Unconventional Oil Market Research, 2033

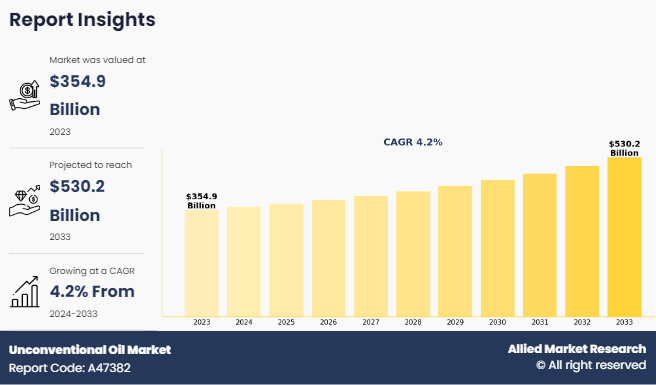

The global unconventional oil market size was valued at $354.9 billion in 2023, and is projected to reach $530.2 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033. The escalating global demand for oil, coupled with significant technological advancements in unconventional oil recovery methods, is driving a substantial increase in the demand for unconventional oil sources. As traditional reserves become more challenging to access and deplete over time, the focus has shifted towards unlocking unconventional oil reservoirs, such as tight oil and oil sands.

Introduction

Unconventional oil refers to petroleum resources that cannot be easily extracted using traditional drilling methods due to geological complexities, low permeability, or technological challenges. As compared to conventional oil, that is extracted relatively easily from underground reservoirs using traditional drilling techniques, unconventional oil requires more advanced and often more expensive extraction methods such as hydraulic fracturing (fracking), steam injection, or mining. Unconventional oil includes oil sands (tar sands), shale oil, and tight oil. The extraction of unconventional oil often involves higher environmental impacts and operational costs compared to conventional oil extraction.

Key Takeaways

- The global unconventional oil market has been analyzed in terms of value ($million). The analysis in the report is provided on the basis of type, technology, operations, 4 major regions, and more than 15 countries.

- The global unconventional oil market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the unconventional oil market are Suncor Energy Inc., Cenovus Inc., Sunshine Oilsands Ltd., Imperial Oil Limited, ConocoPhillips Company, ExxonMobil Corporation, Canadian Natural, Royal Dutch Shell plc, Chevron Corporation, and Athabasca Oil Corporation.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., India, Germany, and Brazil hold a significant share in the global unconventional oil market.

Market Dynamics

The escalation in global oil demand coupled with the depletion of conventional reservoirs has been a driving factor behind the increasing demand for unconventional oil. As population growth, urbanization, and industrialization continue unabated, especially in emerging economies, the global appetite for energy, particularly liquid fuels, has surged. According to the Internation Energy Agency (IEA), the Oil 2023 medium-term market report forecasts that based on current government policies and market trends, global oil demand is expected to rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d) which is supported by robust demand from the petrochemical and aviation sectors. This heightened demand for oil has put pressure on traditional oil reserves, leading to the need to explore and exploit alternative sources of crude oil. All these factors are expected to drive the demand for the global unconventional oil market.

However, inconsistent government regulations present a significant obstacle to the growth of unconventional oil production, creating uncertainty for investors, operators, and stakeholders in the oil and gas industry. According to the International Energy Agency (IEA), provisions of several federal environmental laws apply to certain activities related to oil and gas production, and proposals to expand federal regulation in this area have been highly controversial. Unconventional oil extraction techniques, such as hydraulic fracturing and steam-assisted gravity drainage operate in a regulatory environment that varies widely from one jurisdiction to another, leading to conflicting standards, requirements, and enforcement practices. All these factors hamper the global unconventional oil market growth.

Integration with new technologies to reduce greenhouse gas (GHG) emissions presents opportunities for unconventional oil production to enhance its environmental performance and sustainability while maintaining competitiveness in a rapidly evolving energy landscape. As concerns about climate change intensify and governments and industries commit to decarbonization efforts, leveraging innovative technologies becomes crucial for the future of unconventional oil. All these factors are anticipated to offer new opportunities in the global unconventional oil market forecast.

Segments Overview

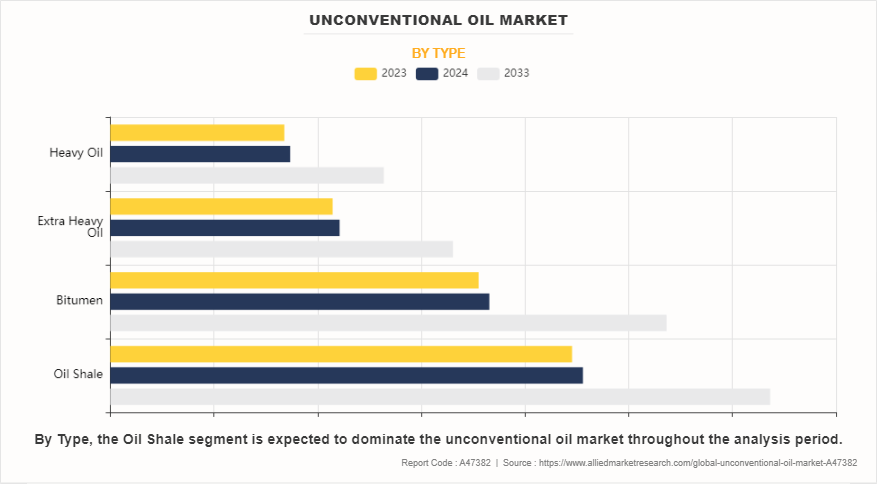

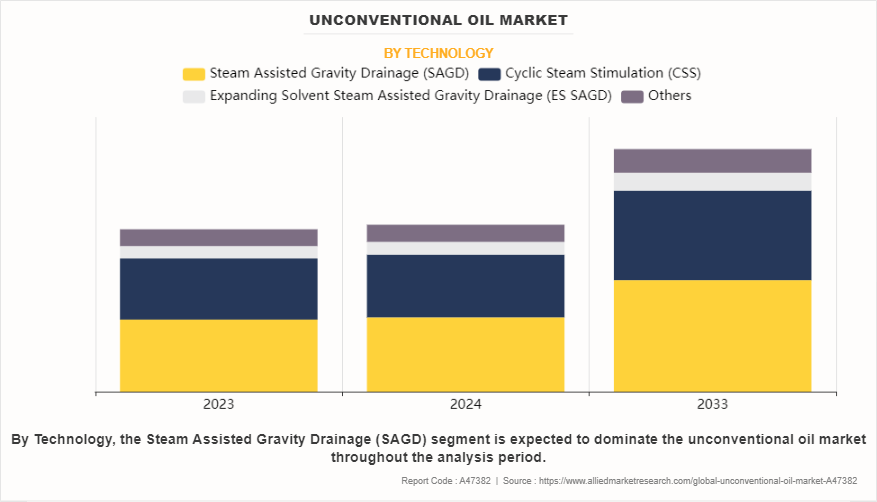

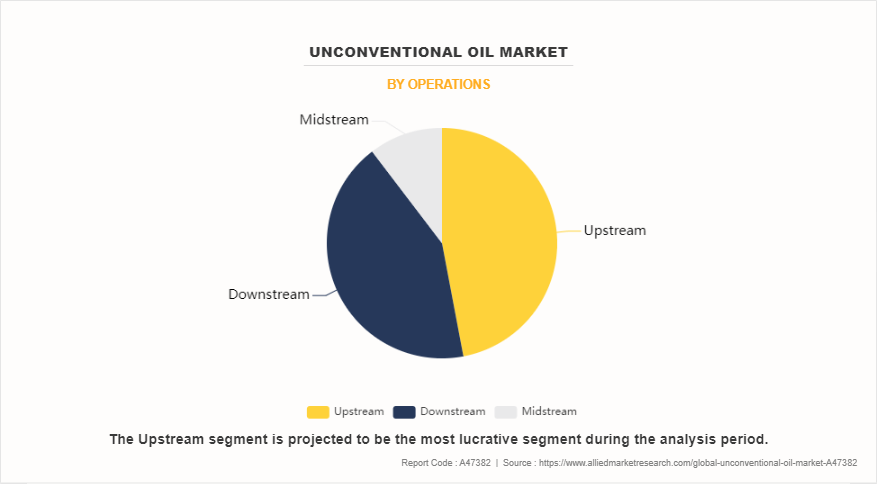

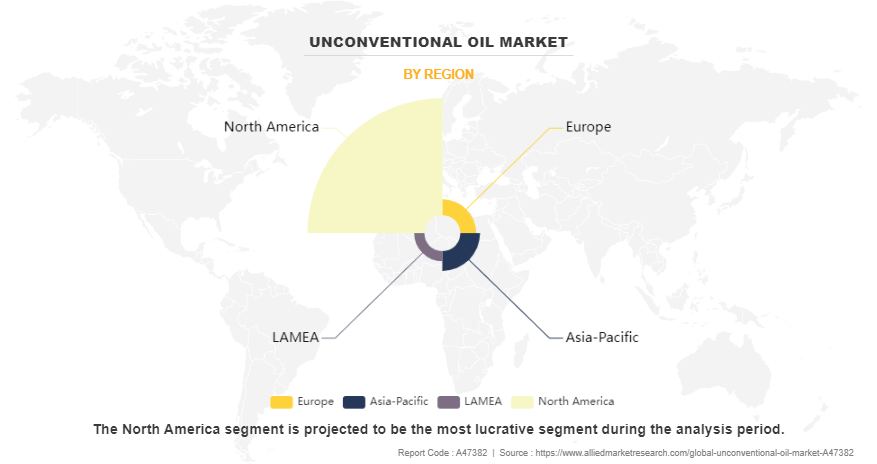

The global unconventional oil market is segmented into type, technology, operations, and region. On the basis of type, the market is classified as extra heavy oil, bitumen, oil shale, and heavy oil. As per technology, the market is categorized into steam assisted gravity drainage (SAGD), cyclic steam stimulation (CSS), expanding solvent steam assisted gravity drainage (ES SAGD), and others. By operations, the market is segmented into upstream, midstream, and downstream. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is classified as extra heavy oil, bitumen, oil shale, and heavy oil. The oil shale segment accounted for less than two-fifths of the global unconventional oil market share in 2023 and is expected to maintain its dominance during the forecast period. Global population and industrialization continue to increase the demand for energy resources. According to the UNCTAD handbook of statistics, over the last 25 years, the world population has increased by 2.1 billion people. Almost all this growth has occurred in developing economies, mainly in Asia and Oceania and Africa. Oil shale presents a potentially significant domestic source of oil for countries seeking to reduce their dependence on imported oil and enhance energy security. In addition, technological advancements play a pivotal role in unlocking the potential of oil shale reserves. Innovations in extraction techniques such as in situ retorting and shale oil refining processes, have improved efficiency and reduced costs making oil shale extraction more economically viable.

On the basis of technology, the market is categorized into steam assisted gravity drainage (SAGD), cyclic steam stimulation (CSS), expanding solvent steam assisted gravity drainage (ES SAGD), and others. The steam assisted gravity drainage (SAGD) segment accounted for more than two-fifths of the global unconventional oil market share in 2023 and is expected to maintain its dominance during the forecast period. SAGD offers distinct advantages over conventional extraction methods in terms of efficiency and environmental impact. As compared to traditional mining techniques which involve extensive surface disturbance and resource-intensive processes, SAGD minimizes surface footprint and reduces environmental disturbances. This makes it a more sustainable and environmentally friendly option, aligning with the growing emphasis on eco-conscious practices within the energy industry.

By operations, the market is segmented into upstream, midstream, and downstream. The upstream segment accounted for less than half of the global unconventional oil market share in 2023 and is expected to maintain its dominance during the forecast period. Regulatory frameworks and environmental considerations are significant driving factors that exert a profound impact on upstream operations in unconventional oil. Regulatory requirements governing land use, water management, air emissions, and waste disposal can significantly influence the feasibility and profitability of projects.

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for less than three-fourths of the global unconventional oil market share in 2023 and is expected to maintain its dominance during the forecast period. Technological advancements have played a pivotal role in unlocking vast reserves of unconventional oil, particularly in shale formations. Innovations in horizontal drilling and hydraulic fracturing techniques have allowed previously inaccessible oil deposits to be economically extracted. In addition, the abundance of shale resources across North America, notably in regions such as the Bakken Formation in North Dakota, the Permian Basin in Texas, and the Montney Formation in Canada drive the demand for unconventional oil.

Competitive Analysis

Key players in the global unconventional oil industry include Suncor Energy Inc., Cenovus Inc., Sunshine Oilsands Ltd., Imperial Oil Limited, ConocoPhillips Company, ExxonMobil Corporation, Canadian Natural, Royal Dutch Shell plc, Chevron Corporation, and Athabasca Oil Corporation.

In the global unconventional oil market news, companies have adopted acquisition and investment strategies to expand the market or develop new products. For instance, in October 2023, Suncor Energy acquired Total Energies' Canadian operations, which holds a 31.23% working interest in the Fort Hills oil sands mining project (Fort Hills) for $1.468 billion. This acquisition added 61,000 barrels per day of net bitumen production capacity and 675 million barrels of proved and probable reserves to Suncor's existing oil sands portfolio. Moreover, in January 2023, ExxonMobil invested in Imperial Oil Limited (IOL) heavy oil product portfolio. In addition, it announced to invest $560 million in the construction of Canada's largest renewable diesel facility. This facility will be located at Imperial’s Strathcona refinery. The project aims to produce 20,000 barrels of renewable diesel per day, with a focus on using locally sourced feedstocks.

History and Overview of Oil Sands Recovery Technology

Early Extraction Methods (1930s-1950s)

- Initially, oil sands were primarily surface mined using simple excavation techniques.

- Hot water extraction processes were also employed, where steam or hot water was injected into the ground to liquefy the bitumen, which is then pumped to the surface.

In-situ Methods (1960s-1980s)

- In situ extraction methods became more prominent, especially for deeper and less accessible oil sands deposits.

- Throughout the 1960s and 1970s, 52 pilot projects involving mining and in-situ techniques were supported by the U.S. government in collaboration with major oil companies such as Conoco, Phillips Petroleum, Gulf Oil, Mobil, Exxon, Chevron, and Shell.

- Steam-Assisted Gravity Drainage (SAGD) emerged as a leading in situ technique, involving the injection of steam into the reservoir to heat the bitumen, allowing it to flow to production wells by gravity.

- Canada began producing its oil sands in 1967 after decades of research and development that began in the early 1900s. Wells were drilled between 1906 and 1917 in anticipation of finding major conventional oil deposits. The area around Fort McMurray, Alberta, was mapped for bituminous sand.

Commercial Development (1990s-2000s)

- The 1990s saw significant advancements in oil sands extraction technology, leading to increased commercial viability.

- Improved mining methods, such as large-scale truck-and-shovel operations, allowed for more efficient extraction of surface deposits.

- In situ techniques such as SAGD were refined and scaled up, leading to the development of major projects such as Syncrude and Suncor Energy's operations.

Technological Innovations (2010s-present)

- Ongoing R&D efforts have focused on improving energy efficiency, reducing greenhouse gas emissions, and lowering the environmental footprint of oil sands extraction.

- Enhanced solvent-based extraction processes, solvent-assisted SAGD, and solvent vapor extraction are among the emerging technologies aimed at improving bitumen recovery and reducing environmental impact.

GHG Intensity of Unconventional Oil Production

GHG intensity refers to the amount of greenhouse gases (GHGs) emitted per unit of a specific activity, process, product, or economic output. It's a measure used to evaluate the environmental impact of various human activities and sectors. The greenhouse gas (GHG) intensity of conventional and unconventional oil production varies depending on several factors, including extraction methods, energy sources used, and production processes.

Unconventional oil production, such as shale oil and tight oil extraction involves hydraulic fracturing (fracking) and horizontal drilling techniques. These methods result in higher GHG emissions compared to conventional drilling due to increased energy requirements, equipment usage, and methane leakage from wells and infrastructure. Unconventional oil extraction processes, such as fracking and steam-assisted gravity drainage (SAGD) for oil sands are highly energy-intensive, contributing to higher GHG emissions compared to conventional methods.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the unconventional oil market analysis from 2023 to 2033 to identify the prevailing unconventional oil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the unconventional oil market overview and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global unconventional oil market trends, key players, market segments, application areas, and market growth strategies.

Unconventional Oil Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 530.2 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 304 |

| By Type |

|

| By Technology |

|

| By Operations |

|

| By Region |

|

| Key Market Players | Suncor Energy Inc., Chevron Corporation, Cenovus Inc., Imperial Oil Limited, Sunshine Oilsands Ltd., Athabasca Oil Corporation, Royal Dutch Shell plc, Canadian Natural, Exxon Mobil Corporation, ConocoPhillips Company |

Analyst Review

According to the opinions of various CXOs of leading companies, the global unconventional oil market is expected to witness an increase in demand during the forecast period. A surge in global oil demand, depletion of conventional reservoirs, and technological advancements in unconventional oil recovery increased the demand for global unconventional oil market during the forecast period.

The escalation in global oil demand, coupled with the depletion of conventional reservoirs, has been a driving force behind the increasing demand for unconventional oil resources. As the global population grows and economies expand, particularly in emerging markets, the demand for energy continues to rise, leading to greater reliance on oil as a primary source of fuel for transportation, industry, and power generation.

Furthermore, advancements in environmental stewardship and sustainability practices have been driving forces behind the adoption of cleaner and more efficient technologies in unconventional oil recovery. “The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade as electric vehicles, energy efficiency and other technologies advance,” said IEA Executive Director Fatih Birol. Companies are increasingly investing in emission reduction technologies, water recycling and treatment systems, and habitat restoration initiatives to minimize environmental impacts and improve stakeholder acceptance of unconventional oil development.

The unconventional oil market was valued at $354.9 billion in 2023, and is estimated to reach $530.2 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

Asia-Pacific is the fastest growing region for the Unconventional Oil Market.

Integration with new technologies to reduce GHG emissions is the upcoming trends of Unconventional Oil Market in the world.

Steam assisted gravity drainage (SAGD) is the leading technology of Unconventional Oil Market.

Technological advancements in unconventional oil recovery and Escalation in global oil demand are the leading drivers for the unconventional oil market.

North America is the largest regional market for Unconventional Oil.

Key players in the global unconventional oil market include Suncor Energy Inc., Cenovus Inc., Sunshine Oilsands Ltd., Imperial Oil Limited, ConocoPhillips Company, ExxonMobil Corporation, Canadian Natural, Royal Dutch Shell plc, Chevron Corporation, and Athabasca Oil Corporation.

Loading Table Of Content...

Loading Research Methodology...