Golf Cart Market Research, 2033

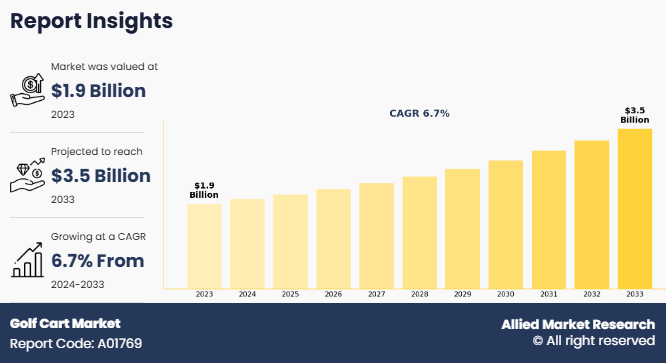

The global golf cart market size was valued at $1.9 billion in 2023, and is projected to reach $3.5 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Report Key Highlighters:

- The golf cart industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the golf cart marketare Aptiv PLC, Tesla, Inc., Continental AG, NVIDIA Corporation, Robert Bosch GmbH, Li Auto Inc., Rivian Automotive, Inc., Volkswagen AG, General Motors Company, Qualcomm Incorporated. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A golf cart is a type of low-speed vehicle driven by electric motors, which is gas-powered and is specifically envisioned for utilization in golf courses for transportation of golfers and equipment within the course premises. It is also known as a non-highway or off-road vehicle with an average speed between 25 and 50 kmph. However, its application has expanded beyond golf courses and extends to residential communities, resorts, industrial complexes, airports, and commercial facilities. These vehicles are available in various configurations, including electric and gas-powered models, catering to different user preferences and operational requirements.

Private golf clubs and resorts increasingly transition to electric golf carts to align with sustainability goals and mitigate the rise in operational costs associated with fuel-powered vehicles. For instance, in November 2024, London Golf Club in Kent acquired 50 Club Car Tempo golf buggies from Bradshaw Electric Vehicles to enhance guest and member experiences. This purchase marked the 25-year partnership between the two companies. Bradshaw Electric Vehicles, a key supplier of Club Car vehicles across the UK, has built a strong reputation among prestigious golf courses. Earlier this year, the company surpassed 5,000 Club Car vehicle sales, earning the 5000 Club accolade, making it only the third dealership in Europe to achieve this milestone. This trend highlights the surge in preference for electric mobility solutions in the golf industry.

Moreover, as consumer preferences shift, manufacturers increasingly utilize both digital and physical retail channels to improve accessibility and customer engagement. For instance, in March 2023, Club Car introduced the Club Car CRU, a street-legal Neighborhood Electric Vehicle (NEV) designed for sustainable short-distance transportation. This innovation is expected to benefit from integrated sales strategies, where online platforms provide convenience for research and purchasing, while offline dealerships offer hands-on experiences and expert guidance. Manufacturers ensure wider consumer reach and adoption of new electric mobility solutions by combining digital accessibility with traditional retail touchpoints. With the increasing adoption of electric and sustainable mobility solutions, the golf cart market forecast anticipates steady growth, driven by advancements in vehicle technology and expanding applications beyond golf courses.

Factors such as increase in the number of golf courses & country clubs, rise in demand for sustainable & electric mobility, and surge in adoption of golf carts in golf courses, resorts, and public areas are expected to drive the global golf cart market growth during the forecast period. However, high initial costs and battery replacement expenses, along with infrastructure challenges in developing regions, are anticipated to hamper market growth. Moreover, the surge in inclination toward solar-powered golf carts and rise in their applications beyond golf courses are expected to offer lucrative opportunities for market growth in the future.

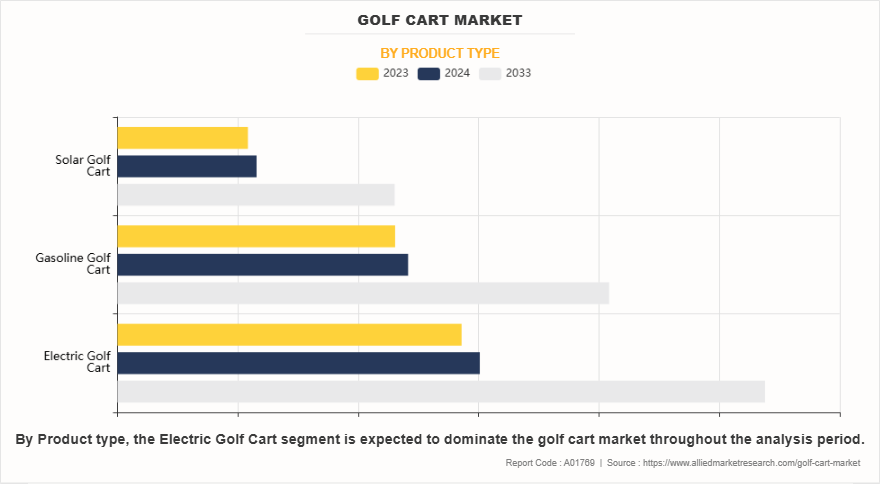

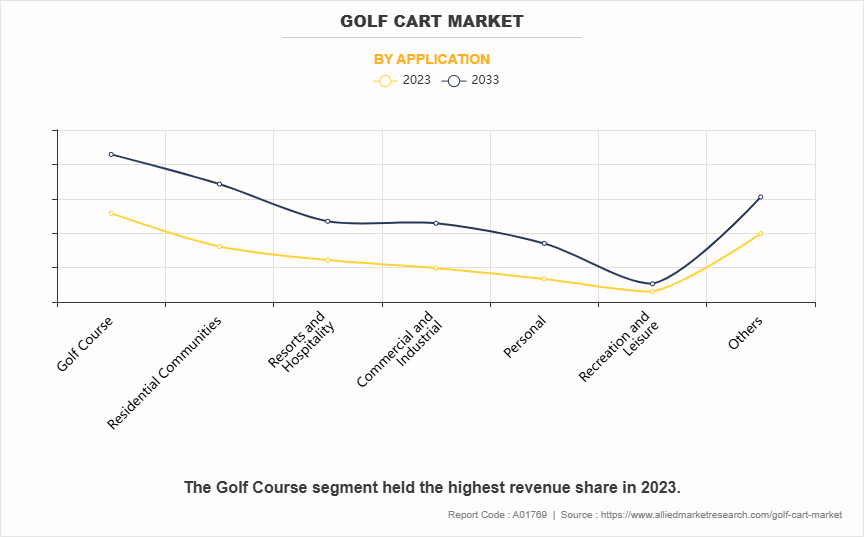

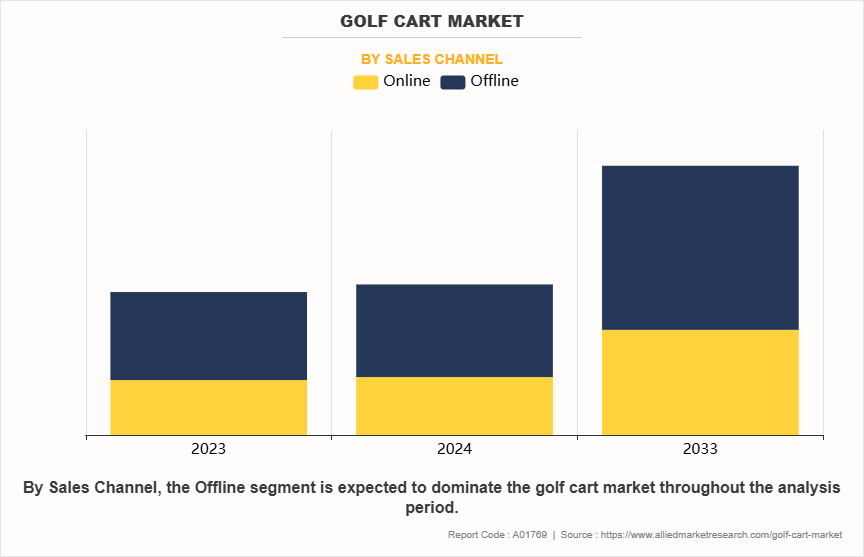

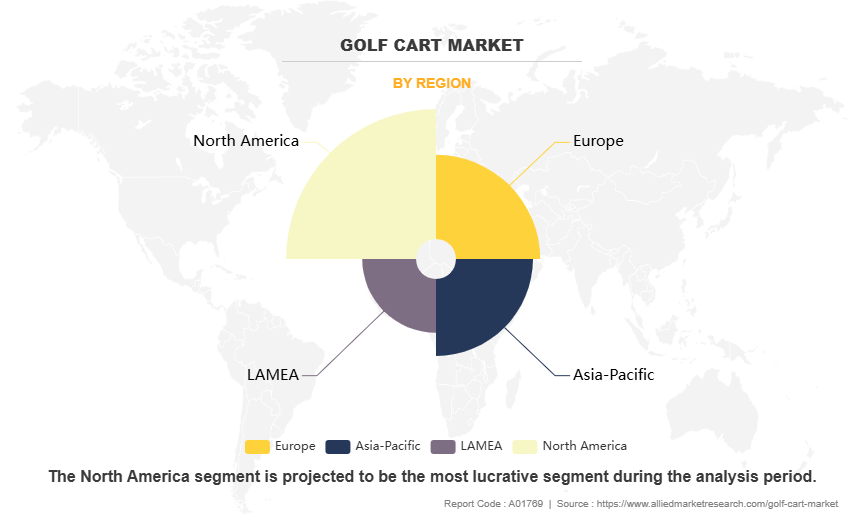

The golf cart market is segmented into product type, application, sales channel, and region. On the basis of product type, the market is divided into electric golf carts, gasoline golf carts, and solar golf carts. As per application, the market is categorized into golf course, residential communities, resorts & hospitality, commercial & industrial, personal, recreation & leisure, and others. On the basis of sales channel, the market is bifurcated into online and offline. Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include ELLWEE, Textron Inc., Marshell Green Power, Maini Corporate Pvt Ltd., HDK Electric Vehicles, Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd., Evolution Electric Vehicles, ICON Electric Vehicles, Waev Inc., VIVID EV, Dealer Spike (Advanced EV), Nordic Group of Companies, Ltd., Club Car, Yamaha Motor Co., Ltd., Denago EV, Kandi America, and Star EV Corporation, USA.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In January 2025, ICON Electric Vehicles partnered with WiTricity to launch ICON LowSpeed Vehicles (LSVs) featuring an industry-first wireless charging option. Golf cars have become the preferred mode of transportation in many communities across the US. It is commonly used for both traditional rounds of golf and for running errands within the community, offering a more convenient and environmentally friendly alternative to other transportation options.

- In October 2024, Veer Savarkar International Airport, Sri Vijaya Puram, introduced a golf cart service to facilitate passenger movement between the airport entry gate and the terminal building. Owing to airport regulations prohibiting auto-rickshaws from entering the premises, passengers arriving by auto-rickshaw were previously required to walk to the terminal. To mitigate this inconvenience, the Airports Authority of India (AAI) and the Department of Civil Aviation, A&N Administration have jointly implemented this initiative, ensuring seamless transit within the airport.

- In July 2024, Kandi America launched NFL Golf Carts features powerful 5,000- watt motor & powered by a 48V Lithium 150Ah battery. Furthermore, it equipped with electric power steering, 10” touch screen, Bluetooth wireless premium sound bar & 4-wheel disc brakes.

- In November 2023, Kandi America launched 500 all-electric mini golf carts for U.S. Market. These vehicles provide a smooth ride & minimize environmental impact. It is powered by electric motors & offers zero emissions, low maintenance, and a longer lifespan compared to traditional gas-powered carts.

Segmental analysis

The golf cart market is segmented into product type, application, sales channel, and region. On the basis of product type, the market is divided into electric golf carts, gasoline golf carts, and solar golf carts. As per application, the market is categorized into golf course, residential communities, resorts & hospitality, commercial & industrial, personal, recreation & leisure, and others. On the basis of sales channel, the market is bifurcated into online and offline. Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA.

By Product Type

By product type, the global golf cart industry is segmented into Semi-SDV and SDV. The electric golf cart segment accounted for the largest golf cart market share in 2023, owing to rise in emphasis on sustainability and the global push for electric mobility. Government regulations promoting eco-friendly transportation solutions have further accelerated its adoption. Lithium-ion batteries, replacing traditional lead-acid variants, have improved efficiency, and reduced overall charging times, enhancing the appeal of electric models.

By Application

By application, the global golf cart market is segmented into distributed architecture, domain centralized architecture, zonal control architecture, and hybrid architecture. The personal segment accounted for the largest market share in 2023, driven by the popularity of golf, the expansion of new golf courses, and the shift toward sustainability. Moreover, the adoption of electric golf carts is steadily increasing as sustainability becomes a priority across various sectors. Environmental concerns, such as reducing carbon emissions and minimizing noise pollution, boost the shift toward electric alternatives.

By Sales Channel

By sales channel, the global golf cart market is bifurcated into online and offline. The offline segment accounted for a dominant market share in 2023, as the after-sales services, such as maintenance and repairs, are often more accessible and reliable through offline retailers. The offline segment is also bolstered by the presence of industry events, such as exhibitions and trade shows, where customers can view new models and interact with manufacturers and distributors.

By Region

Region wise, North America held the largest market share in 2023, owing to the increase in demand across multiple applications beyond golf courses. The region's well-established golf culture remains a key driver, particularly in the U.S. and Canada, where golf continues to be a widely played sport.

Increase in the number of golf courses and country clubs

The surge in the number of golf courses and country clubs worldwide is a significant factor driving the demand for golf carts. As golf becomes popular among amateurs and professionals alike, the need for well-equipped golf courses continues to rise. Countries invest in new golf facilities to cater to an increasing number of players, and driving demand for golf carts is an essential part of the infrastructure. Many high-end clubs and resorts focus on enhancing the golfing experience by providing fleets of modern, eco-friendly golf carts.

For instance, in October 2024, the Dwarka Golf Course, India’s longest at 7,377 yards, opened for memberships, according to officials from the Delhi Development Authority (DDA). Located in Sector 24 and spanning 159 acres, the 18-hole course is designed to offer a premium golfing experience. The facility is expected to feature one of the country’s longest driving ranges, measuring 372 yards, with a double-decker structure housing 52 bays, 26 on each level for golf carts.

Within Delhi, this surpasses existing facilities such as the Siri Fort Golf Course, which has 48 bays, and the Qutub Golf Course, which has 28 bays. The course is expected to include a golf academy and a luxury clubhouse, reinforcing its status as a premier golfing destination. The expansion of such high-profile projects further contributes to the increasing golf cart market size.

Rise in demand for sustainable & electric mobility

The demand for electric golf carts has increased as more people and businesses look for clean and energy-efficient transportation options. Electric carts do not produce emissions such as gasoline-powered carts, making them a better choice for golf courses, resorts, gated communities, and commercial spaces. Many governments and organizations encourage the use of electric vehicles to reduce pollution and promote sustainability.

Manufacturers introduce new electric golf carts to meet the growing demand for sustainable and efficient transportation solutions in golf courses, resorts, and commercial applications. For instance, in November 2024, Massimo Group, a manufacturer and distributor of powersports vehicles and pontoon boats, introduced its latest MVR Series electric carts, comprising the MVR 2X Golf Cart and the MVR Cargo Max Utility Cart. Designed to address the surge in demand for low-speed electric vehicles (LSVs), these high-performance models offer enhanced versatility for both recreational and commercial applications. The launch reflects Massimo’s strategic focus on expanding its electric mobility portfolio to meet evolving consumer and industry needs. Such developments further boost the golf cart market demand.

High initial cost and battery replacement expenses

One of the main challenges in the golf cart market is the high initial cost of purchasing a golf cart, especially for electric models. Many buyers, including small businesses, resorts, and individuals, find the upfront price of a golf cart expensive compared to other transportation options. Electric golf carts, which have become more popular due to their eco-friendly benefits, often require advanced battery technology, making them costlier than gasoline-powered alternatives.

Moreover, battery replacement expenses add to the long-term costs. Batteries in electric golf carts have a limited lifespan depending on usage and maintenance. The cost of a new battery pack, especially lithium-ion batteries, can be significant, making it a financial burden for owners. While electric golf carts help reduce fuel expenses, their battery costs and maintenance requirements remain a key concern for potential buyers, which hinders overall golf cart market growth.

Growth in inclination toward solar powered golf carts

Increase in focus on sustainability and energy efficiency has led to a growing interest in solar-powered golf carts. These carts integrate solar panels on their roofs to generate electricity, reducing dependence on traditional charging methods and extending battery life. As fuel prices fluctuate and environmental concerns rise, solar-powered golf carts present a cost-effective and eco-friendly alternative for golf courses, resorts, gated communities, and commercial applications.

In addition, businesses and individuals looking to reduce operational costs are increasingly considering solar models due to their lower electricity consumption and reduced maintenance requirements.

Manufacturers respond to this trend by introducing new and improved solar-power models to meet the growing demand. For instance, in August 2024, LOBO EV Technologies Ltd., a developer and manufacturer specializing in electric bicycles, mopeds, tricycles, and off-highway four-wheeled electric shuttles, introduced a new solar-powered golf cart. The initial production batch of 33 units has been successfully sold to customers in the U.S., marking the company's third consecutive export of golf carts to the U.S. market. This development underscores LOBO’s expanding market penetration and commitment to delivering sustainable, high-performance electric mobility solutions.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the golf cart market analysis from 2023 to 2033 to identify the prevailing golf cart market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the golf cart market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global golf cart market trends, key players, market segments, application areas, and market growth strategies.

Golf Cart Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.5 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2023 - 2033 |

| Report Pages | 433 |

| By Product type |

|

| By Application |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Textron Inc., HDK Electric Vehicles, Star EV Corporation, USA, VIVID EV, Kandi America, Maini Corporate Pvt Ltd., Nordic Group of Companies, Ltd., ELLWEE, Evolution Electric Vehicles, ICON Electric Vehicles, Waev Inc., Denago EV, Dealer Spike (Advanced EV), Marshell Green Power, Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd, Yamaha Motor Co., Ltd., CLUB CAR |

Analyst Review

Golf cart is a small motorized vehicle used for transportation of golfers around the golf course and also used as off-road vehicle across various locations such as hotels, airports, resorts, and many more areas. The golf cart market is expected to reach $2,591.69 million by 2023, owing to rise in demand for environmental protection and stringent government rules & regulations towards vehicle emission. The different golf cart includes electric, gasoline, or solar powered, which emit less or no air pollutants.

Growth in population, increase in globalization, and rise in purchasing power drive the demand for golf carts. In 2016, North America was the highest contributor, in terms of revenue, in the golf cart market. In addition, electric golf cart has contributed significant revenue to the market, majorly from the U.S. Furthermore, the solar golf cart is anticipated to witness the highest growth rate during the forecast period, due to heavy investment on renewable energy across the developing nations.

Key market players have adopted various strategies, such as new product launch, business expansion, and strategic alliances to increase awareness about golf cart across various countries.

The leading application of Golf Cart Market is personal.

Key players covered in the report include ELLWEE, Textron Inc., Marshell Green Power, Maini Corporate Pvt Ltd., HDK Electric Vehicles, Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd., Evolution Electric Vehicles, ICON Electric Vehicles, Waev Inc., VIVID EV, Dealer Spike (Advanced EV), Nordic Group of Companies, Ltd., Club Car, Yamaha Motor Co., Ltd., Denago EV, Kandi America, and Star EV Corporation, USA.

The global golf cart market size was valued at $1.9 billion in 2023, and is projected to reach $3.5 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

The largest regional market for Golf Cart is North America

The upcoming trends of Golf Cart Market in the globe are the surge in inclination toward solar-powered golf carts and rise in their applications beyond golf courses.

Loading Table Of Content...

Loading Research Methodology...