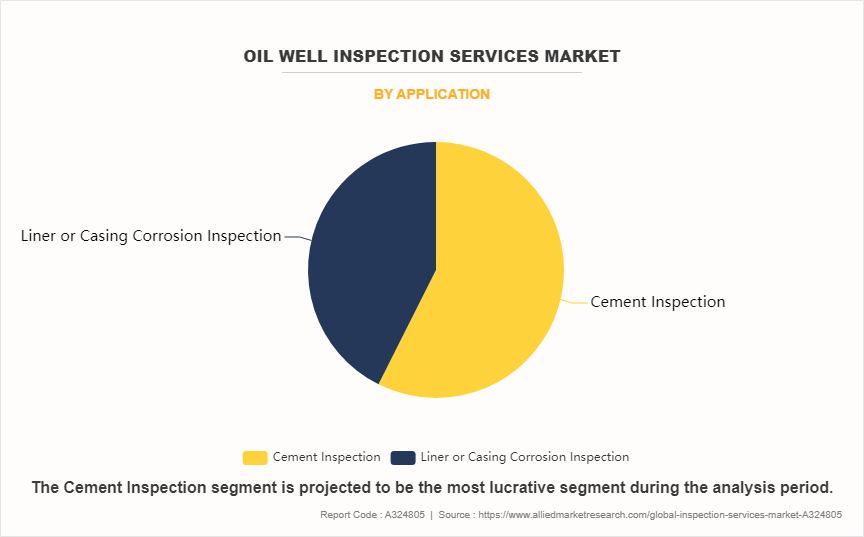

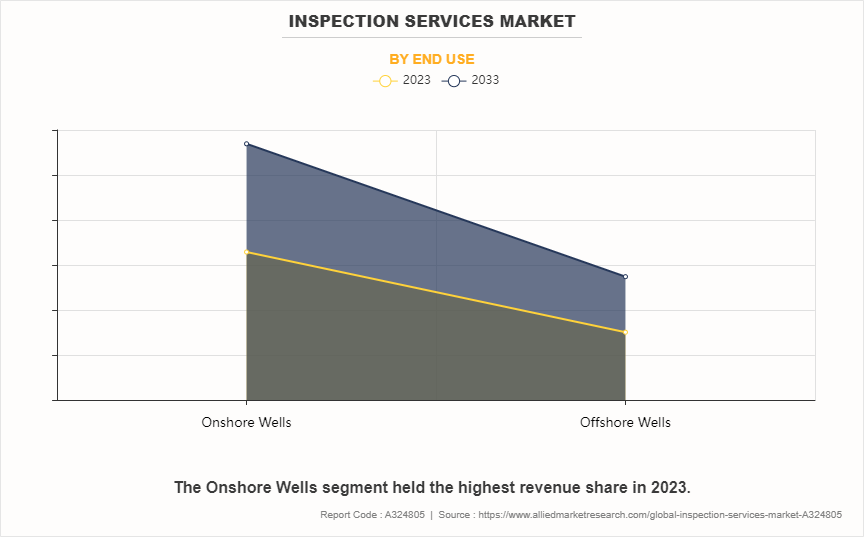

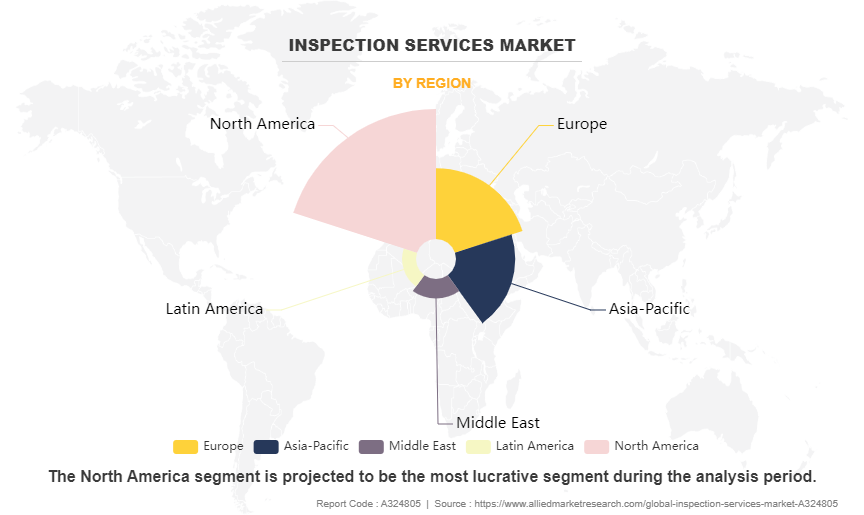

The global oil well inspection services market is segmented into well type, technology, application, end use, and region. On the basis of well type, the market is bifurcated into horizontal wells and vertical wells. On the basis of technology, the market is categorized into ultrasonic technology, standard sonic logging, multi finger calipers, and electromagnetic logging. By application, the market is divided into cement inspection and liner or casing corrosion inspection. By end use, the market is segmented into onshore wells and offshore wells. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Latin America.

On the basis of well type, the market is bifurcated into horizontal wells and vertical wells. The horizontal wells segment accounted for more than three-fifths of the global oil well inspection services market share in 2023 and is expected to maintain its dominance during the forecast period. The complexity of horizontal wells necessitates regular inspection to monitor the integrity of the wellbore and casing. As compared to vertical wells, horizontal wells traverse through different geological formations and encounter varying downhole conditions. This variability increases the risk of corrosion, scale buildup, and mechanical wear, which compromise production efficiency and safety. Well inspections provide essential data on these conditions, enabling operators to detect potential issues early and plan maintenance or remedial actions effectively.

On the basis of technology, the market is categorized into ultrasonic technology, standard sonic logging, multi finger calipers, and electromagnetic logging. The ultrasonic technology segment accounted for more than half of the global oil well inspection services market share in 2023 and is expected to maintain its dominance during the forecast period. Advancements in ultrasonic sensor technology have improved its effectiveness in challenging environments such as deep wells or those with complex geometries. Enhanced sensor capabilities, coupled with sophisticated data analysis techniques, allow for more accurate detection and characterization of defects, ensuring early identification and mitigation of potential risks.

By application, the market is divided into cement inspection and liner or casing corrosion inspection. The cement inspection segment accounted for less than three-fifths of the global oil well inspection services market share in 2023 and is expected to maintain its dominance during the forecast period. Proactive cement inspection helps identify potential issues early, allowing operators to address them before they escalate into costly problems such as casing failures or remedial cementing operations. This proactive approach mitigates risks and enhances operational efficiency and reduces overall lifecycle costs associated with well operations.

By end use, the market is segmented into onshore wells and offshore wells. The onshore wells segment accounted for more than two-thirds of the global oil well inspection services market share in 2023 and is expected to maintain its dominance during the forecast period. The aging infrastructure of onshore wells presents a persistent need for inspection services. Many wells have been in operation for decades, leading to wear and degradation of equipment and structures over time. Routine inspections are essential to identify corrosion, mechanical wear, and other potential issues that compromise well performance or safety. This ongoing maintenance requirement ensures a steady demand for inspection services to mitigate risks and extend the operational life of aging wells.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Latin America. The North America region accounted for more than two-fifths of the global oil well inspection services market share in 2023 and is expected to maintain its dominance during the forecast period. U.S. and the Canadian Energy Regulator (CER) in Canada, have implemented rigorous standards for environmental protection and operational safety. These regulations require oil companies to conduct regular inspections and maintenance to comply with safety standards and minimize environmental impact. Compliance with these regulations helps companies avoid fines and legal repercussions and fosters a culture of safety and responsibility within the industry.

Competitive Analysis

Key players in the global inspection services industry include Halliburton, Weatherford, Baker Hughes Inc., Ranger Energy Services, EyeROV (IROV Technologies Pvt Ltd), Metalogic Inspection Services, Zetec, Inc., Kappa Engineering Corporation, Schlumberger Limited, Cereu Ultrasonics, darkvision technologies inc., WellGuard AS, ARCHER, TGT Diagnostics, and PROBE TECHNOLOGIES HOLDINGS, INC.

In the global oil well inspection services market overview, companies have adopted agreement and acquisition strategies to expand the market or develop new products. For instance, in April 2024, Halliburton and Intelligent Inspection Corporation (IIC) signed a definitive agreement for the development, marketing, and delivery of robotic technology to the oil industry. This is expected to facilitate the development, marketing, and delivery of various robotic and artificial intelligence technologies aimed at enhancing oil exploration, drilling, and production operations. Moreover, in August 2022, Baker Hughes Company acquired Quest Integrity to deliver expanded asset inspection solutions and services for the energy and industrial sectors. This Acquisition boosted Baker Hughes’ asset integrity solutions for “difficult to inspect” pipelines, adding capability for inspection of furnace tubes, loading terminals, jet fuel lines along with other industrial markets.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oil well inspection services market forecast analysis from 2024 to 2033 to identify the prevailing oil well inspection services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oil well inspection services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oil well inspection services market trends, key players, market segments, application areas, and market growth strategies.

Oil Well Inspection Services Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.5 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 448 |

| By Well Type |

|

| By Technology |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Baker Hughes Company, WellGuard AS, PROBE TECHNOLOGIES HOLDINGS, INC., Archer, Ranger Energy Services, Zetec, Inc., DarkVision, Halliburton, Metalogic Inspection Services, Weatherford, TGT Diagnostics, EyeROV (IROV Technologies Pvt Ltd), Cereus Ultrasonics Ltd., KAPPA Engineering, SLB |

Analyst Review

According to the opinions of various CXOs of leading companies, the global oil well inspection services market is expected to witness an increase in demand during the forecast period. Increase in demand for energy and oil extraction efficiency and environmental concerns and sustainability initiatives have increased the demand for the global oil well inspection services market during the forecast period. Oil well inspection services are essential in ensuring compliance with stringent environmental regulations and standards aimed at protecting air and water quality, wildlife habitats, and human health. By conducting regular inspections using advanced technologies and methods, companies detect and mitigate potential environmental risks such as leaks, spills, and emissions, thereby safeguarding natural resources and mitigating reputational and operational risks.

Moreover, sustainability initiatives are driving oil companies to adopt more responsible practices throughout their operations, including inspection and maintenance processes. This includes investing in innovative technologies such as drones, sensors, and AI-driven analytics, which improve the accuracy and efficiency of inspections and support sustainable resource management. These technologies enable proactive monitoring of infrastructure integrity, early detection of equipment failures, and optimization of maintenance schedules, contributing to operational reliability and efficiency while reducing environmental impacts.

The global oil well inspection services market was valued at $1.4 billion in 2023, and is estimated to reach $2.5 billion by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Technological advancements in inspection methods is the upcoming trends of oil well Inspection Services Market in the globe.

Cement inspection is the leading application of oil well Inspection Services Market.

North America is the largest regional market for Inspection Services.

Key players in the global oil well inspection services market include Halliburton, Weatherford, Baker Hughes Inc., Ranger Energy Services, EyeROV (IROV Technologies Pvt Ltd), Metalogic Inspection Services, Zetec, Inc., Kappa Engineering Corporation, Schlumberger Limited, Cereu Ultrasonics, darkvision technologies inc., WellGuard AS, ARCHER, TGT Diagnostics, and PROBE TECHNOLOGIES HOLDINGS, INC.

Loading Table Of Content...

Loading Research Methodology...