GMO Testing Market Summary

The global GMO testing market size was valued at $3.9 billion in 2021, and is projected to reach $6.2 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031. North America was the highest revenue contributor, accounting for $1,558.5 million in 2021, and is estimated to reach $2,120.1 million by 2031, with a CAGR of 3.3%.

Key Market Trends and Insights

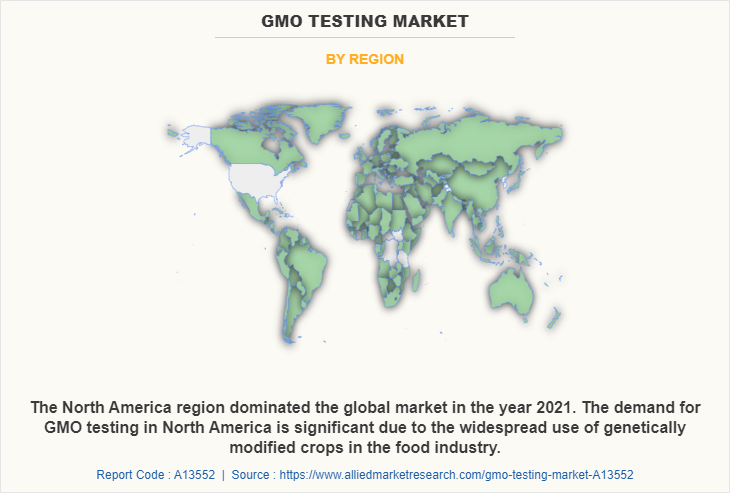

Region wise, North America generated the highest revenue in 2021.

The global GMO testing market share was dominated by the soy segment in 2021 and is expected to maintain its dominance in the upcoming years

The stacked segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 3.9 Billion

- 2031 Projected Market Size: USD 6.2 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 4.8%

- North America: Generated the highest revenue in 2021

Market Dynamics

GMO testing refers to the process of analyzing food, feed, and other products to determine whether they contain genetically modified organisms (GMOs). This involves identifying and quantifying the DNA or protein sequences that are specific to the GMO, using a variety of analytical methods, such as PCR (polymerase chain reaction), ELISA (enzyme-linked immunosorbent assay), and DNA sequencing.

The COVID-19 pandemic has had an impact on the GMO testing market, as it has on many industries. The pandemic has caused disruptions to supply chains and logistics, which has affected the availability and distribution of GMO testing equipment and reagents. Additionally, many laboratories have had to operate at reduced capacity or temporarily shut down due to lockdowns and social distancing measures.

GMO testing is important for several reasons, including ensuring the safety and quality of products, meeting regulatory requirements in many countries, and addressing consumer concerns about the use of GMOs in food and other products. The testing can help to identify whether a product is genetically modified, as well as the specific type of modification, which can be important information for consumers and regulators.

GMO testing can be conducted at various stages of the product lifecycle, including during the development and cultivation of GMO crops, as well as during the production and distribution of products made from GMOs. The testing can be done on a variety of products, including food, animal feed, seeds, and plant materials.

Falsification and economically motivated adulteration are some of the biggest fraudulent acts in the food industry. The intake of contaminated food, comprising toxic chemicals and radioactive materials, results in foodborne sickness, which might further lead to death. Some major food fraud activities include recycling animal byproducts, selling goods past their “use by” date, fake statements about ingredients, and unsafe food handling processes. However, many leading food safety organizations, such as Food Safety and Inspection Service have been detecting and mitigating such deliberate actions, with a growth in focus on food safety.

However, in developing countries, micro-, small-, & medium-food manufacturers dominate the market. These manufacturers often lack adequate knowledge & facility to maintain food safety standards. In addition, street food in developing countries is one of the significant sources of unhygienic food & water, as water supplies & disposal of water is not appropriate. However, street food is high in demand in countries such as India. Moreover, a lack of proper communication between food control organizations and consumers may be found only when consumer complaints are registered, which limits GMO testing market growth.

Owing to foodborne diseases associated with ready-to-eat foods and fresh food products which are cultivated differently, there is a need of tackling such deceptive activities. Thus, the introduction of microbial intervention technologies and innovations in food technology to reduce, eliminate, and control pathogens from food products impact the market positively. Ohmic processing, ultra-high pressure hydrostatic processing, high electric field pulses, radiofrequency (RF) heating, and microwave processing are some of the widely used methods in food processing operations.

These methods involve the use of electromagnetic waves to generate heat in a material for further pasteurization and sterilization. Different methods are used for different food product categories to effectively destroy the microorganisms and increase the shelf life of a product. In addition, the adoption of instant test kits protects the company from inadvertent adulteration of food products, which is expected to provide potential opportunities for market expansion.

The Asia-Pacific GMO testing market is experiencing growth due to several factors. One of the key drivers of this market is the increasing adoption of genetically modified (GM) crops in the region, particularly in countries such as China, India, and Australia. This has led to a greater need for GMO testing to ensure compliance with regulatory requirements for labeling and safety assessments.

Another driver of the Asia-Pacific GMO testing market demand for non-GMO products in the region. As consumers become more aware of the potential risks associated with consuming GM products, they are seeking out non-GMO alternatives. This has led to an increased demand for GMO testing services to verify the non-GMO status of products. Additionally, there has been a strengthening of the regulatory framework for GMOs in many countries in the Asia-Pacific region, including China, Japan, and Australia. This has led to an increased need for GMO testing to ensure compliance with these regulations.

Segment Review

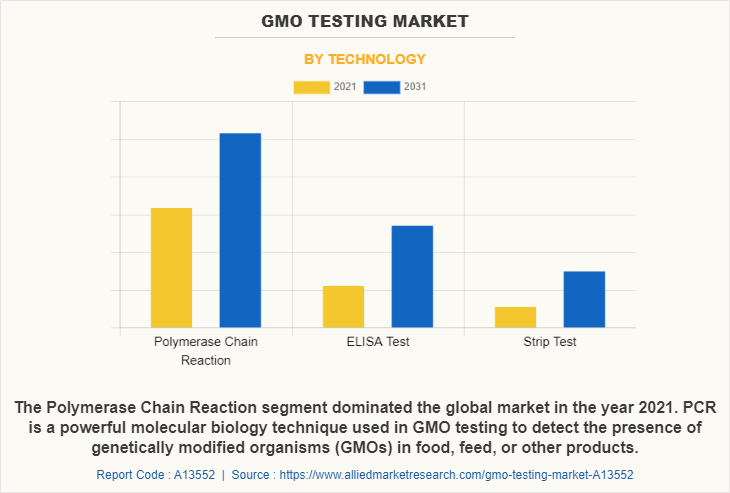

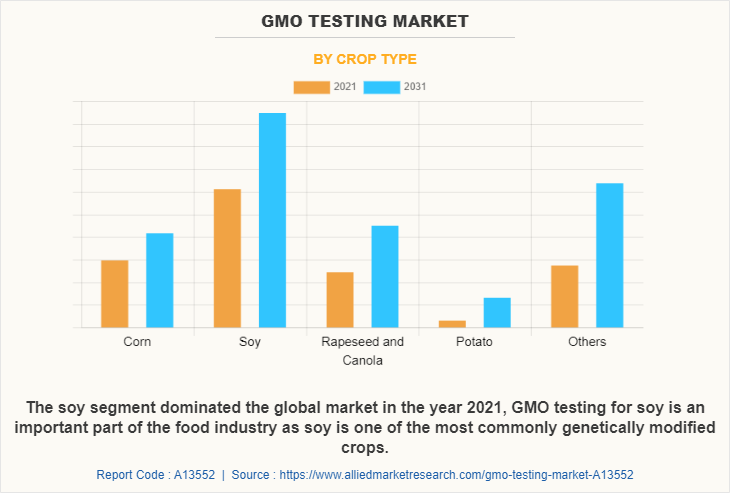

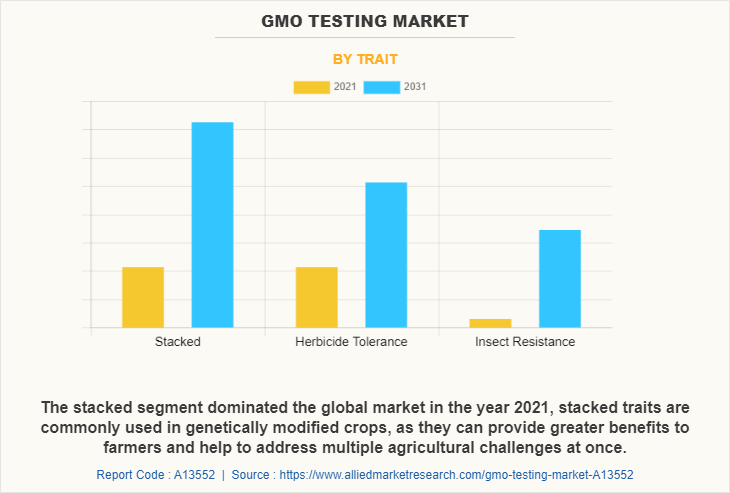

The GMO testing market size is analyzed on the basis of technology, crop type, traits, and region. On the basis of technology, the market is subdivided into a polymerase chain reaction, ELISA test, and strip test. On the basis of crop type, the market is classified into soy, rapeseed/canola, potato, and others. Depending on traits, the market is classified into stacked, herbicide tolerance, and insect resistance. As per region, the market is categorized into North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, Sweden, Netherlands, Denmark, Poland, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Thailand, Malaysia, Singapore, New Zealand, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, South Africa, Middle East, Saudi Arabia, Egypt, Nigeria, and rest of LAMEA).

By technology, the polymerase chain reaction segment dominated the global market in the year 2021 and is likely to remain dominant during the GMO testing market forecast period. A quick and inexpensive quantitative method called real-time polymerase chain reaction can count the number of specific DNA segments present in samples. Also, it aids in identifying purposeful and unintentional food adulterations caused by biological pollutants. Moreover, polymerase chain reaction technology is used by the agricultural biotechnology sector at various stages of the product development. The approach is primarily used to assess the amount of genetically modified material contained in a product or to verify the presence or absence of genetically modified material in a sample of the product. Also, there is a growing need for food analysis to guarantee the quality and safety of food due to the quick changes in food's diversity, quantity, and mobility.

As per crop type, the soy segment dominated the global market in the year 2021 and is likely to remain dominant during the forecast period. Soy is one of the most commonly genetically modified crops, and therefore, the soy GMO testing market is an important component of the overall market. The global soy market is expected to grow due to the increasing demand for non-GMO soy products and the regulatory requirements for GMO labeling and testing. The increasing consumer demand for non-GMO soy products is driven by concerns about the potential health and environmental impacts of GMOs. This has led to an increase in the demand for soy GMO testing, as companies seek to verify the non-GMO status of their soy products. The soy market includes testing of various soy-based products, such as soybeans, soy oil, soy protein, and soy milk.

Depending on traits, the herbicide tolerance segment dominated the global GMO testing market in the year 2021 and is likely to remain dominant during the forecast period. The herbicide tolerance GMO trait market is an important component of the overall GMO market. It includes crops that have been genetically modified to be tolerant to specific herbicides, such as glyphosate, 2,4-D, and dicamba. The market is driven by several factors, including the increasing demand for higher crop yields and the need to reduce the use of herbicides.

One of the main drivers of the herbicide tolerance GMO trait market is the increasing demand for higher crop yields. By introducing herbicide tolerance genes into crops, farmers can more effectively control weeds and other pests, which can result in higher crop yields. This can be especially important in regions where agricultural land is limited, and farmers need to maximize their productivity.

Region-wise, North America dominated the global GMO testing market in the year 2021 and is likely to remain dominant during the forecast period. The North American market is a significant component of the global market. GMO testing involves the analysis of food and feed products to detect the presence of genetically modified organisms (GMOs) and to verify the non-GMO status of products.

North America has a well-established regulatory framework for GMO testing and labeling, which has driven the growth of the GMO testing market in the region. In the United States, the USDA regulates GMOs, while the FDA oversees the safety of GMOs in food products. The Canadian Food Inspection Agency (CFIA) regulates GMOs in Canada.The North American market is driven by several factors, including the increasing demand for non-GMO products, regulatory requirements for GMO labeling and testing, the growing biotech industry, advancements in technology, and increased public awareness of GMOs.

The GMO testing market is composed of various types of GMO testing services, including PCR-based testing, immunoassay-based testing, and DNA sequencing-based testing. The market is also segmented by application, including food testing, feed testing, and environmental testing.

Competitive landscape

The players included in the market analysis have adopted various developmental strategies, including but not limited to product launches, geographical expansion, and acquisitions to increase their GMO testing market share, gain profitability, and remain competitive in the GMO testing Industry. The key players included in the market analysis are ALS Limited, Bio-Rad Laboratories, Inc., EnviroLogix Inc., Eurofins Scientific, Institut Merieux, Intertek Group plc, Koninklijke DSM N.V., LGC Limited, Mérieux NutriSciences, Microbac Laboratories, Inc., Premier Analytics Services, R-Biopharm AG, SGS SA, Thermo Fisher Scientific Inc., and TUV SUD AG.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current GMO testing market trends, estimations, and dynamics of the GMO testing market analysis from 2021 to 2031 to identify the prevailing GMO testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the GMO testing market segmentation segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global GMO testing industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and GMO testing market growth strategies.

GMO Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.2 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Technology |

|

| By Crop Type |

|

| By Trait |

|

| By Region |

|

| Key Market Players | Intertek Group plc, TUV SUD AG, Eurofins Scientific, OMIC USA Inc., Premier Foods plc, LGC Limited, Koninklijke DSM N.V., Bio-Rad Laboratories, Inc. , EnviroLogix Inc., Thermo Fisher Scientific Inc. , ALS Limited, R-Biopharm AG, SGS SA, Institut Merieux, Microbac Laboratories, Inc. |

Analyst Review

Demand for non-GMO products has increased as consumer awareness of GMO-related issues has grown, even in states where GMO labeling laws were not eventually passed. In addition, the distinction is quantifiable: They discovered that variations in consumer awareness linked to legislative activity can account for 36% of the uptake of new non-GMO products. GMO labelling has gained prominence in public and political discourse over the past three decades. Notwithstanding the fact that the United States will require disclosure labels on all goods that contain GMOs starting on January 1, 2022, the study cites a 2016 National Academy of Sciences assessment that found no scientific evidence that GMO foods are less healthy or safe than non-GMO products. Therefore, owing to the mandatory guidelines the demand for GMO testing is boosting the GMO Testing Industry.

As a result, the development of microbial intervention technologies and advancements in food technology to lower, eradicate, and control pathogens from food products have a beneficial effect on the market. Some of the techniques that are frequently employed in food processing operations include ohmic processing, ultra-high pressure hydrostatic processing, high electric field pulses, radiofrequency (RF) heating, and microwave processing.

These procedures involve heating a substance using electromagnetic waves in order to further pasteurize and sterilize it. To successfully eliminate germs and lengthen the shelf life of a product, various techniques are employed for various food product categories. In addition, the use of rapid test kits shields the business from unintentional food product adulteration, which is anticipated to present prospects for market advancement.

The global GMO Testing Market Size was valued at $3.9 billion in 2021, and is projected to reach $6.2 billion by 2031

The global GMO Testing market is projected to grow at a compound annual growth rate of 4.8% from 2022 to 2031 $6.2 billion by 2031

The key players included in the market analysis are ALS Limited, Bio-Rad Laboratories, Inc., EnviroLogix Inc., Eurofins Scientific, Institut Merieux, Intertek Group plc, Koninklijke DSM N.V., LGC Limited, Mérieux NutriSciences, Microbac Laboratories, Inc., Premier Analytics Services, R-Biopharm AG, SGS SA, Thermo Fisher Scientific Inc., and TUV SUD AG.

Region-wise, North America dominated the global market in the year 2021

Stringent Regulatory Requirements, Rising Consumer Demand for Non-GMO Products, Growth in Genetically Modified Crop Cultivation, Increasing Food Safety Concerns, Technological Advancements in Testing Methods, Expansion of Food Processing & Global Trade majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...